Consumers Ignore The Fed On Black Friday

Today’s letter is brought to you by Cal.com!What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in Cal.com and we use it instead of Calendly. Cal.com is the leading open-source scheduling platform, which gives you the same superpowers of efficiency previously reserved for elite corporations and tech gurus. Stop wasting your time with scheduling software that doesn’t work. Use technology to make your life easier. Cal.com is transforming sophisticated calendar management into an accessible tool for all via a user-friendly interface. Set up is quick, easy, and you will never go back to your boring calendar tool. Exclusive for Pomp Letter subscribers, use code “POMP” for $500 off when you set your team up with Cal.com. Save time. Save money. Use Cal.com. To investors, After an explosion in asset prices and inflation in 2020-2021, the Federal Reserve has remained committed to destroying demand and getting the economy under control. The fastest interest rate hikes in history since March 2022 had the desired effect of destroying investment demand. We saw the S&P 500 drop more than 20% from the peak of Q4 2021. TLT, the 20 Plus Year Treasury Bond ETF, is down more than 12% in the last 12 months. But seeing investment values fall significantly is only one part of the equation. Citizens have three options with their money — they can invest it, they can spend it, or they can save it. If the Fed is able to discourage people from investing, they still need to discourage people from spending the money if they want to succeed in their fight against a hot economy. The data from Black Friday suggests that the consumer may not be listening to the Fed nearly as much as the central bank would like. Rebecca Picciotto writes for CNBC:

