AI Tailwinds, back half of 2024 or now? Master CEO, salesman extraordinaire, Bill McDermott, CEO of ServiceNow, issued a couple 🤯 statements which could bode well for the entire enterprise software ecosystem! Here’s are a few key excerpts from the ServiceNow earnings transcript.

Bill McDermott -- Chairman and Chief Executive Officer

Things are going very well out there, and the momentum is terrific. What's really happening and I can say this after 186 CEO meetings in the last six months, the CEOs are now getting very involved with the Gen AI revolution. They realize there has to be architectural adjustments to their environment and the manner in which they manage their data and the platforms they're beholden to actually take advantage of Gen AI…

When you have that C-level executive meeting, they really get it now. And with regard to Gen AI, the momentum is outstanding. As I said, that SKU has outsold any other new introduction we put into the marketplace. So, there's a real appetite to invest in Gen AI, and there's no price sensitivity around it because the business cases are so unbelievable.

I mean if you're improving productivity, 40%, 50%, it just sells itself. So, I think we're in a really, really good place. The Gen AI investments are coming. We're actually getting orders because we have great product, thanks to CJ and his unbelievable engineering team.

So, I would tell you at this time last year, compared to this time this year, you should be more bullish now.

AI is a catalyst for existing SKU and workflows matter!

And employee workflows, nine of our top 20 deals, and was kind of interesting. Every single CEO now is looking to make the people packed far more productive than it is and with natural language to have your employees seek the data and the information they want and have it reported back to them in just a very nice paragraph of content and data so they can do their jobs better, is kind of like in the no-brainer category. And we have some really great logos that I'm sure CJ would like to share with you as well. But both of those areas are really good.

And incidentally, that employee spot that I mentioned was up 80% year over year.

CJ Desai -- President and Chief Operating Officer

Thank you, Bill. And Arjun, some of the questions that you asked, you're spot on. So, AI and specifically Pro Plus SKU was a catalyst, both for our employee and customer workflow. So, that's number one.

AI drives shorter sales cycles especially when mandated by CEO!

CJ Desai -- President and Chief Operating Officer

So, let me just touch on that. On generative AI the demand for generative AI varies by industry, but I'll give you an example of a large manufacturing company, the CIO reached out to me in October, wanted to do a four-week POC and purchased it in December. So, from a sales cycle perspective, that was a top-down decision moving very, very fast. A large retailer is currently also doing a proof of concept with ServiceNow Pro Plus SKU because it is a CEO initiative that Bill talked about.

So, from a demand on Gen AI specifically, it is very, very clear that customers are pulling us in that direction in certain industries. And for those sales cycles, yes, they are very fast. They want to see a large manufacturing company CEO that Bill met in Germany, I had a follow-up call in December, and he said, CJ, I want to kick off on Pro Plus SKU for the specific use cases on ITSM. And you and I should review the results end of February.

ServiceNow is not the only company touting the demand for AI from large enterprises as IBM stock is up 13% after it’s earnings call citing massive tailwinds for its WatsonX product.

Arvind Krishna -- Chairman and Chief Executive Officer

Last quarter, I shared with you that our book of business in the third quarter specifically related to generative AI and watsonx was in the low hundreds of millions. Since then, demand continues to increase and our book of business in the fourth quarter is roughly double the third-quarter amount. We continue to have thousands of hands-on client interactions, including an acceleration in pilots that were completed during the quarter. Software transaction revenue and SaaS ACV was approximately one-third of our book of business related to generative AI in the fourth quarter, and two-thirds was consulting signings.

There was a balance of both large and small transactions across both segments. Enterprise use cases addressing code modernization, customer service, and digital labor continue to offer meaningful near-term benefits to clients. We've been collaborating with numerous clients using watsonx code assistant for Ansible. This includes a successful pilot with Citi, where initial results point to substantial developer productivity and core quality improvements that have led to plans for a rapid expansion focused on scaling for enterprise-wide outcomes.

Stay tuned as next week Microsoft releases its earnings and will be an even bigger indicator of what’s to be expected for enterprise software and AI demand acceleration for 2024.

Switching gears, here are a couple of recently released videos/podcasts I appeared on this past week. The topic du jour was AI…

First up is this one with John Furrier of Silicon Angle/The Cube: “A vision for AI and the future: How Boldstart Ventures seeks to fund the next wave of enterprise innovation”

Next up is the latest podcast episode on Artificiality with Dave and Helen Edwards: “Ed Sim: AI Venture Capital”

| Ed Sim: AI Venture Capital Helen and Dave Edwards Episode |

So where does an experienced investor who has seen countless tech waves come and go place his bets in this new AI-first future? That’s the key topic we dive into today.

While AI forms a core part of our dialogue, Ed emphasizes that he doesn’t look at pitches and go “Oh, AI, I need to invest in that.” Rather, he tries to see if founders have identified a real pain point, have a unique approach to solving it, and can clearly articulate how they will provide a significant improvement over status quo. AI is an important component, of course, but it isn’t a reason to invest alone.

