The Pomp Letter - The Trade Of Our Generation

To investors, The US national debt crossed over $34 trillion yesterday, which is the highest it has been in history. This all-time high milestone is not one to celebrate. Charlie Bilello points out that the $12 trillion increase in the debt over the last 5 years signals a 55% increase during that time. The growth is hard to comprehend. Potentially more concerning, the US national debt as a percent of GDP has been increasing an alarming rate as well:

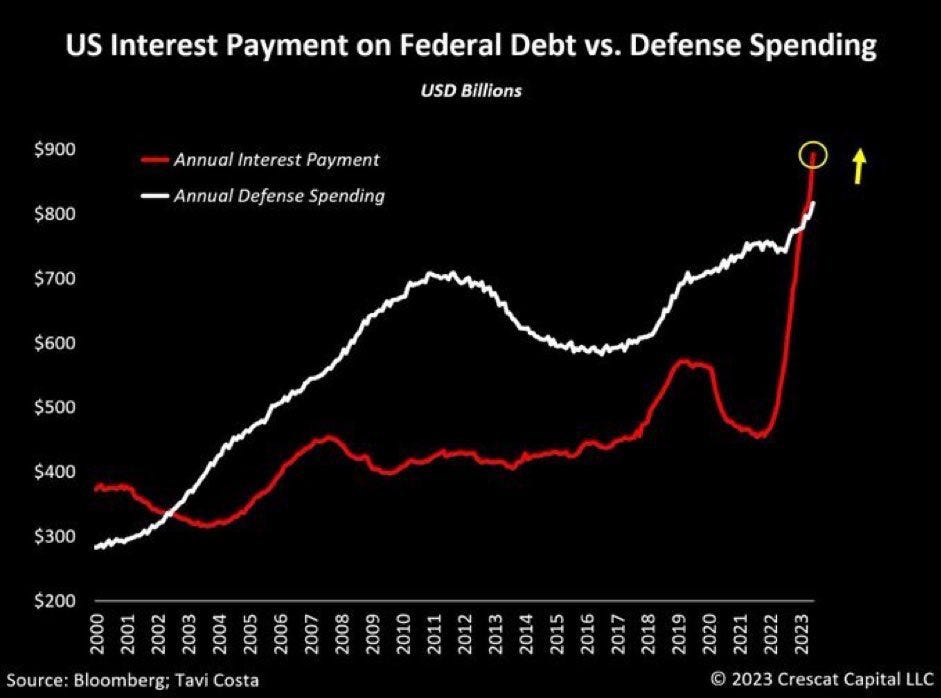

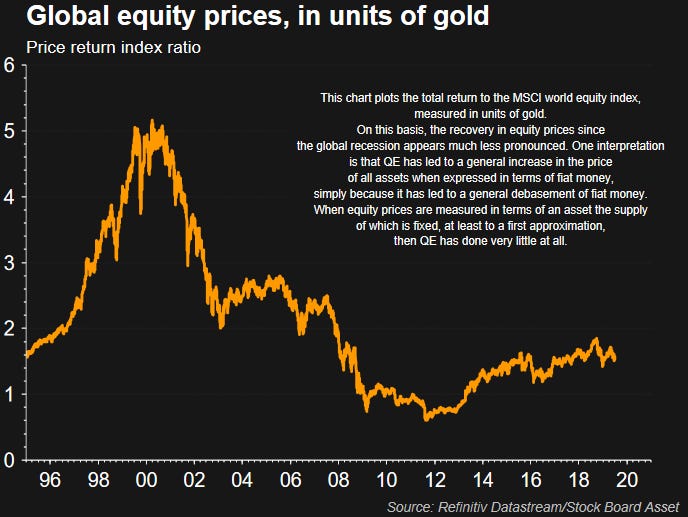

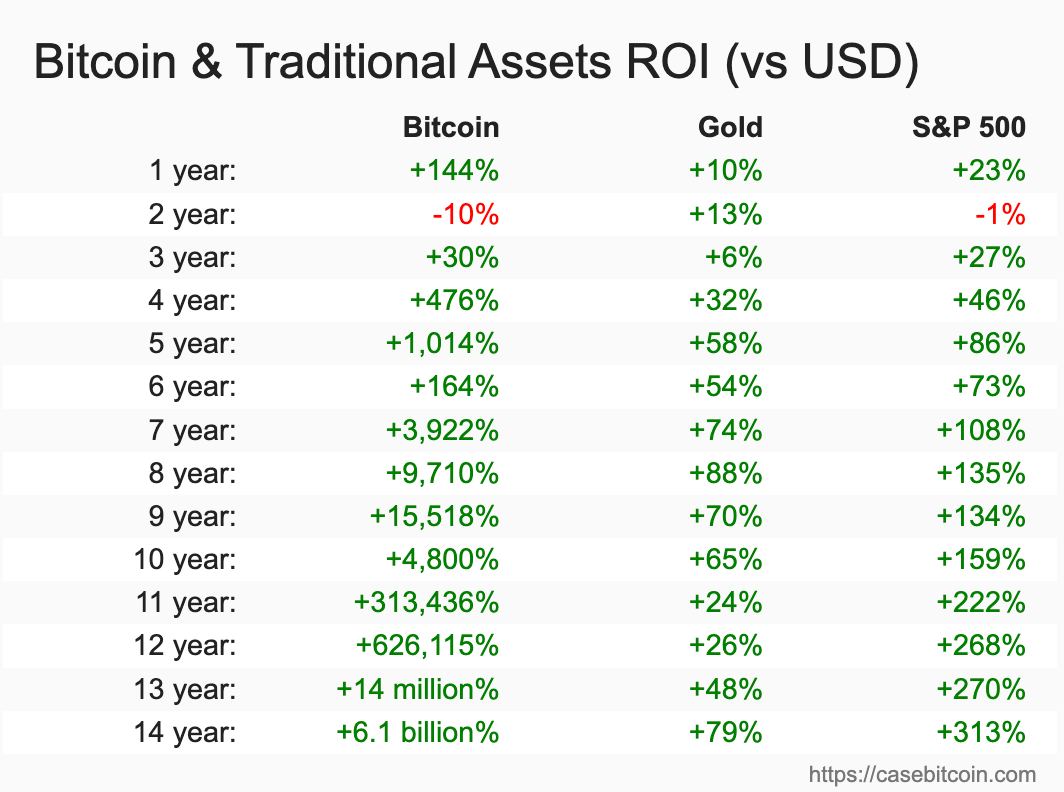

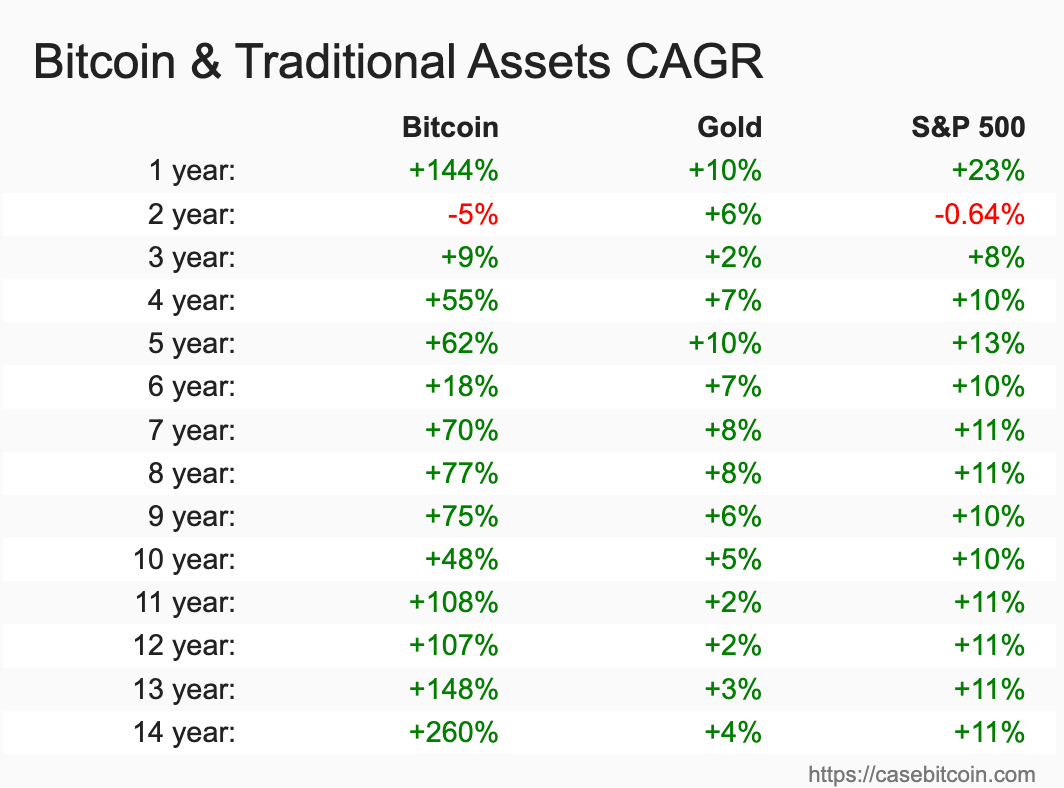

There has been a 50% increase since 2010, which highlights how much faster debt is growing than the economy. Simply, we are a nation addicted to printing money and there is no end in sight. This has caused catastrophic issues with interest rates high. The US is now spending materially more money on the national interest payment compared to our defense budget. That is quite a feat considering we are handing out weapons and equipment around the world like it is candy, so our allies can fight our proxy wars. The three data points — the national debt, debt-to-GDP ratio, and the US interest payment — highlight the need for the United States to continue debasing the currency. They literally have no other choice. There will be short periods of time where the government and the Fed can slow the rate of debasement, but the macro tailwind is for an accelerated debasement over the long run. Why is this important? The trade of our generation is to be long assets that benefit from currency debasement. Thankfully, most investment