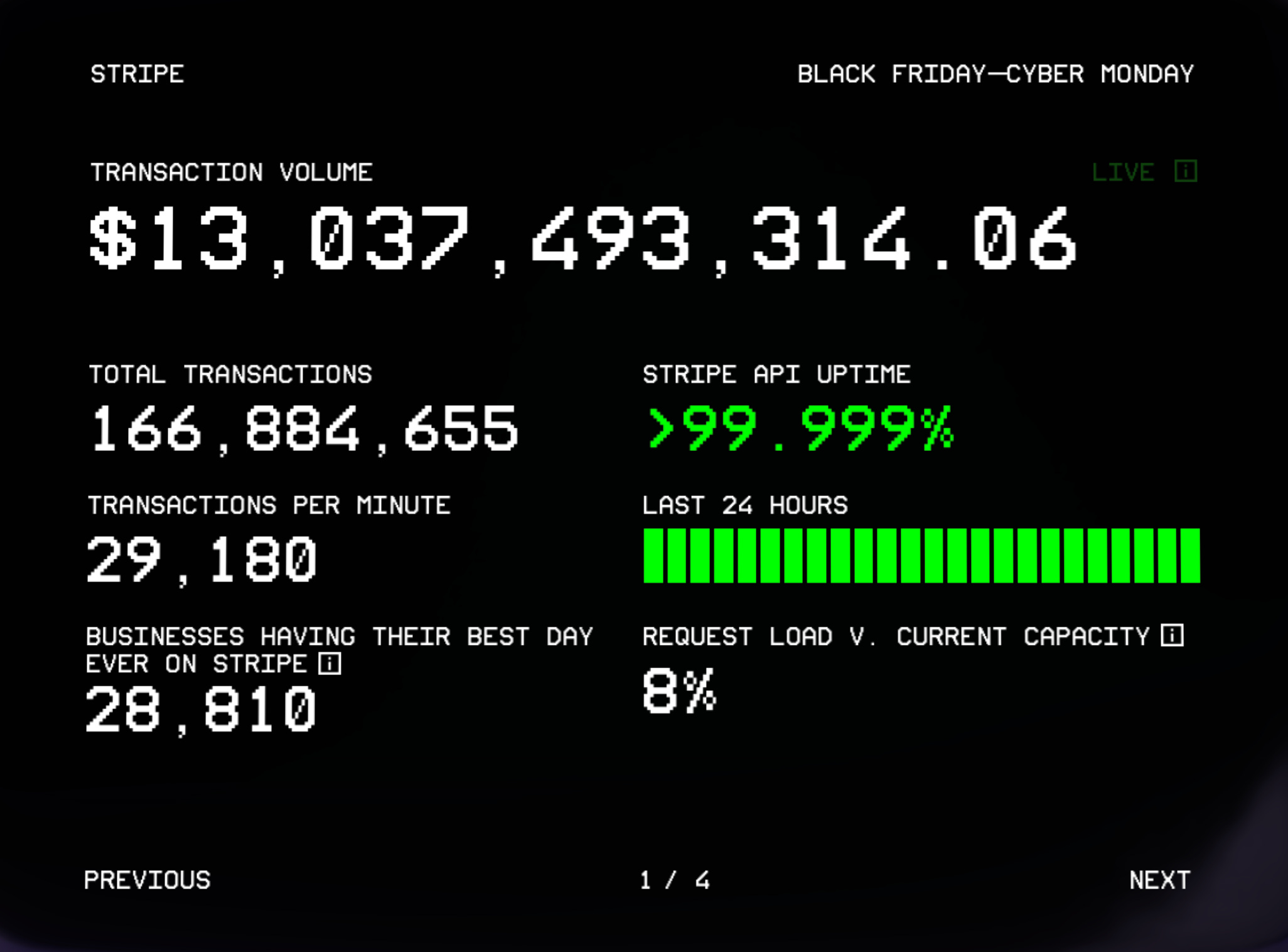

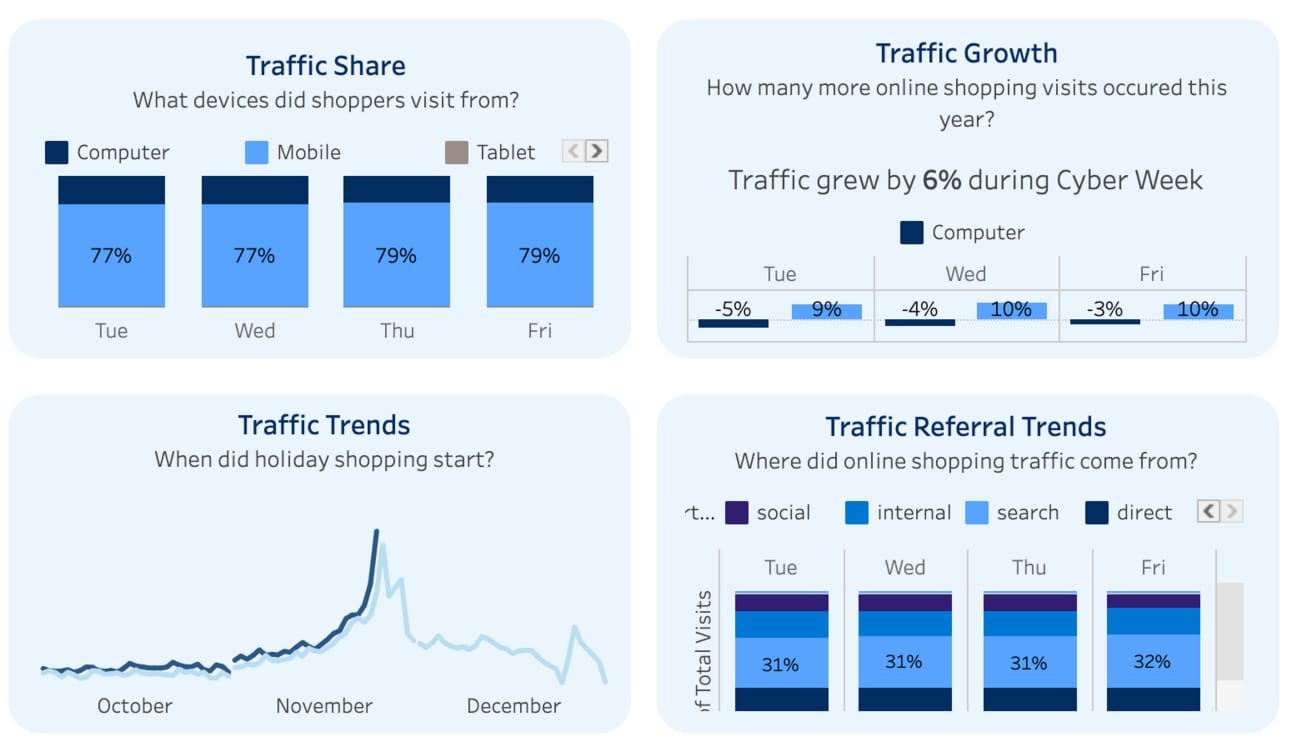

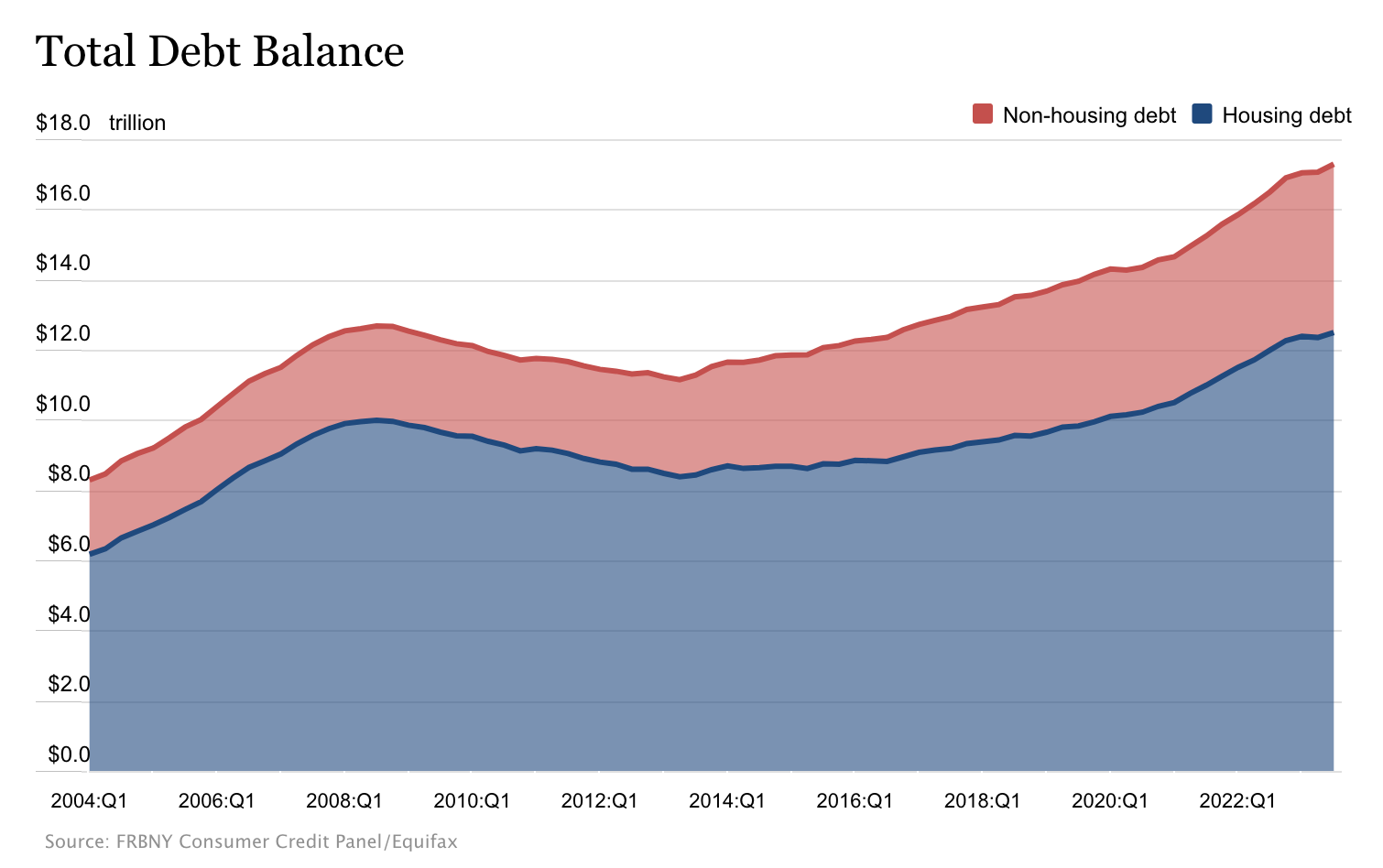

These are very large numbers. Stripe, the fast-growing payments company, built a live dashboard to track various metrics for Black Friday & Cyber Monday. As of 8:30am EST this morning, the dashboard showed more than 166 million transactions and $13 billion in transaction volume. These numbers are exclusively for Stripe, so you can imagine how much larger the numbers get when you incorporate all payment processors. Unfortunately we won’t have that data for a few more days. Another interesting data point from Salesforce that was highlighted by Bay Area Times, and supports Pandya’s analysis of impulse purchases, is that 79% of all purchases came from mobile, rather than the majority being driven by desktop users. So what does this have to do with the Federal Reserve and inflation? While the central bank has been successful in destroying investor demand, they seem to have failed at destroying consumer demand so far. That doesn’t mean they will not be successful in the future, but so far the data is overwhelming in proving that consumers are still ready to spend money on consumption. An important question to ask is where all this money is coming from that the consumer is spending. According to the New York Fed, the Q3 data shows that households continue to take on more debt across various debt types.

Matt Egan explained for CNN why this rising debt situation, especially for consumer credit cards, is important to pay attention to:

To make matters worse, Egan continues:

