Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 48, 23/11/2023 - 29/11/2023)

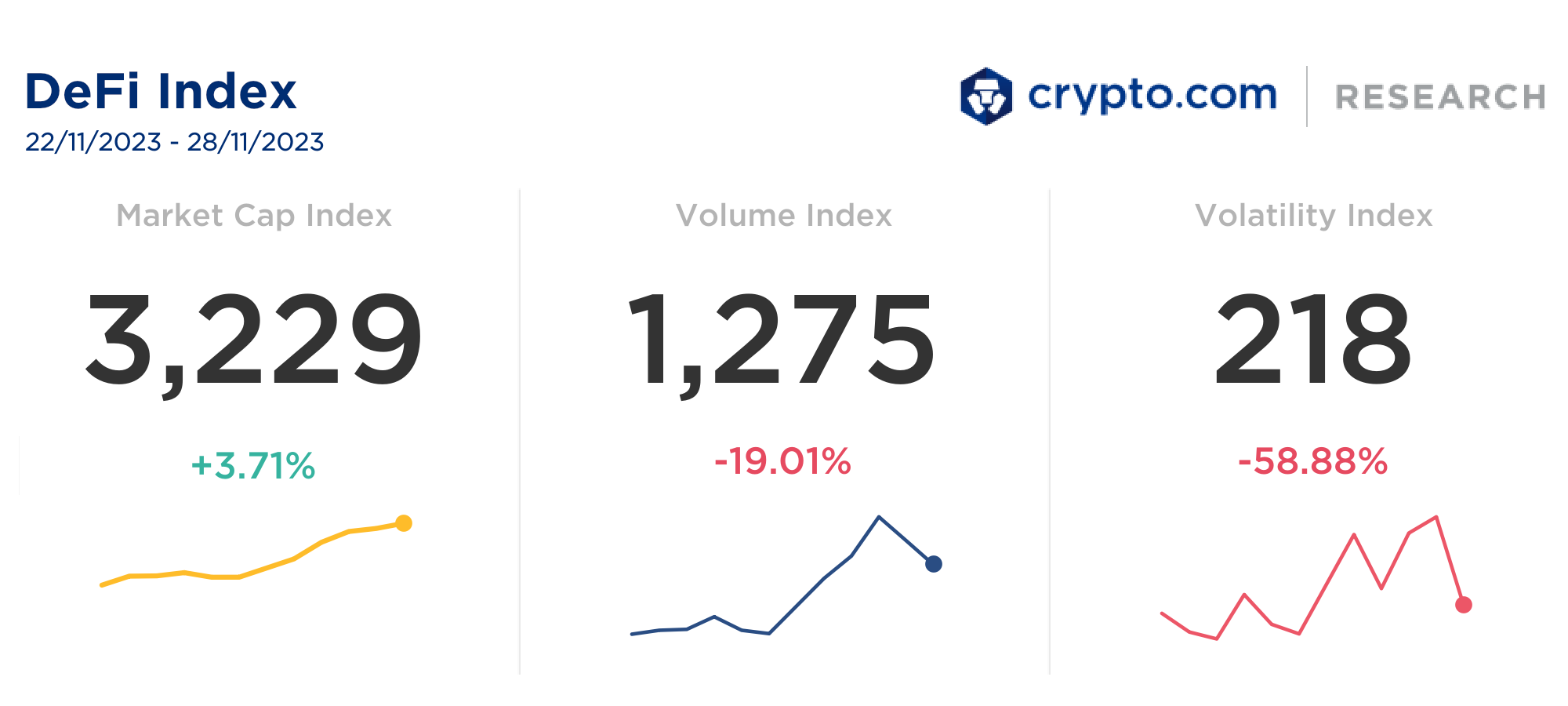

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 48, 23/11/2023 - 29/11/2023)Blast skyrockets with nearly US$600M in TVL days after launch. dYdX completes mainnet migration, rolls out a $20M launch incentive program. Cosmos founder calls for chain split to create AtomOne.Weekly DeFi IndexThis week’s market cap index was positive at +3.71%, while the volume and volatility indices were negative at -19.01% and -58.88%, respectively.

