US Citizens Had To Become Market Speculators

Today’s letter is brought to you by Dream Startup Job!

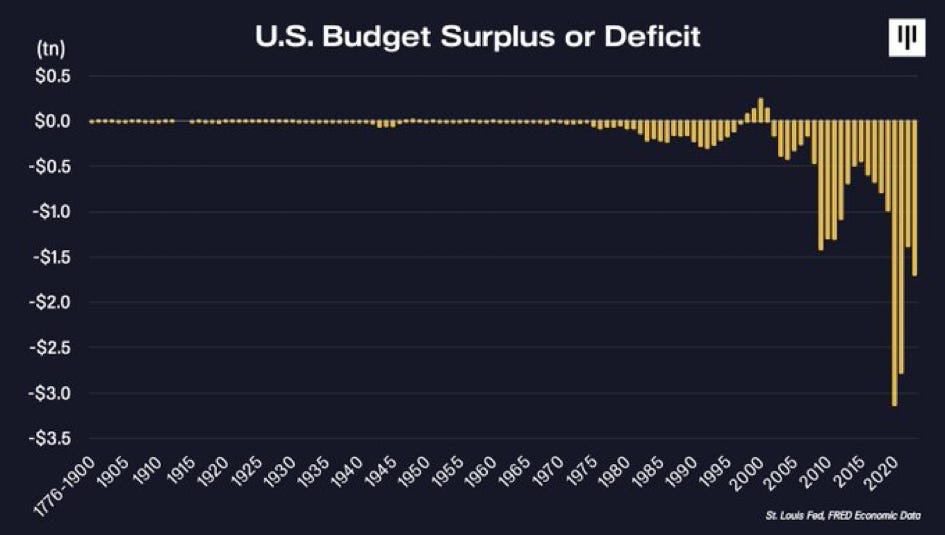

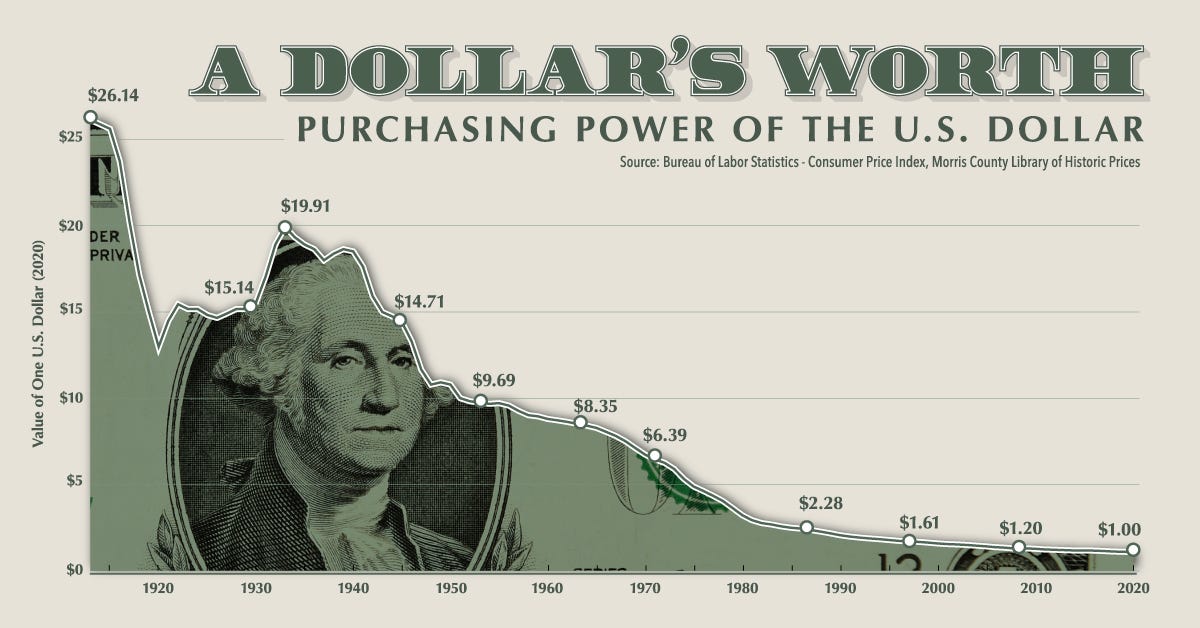

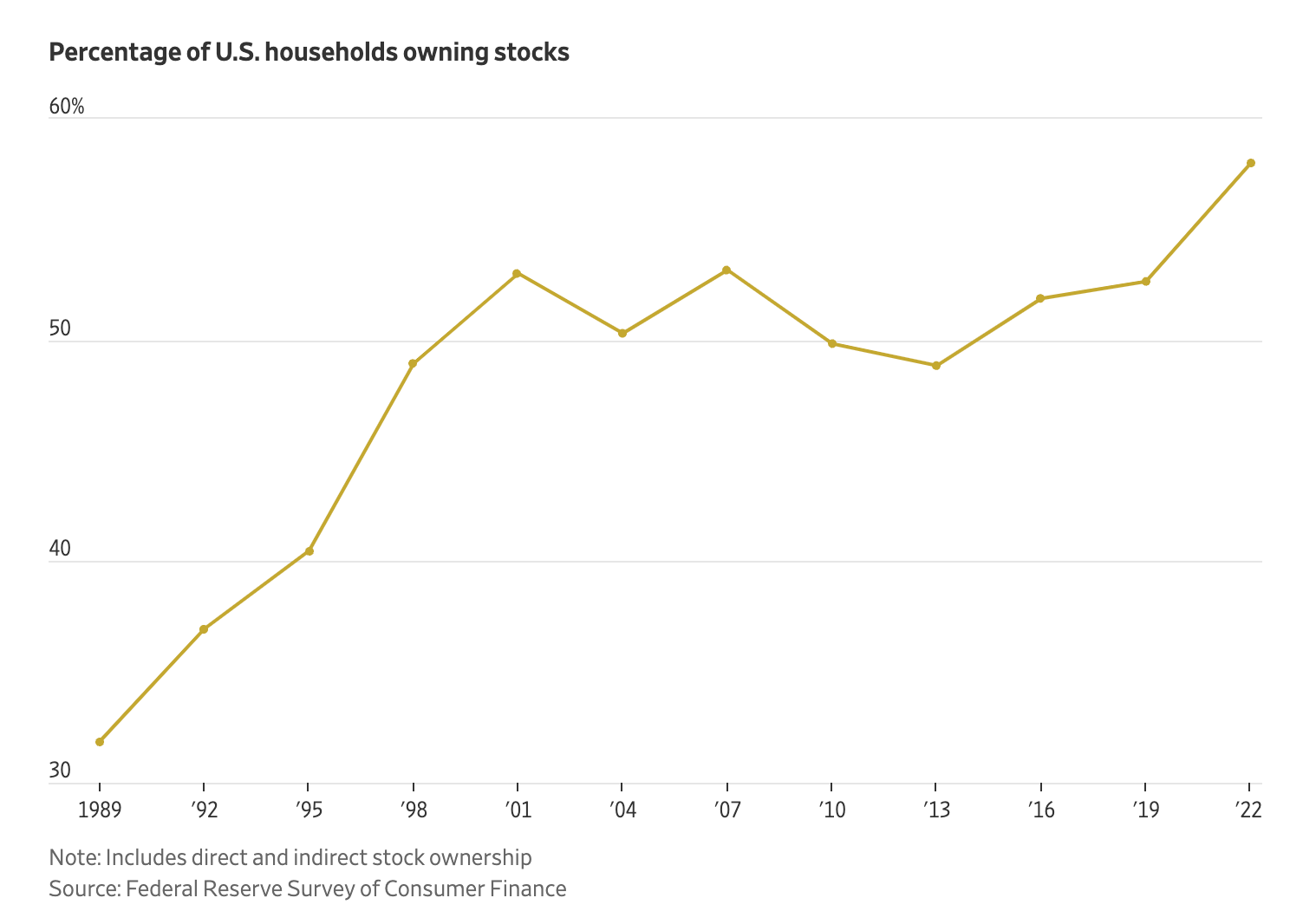

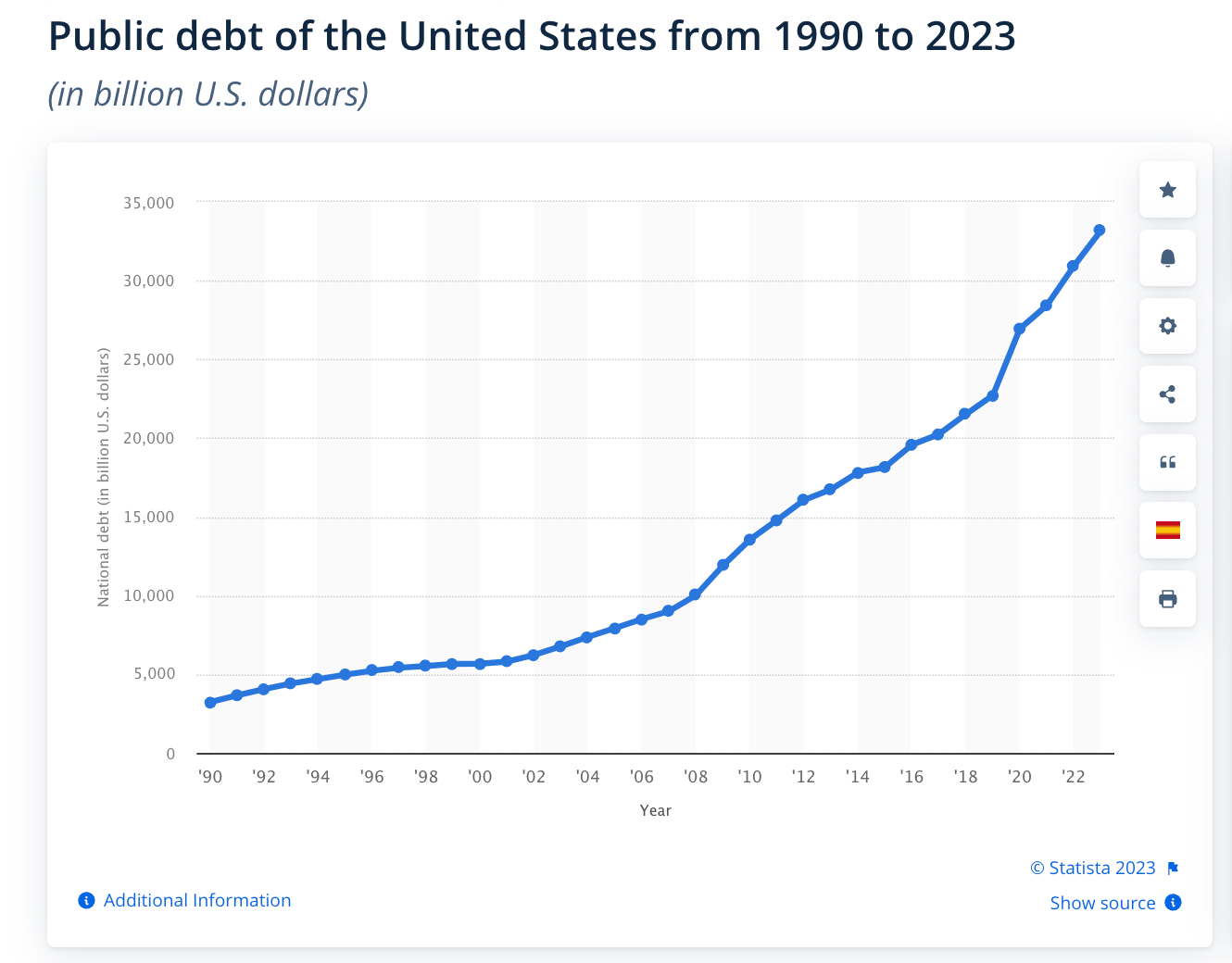

To investors, The citizens of America are being forced to become market speculators. Historically, some portion of the population was drawn to the idea of wagering capital to drive a return on their investment, yet a majority of individuals chose to refrain from this activity and merely save their money. To understand the phenomenon, we must first identify a key structural change that happened in the 1970s — the United States went off the gold standard, the government became addicted to running an ever-increasing deficit, and the national debt has ballooned to $33+ trillion. This chart from Pantera’s Dan Morehead is eye-opening. As the national debt became larger, the US government realized they had a more robust ability to devalue the currency so we theoretically could pay off a fixed debt amount with future devalued dollars. You can see a rapid decline in the purchasing power that began at the start of the 1970s. While the devaluation of the dollar allows for debt to be paid off at advantageous terms later, even though it is unlikely that the US will ever pay off their debt, the largest negative repercussion from this decision