Aziz Sunderji - A Renter’s Paradise—but for how Long?

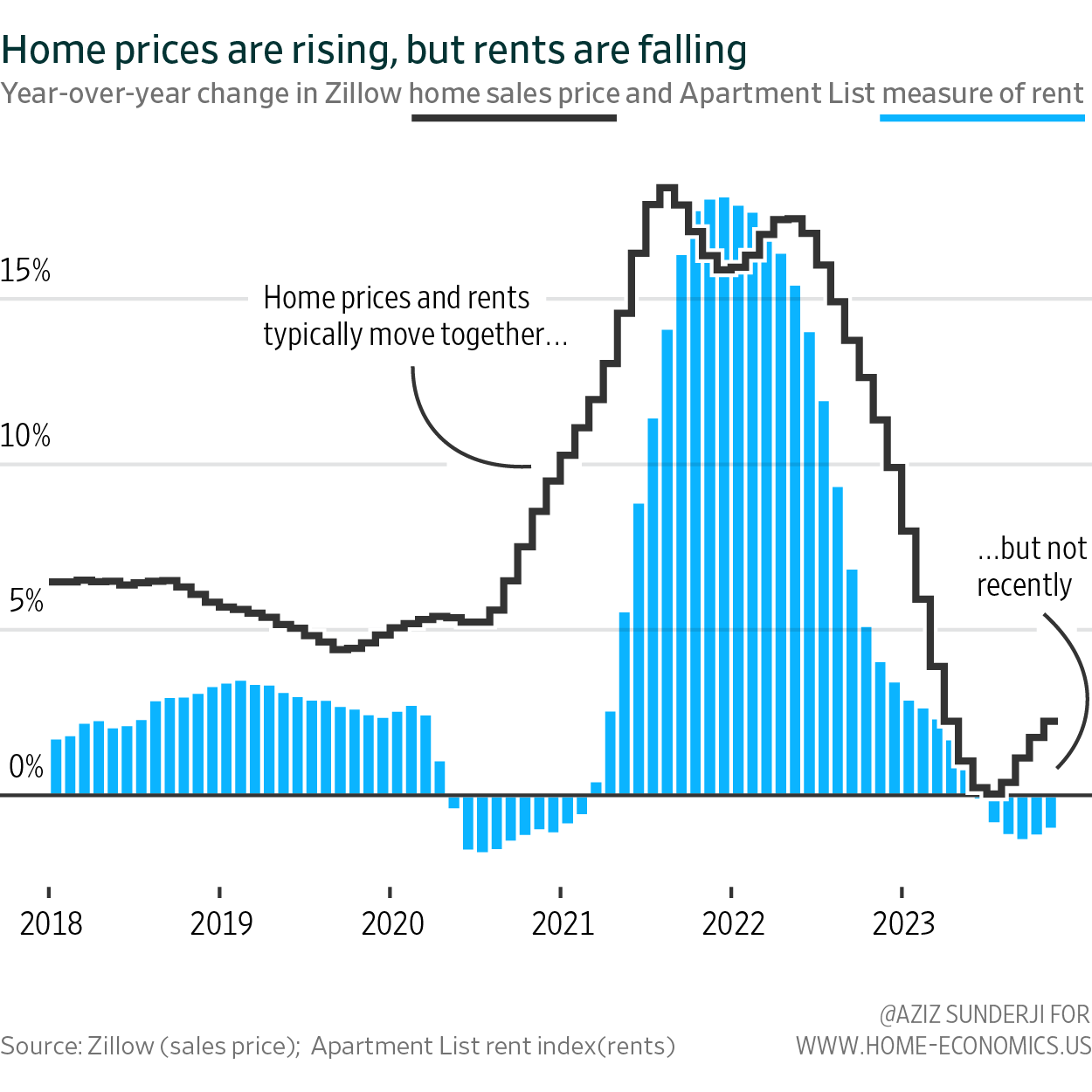

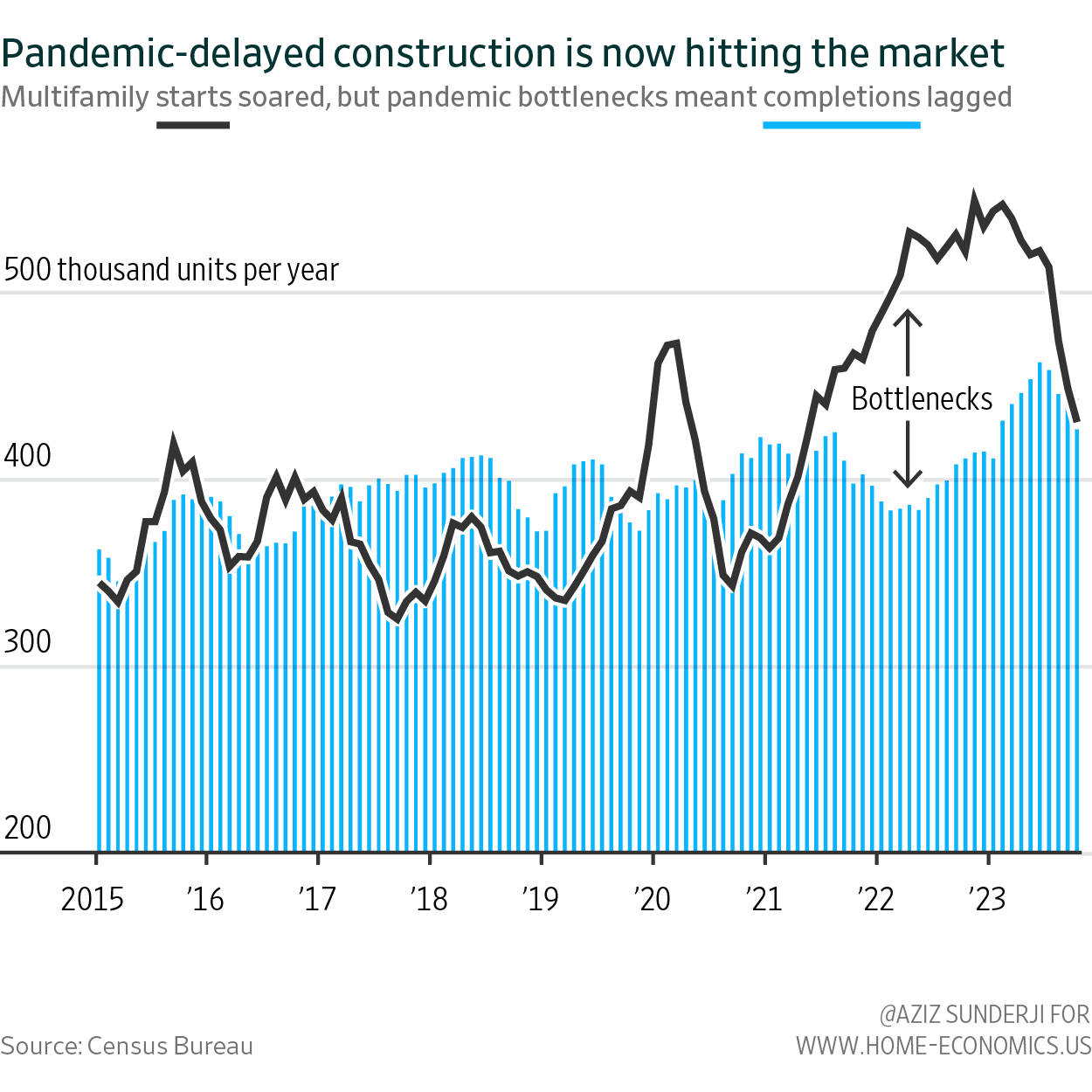

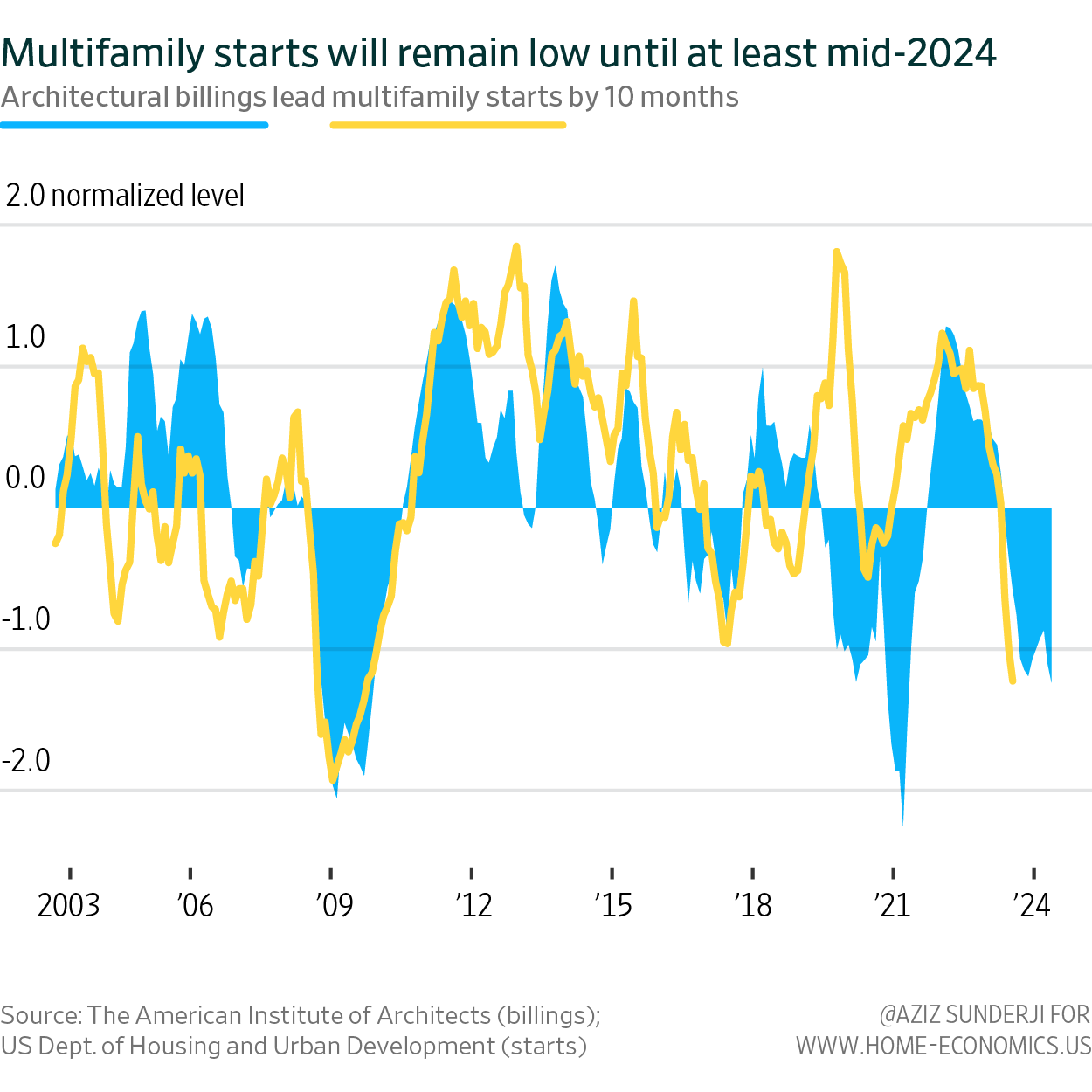

Welcome back to Home Economics—a data driven, forward looking newsletter about the American housing market. Today’s edition focuses on the surge of multifamily building coming to market and what it means for renters. SPEED READHome prices and rents are moving in different directions. Since the summer of 2022, home prices are up over 1%. Rents are down almost 4%¹. Two houses, both alike in dignity, but not in pricePrices and rents don’t move in lockstep, and they shouldn’t be expected to. The two markets are different—both on the demand side (renters are younger and poorer) and on the supply side (most homes for sale are single family houses, most rentals are apartment units). Still, they’ve historically followed broadly similar patterns. What’s happening today—home prices rising while rents are falling—is pretty unusual. What’s going on?Multifamily construction started to rise rapidly in 2021. Last year, starts soared to the highest level since the 1980s. But construction was hampered by pandemic-related bottlenecks. As Thesis Driven points out, the average span between permitting and breaking ground on new construction rose from 1.4 months in 2014 to 2.8 months in 2022. Starts to completion rose from under a year to 17 months. Those bottlenecks are now clearing, and units under construction are turning into a deluge of completions. Supply of rental units is soaring. That’s the main reason rents are falling. To be fair, there has been a boom in construction of single family homes, too. But the pandemic and demographics fueled a matching surge of