The Whimsical Tale of BTC Ordinals: So Easy, Even a 60-Year-Old Grandma Can Understand It

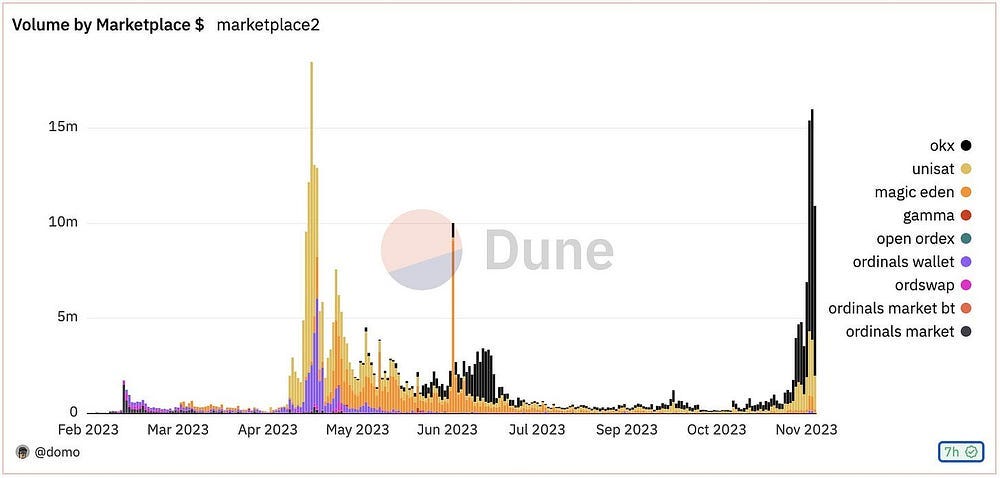

Author: 0xSea.eth, Podcast “Sea Talk” Host Original link: https://x.com/_0xSea_/status/1722875509569433656?s=20 Have you been baffled recently by the endless emergence of new protocols like Ordinals, BRC-20, Atomicals, and Pipe? Confused about how they’re all related? Don’t worry, let me help you untangle their timeline and the subtle connections between them. I’ll try to explain in simple language, avoiding complex concepts, with the goal of making it understandable for newcomers and even grandmothers. This article is not intended as investment advice. Chapter I: Ordinals and BRC-20, Casey and domo’s Spirited Adventures in the Bitcoin World The Pandora’s box of Bitcoin was opened by a man named Casey Rodarmor. In December 2022, Casey launched the Ordinals protocol. It assigns a unique serial number to each satoshi (the smallest unit of Bitcoin) and tracks them in transactions. Anyone can attach additional data to these satoshis through Ordinals, including text, images, videos, etc. This is made possible by the permissionless nature of blockchain/Bitcoin. Initially, Ordinals didn’t have the popularity it enjoys today. Early users mainly created NFTs on it, and the trading volume was modest. Casey’s original vision for Ordinals was to enable people to store something eternal on Bitcoin, the oldest and most consensus-strong blockchain. For a while, many equated Ordinals with “Bitcoin NFTs.” The game changed on March 8, 2023, when an anonymous developer named domo launched BRC-20 based on the Ordinals protocol. The name BRC-20 immediately brings to mind the ERC-20 token standard on Ethereum. Simply put, BRC-20 is a token issuance protocol based on Ordinals, which in turn is based on Bitcoin. Issuing tokens on BTC? For most, the idea felt magical and counterintuitive. When the first token ORDI was issued, tools like Unisat for token minting were not yet available. One had to run a Bitcoin full node locally. Early tech developers like ship.eth seized this opportunity, acquiring tokens at a very low cost. As BRC-20 gained explosive popularity in May-June and October-November, its transactions dominated a large portion of the Ordinals protocol, which greatly displeased Casey. He has publicly expressed his frustration, stating that BRC-20 brought a lot of junk to his creation, Ordinals. Recently, Casey’s team sent a letter asking Binance to remove the mention of Ordinals from the ORDI token introduction, as he didn’t want Ordinals to be associated with ORDI. Conclusion 1: Casey didn’t own any tokens when ORDI was launched. Domo seems to have minted about 1000 (equivalent to one), but whether there are other secret holdings in different wallets is unknown. As ORDI’s value surged, the inner thoughts of these two individuals remain a mystery. Gossip 1: During the Singapore conference in September, someone arranged for Casey and domo to attend the same event. Reportedly, they met and greeted each other amicably. Examining their Twitter posts reveals stark differences in their involvement with the project. Gossip 2: Domo attended the conference in Singapore wearing a face mask in public appearances. The reason for this remains unknown. Chapter II: A Guy Named Beny and His Intricately Nested Governance Models Following the emergence of BRC-20, an active developer in the community, known as Beny (who seems to have no public Twitter account), proved to be a dynamic force. Around March, he launched the BRC-20 proxy tool LooksOrdinal (non-tokenized), deployed TRAC in May, as well as the first 21 million total supply Cursed Inscription -CRSD, introduced the OrdFi-oriented BRC-20 improved version Tap Protocol in August, and released an enhanced version of the Runes protocol, Pipe, in October. You might wonder why this guy is juggling so many projects. That’s a question for Beny himself, but it’s clear he’s both energetic and has a keen sense for opportunities. So, what’s the relationship between these projects? 1. TRAC is a BRC-20 token and also the governance token of Tap Protocol. 2. Tap Protocol is an improvement at the protocol level of BRC-20. Both TAP and -TAP tokens are issued based on Tap Protocol and have moved beyond the scope of BRC-20 (though they’re still based on Ordinals). 3. TAP is the governance token for the Pipe protocol. 