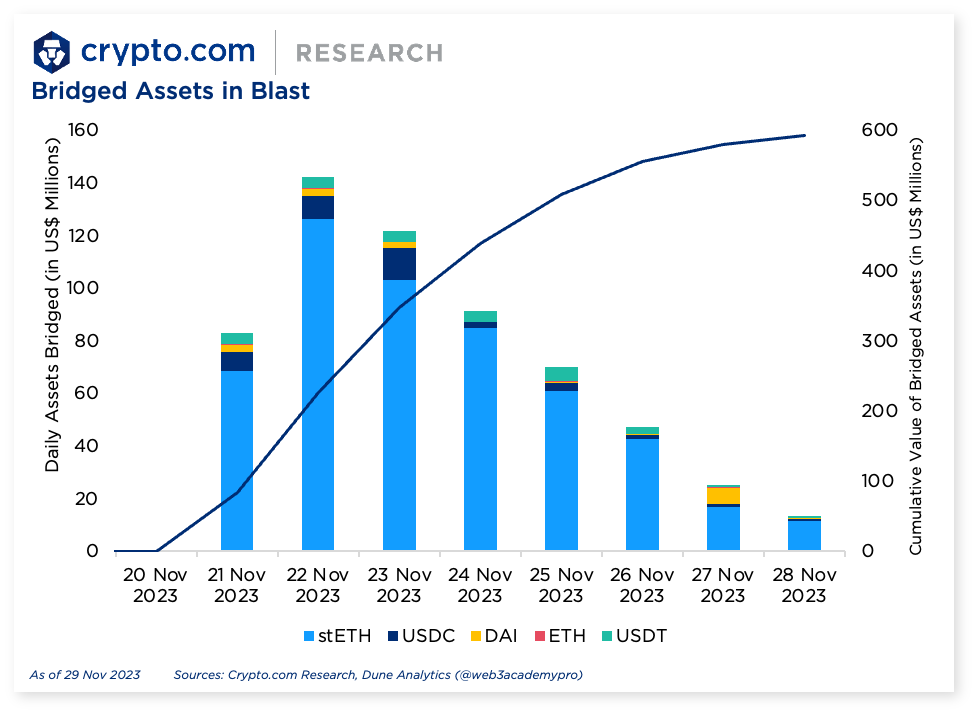

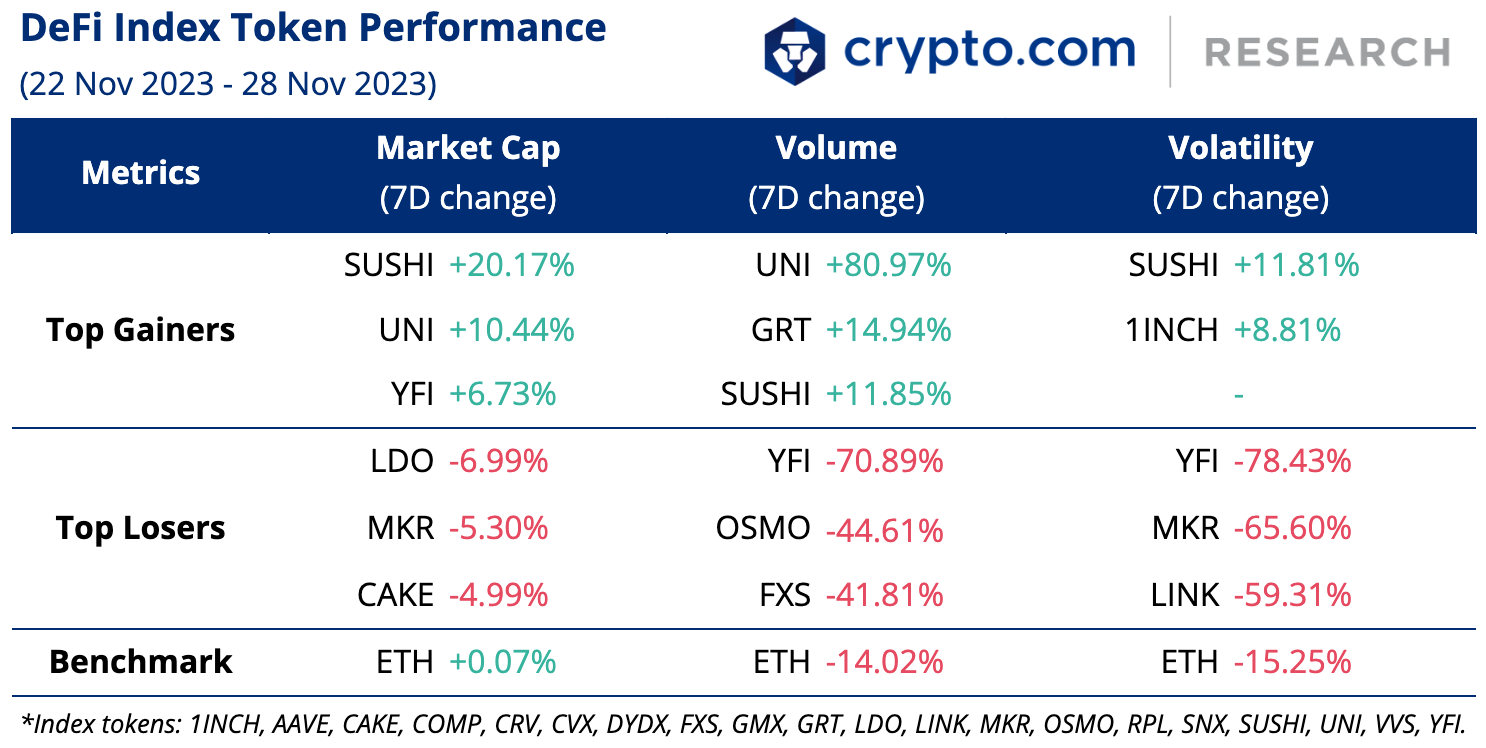

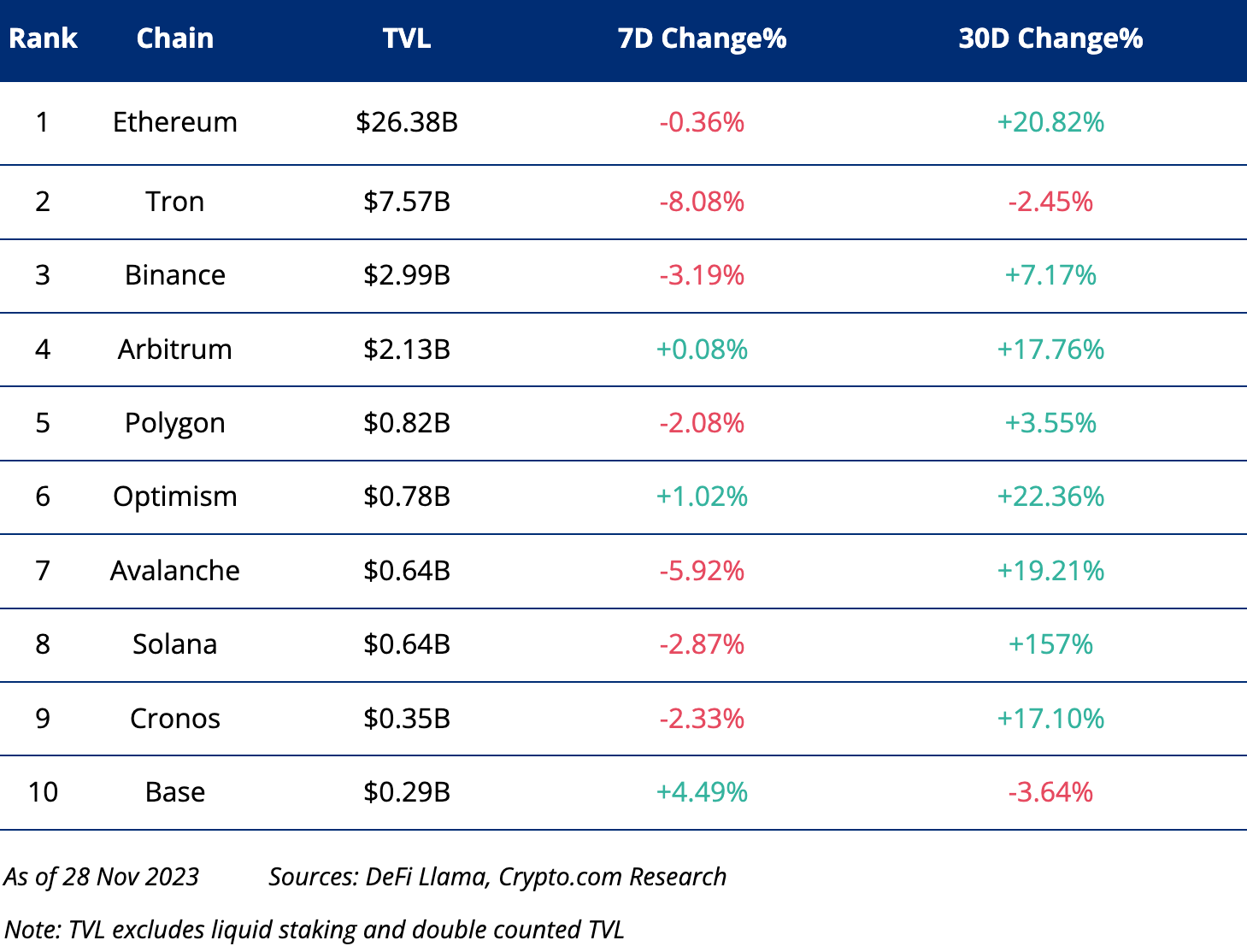

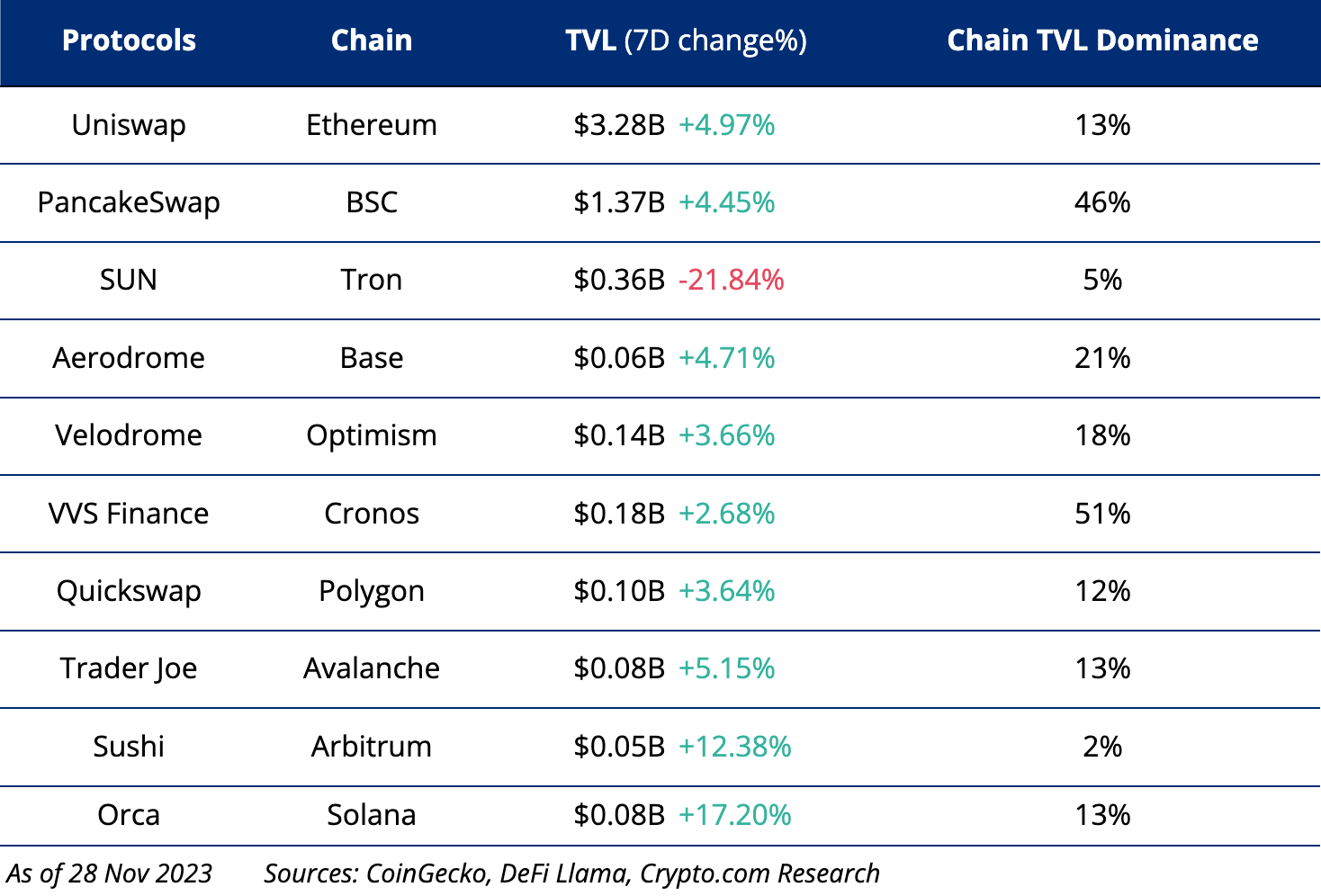

Chart of the WeekOn 21 November, the team behind NFT marketplace Blur announced the development of Blast, an Ethereum scaling solution that leverages optimistic rollup technology and aims to reduce transaction costs. It features native ETH and stablecoin yields and promises token incentives to early adopters. The project has significant backing from several venture capital firms, including Paradigm and Standard Crypto. Blast is rapidly gaining traction; however, the project has incited strong discussions among the crypto community for various reasons. For one, the product is not yet live. It also cannot be classified as a Layer 2 — as it lacks a testnet, transactions, a bridge, rollback capabilities, and transaction data transmission to Ethereum — but rather only as an