Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #370

What's 🔥 in Enterprise IT/VC #370The End of an era - the extinction of "Hypergrowth" public enterprise software cos, >40% NTM Revenue 📈 - Guggenheim PartnersAs I was thinking about the newsletter this weekend, I got this mind-blowing 🤯 email from Rob Bartlett who is a Sr. MD, phenomenal banker, and leads the Security & Software Infra group for Guggenheim.

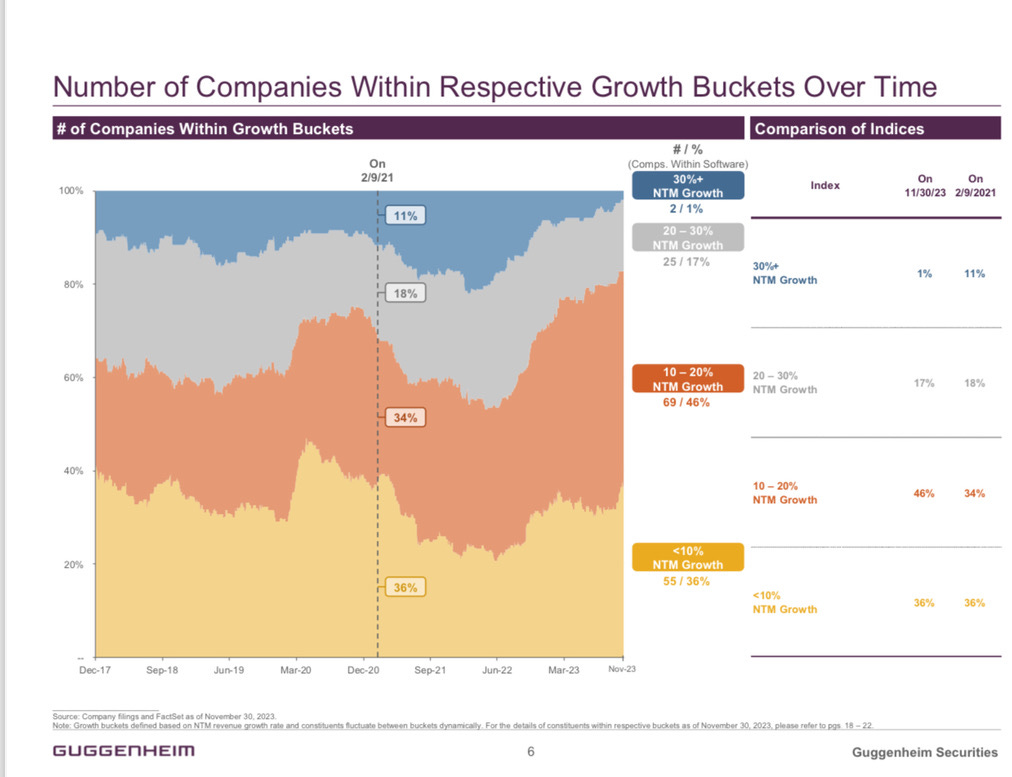

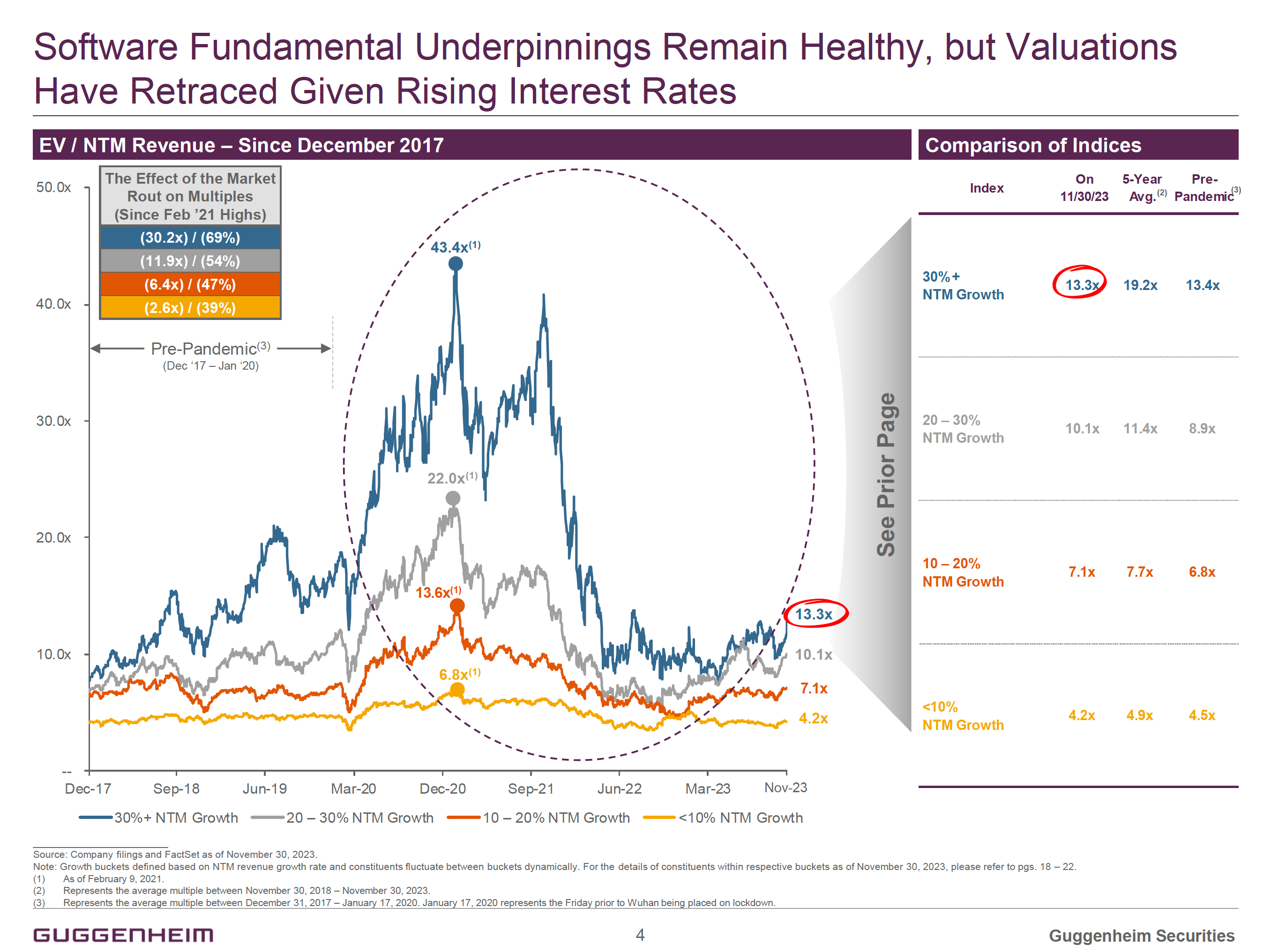

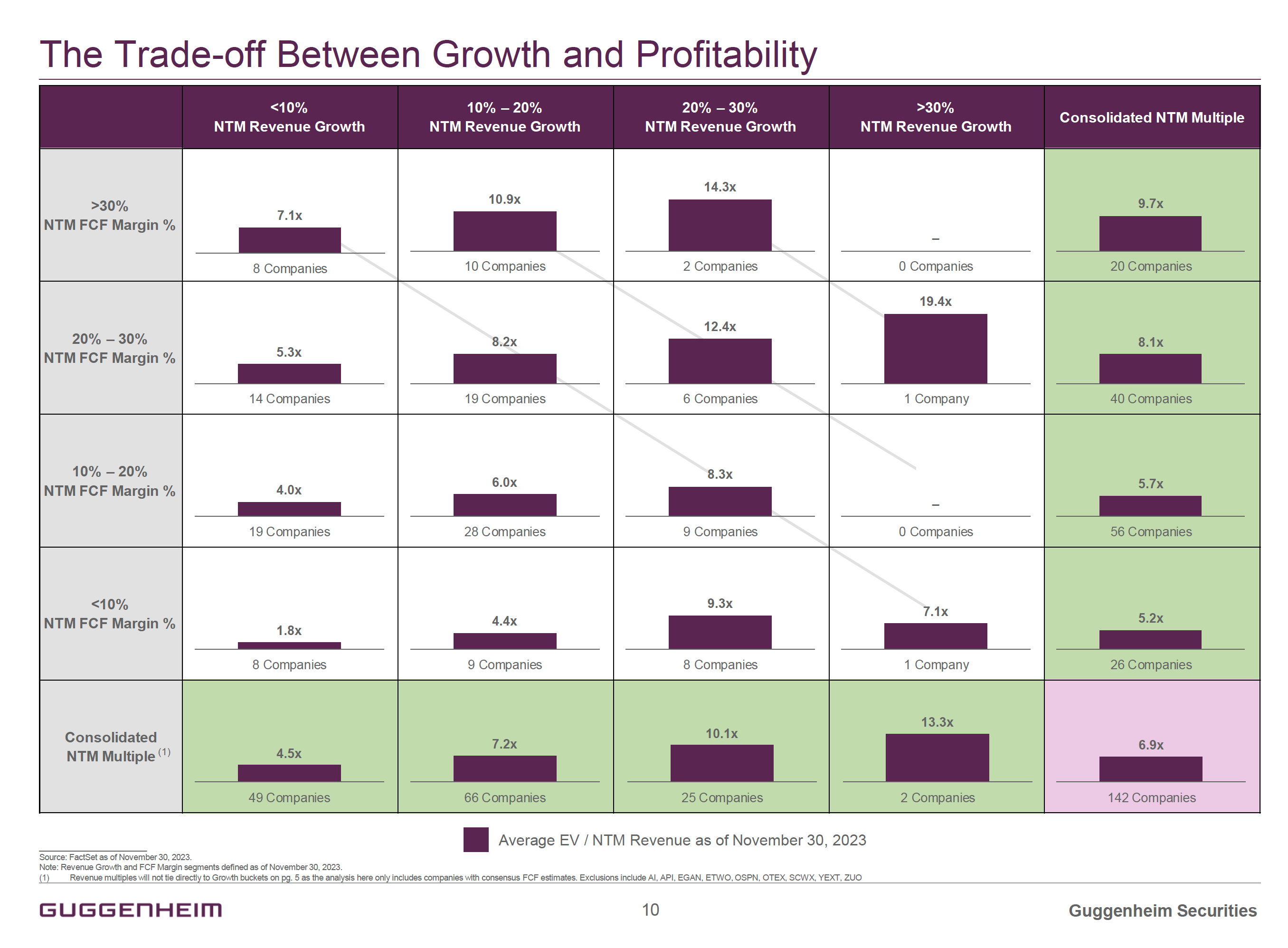

Here’s Slide 6. You can see 20% of companies were in the >30% growth bucket mid-2022, and it’s quickly adjusted downwards to just 2 companies representing 1% (Snowflake and SentinelOne). This is absolutely mind blowing and a combination of the COVID acceleration unwinding, a tough economy, rising interest rates, and the public market demanding efficient businesses. There is one silver lining