Net Interest - The Ackman Discount

Ten years ago, in a ballroom in London, Bill Ackman spelled out his plans for the future. He had been running his investment firm, Pershing Square Capital Management, since 2004 and had done well. His flagship fund was up 7.3x since launch, equivalent to +20.8% a year, and he was managing $14.1 billion. “The smart-alecky boy wonder,” the New York Times called him. Most of Ackman’s money was run in a traditional hedge fund format. So-called limited partners would hand him money to manage, paying a 1.5% annual management fee plus 20% of any positive performance. They were a happy group: Over the previous decade they accrued more than $13.9 billion of profits. He should have been happy, too. In 2014 alone, he reportedly earned $950 million. But he wasn’t entirely satisfied with the fund’s structure. The problem is that limited partners can be flighty, redeeming capital when the manager least wants them to. Ackman himself imposed some fairly strict terms compared with industry norms. On around half his funds, investors were allowed to redeem just one-eighth of their capital per quarter; the rest was subject to rolling two year, and one-third per year contractual lockups. What Ackman hankered after was permanent capital. He argued that his activist approach to investing required more stable money than his funds could mobilize. “Our open-ended structure has prevented us from investing our capital in an optimal fashion,” he wrote. “Being forced to sell an investment in the middle of an activist campaign can be damaging to the execution of that investment, and, as a result, we have historically set aside cash and liquid passive investments to minimize this risk.” So in 2014, he came to Europe to raise a closed-end fund. Closed-end funds had been around for a long time; in fact, they pre-date their open-ended cousins. Rather than letting money flow in and out on demand, they raise capital by issuing a fixed number of shares at inception, which the manager can then invest. After inception, they close to new capital, leaving it up to investors to buy and sell from each other in secondary markets to increase their exposure or cash out. For years, closed-end funds were a staid backwater of investment markets. In the UK, where they were invented (The Foreign & Colonial Investment Trust, launched in 1868, is still going) advisers had less of an incentive to recommend them because unlike open-ended funds, they didn’t kick back hefty commissions.¹ But then, in 2006 and 2007, hedge funds began to tap them to raise permanent capital:

