The Signal - Sweat and debt await PE fund managers

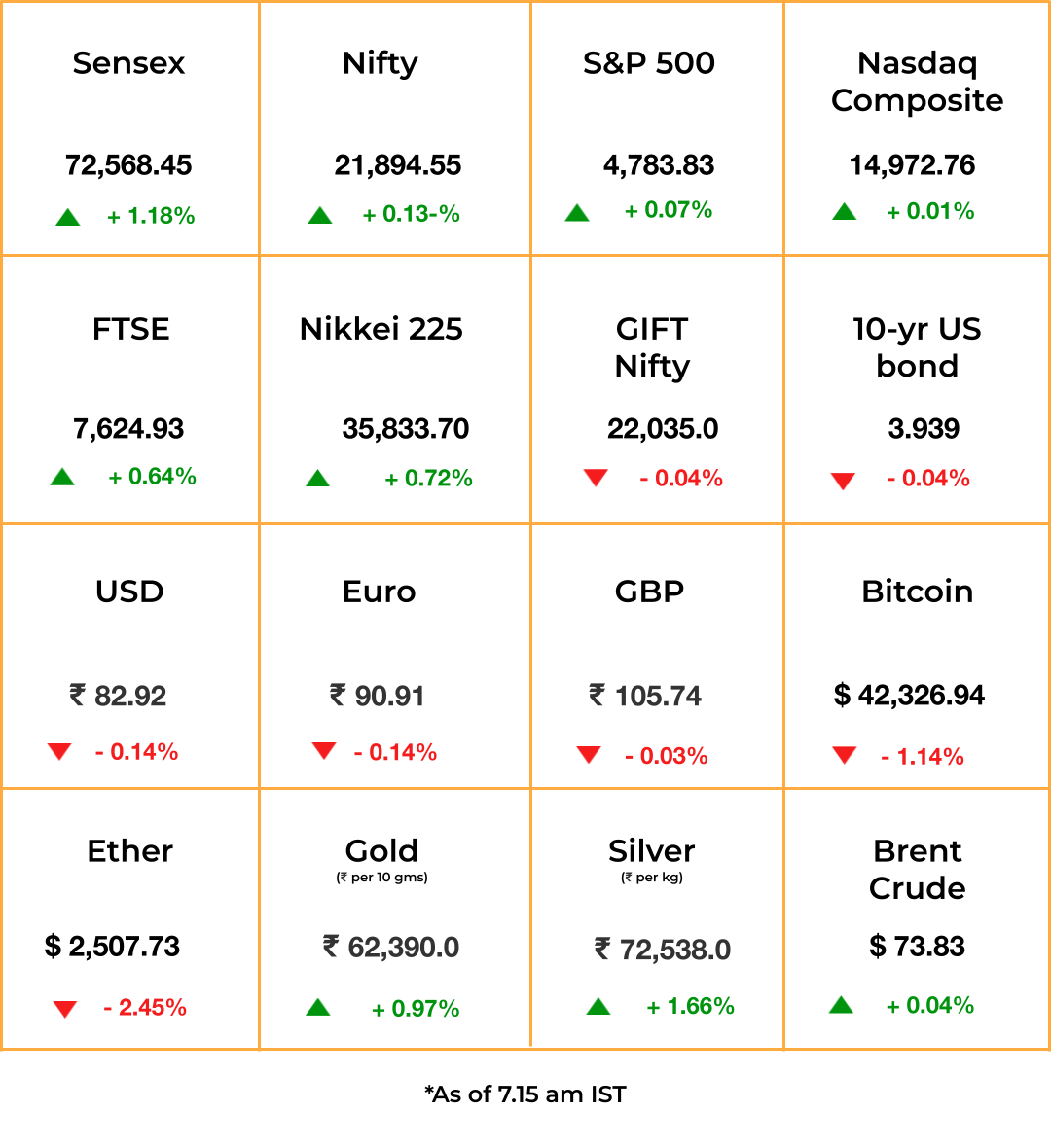

Sweat and debt await PE fund managersAlso in today’s edition: US warms to WhatsApp; Taiwan: chips fall in democracy’s favour; US may get access to Indians’ PF data; 2027: Rise of the richGood morning! Come what may, this is an invite the rich and famous in India cannot decline. More than 100 chartered flights will land in Ayodhya on January 22 bearing industrialists, movie stars and other celebrities headed to witness the consecration of the newly built Ram Temple. So much so that there will not be enough space to park all the planes. As per the Economic Times, the spanking new Ayodhya city airport is set to witness a sixfold growth in flight movements post the temple’s inauguration. Venkat Ananth and Adarsh Singh also contributed to today’s edition. Programming note: We are taking a day off on Monday, January 15, on the occasion of Pongal and Makar Sankranti. There will be no edition of The Signal and The Signal Daily on Tuesday. We will resume publication on Wednesday. The Market Signal*Stocks & Economy: Japanese equities began the week on a positive note but other Asian indices were displaying weakness. US stocks had ended the last session of the previous week without much gain but in the green nevertheless. Morning GIFT Nifty movements indicated Indian equities will continue from where they left off on an upbeat note last Friday. A slew of important data is expected this week. While the US will reveal retail sales, unemployment numbers, home sales and industrial production data, among others, the UK, Eurozone and Japan will release inflation numbers. The Federal Reserve will release its Beige Book survey. A bunch of Fed officials are expected to speak during the week. A barrage of commentary is expected from the global elite through the week as they gather in Davos, Switzerland, from today to take stock of what’s happening on the planet and mull over how to “rebuild trust.” TECHNOLOGYWhatsApp’s HomecomingIt’s not a bad time to be Mark Zuckerberg. The Meta CEO will