assets priced in US dollars will benefit from this trend. One of the biggest winners will naturally be bitcoin, specifically because of the finite supply and sound money principles. Gold will do well also, yet I believe that most of the asymmetric upside in the asset was captured by previous generations. Stocks are a forgotten asset class when it comes to currency debasement. Let’s use the MSCI World Equity Index as an example. Since the Global Financial Crisis, the index appeared to have gone on an epic run of appreciation. When you evaluate the same index priced in units of gold, instead of US dollars, you can clearly see that most, if not all, of the growth that was experienced in the 2010s was from currency debasement. Another asset class that will always do well in currency debasement periods is real estate. There is a reason why it is estimated that the industry produces 90% of millionaires in the United States. These investors have simply bought properties and had the patience to let the government debase the currency. It is not rocket science. So the trade of our generation is to simply get long investment assets that benefit from debasement and avoid cash and cash-like equivalents such as bonds. I truly believe it is that simple. Here is how that has played out in the last 15 years: And the compound annual growth rates are even more impressive: There is a lot of over intellectualization of investing in financial markets. If you try to optimize for the absolute best return, it can be very difficult. If you want to merely do well, then you can buy various investment assets and chill. Time in the market is more valuable than timing the market. It is almost like the boring, timeless investing advice is timeless for a reason :) Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Dave Collum is a Professor of Chemistry at Cornell University. In this conversation we discuss his year in review of 2023, which includes financial markets, bitcoin, digital totalitarianism, political landscape, climate change, biological males, and more. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here Disaster Is Coming In 2024 Says Dave Collum Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The State of Bitcoin Heading Into 2024

Tuesday, January 2, 2024

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Powerful Technology Is Moving Into The Hands Of Retail Investors And It Will Revolutionize Markets

Friday, December 29, 2023

Listen now (4 mins) | To investors, This is my last letter to you of 2023. I figured I would leave you all with some alpha on how to put yourself in a better financial position during the new year.

Asset Prices Are The Crouched Lion Approaching Their Prey

Thursday, December 28, 2023

Listen now (5 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

My Top 10 Books From 2023

Wednesday, December 27, 2023

To investors, I try to read as much as I can. Sometimes I sit down and read a single book all the way through to the end. Other times I am reading two or three books at the same time. Given everything

Special Message From Anthony Pompliano :)

Tuesday, December 26, 2023

Hey - thanks for being a free subscriber to The Pomp Letter. I have a holiday surprise for you. As you know, I spend hours per day studying financial markets, so I can put together timely letters to

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these