demand for homeownership (helped by generous homebuilder financing). The boom in multifamily construction has been larger in historical context compared with the rise in single family homebuilding, and there’s been no concurrent surge in demand to absorb it. The result is a golden moment for renters. Data from the National Multifamily Housing Council suggests the rental market is tilted in renters’ favor as much as it was at the height of the pandemic, and before that, during the 2008 crash. Jay Parsons at RealPage argues that rents are weakest in markets where supply expanded the most. How long will it last?Sadly for renters, I think this moment is fleeting. The same factor that helped create the current tailwinds for renters—high supply—is set to abate. Multifamily housing starts are falling sharply. Developers are responding to market conditions—prices, potential operating income, and financing costs—that are the least appealing they’ve been in 15 years, according to the Freddie Mac Multifamily Apartment Investment Market Index. Supply will remain lowThe best leading indicator for starts is architectural billings. The American Institute of Architects measures these every month. Billings are strongly predictive of multifamily starts. The latest billings data suggests starts will remain depressed until at least next summer². My rough model (results below) for this relationship suggests multifamily starts decline to 275-325k units per year midway through 2024. That’s at best the pre-pandemic average, and at worst the lower level of starts that prevailed in the 2000s. A low level of starts means there’s little new construction to replace the volume of units now being completed. Today’s surfeit of supply can sustain falling rents