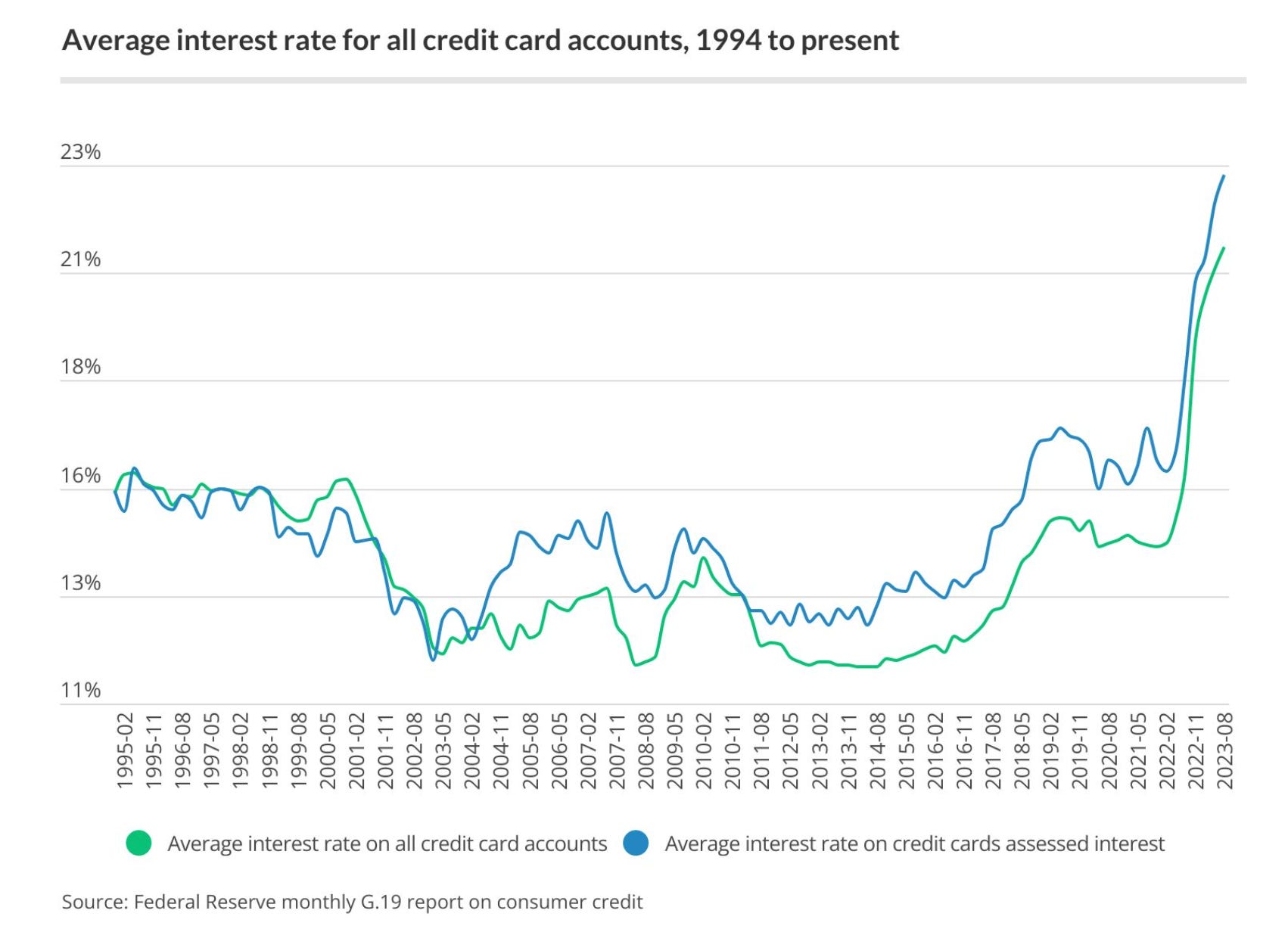

The problem is only going to get worse unfortunately. Interest rates on credit cards have been spiking in a fairly insane manner. The average interest rate on all credit card accounts in the US is now over 21%. Just look at this chart from LendingTree showing historical credit card interest rates: Not exactly what you want to see if the American consumer is using credit card debt to continue to spend enormous amounts of money on consumptive goods. So we have an economy that is still showing a strong consumer spending pattern, but it appears to be financed increasingly with debt. Where else have we seen this happen? The US government. Spending from the federal government has continued to increase, along with more and more borrowing. We are turning into a nation of borrowers. There is no fiscal discipline at the government or individual level on average. There is still time to turn around both ships, but the probability gets lower with each passing day. Never bet against America. But America better hurry up and get back into strong financial shape, so we are prepared to deal with a recession if it ever comes. Hope you all have a great day. I”ll talk to everyone tomorrow. -Anthony Pompliano If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin. Cliff Weitzman is the founder & CEO at Speechify. In this conversation, we talk about the explosion in audio content on the internet, how text to speech audio has become so great, why exactly so many people are now listening vs reading or watching, and how this impacts content creators and human productivity. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here This Immigrant Helped 25 Million Read With Artificial Intelligence Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The People of Argentina Have Spoken & Americans Should Listen

Monday, November 20, 2023

Listen now (8 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

This Recession Indicator Is Sounding The Alarm

Friday, November 17, 2023

Listen now (3 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

We Need A Zero-Based Budget For US Government

Friday, November 17, 2023

Listen now (5 mins) | Today's letter is brought to you by Sidebar! Ready to accelerate your career? As we all know, navigating a big career transition is hard to do. It's one thing to set a

Ken Griffin Sounds Alarm On Inflation & Debt

Thursday, November 9, 2023

Listen now (5 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Why High Interest Rates Have Not Destroyed The Housing Market

Monday, November 6, 2023

To investors, Predictions of an incoming recession have been happening since the Federal Reserve began to raise interest rates at the fastest pace in history. The theory is that market participants

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these