Earnings+More - Entain admits to BetMGM misjudgment

Entain admits to BetMGM misjudgmentEntain’s mea culpa, Rush Street ahead, Super Group considering Betway US options, Betr raises again, Strive confirms investment +More

Technicolor pachyderms is really too much for me. Entain’s mea culpaThe aim of our patrol is a question rather droll: Interim CEO Stella David kicked off Entain’s FY presentation by suggesting she wanted to address a “number of elephants in the room”, including what she said was an erroneous focus on delivering for BetMGM at the expense of the rest of the business. “We know what’s gone wrong,” she said.

That’s not who we are: David also disowned Entain’s previous aspirations as expressed by former CEO Jette Nygaard-Andesen for the company to become a “broader interactive entertainment” entity. “Quite frankly, that was a distraction,” David said.

By the numbers: David admitted the performance for 2023 was not up to snuff. Total revenues including its share of BetMGM were up 14% YoY to £4.77bn or 2% up on a pro forma basis. Underlying EBITDA was up 4% to £857m.

Not working: David said Entain would “do better” in key markets. In the UK she said the company had undergone a “very long, iterative process of doing multiple affordability measures”, which had generated “significant complexity in the customer journeys.”

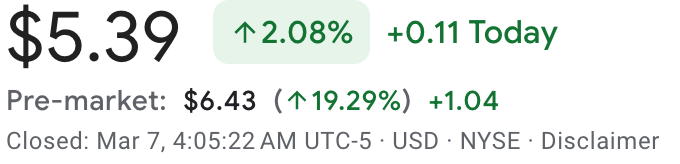

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless. For more info, go to www.kambi.com +MoreMGM Resorts and Marriott Bonvoy have officially launched their customer loyalty partnership covering all of MGM’s Las Vegas and regional properties. Circa Sports is to open a sportsbook outlet at Silverton Casino Lodge in Las Vegas next week, its seventh outlet, according to the Las Vegas Review-Journal. By the numbersFanDuel reclaimed top spot in terms of OSB and iCasino market share in Q423 from main rival DraftKings, helped by an all-time high share of 23% in iCasino, according to EKG. FanDuel stood at ~34% with DraftKings just behind on ~33%. Read acrossIn Compliance+More today, bet365 is in hot water in Australia with the country’s financial intelligence agency. Plus, Alabama’s bill is shorn of OSB and B&M casinos, Minnesota looks at banning in-play and a look at recent moves against college props betting. Investors warm to Rush StreetProof of the pudding: Steadily improving adj. EBITDA metrics on a quarterly and yearly basis were enough to see the Rush Street share price rise by almost 20% AMC yesterday. Q4 adj. EBITDA came in at $11.5m compared to a loss of $17.3m the year previous, while on a yearly basis it came in at $8.2m vs. a $91.8m loss in 2022.

🚀 Rush Street up 20% after market close yesterday You Delaware it well: CEO Richard Schwartz was keen to point to RSI’s early success in Delaware where it has taken over the sole operator status previously enjoyed by 888. “Delaware will be profitable for us quite quickly,” he told the analysts. “We came out of the gate pretty strong.”

Duolingo: LatAm remains “topical”, said Schwartz, who added the company was a “proven leader” in the region with Colombia growing at a “rapid pace.” He noted that five years ago “no one in our company even spoke Spanish fluently,” but by “focusing on the fundamentals” Rush Street was now the second-largest operator in Colombia.

Super Group’s US strategic reviewAll the rage: Betway parent company Super Group became the second largely European-focused operator to say it is considering the future of its US operations, less than a year after stating its bold ambitions for the “attractive market.” Recall, yesterday, 888 said its US business was under review as it exited its Sports Illustrated partnership.

In better news: Elsewhere, the company lauded a record performance with Q4 net revenue up 7% to €352m, although adj. EBITDA sank almost 19% to €33.6m. FY23 revenue was up 8.5% to €1.4bn and adjusted EBITDA was down 6% to €198m.

Maximize your success in 2024 with Optic Odds' real-time Odds Screen. Built with an emphasis on speed and coverage, Optic Odds offers:

Get in touch at opticodds.com/contact. Betr raises againFighting fit: The pugnacious OSB contender Betr has tapped up its investors once again, this time for $15m, valuing the Jake Paul-fronted company at $350m. The new money comes from new investors Harmony Partners and 10X Capital with participation from existing investors including Fuel Venture Capital, Aliya Capital Partners and Eberg Capital.

Out of the frying pan: Having started out as solely a micro-betting operator, Betr subsequently pivoted towards including a full OSB betting roster as well as a fantasy sports offering called Betr Picks.

Mr Brightside: Talking to Bloomberg yesterday, CEO Joey Levy said Betr still “ultimately plan[s] on being a nationwide sportsbook brand.”

Strive confirms OpenBet investmentStrive Gaming has confirmed OpenBet has taken a “significant stake” in the business in an investment round with participation from family office Knutsson and specialist gaming fund Astralis Capital Management as well as Betsson, which previously invested in Strive in a seed funding round.

The new investment was predicted by Earnings+More, which said in late February that Strive would be raising $5m at a valuation of $50m with OpenBet taking up the majority of the new money. Earnings in briefGenius Sports: The data-plus provider was certainly celebrating Hard Rock’s monopoly in Florida, saying it saw an “immediate uplift” on the back of its launch in Q4, with CEO Mark Locke adding that further growth from the Sunshine State for 2024 was “baked in.”

NeoGames: The big news from the iLottery-to-iCasino/OSB supplier was its acquisition by Aristocrat is now due to complete in May. Ahead of that, Q4 revenues dropped by 21% to $64.9m due to an accounting change related to new commercial terms for its Aspire Core OSB contracts. Adj. EBITDA was flat at $18.2m.

Bet-at-home: Net revenue fell 14% to €36m while EBITDA tumbled back 62% to €800k, which the company blamed on the imposition of betting limits in its key market of Germany. The company said it had also lost out from the migration of customers to the new EveryMatrix platform during the year.

Calendar

InclineBet provides performance-driven digital marketing services to the global regulated iGaming market. Our team bring unrivalled expertise in digital marketing, online casino and sports betting to deliver high-performance UA, CRM and Creative services. iGaming isn’t merely another market we serve, it’s the only market. Click to learn more about what we do and how we can help. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Out of the picture: 888 cans SI partnership

Wednesday, March 6, 2024

888's US strategic review, Full House and AGS earnings reviews +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Enough! Can startups raise too much cash?

Tuesday, March 5, 2024

The perils of fundraising, a busy start to 2024 continues, GuardDog's debut investment, Dmitry Belianin talks mentoring +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Scoop: Entain puts PartyPoker up for sale

Monday, March 4, 2024

Entain's bolt-on reversal, the long road ahead for IGT/Everi, startup focus – Supremeland +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Catena soars as Better Collective raises war chest

Friday, March 1, 2024

Better Collective cash raise, IGT and Everi combo, Lottomatica M&A prediction +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Caesars’ mountain to climb in Michigan

Tuesday, February 27, 2024

Michigan player data analysis, B&M gaming in January, OSB promo spend analysis +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these