Scaling Ethereum With Optimistic Rollups | Layer 2 Review

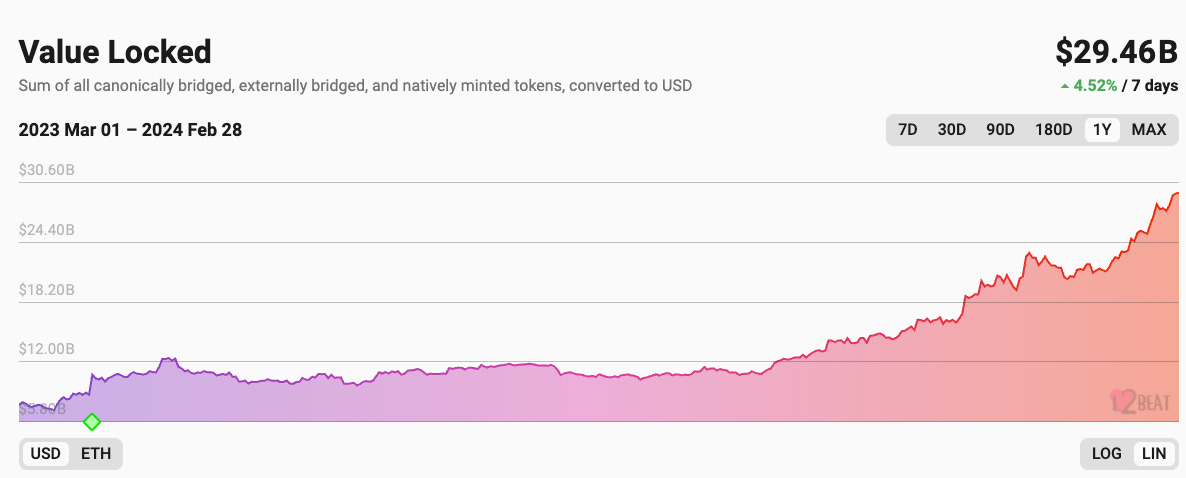

Scaling Ethereum With Optimistic Rollups | Layer 2 ReviewQuick Reads and Hot Links Covering the People and Projects Who Are Scaling EthereumDear Frens, The bull is tightening its rein on the market, and as expected we are seeing gas fees on Ethereum soar. This and many other issues reinforce Layer 2 solutions' crucial role in this path toward global adoption. Despite challenges like centralization and interoperability issues, with over $30 billion in total value locked, Layer 2 momentum remains strong, driving innovation and growth within the ecosystem. In our previous issue, Kornekt explored the rollup stages, emphasizing the maturity framework inspired by Vitalik Buterin, categorizing rollups into Stage 0, Stage 1, and Stage 2. Stage 0 projects like Optimism post all transactions on-chain, while Stage 2 projects allow permissionless fraud proofs and time-locked upgrades for user security. This week, we take a peek at the tech behind optimistic rollups. Optimistic rollups are Layer 2 protocols that enhance Ethereum's scalability by processing transactions off-chain, reducing computation on the main chain. They rely on Ethereum's security by publishing transaction results on-chain. In addition to knowing more about optimistic rollups, we bring you updates on governance activity at major L2s and ecosystem updates to keep you informed about the latest releases and events. Enjoy and stay tuned for more! Contributors: Lucent1, Warrior, jengajojo, Tonytad, anointingthompson1.eth, Kornekt, WinVerse, This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🗞️ Ecosystem Updates⛓️ Blast-based GambleFi Platform 'RiskOnBlast' Allegedly Rugpulled Presale Participants 🆕 Arbitrum Launches Onchain Gameathon, ‘Arbitrum Arcade’, in Conjunction With Clique 🔀 Arbitrum Foundation Funds Crypto-related Film From Oscar-winning Producer ➿ Former Terra, Cosmos Developers Raise $7.5 Million for Rollup-focused Blockchain Initia ⚡ Mantle v2 Sepolia Testnet Public Contest Powered by Secure3 ⭕ Mantle Token Hits All-time High Amid Increased Interest in Layer 2s 🔒 Blast Crosses $2 Billion in TVL Ahead of Feb. 29 Mainnet launch 📈 SettleMint has Integrated Polygon zkEVM Into its Blockchain Transformation Platform 🔮 New Layer 2 Ethereum Network, Zircuit, Soars Past $200m in Deposits in First 72 Hours 🏛 Governance💬 Proposals in DiscussionArbitrum