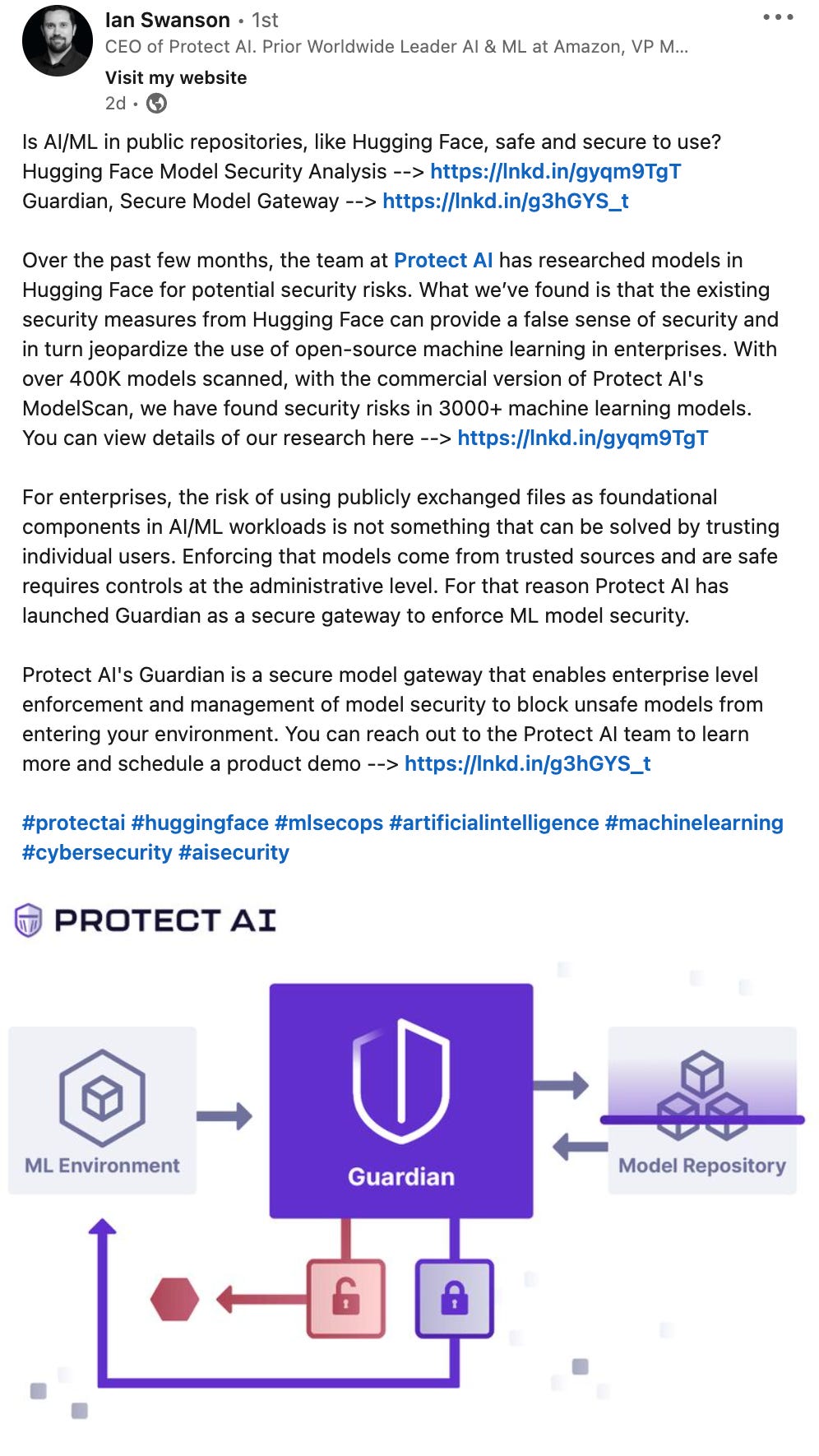

With that framing in mind, Ed shares where he is most excited to invest in light of recent generative AI breakthroughs. Unsurprisingly, AI security ranks high on his list given enterprises’ skittishness around adopting any technology that could compromise sensitive data or infrastructure. Ed saw this need early, backing a startup called Protect AI in March 2022 that focuses specifically on monitoring and certifying the security of AI systems.

The implications of AI have branched into virtually every sector, but Ed reminds us that as investors and builders, we must stay grounded in solving real problems vs chasing the shiny new tech.

🙏🏼 for reading and please share with your friends and colleagues!

