Affiliate M&A is a buyer’s market – and that buyer is Better Collective

Affiliate M&A is a buyer’s market – and that buyer is Better CollectiveAffiliate M&A, activists get active, (not) the month in transactions +More

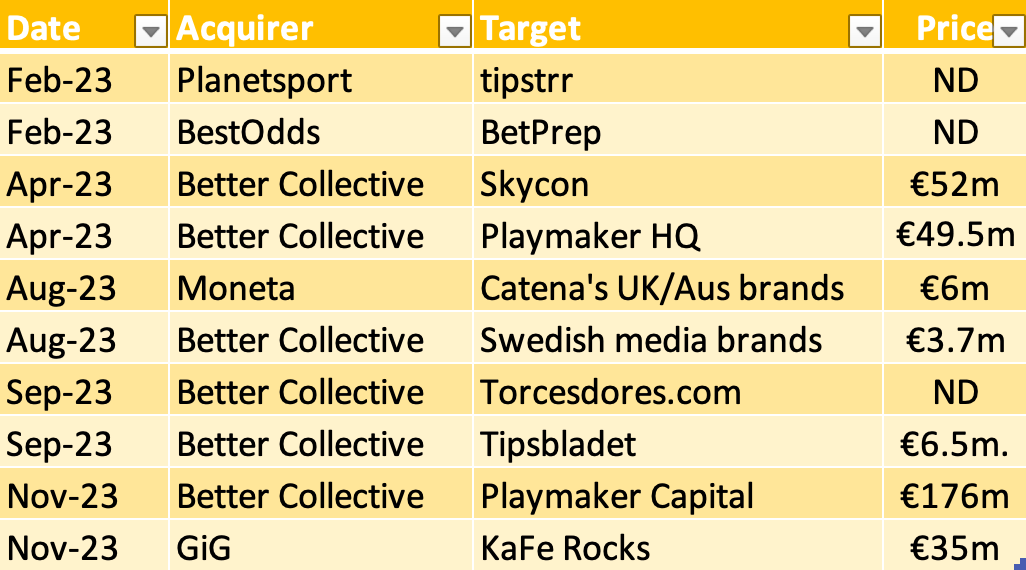

They can afford to pick and choose. Affiliate M&AA recent flurry of deals suggests consolidation in the gaming affiliate space has entered a new phase. Buyer’s market: In 2023, M&A has once again been the dominant theme within the gaming affiliate space, particularly regarding the leading listed players in Europe and the US. As tracked by the gaming team at Citizens, at least 10 deals were completed over the year. Collective effort: But if it is a buyer’s market, then what this really means is that it is one single buyers’ market. In 2023, the Copenhagen-based Better Collective dominated the gaming affiliate M&A picture, completing six out of the 10 deals tracked and accounting for €288m of the €329m worth of disclosed deals.

🤝 Ten affiliate M&A deals were tracked in 2023 Source: Citizens Bank Rack ‘em: Previous large deals include the $240m acquisition of Action Network as well as the €55m laid out on Rotogrinders and the €44m on Atemi. Esports has also been an area of activity including the €105m spent on Futbin and the €35m for HLTV.org.

Itchy and scratchy: On its Q3 earnings call, Better Collective CEO Jesper Søgaard pointed out that M&A was integral to the company’s strategic aim of becoming a “leading digital sports media group” and the Playmaker Capital deal in November – the second-largest deal in its history – certainly scratches that itch.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. Scaling heightsSnowball: Market watchers and participants agree the pace of M&A in the affiliate sector picked up in H2. “The space has always been very fragmented, but scale is increasingly important, as is geographic diversification,” says Sandford Loudon, partner at Oakvale Capital.

To this point, it is no coincidence that the larger affiliate providers are keen to emphasize the extent to which they have been able to convert a lot of their North American business to revenue share. Better Collective said recurring revenue made up 61% of total revenues, with the North American team having “fast-forwarded” the transition to rev share.

Fallen from the pedestalLook on my works, ye mighty, and despair: Affiliate M&A is a long-standing trend and, while the building of scale is a path being followed by many, in Catena Media the sector has its own Ozymandias and an object lesson in how not to do it.

Nothing beside remains: Sources are quite scathing about what went wrong with Catena’s roll-up strategy. “I don’t think Catena was ever built to integrate and realize synergies,” says Ben Robinson, a partner at RB Capital. “It rolled up at such a rapid pace that it didn't allow for this.”