4. Pipe protocol, inspired by the concept of Runes, has evolved beyond the scope of Ordinals. What a cleverly nested governance structure! Uniquely, all 21 million TAP tokens are currently held by Beny, with zero in circulation; the market has access to the first token -TAP from Tap Protocol. The plan is for the project team to use TAP for financing and governance, and a portion will be airdropped to holders of TRAC, -TAP, and PIPE, though the specific ratios are yet to be determined. (Note: PIPE is the first token of the Pipe protocol) If you’re interested in Tap Protocol, you can check out the introduction previously written by the author here: https://twitter.com/0xSea/status/1689560490907680768 Regarding the other two projects, Looksordinal and -CRSD: the former is purely a tool without any token; the latter, due to the Ord development team not yet completing the types for all negative inscriptions, lacks a comprehensive index for -CRSD, making it currently untradeable. Conclusion 2: A team launching three interconnected projects in a nested doll-like manner is a unique strategy in the current landscape of Layer 1 technology. Chapter III: Half a Year in the Making, the Rising Star Protocol Atomicals Emerges About three months after the release of Ordinals, another anonymous developer took notice of it. After thorough research and contemplation, he identified some areas where Ordinals fell short. He then got to work and, after 6–7 months of dedicated development, launched the Atomicals Protocol in September. In the early hours of September 21, the first token ATOM on the Atomicals protocol was issued and mined out in about 5 hours. Mining ATOM requires a computer CPU and the installation and configuration of a local environment, which is a higher technical barrier (more Geeky) than the simple gas-sniping method of BRC-20, and arguably fairer. Fundamentally, Atomicals Protocol has several key differences compared to Ordinals: 1. Atomicals are minted and propagated based on BTC’s UTXO, where 1 token equals 1 sat. This aligns more closely with Bitcoin’s technology, adding no extra burden to the BTC network and holding a higher standard of ‘orthodoxy’ in technical terms, aligning well with the technical aesthetics of BTC Maximalism. 2. In comparison, Ordinals takes a more ‘hands-off’ approach, not having its own token issuance protocol (hence the emergence of BRC-20 later). However, when the Atomicals protocol was launched, it had already defined the ARC-20 token standard and other broader use cases. As the community delved deeper into the Atomicals Protocol, they began to appreciate its comprehensive nature, marked by the lengthy development time, the founder’s determination, and the variety of scenarios and features it considered. This well-prepared and complete protocol gradually earned significant respect within the community. It’s worth mentioning that developer ship.eth, after watching several interviews with the anonymous founder of Atomicals, remarked that the founder’s way of speaking was very reminiscent of a young Steve Jobs. I share the same sentiment; the founder speaks rationally and engagingly, earning a positive impression. This story somewhat mirrors the early days of Vitalik Buterin, who, finding Bitcoin too limited and his proposals for improvement rejected, joined forces with a few colleagues to create Ethereum, a narrative quite similar to the birth of the Atomicals Protocol. For those interested, you can watch interviews with the founder here:  &  Conclusion 3: After six months of dedicated development, Atomicals, emerging as a strong contender to Ordinals, is garnering significant attention. Currently, its ecosystem is still in the early stages, with more builders actively joining in. Chapter IV: The Defiant Casey and the Rising Force of Runes As mentioned earlier, Casey has always been critical of BRC-20, believing it brought too much ‘junk’ inscription and polluted the purity of Ordinals. Less than a week after the release of Atomicals, on September 26, Casey tweeted about a new idea: a homogenized token protocol based on Bitcoin, named Runes (Rune Protocol). Similar to Atomicals (great minds think alike), Runes’ significant improvement over BRC-20 is its basis on UTXO technology. Casey believes that a well-crafted homogenized token protocol for Bitcoin could bring considerable transaction fee revenue, along with more developers and users to the Bitcoin ecosystem. Shortly after the publication of Runes’ documentation, Comrade Beny saw an opportunity and launched the Pipe protocol based on the concept of Runes, linking back to Chapter II. On Casey’s end, due to ongoing upgrades to the Ordinals protocol and occasional minor bugs requiring his attention, the official launch of Runes is still uncertain. However, I believe it will be a highly anticipated protocol in the Bitcoin ecosystem. Conclusion 4: As the founder of the highly popular Ordinals protocol, Casey’s launch of Runes is sure to receive enthusiastic market attention. Finally, over the past six months, a plethora of new ‘protocols’ have emerged on Bitcoin. With my limited energy and capabilities, I am unable to mention them all, please forgive me. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Comparing BRC20 and Taproot Assets: Market Speculation vs Technical Advancement