OptimismPolygonStarknetScaling Ethereum With Optimistic RollupsAuthor: Kornekt Optimistic rollups have emerged as a promising approach to scaling Ethereum's transaction throughput without sacrificing its core principles. Unlike its counterparts, such as Plasma or zk-rollups, an optimistic rollup operates on the principle of optimism, assuming the validity of transactions by default and leveraging off-chain processing to achieve significant scalability gains. This optimistic approach allows for faster and cheaper transactions, making it an attractive option for dApp developers and users alike. Core Components of an Optimistic RollupAt its core, an optimistic rollup comprises several key components, each playing a crucial role in its operation and functionality. Let's get into the intricate details of these core components. Rollup ContractThe rollup contract serves as the backbone of optimistic rollups, residing on the Ethereum mainnet. It includes a set of contracts that manages the rollup status, stores rollup blocks, and handles user deposits, withdrawals, and dispute resolution. Sequencers/OperatorsSequencers or operators are responsible for creating rollup blocks and facilitating the transfer of transaction information between Layer 2 and Layer 1. They collect and aggregate transactions off-chain, grouping them into a single rollup block before sending them to the Ethereum mainnet. Data Availability LayerEnsuring data availability is crucial for the integrity and security of optimistic rollups. This layer ensures that transaction data is accessible and verifiable by all participants, mitigating the risk of data manipulation or censorship. Fraud ProofsFraud proofs are essential for maintaining the security of optimistic rollups. They provide a mechanism for disputing invalid state transitions and challenging fraudulent transactions. If a validator detects a discrepancy, they can submit fraud proof to initiate the dispute resolution process. While this is an essential component of optimistic rollups, not all active optimistic rollups have a functioning fraud proof system. The presence of an active fraud proof system is one important factor used to gauge rollup maturity. Security Guarantees of Optimistic RollupsCentral to the success of optimistic rollup is its robust security model, which relies on a combination of economic incentives, cryptographic techniques, and decentralized mechanisms. Economic IncentivesAt the heart of optimistic rollup's security model are economic incentives designed to discourage malicious behavior and incentivize honest participation. Validators, sequencers, and users are economically incentivized to adhere to the protocol rules and refrain from engaging in fraudulent activities. Validators receive rewards for processing transactions accurately and honestly, while challengers are rewarded for detecting and proving fraudulent transactions. Fraud Proof and Dispute ResolutionOptimistic rollups employ fraud proofs as a mechanism for challenging invalid state transitions and disputing fraudulent transactions. Validators or users can submit fraud proofs to the rollup contract, providing evidence of fraudulent activity. The dispute resolution process involves on-chain verification of the contested transactions, with penalties imposed on the guilty party. By allowing participants to challenge and verify the validity of transactions, optimistic rollups ensure the integrity and security of the system. Cryptographic TechniquesCryptographic primitives such as Merkle trees and cryptographic commitments play a vital role in securing optimistic rollups. Merkle trees are used to efficiently represent and verify the validity of transaction data, enabling participants to verify the inclusion of transactions in a block without requiring access to the entire transaction history. Cryptographic commitments ensure the integrity and immutability of transaction data, making it tamper-resistant. Transparent and AuditableTransparency and auditability are fundamental principles of optimistic rollups, allowing participants to verify the correctness and fairness of the protocol operation. All transactions and state transitions are recorded on-chain, enabling anyone to audit the system's integrity and detect any discrepancies or anomalies. Challenges Facing Optimistic RollupsWhile optimistic rollups offer promising scalability solutions for Ethereum, its design and implementation are not without challenges and trade-offs. Addressing these complexities is crucial for optimizing the performance, security, and usability of optimistic rollups. Here are some key challenges and trade-offs associated with optimistic rollups: Scalability vs. DecentralizationOne of the fundamental trade-offs in optimistic rollup design is balancing scalability with decentralization. Optimistic rollups aim to improve transaction throughput and reduce fees by offloading transactions to Layer 2. However, the quest for scalability has increased centralization operations in the form of sequencers and validator sets. Transaction FinalityOptimistic rollups introduce a delay in transaction finality due to the dispute resolution process. During this period, transactions may be contested, leading to delays in confirming the validity of transactions. Users have to wait for the specified challenge period to be able to withdraw funds back to the Layer 1 chain. Interoperability With Other Layer 2 Scaling SolutionsInteroperability between rollups and other scaling solutions remains a challenge. Developments in this regard focus on interoperability protocols, cross-chain communication standards, and composability frameworks to facilitate seamless interaction between optimistic rollups and other scaling solutions. In a move to enhance interoperability, Optimism, a leading optimistic rollup, is working towards incorporating zero-knowledge proofs in its OP stack. Continued collaboration, research, and development efforts will further strengthen optimistic rollups as a leading Layer 2 scaling solution and drive widespread adoption across the blockchain ecosystem. 📈 DataTotal Value Locked on L2s Moves Past $29 Billion!