ring in his company’s 20th anniversary next month with a bright spot: A 9% surge in WhatsApp daily users in the US in 2023, per Big Technology. Wassup?: Beyond immigrants, its traditional users, the platform is attracting young people and businesses, which find it more efficient than phones and emails to reach large user groups. Daily business users rose 80% in 2023 and 122% in 2022. New use cases (school parents) and international travel to destinations, where WhatsApp is ubiquitous, have also played a big part. New toy: Meta is moving on from the $50 billion metaverse failure with a fresh, hard pivot to AI. Bloomberg reports that employee morale at Meta’s Reality Labs has “plummeted”, and even the Instagram Threads team feels “neglected”, as Zuckerberg has taken direct control of the company’s AI efforts. 🎧Mark Zuckerberg is done with the metaverse for now. His new priority? AI. Also in today’s episode, a strange music fraud ft. phantom artists. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, or wherever you get your podcasts. GEOPOLITICSAnother day, another electionTaiwan voted on January 13 to promote vice president Lai Ching-te as its next President. The country, whose politics is a hot-button global issue thanks to its dominance of the chip industry, chose Lai with 40.1% of the votes — the lowest winning percentage since 2000. The President-elect has vowed to ensure peace in the Taiwan Strait and maintain strong ties with other democracies, a difficult balancing act. Status unchanged: China said there will be no change in its approach. The US on its part will continue with “strategic ambiguity”, where it acknowledges China’s claim over the island yet maintains unofficial relations with Taiwan. POTUS Joe Biden has categorically denied Taiwan’s independence. However: House Speaker Mike Johnson (Republican) isn’t a fan of this strategy and intends to send a delegation of lawmakers to Taipei for the inauguration. Meanwhile: ‘Coordinators’ are smuggling war-torn Palestinians into Egypt for a price of $10,000. PRIVATE EQUITYInvest-And-Forget No More