for a matter of quarters, not years. The surplus could dissipate especially quickly if would-be owners are increasingly lured into renting by today's high price to rent ratio (this trend is already underway). So, as much as the balance of power lies with renters today, it may soon shift back to landlords. Maybe “the rent’s too damn high”, but at least it’s falling. I doubt we’ll be able to say that a couple of years from now. 1 To capture how rents change in a market over time, Apartment List estimates the expected price change that a rental unit should experience if it were to be leased today. In other words, this measure avoids the severe lag problem seen in the Census Bureau’s measure of rents. Apricitas Economics covered this extensively here. 2 Many analysts look at permits as a leading indicator for starts, but the permits are in fact coincident with starts. Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

Growing Pains for Home Prices

Friday, December 8, 2023

Could valuations stagnate for years?

This bird is cooked

Thursday, November 23, 2023

Rising unemployment is bad news for the economy and for home prices

How to Make Great Charts

Friday, November 17, 2023

An entirely biased view

Another Reason Mortgage Rates will Fall

Friday, November 10, 2023

As rate vol dips and the yield curve steepens, prepayment risk will abate

A Smaller “Term Premium” means Lower Mortgage Rates

Friday, November 3, 2023

Especially after Wednesday's announcement from the Treasury

You Might Also Like

EmRata Flaunted Pelvic Bone Cleavage, Aka "Pelvage," In The Tiniest Skirt

Monday, March 10, 2025

Plus, your love life this week, your daily horoscope, and more. Mar. 10, 2025 Bustle Daily Chet Hanks EXCLUSIVE Chet Hanks Has The Last Laugh It's easy to make assumptions about Chet Hanks, namely