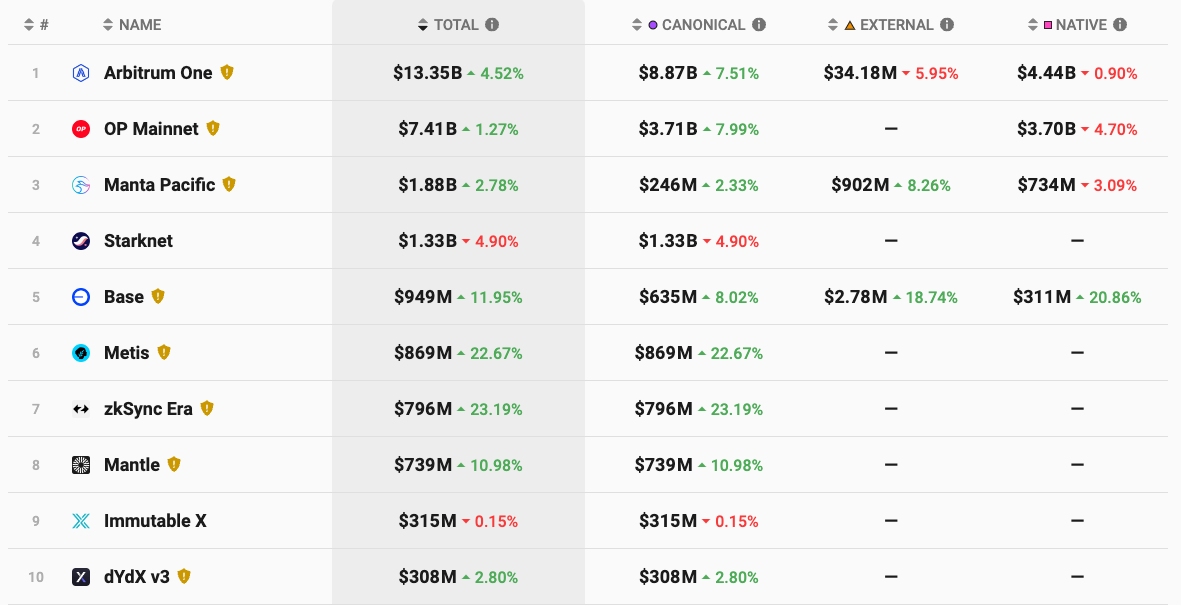

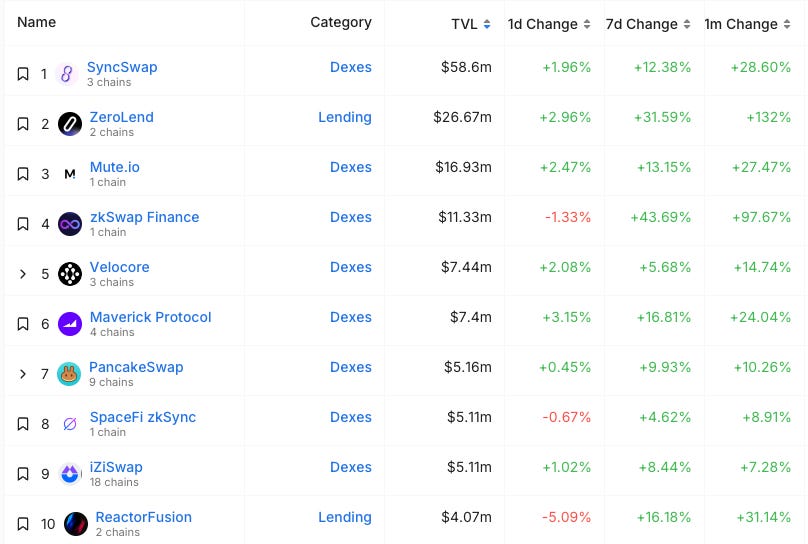

Top Ten Projects by Total Value Locked:

