Caesars buys WynnBet’s Michigan operations

Caesars buys WynnBet’s Michigan operationsCaesars furthers Michigan access, Kambi hopes, AGA’s 2023 roundup +More

Double chins and bowling pins. Caesars’ Michigan move and Q4 earningsSay yes! To M!ch!gan! Caesars Entertainment has announced it has bought WynnBet’s Michigan OSB and iCasino operation and has, alongside that, extended the market access agreement with the Sault Ste. Marie Tribe of Chippewa Indians.

The family silver: This is the second instance of WynnBet selling on market access within the space of a week after it sold its New York license to Penn for $25m. The company also recently announced it intended to shutter its operation in Massachusetts. A bit of leg: The Michigan news came with Caesars’ Q4 earnings, which as were pre-announced in January showed the Las Vegas operation encountering “several one-time headwinds” as revenues dipped 5.5% to $1.09bn. Regionals was up 0.5% to $1.36bn while digital rose 28% to $304m.

If it wasn’t for you pesky kids: Hession said, on a hold-adjusted basis, the digital business would have produced “close to” $60m in adj. EBITDA. He also noted the percentage of customers taking up parlays “continues to improve.”

Tune in, turn off: Reeg noted the growth in online generally, in mature markets as well as debuting states, “consistently exceeded our expectations” and “continue to grow at steady clips.” He added that, at a company-specific level, the news of the Penn-ESPN tie-up had been a bonus as it allowed Caesars to “terminate an agreement that wasn’t profitable for us.” High-octane misfire: In Las Vegas, Reeg noted the patchy performance during F1, with the high-end properties doing well but ”less so” for the rest of the Strip. “As with anything of that scale where you launch, you learn,” he added, noting that the lowest-end ticket was “pricey by any definition.”

Here’s Tom with the weather: Reeg said January had been a “debacle” for the regionals business due to inclement weather, but added the business “remained firm.” He noted that in various markets, including Chicago. the company was now lapping new competition. Tickets are now available for the Earnings+More: Capital Markets Forum taking place at the New York Stock Exchange on the afternoon of Monday, May 6. Consisting of six panels discussing various pivotal topics impacting the North American betting and gaming sector from corporate development to M&A and investor relations, the event features speakers from:

Follow this link for more information on how to obtain your ticket. Use the code EARNINGS100 for a $100 discount available to E+M subscribers. +MoreBeyondPlay has been bought by FanDuel for an undisclosed sum, with the jackpot management system provider to be incorporated into the operator’s iCasino operation. BeyondPlay was formed in 2021 by Karolina Pelc who said on LinkedIn today “this is the dream.” AML regtech provider Kinectify has announced it has received an unspecified “incremental” investment from Aristocrat. Existing investors including Acies Investments, the Eastern Band of the Cherokee Indians and Eilers & Krejcik Gaming have also contributed additional capital. Game over: Esports Entertainment will voluntarily delist from the Nasdaq today, Wednesday. Its shares will be quoted on the OTC Pink Market with plans to be subsequently listed on the OTCQB Venture Market. By the numbersPennsylvania: B&M gaming declined 12% in January to $252m – see above on the weather issues – but overall GGR rose 3% to $505m, helped by a 49% rise in sports betting to $98m on handle that rose 11% to $858m. iCasino was up 12% to $150m. Michigan: FanDuel increased its market share across sports betting and iCasino to 31%, followed by BetMGM on 23% and DraftKings (21%). GGR across both products rose 23% to $212m. Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Kambi hopes for ‘material’ growthOut of shape: Kambi was “not satisfied” with the earnings from Q4 with soon-to-depart CEO Kristian Nylén laying the blame largely on the performance of Shape Games. The company recently agreed an early settlement with the former owners and Nylén said Kambi would quickly move forward with full integration. Cold water: Nylén said the forecasts for the business were under review, in part due to a recognition that sports-betting regulation in California was now “very unlikely to happen” before 2028.

Out of tune: Revenue fell by 23% YoY in Q4, but excluding the one-off termination payment from Penn in the prior-year period the revenue decline was cut to 2%. The €12.6m Penn fee also distorted the EBITDA line, which was down 38% YoY to €17m.

Moving on: Nylén pointed out that Kambi would be due a minimum guarantee of €55m from Kindred over the next three years under its new agreement. Recall, Kindred is hoping to move to its own proprietary sportsbook over the course of the next three years, albeit with skepticism being expressed recently over the pace of the move. Analyst takes – DraftKingsThe same old routine: DraftKings will likely resume its standard practice of under-promising and over-delivering in 2024, barring any disastrous sporting results, suggested the team at JMP. They indicated the guidance is “conservative” and will lead “upside to estimates throughout the year.”