👇🏼

Customers don’t buy TAM, they buy a product, but investors want TAM - here’s how I think about it

Zoom in on end user, how to make a hero and then zoom out on bigger picture. On new emerging markets, I like to ask if everything goes right what could this look like and how is your product an everyday part of a customer’s life? Another way to think about new markets is “Intuitive TAM” - use your common sense

🤯 $200M Euro Inception round in works for 2 Google DeepMind scientists to start new AI company or is that pre-seed 🤣

💰 and then we have Cohere which is in “talks to raise as much as $1bn as AI arms race heats up” (FT)

Latest fundraising could give start-up backed by Nvidia and Oracle a higher valuation than the $2.2bn it achieved last year

Three people close to the talks said the Toronto-based start-up had not yet fixed a valuation for its new round or an exact fundraising target, but two of the people said a range of $500mn to $1bn in fresh capital had been discussed.

That is more than the total Cohere has lured from investors across four fundraising series to date, according to Crunchbase, and is expected to give the company a far higher valuation than the $2.2bn it achieved when it raised $270mn — which came from investors including Nvidia and Oracle and venture firms including Index Ventures and Inovia Capital — in June 2023.

And more AI massive funding rumors:

“Elon Musk’s AI start-up seeks to raise $6bn from investors to challenge OpenAI

Tesla chief targets $20bn valuation in bid to take on OpenAI” (FT)

Is AI/ML in public repos, like Hugging Face, safe and secure to use? 👇🏼

💪🏼 Congrats to portfolio co Protect AI on the release of an industry-first secure ML gateway, which enables organizations to enforce security policies on ML Models to prevent malicious code from entering their environment

I missed this from a couple of weeks ago but given the recent sale of portfolio co Jeli to PagerDuty, I found this fascinating:

PagerDuty Inc., a provider of services to predict and prevent software calamities, is considering options amid takeover interest from private equity firms, people with knowledge of the matter said.

PagerDuty, whose shares had fallen about 8% over the past 12 months through Tuesday, rose as much as 17% on Wednesday. They were up 16% to $26.22 at 1:28 p.m. in New York trading, giving the company a market value of about $2.4 billion.

Repeat after me, if you’re a single product company looking to IPO or already public, it’s tough to build an enduring and attractive growth profile for public investors. PagerDuty is better off as a private company and expect many more of these to happen in 2024.

According to a JMP Securities research report:

In addition, one private equity source we spoke with last week indicated that sellers’ expectations have become more reasonable as sellers have generally let go of 2021-level valuation expectations

Another example is the recent purchase of Calyptia by Chronosphere in observability space. Reindeer games have begun as high priced 🦄 buying smaller private cos to evolve from single product cos to become platform cos.

“With observability data growing by orders of magnitude, companies are ill-equipped to manage the costs and scale of this deluge, forcing their teams to make trade-offs. Teams are especially challenged to handle log data, which is prohibitively expensive to move and store,” said Martin Mao, CEO and co-founder of Chronosphere. “With the addition of Calyptia’s leading observability pipeline solution, we’re taking an important step to ensure that developers have the ultimate control over all their observability data from end to end — including log files to control cost and improve developer productivity.”

With Calyptia, Chronosphere says, its users will gain an observability pipeline system that they will be able to use to collect, transform and route their metric, log and trace data. This, for example, means that they will now be able to route data from the company’s recently announced log storage and visualization solution (powered by CrowdStrike) to their preferred data back end.

Israeli cybersecurity startups continue to think about selling instead of going long - if true, a 10x on total capital invested is an awesome outcome esp. for a company so early with limited revenue - “Zscaler in negotiations to acquire cyber startup Avalor for $250-350 million” (CTech - Calcalist)

Avalor, which came out of stealth with a $25 million Series A last year, has developed an open data platform which can integrate data from legacy systems, data lakes, data warehouses, SQL databases, applications, and more, and then normalize and analyze it

Above makes sense since sector was overfunded and now need to make sure companies raise the right amount of capital to continue to preserve options as they grow. And many others are getting the memo as “Cybersecurity Startup Funding Hits 5-Year Low, Drops 50% From 2022” (Crunchbase News)

Just two years ago venture funding to cybersecurity was on fire, with more than $23 billion flooding the sector.

In 2023, cyber startups saw only about a third of that, as venture funding dipped to its lowest total since 2018. Security companies raised $8.2 billion in 692 venture capital deals last year — per Crunchbase numbers — compared to $16.3 billion in 941 deals in 2022.

The drop was exacerbated by Q4 numbers, as startups locked up $1.6 billion — marking the lowest quarter since Q3 2018 when cyber firms raised just $1.3 billion. Only three cyber startups raised rounds above $100 million:

Despite this massive drop in funding which I believe is good for the sector as it removes the me-toos and 10 in every category, I’m still pumped to continue finding new founders building new categories. To that end, I’m pumped to inception invest in a new cybersecurity company - more to come in a few quarters.

Crypto infra is back on institutional side and where it makes most sense, same day settlement with low friction - see Larry Fink from Blackrock clip on what’s next