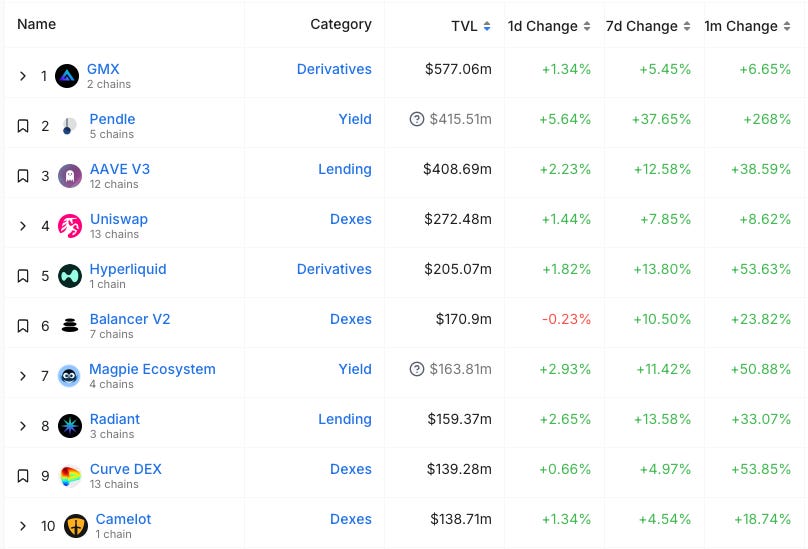

🔭 Project WatchArbitrumTop Projects by TVL

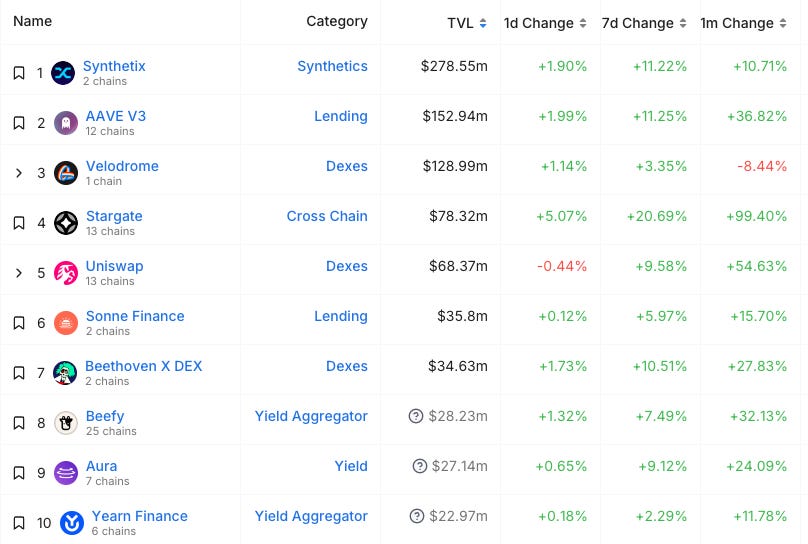

OptimismTop Projects by TVL

zkSyncTop Projects by TVL

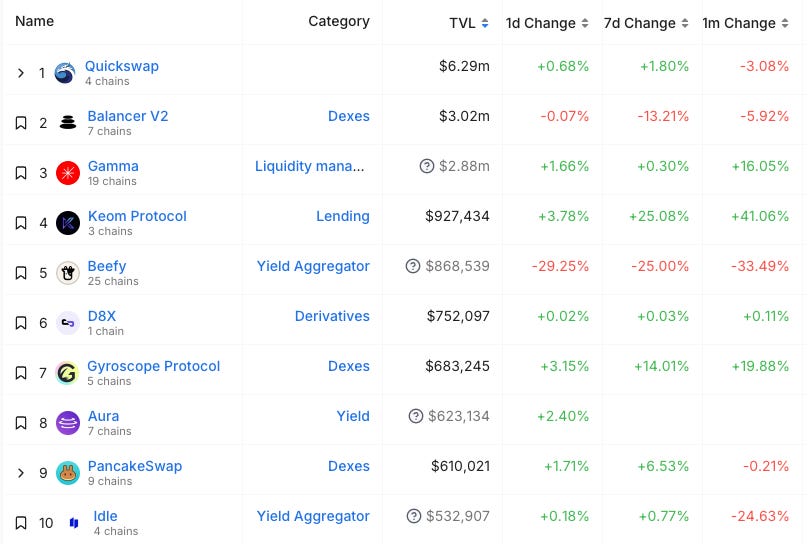

zkEVMTop Projects by TVL

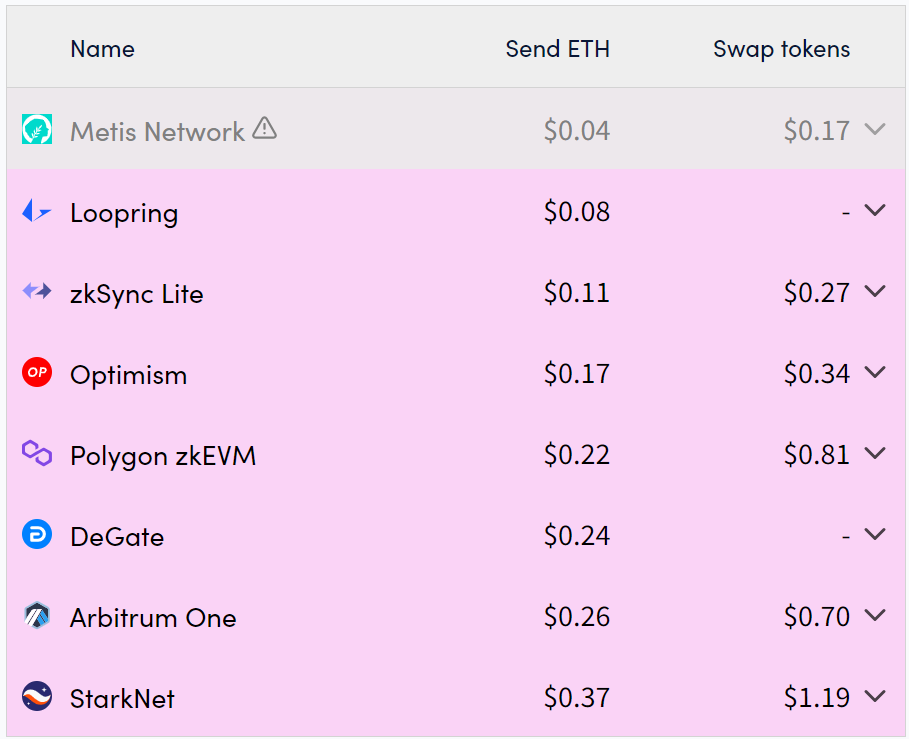

🔥 L2 Fees and Costs UpdateTransaction Fees as of February 28, 2024:

|

Older messages

Ideation | BanklessDAO Weekly Rollup

Saturday, February 24, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Primer on Rollup Stages | Layer 2 Review

Monday, February 19, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is BanklessDAO Officially Coming to an End? | BanklessDAO Weekly Rollup

Monday, February 19, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Spotlight on Fight Club | BanklessDAO Weekly Rollup

Saturday, February 10, 2024

Catch Up With What Happened This Week in BanklessDAO

Building Community Through Social Media | BanklessDAO Weekly Rollup

Saturday, February 3, 2024

Catch Up With What Happened This Week in BanklessDAO

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