though; while multiples have been wrecked from a peak of 43.4X three years ago, there has been a slight uptick in the last month to 13.3X for High Growth, >30% companies which is back to Pre-Pandemic levels. Let’s see if this continues moving forward in the next few months. Here’s a chart showing the all important trade-off between growth and profitability. In the end, growth is rewarded more than FCF but at same time you need both. If you’re just a profitable company with amazing FCF >30% you’re multiple is just 9.7x forward versus 13.3X forward for >30% growth cos. With the 1000+ 🦄 still private, the big question will be if this new batch of public cos will come out of gate to help recreate the >40% growth bucket or if we have just hit a wall? I expect the former as this new class of IPO candidates has had time to readjust growth and profitability expectations in private and will create a new class of >40% efficient growth companies with positive FCF. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

Markets

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #369

Saturday, November 25, 2023

Selling what's on the 🚚 vs. the one more feature trap - importance of the right ICP

What's 🔥 in Enterprise IT/VC #368

Saturday, November 18, 2023

Thoughts on board governance

What's 🔥 in Enterprise IT/VC #367

Saturday, November 11, 2023

OpenAI Dev Day - it was the best of times, it was the worst of times; also latest data on AI deployment in enterprise

What's 🔥 in Enterprise IT/VC #366

Saturday, November 4, 2023

Reflecting on 27 years of enterprise software investing + understanding the experience trap

What's 🔥 in Enterprise IT/VC #365

Saturday, October 28, 2023

The new era in venture and race to be first: Inception Investing - what does it mean and why pre-seed ain't first any more

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