is the erosion of citizens’ savings value. The majority of citizens were holding cash in the bank account trying to save their way to wealth, yet the government was destroying that value simultaneously. This devaluation forced more citizens to seek paths to protect their wealth. Investment assets like stocks became a popular option because the belief has been that the stock market will outgrow any inflation implemented by the government. So how significant was this trend? Within 30 years, more than 50% of all US citizens owned stocks directly or indirectly. Last year the percentage of US citizens holding stocks hit an all-time high just under 60%. The rise from 53% stock ownership in 2019 to 58% stock ownership in 2022 is largely driven by the mania ushered in from zero-interest rates and trillions of dollars in quantitative easing. This problem is not going away. The national debt chart looks like an exponential growth chart a Series A startup would show investors to elicit their next mega-round of funding. Up and to the right. No end in sight. This runaway debt means the United States has no choice but to continue devaluing the US dollar. As they devalue the dollar, more citizens will seek investment assets like stocks, real estate, gold, or bitcoin to protect their wealth. We should see ownership of each of these assets, especially stocks, hit new all-time highs over and over again throughout the next decade. At the same time more capital and investors has flooded into the public stock market, the number of public companies has been declining at an alarming rate. The folks at BlueTrust write “In 1996 the number of listed companies in the U.S. peaked at 8,090, but as of Q1 2023, it had fallen to 4,572, a drop of 43%. The chart below highlights this dramatic decrease in public companies, which occurred in spite of growth in the economy, global market expansion, and new industries and technologies.” More capital chasing fewer companies. All this happening while the dollar, which stock prices are denominated in, continues to become less value over the long term. This is what drives the stock market up forever. There is immense wealth to be built by simply buying stocks and letting the market structure take over from there. If you take this analysis to the extreme, there is also more capital chasing a finite amount of bitcoin, so the same macro tailwind should work in the digital currency’s favor as well. Investors win, savers lose. That is the story in America for the foreseeable future. Don’t get caught on the wrong side of the equation. Hope everyone has a great day. I’ll talk to each of you tomorrow. -Anthony Pompliano If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin. Bill Miller IV serves as CIO and Chairman at Miller Value Partners, he also serves as a Portfolio Manager. In this conversation, we talk about the bitcoin market, ETF’s, miners, regulation, halving, stablecoins, artificial intelligence, and a non-bitcoin yield focus fund that Bill also manages. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here Bill Miller IV Explains Why He Is So Bullish On Bitcoin Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Governments Need Revenue And More Taxes or Printing Is Not The Answer

Monday, December 18, 2023

Listen now (5 mins) | Today's letter is brought to you by Sidebar! Do you want to level up your career in 2024? As we all know, navigating a big career transition is hard to do. Sidebar is a

The Greatest Marketing Blitz In Finance History Is Coming

Friday, December 15, 2023

Listen now (3 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

Certainty In Markets Ushers In New All-Time Highs

Friday, December 15, 2023

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Retail Investors Were Unfazed By The Crash In Asset Prices

Monday, December 11, 2023

Listen now (6 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Keep Your Friends Close And Your Enemies Closer

Friday, December 8, 2023

Listen now (5 mins) | Today's letter is brought to you by Sidebar! Do you want to level up your career in 2024? As we all know, navigating a big career transition is hard to do. Sidebar is a

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these