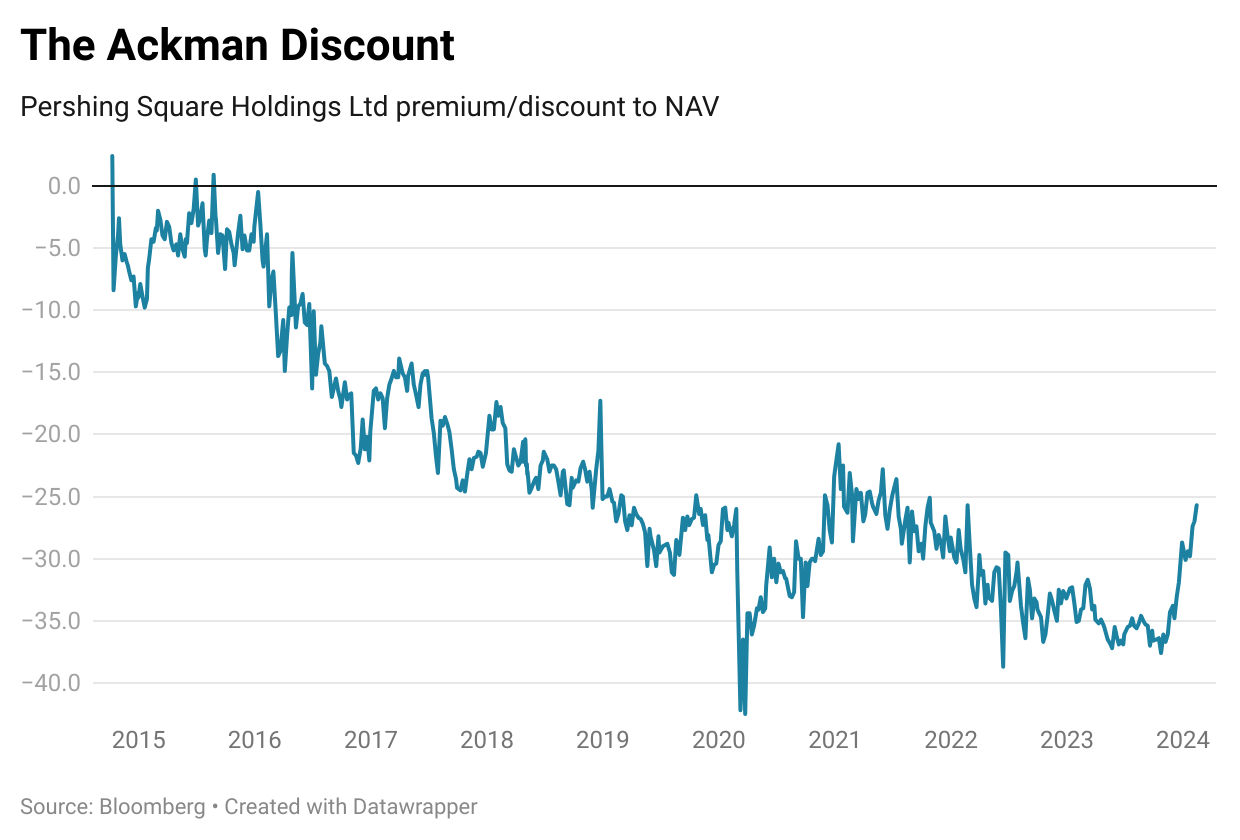

In each case, newly-raised funds were channeled into the manager’s master fund, alongside other limited partner capital. At Marshall Wace, the contribution from the listed vehicle gave the underlying fund a major boost, increasing its assets by half. At Third Point, it only increased assets in the master fund by 10% but its permanence would pay off when Loeb suffered redemptions during the global financial crisis just over a year later.² Another feature of the funds was their legal domicile in Guernsey, chosen to avoid entity-level taxation. By staying outside the US, they were also exempted from the US Investment Company Act of 1940, which prevents registered investment companies from charging hedge-fund style fees. This precluded sponsoring firms from marketing to US buyers, diminishing their target market, but with 20% incentive fees on offer, that was a trade-off worth making. Which explains why Bill Ackman chose Europe as the place to drum up support for his new fund. Ackman proposed a slightly different fund structure than the others. He’d base his new fund – Pershing Square Holdings Limited (PSH) – in Guernsey and list it in Amsterdam (later adding London as a dual listing) but rather than use it as a feeder for his master fund, he wanted to invest directly out of it, replicating his core portfolio within the vehicle. He also offered a lower incentive fee of just 16%, with a plan to reduce that further.³ The structure was designed to counter the scourge of all closed-end funds: the discount. Because closed-end funds are subject to their own supply and demand dynamics in the secondary market, they often trade at a spread to their underlying net asset value (NAV). Usually, that means a discount. Within a few months of listing, Third Point Offshore Investors Limited had slipped to an 8.5% discount and, in the teeth of the financial crisis, it fell to a 44% discount. A widening discount detracts from the return an investor is able to extract from the fund and any discount at all makes it difficult for the fund to issue new shares to support the manager’s growth. “Over time, we believe that if we continue to generate attractive rates of returns, PSH should trade at a premium to its NAV,” wrote Ackman. “While trading at a premium to NAV is not a common occurrence for most closed end funds, we believe that Pershing Square’s performance history and PSH’s strategy, scale, liquidity and structure differentiate PSH from the typical closed end fund. While our corporate form is that of a closed end fund, our approach, governance structure, and the compensation of management are better compared to publicly traded investment holding or operating companies.” Ackman raised $2.73 billion in the listing which, combined with other assets rolled into the fund, lifted his PSH capital base to $6.2 billion. He argued that PSH should be thought of more as a holding company, like Berkshire Hathaway, than a closed-end fund. “Companies that have earned similar historical returns on equity to PSH…have historically traded at substantial premiums to book value,” he wrote. For various reasons, investors didn’t buy it. The fund went to a 9% discount at the end of its first year of trading, and later crashed to a 37% discount as recently as September 2023. Along the way, Ackman has pursued a side hustle dedicated to narrowing the discount (alongside his other side hustles). He has bought back shares; initiated a dividend; bolstered board governance; uplisted to London, where PSH is a member of the FTSE100 index; and tied the dividend to increases in net asset value. He even flirted with the idea of merging PSH with an operating company to bring it back to the US free of the shackles of the Investment Company Act of 1940. In the end, he announced last week the launch of a new fund, Pershing Square USA Limited, which will list on the New York Stock Exchange. The US version looks rather like the European version except for lower fees, to comply with the ‘40 Act. The fund will not charge a performance fee, just an annual management fee of 2.0% (albeit it’s waived for the first year). This raises conflicts of course: why would Ackman allocate an investment to this fund when he could allocate it to another of his funds that offers higher fees? Fortunately, he has an “allocation policy” and the new fund will have a Board.⁴ But where does it leave PSH and its perennial discount? To explore further, read on (and be sure to check out the footnotes). Subscribe to Net Interest to read the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Funding Mr Bates

Friday, February 9, 2024

Litigation Finance: The Rise of an Asset Class

New York State of Mind

Friday, February 2, 2024

The State of US Regional Banks

Debt Collectors

Friday, January 26, 2024

The Subsector at the End of the Value Chain

Hard Assets

Friday, January 19, 2024

Infrastructure: The Rise of an Asset Class

The Points Guy

Friday, January 12, 2024

Inside the Business of Air Miles

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