intermediary contract that deposits and locks assets. Despite these concerns, among others, Blast has reached over US$500 million in TVL in less than a week, which includes assets like ETH staked in Lido and DAI in Maker DSR. Blast has surpassed zkSync Era, becoming the fourth largest L2 by value locked. Uniswap’s governance has approved a proposal to delegate 10 million UNI tokens from the DAO’s treasury to seven active delegates (including 404 DAO, Wintermute Governance, PGOV, and StableLab) to combat low participation rates. The tokens will not be tradeable and will only be used for voting purposes, potentially increasing the delegates’ voting power in governance proposals. TVL of Top ChainsTop DEX by ChainNews Highlights

Recent Research Reports

Recent University Articles

DisclaimerThe information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.The brands and the logos appearing in this report are registered trademarks of their respective owners.We’re all ears.Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you! Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening! Hungry for more? Visit our Research Hub and University to access other insightful crypto research! Share with a friend if you like our email! Crypto.com DeFi Research is free today. But if you enjoyed this post, you can tell Crypto.com DeFi Research that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 47, 16/11/2023 - 22/11/2023)

Wednesday, November 22, 2023

Circle launches 'bridged USDC standard' on new networks. Aave Companies rebrands to Avara, acquires crypto wallet Family. EigenLayer to launch second phase of its mainnet in H1 2024.

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 46, 9/11/2023 - 15/11/2023)

Friday, November 17, 2023

Crypto.com obtains digital asset provider license in Dubai. Circle and Noble to bring native USDC to Cosmos via CCTP. Ordinals mints push Bitcoin transaction fees to reach a new peak.

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 45, 2/11/2023 - 8/11/2023)

Wednesday, November 8, 2023

Celestia launches its mainnet beta following the TIA token airdrop. Optimism introduces the Canyon Hardfork. Arbitrum DAO passes proposal to allow ARB token staking.

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 44, 26/10/2023 - 1/11/2023)

Wednesday, November 1, 2023

Ethereum devs confirm Dencun upgrade ruled out for 2023. Arbitrum Orbit is now officially mainnet-ready. Lido DAO raise concerns over LayerZero's unapproved wstETH bridge rollout.

Weekly Update - DeFi and Layer 1 & Layer 2 News (Week 43, 19/10/2023 - 25/10/2023)

Wednesday, October 25, 2023

dYdX becomes open source as it transitions to Cosmos-based blockchain. Celestia gears up for mainnet beta launch. Safereum unlocked and dumped native tokens in US$1.3M exit scam.

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