Gold in them there hills: They noted the bearish position on Jackpocket – that it is a company losing cash and needing investment – was similar to the beef around the Golden Nugget deal.

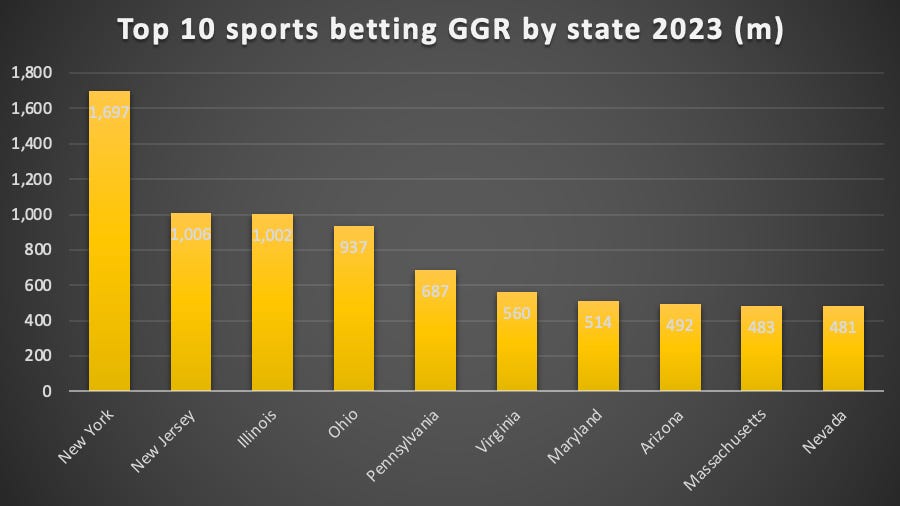

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. AGA commercial gaming reviewAnatomy of a boom: The growth rates for sports-betting and iCasino outpaced those of B&M gaming by some margin in 2023 and in Q4, according to the American Gaming Association’s review of commercial gaming in 2023.

Topping out: Nine separate gaming markets garnered GGR of over $1bn, headed by the Las Vegas Strip, which brought in $8.83bn, up 7.2% YoY. It was followed by Atlantic City with $2.86bn and the Chicagoland market where GGR hit $2.19bn, both up 25% YoY. The smallest of the billion-dollar club was Detroit at $1.24bn. 10 to follow: The top 10 sports-betting markets generated GGR between them of $7.86bn. The list was headed by New York, which enjoyed a 24% YoY rise to $1.7bn, followed by New Jersey, which saw GGR rise by 32% to $1.01bn. 🎉 The top 10 sports-betting markets in 2023 Earnings in briefThe Lottery Corporation: Weaker trading due to the economic backdrop and a move to increase the probability of larger jackpots in its main Oz Lotto game meant revenues dipped by 4% in H124 to A$1.84bn ($1.21bn). EBITDA was down by 2.5% to A$399m. Raketech: Success in the sub-affiliation segment helped push Q4 revenues up 45% to €22.8m but EBITDA dropped slightly to €6m due, the company said, to softer trends in Sweden. The company also issued FY24 guidance for expected EBITDA of €24m-€26m. Calendar

Diverse, high quality sports content is a key feature that sportsbooks must provide to attract and retain players. For this reason we’re delighted to announce our streaming partnership with Infront Bettor, a leading provider of live sports content to the iGaming industry. Bringing this content to market will add considerable value to our sports offering and increase engagement and activity on our betting brands. To find out more, go to www.soft2bet.com. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Less than super: online poker’s travails

Tuesday, February 20, 2024

Online poker scandal, Jackpocket concerns, Penn's online losses examined, Macau revival +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

‘Priority USA’ – DraftKings’ home turf ambitions

Monday, February 19, 2024

DraftKings call and reaction, by the numbers – NJ and NY, startup focus – LiveDuel +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Name in lights: MGM revels in the business of show

Monday, February 19, 2024

MGM's boomtown benefits, Penn's NY license, DDI and GiG earnings, Catena reaction +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Penn revives ghost of OSB losses past

Monday, February 19, 2024

Penn earnings disappoint, Betsson earnings, MGM and GiG reaction +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DraftKings pockets Jackpocket, misses on earnings

Monday, February 19, 2024

DraftKings M&A and Q4 earnings, Penn earnings reaction, shares watch – DDI, sector watch – Bitcoin +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these