Building blocksFollow the leader: With the example of Catena Media fresh in the memory, the sector giants are arguably now progressing with greater deliberation over the bigger deals that are, in the process, reshaping the sector. Following the example of Better Collective, both GiG and Gambling.com seem set on buy-and-build strategies that appear to emulate the strategy of the sector leader.

Vaduz: On the company’s Q3 call, CEO Charles Gillespie said: “Just because we haven't announced anything in two years doesn’t mean we’re not tirelessly working in the background on some fairly interesting stuff.” He also suggested the company would “maybe raise a little capital” to fund bigger deals.

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth? Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for. Return on effortBench press: While there is a wide range of values attached to Better Collective’s deals in the last 12 months – from €6m to €176m – for the larger gaming affiliates, ever larger price tags are more likely than not in the years ahead.

Loudon agrees that M&A in the affiliate space is about “acquiring and integrating properly while extracting synergy and not creating an overdependence on key individuals who leave after earnout periods”.

Play your cards right: As ever, the sticking point for any M&A comes down to price, but Robinson suggests that, to an extent, the arbitrage between (lower) non-public EBITDA multiples and (higher) publicly traded also “contributes to the M&A momentum”.

Tree of life: Still, life beyond the relatively rarefied atmosphere of high-level M&A does go on. Loudon suggests the vertical is “going through a Cambrian explosion”, while one industry insider points out that as much as the bigger entities believe they can “build fortresses, they can’t”. “There will always be space for newcomers.”

+More dealsActivists get active: At Entain, the news last week that Corvex has become the latest activist investor name to be added to the shareholder register heaps even more pressure on a management team that so recently lost its figurehead.

Bragg Gaming: Also under pressure from its own shareholders is Bragg, which was the subject of an open letter from Raper Capital in late November that called on management to consider a partial or complete sale of its assets in order to maximize the value of its assets.

📢 Bragg’s share price performance in 2023 (Not) the month in transactionsAu revoir, for now: Playtech buying 888 was the deal that didn’t happen, at least not yet, but a story in early December in The Sunday Times suggested discussions held during the summer ultimately came to nothing due to disagreements over valuation.

Obstacle course: As was noted previously, the obvious handicaps for Playtech to execute any deal in B2B remain the unresolved legal dispute with Caliente in Mexico and its Asian-based shareholder base, which has historically been reluctant to countenance any form of M&A. Yam curious oranj: With regard to the latter, sources suggested recent Playtech board appointments have raised eyebrows. Specifically, the brief board presence of Ruby Yam is thought noteworthy. The former head of private banking at China Construction Bank was appointed to the Playtech board as a non-executive in May.

Sportsbooks! Checkout some of Matchbook’s latest quotes across NFL, NCAAF, MLB & NBA: NFL: NY Giants/LV Raiders O37.5; $107k @1.95 NCAAF: Marshall +3.5 (vs Appalachian State); $34k @ 1.83 MLB: ARI Diamondbacks ML (vs TEX Rangers); $36k @ 1.99 NBA: NO Hornets +12.5 (vs DAL Mavericks); $170k @ 1.90 Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins. Stop being forced to limit customer stakes due to market liability. Stop being caught out by stale prices and one sided markets. Matchbook B2B, because the best price is for everyone. Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

DraftKings the loser from ESPN Bet’s initial launch

Monday, December 18, 2023

By the numbers – ESPN Bet, Entain board concession, startup focus – UNLV's Black Fire program +More

Doors to manual: Entain chief resigns

Friday, December 15, 2023

Nygaard-Andersen resignation, Brazilian sports betting, by the numbers – ESPN Bet, Hard Rock expands into social +More

Ruffling feathers: Corvex buys Entain stake

Friday, December 15, 2023

Entain fall out, ESPN Bet figures, XL Media shortcomings, analyst takes +More

Making payroll: an inside guide to first hires

Tuesday, December 12, 2023

Startups' first hires, inside the raise – Fluid, growth company gazette +More

‘Private Jette’ – is Entain ready to drop the pilot?

Monday, December 11, 2023

Entain disquiet, DAZN fund raise, Penn's New York needs, analyst takes, startup focus – Odditt +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these