The 20 best cookbooks of spring

Monday, March 10, 2025

NYC steakhouse sues Texas over attempted “Texts Strip” rebranding.

(sorry)

Monday, March 10, 2025

now with the link this time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

an equinox stretch

Monday, March 10, 2025

everything you need for Wednesday's workshop ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

9 Strange Tax Deductions You Might Actually Qualify For

Monday, March 10, 2025

Easiest Ways to Spot an Unpaid Tolls Scam Text. Good news: The IRS might allow you to deduct all those gambling losses. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

Maybe You Fund The People Who *Will Start* Families

Monday, March 10, 2025

At best, the DOT's new funding priorities get causation wrong ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“In this Poem, We Will Not Glorify Sunrise” by Sarah Freligh

Monday, March 10, 2025

nor admire the apples that blossom / during a February heat wave ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Glen Powell to the (couture) rescue

Monday, March 10, 2025

— Check out what we Skimm'd for you today March 10, 2025 Subscribe Read in browser But first: our editors' cult-status products Update location or View forecast Good morning. While we might

Deporting Undocumented Workers Will Make Housing More Expensive

Monday, March 10, 2025

The effect will be most pronounced in Texas and California ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend

Monday, March 10, 2025

So edgy. The Zoe Report Daily The Zoe Report 3.9.2025 The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend (Hair) The Viral "Jellyfish" Haircut Is 2025's Most