Tuesday, November 21, 2023

Author: @tmel0211 Source: https://twitter.com/tmel0211/status/1722123517570023863 I rarely discuss BRC20.Why? Because, if you understand it, BRC20 fundamentally falls into the category of market

Argentina’s new president Javier Milai: severs ties with parents, vows to abolish central bank, supports Bitcoin

Monday, November 20, 2023

Author: Wade Editor: Colin Wu On November 19, Javier Milei, a candidate from Argentina's far-right electoral alliance “Liberty Advances Party” and a member of the Chamber of Deputies, was elected

Asia's weekly TOP10 crypto news (Nov 13 to Nov 19)

Sunday, November 19, 2023

Author:0xMingyue Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong Legislator Proposes Including Bitcoin Purchases in Investor Immigration link On November 13th, according to Sing Tao

Weekly Project Updates: Spread of Multi-Chain Inscriptions, OKX to Launch New Chain X1, Pyth Network Airdrop, etc

Saturday, November 18, 2023

1. Record-Breaking On-Chain Inscriptions Data a. Bitcoin Ordinals Achieves Historic Daily Engravings of 505000 link According to the data panel provided by @bcrypt5, on November 12th, the Bitcoin

WuBlockchain Weekly: Tether Invests $500 Million in Mining, Bithumb is Exploring an IPO, Rapid Decline in US Infla…

Friday, November 17, 2023

1. US Inflation Data a. US October Unadjusted CPI Year-on-Year Rate at 3.2% link In October, the US seasonally adjusted CPI had an annual rate of 3.2%, slightly below the expected 3.3%, and down from

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