Tectonic shifts are shaking up the $8 trillion global private capital sector. BFD: To begin with, BlackRock, the world’s biggest asset manager, is buying Global Infrastructure Partners (GIP), which has $106 billion in assets, for $12.5 billion. BlackRock chief Larry Fink and GIP founder Adebayo Ogunlesi believe “private capital was entering a phase of consolidation in which size, resources and the ability to win access to the world’s largest companies would be paramount”, the Financial Times reported. Repay and take: Sovereign wealth funds and state pension pools are demanding fund managers return their money invested in old funds, and lower management fees, if they want new capital. Perhaps they have cottoned on to a dubious PE industry practice of “continuation funds”. Ambitious Gulf aristocrats will increasingly call the shots in private equity as they look to deploy and diversify their oil wealth. Five West Asian funds led by Saudi Arabia’s PIF brought in the largest share (43%) of fresh capital among state-owned investors in private markets in 2023. The Signal Investors' demand to return previous investments will pressure managers to sell assets or borrow money, typically known as management company or manco loans. It will have knock-on effects on PE-funded companies, compelling them to pile on debt to pay dividends and fund buybacks. Savvy investors are offering debt directly to fund managers and companies looking for leverage. As interest rates fall, all this will fuel global mergers and acquisition activity. TRADEUncle Sam 🤝🏽 Bharat MataAs a record number of Indians seek ways to enter the US, both countries have held talks to get India ‘treaty status’, enabling (non-immigrant) E1 and E2 visas for Indians. These allow Indians to streamline social security benefits (such as provident funds), meaning Indian workers won’t need to pay PF and other deductions in both countries. Data dump: For this, India is providing the US data on its social security schemes, allowing it to access Indian Provident Fund and other databases. There were 660 such agreements worldwide in 2020, up from just 100 in 1980 (pdf); the US has similar arrangements with several countries including Taiwan, Sri Lanka, and Pakistan. Mining friendship: Washington and New Delhi also agreed to share information on critical minerals as they smooth ties after the US accused India of attempting to assassinate a US citizen Gurpatwant Singh Pannun on American soil. CONSUMERIndians Are Living In The Gilded AgeIn the next three years, many more millions of Indians will be popping open the champagne, decked out in fineries. A Goldman Sachs report estimates that the number of Indian rich (earning >$10,000 or ₹8.3 lakh a year) has grown 12.6% every year since FY19 and will hit 100 million by 2027. These Indians are bingeing on the finer things in life, fuelling growth of the companies selling them. Wine & dine: GS predicts these affluent Indians will splurge most on travel, private healthcare, and eating out (or ordering in). Among its top stock recommendations are jewellery brand Tanishq’s owner Titan, Zomato, Apollo Hospitals, ticketing platform MakeMyTrip and luxury malls operator Phoenix Mills. But remember: We’re only talking about 4% of India’s working-age population. The vast majority of the country is struggling to make ends meet; India’s per capita annual income is only $2,100 a year. FYIBird troubles: Boeing’s 2024 woes continue after a 737-800 aircraft operated by All Nippon Airways turned back to its departure airport after a crack on the cockpit window was spotted midair. Spicing up: Tata Consumer is set to acquire Capital Foods and pick up a controlling stake in FabIndia-owned Organic India in a bid to broaden its portfolio of consumer brands. Trimming down: Banking major Citigroup will eliminate 20,000 jobs (or 10% of its workforce) by the end of 2026 as part of a restructuring. Pink slips: Instagram and Discord let go of 60 and 170 employees, respectively. Record label Universal Music will reportedly lay off “hundreds of employees'' in the first quarter of 2024, while Disney’s Pixar studio is also readying job cuts. More strain: The Maldivian government has set a March 15 deadline for Indian troops stationed in the island nation to leave the country. The announcement came after Maldivian President Mohamed Miazzu’s recent trip to Beijing. Poof: Google has removed popular crypto exchanges such as Binance, Huobi, and Kraken from its Play Store in India. Google’s action follows Apple booting out these apps from its App Store last week. Telecom networks and ISPs have blocked their website URLs. Aila!: Indian cricket legend Sachin Tendulkar has invested an undisclosed amount in the Indian Street Premier League, a franchise-based T10 tennis-ball cricket tournament. Tendulkar will also serve as a member of the league’s “core committee”. THE DAILY DIGIT45.6 millionThe number of soundtracks on music streaming platforms that had zero streams in 2023, according to Luminate. (Bloomberg) FWIWDiscovery!!!: This might be the biggest discovery of this year. Archaeologists working in the Amazon rainforest have discovered an extensive network of cities dating back 2,500 years. The cities are remarkably well preserved with evidence of “wide streets, long, straight roads, plazas and clusters of monumental platforms”. These cities are located in the Upano Valley of present-day Eastern Ecuador. The archaeologists used LIDAR technology to detect structures below the thick canopies in the forest. This groundbreaking discovery has unearthed a new facet in our understanding of civilization in the Americas. What a time to be alive! Big money: If you thought big money is only disrupting the world of sports, then boy do we have news for you. Arena BioWorks, a group with $500 million in its kitty, is shaking the world of academia. Backed by some of the wealthiest families in the USA, Arena is poaching highly acclaimed professors from elite institutes to discover scores of new drugs for-profit. For the professors joining in, it’s the increasing frustration with the bureaucratic approach to grants and funds in the universities that's drawing them in. Feels like we know this story and how it’s gonna end. Nostalgia is expensive: Everyone loves the good ol days. That stands for fashion too, as people in the West have started obsessing over clothes made back in the day. The usual refrain is that they were of so much better quality and that their sizes were more realistic and better cut. Turns out, this time people are right. Clothes were better back then but the reason behind this change is also… people. Yes, the demand for fast, cheap and comfortable clothes has led brands to incorporate these qualities into their clothes. So, for people wanting to hark back to the good ol clothes of yore, the best solution is going high-end. Them's the rule. The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Inside gaming’s most thrilling feats

Saturday, January 13, 2024

What gameful design teaches us about the art of gamification

Serving 'em hot!

Friday, January 12, 2024

Unraveling the rise of Prime Volleyball League and what the future has in store for the game

Mystery of the missing cereal

Friday, January 12, 2024

Also in today's edition: What's going on, Boeing?; Not enough work; A Taiwan war will be pyrrhic; No blunderbuss this

Gujarat preps a GIFT horse

Friday, January 12, 2024

Also in today's edition: TV's turnaround; Old money, new horizons; India's single malt moment; Japan shoots for the moon

Those pills will cost you

Friday, January 12, 2024

Also in today's edition: Slim pickings for TCS, Infy; Norwegian blunder; Prime Video ads are a-comin'; More jobs lost to AI

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these