Net Interest - Big in Japan

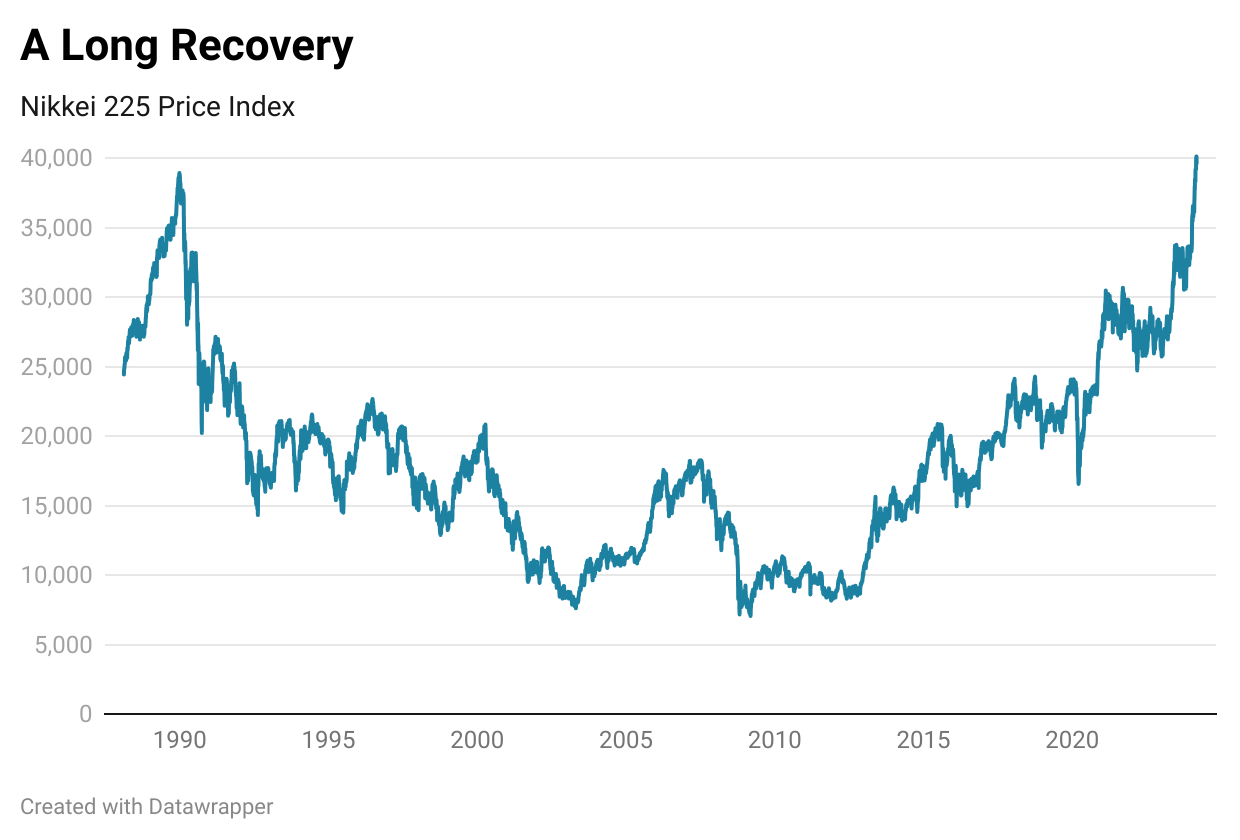

I entered the finance industry in the mid 1990s, so I missed the Japan market bubble. But even then, it left its mark. One of my first colleagues had been steered by his father to take up Japanese at a young age. He hadn’t excelled in any particular subject at school, so his father suggested he learn the language to give himself a head start. Japan was, after all, the future. By the time he took a job on the trading floor, singularly qualified to sell Japanese stocks to London-based institutions, the market had peaked and he was left yearning the career his father had imagined for him. Last month, the blue-chip Nikkei 225 Index finally reclaimed its 1989 high and has since risen further. Already this year, it’s the best performing major stock index in the world, up 19%, extending its 12-month run to 40%. A key catalyst for the rebound is the country’s anticipated exit from negative interest rates. With inflation having matched or exceeded its target for almost 24 straight months, the Bank of Japan no longer needs to maintain the ultra-loose monetary policy it deployed to tackle deflation. Households and companies can finally put to work some of the cash they have been stockpiling.¹ So far, engagement in the market has come largely from foreign investors, who account for around 70% of trading in the broader Topix Prime index of stocks. As well as the economic backdrop, they have been attracted by corporate governance reforms spearheaded by the Tokyo Stock Exchange. As part of a program to boost the investability of its wares, the Exchange now requires all companies that trade below book value to lay out a plan to bolster their valuation (37% of Nikkei constituents trade below book value, compared with ~3% of stocks in the S&P 500). It has also encouraged companies to eliminate their web of cross-shareholdings, long a drag on returns. The response has been positive: In the past year, dividends and share buybacks have soared, management buyouts are on the rise, and high-profile companies like Toyota are leading a drive to unwind cross-shareholdings. Domestic investors have been slower to return to the market, likely fatigued by how long it has taken to recover (longer even than it took Wall Street to bounce back following its 1929 crash). Over the course of 2023 and into early 2024, domestic investors were net sellers of Japanese stocks even as foreigners bought. But as the market has made further advances, they have been drawn in. Towards the end of January, retail investors turned net buyers and the day the Nikkei touched 40,000, one large broker, SBI Securities, saw its stock-trading app crash on the market open. As they come back to the market, Japanese retail investors have a lot of ground to make up. Equities account for just 11% of household financial assets in Japan, compared with 39% in the US and 21% in Europe. Investment funds add another 4% but in the US that number is 12% and in Europe it is 10%. In contrast, Japanese households hold over half their assets in cash – fine when consumer prices are falling, expensive when they are not. A government program to incentivise stock ownership could help. In January this year, the government expanded the scope of its tax-free Nippon Individual Savings Account (NISA) scheme. Individuals can now invest up to 18 million Yen ($120,000) over their lifetime without incurring tax on investment income or capital gains. While the scheme doesn’t require investors to buy domestic stocks (unlike the “BRISA” unveiled in the UK this week) many have started to look to their home market to invest some of their funds. Between the market and retail investors sit brokerage firms, and whenever interest in the market rises, brokerage firms benefit. The rally in crypto has made Coinbase one of the top-performing financial stocks globally, up 40% year-to-date. Similarly, Robinhood, which has benefitted from rallies in both crypto and Nasdaq stocks, is up 28% year-to-date. But the best performing financial stock globally so far this year is listed in Japan: Nomura, the country’s largest independent brokerage firm, is up 44%. Unlike those other two, Nomura has been around for a long time: Next year it celebrates its one hundredth birthday. Along the way, it has seen boom and bust, scandal and recovery. To see how a broker deals with cycles, and how it hopes to profit from this one, read on.  Continue reading this post for free, courtesy of Marc Rubinstein.A subscription gets you:

|

Older messages

Tony Robbins’ Favorite Asset Class

Friday, March 1, 2024

Inside the “GP Stakes” Business ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Third Network

Friday, February 23, 2024

Capital One's Pursuit of the Holy Grail ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Ackman Discount

Monday, February 19, 2024

Inside Bill Ackman's Listed Hedge Fund Complex ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Funding Mr Bates

Friday, February 9, 2024

Litigation Finance: The Rise of an Asset Class

New York State of Mind

Friday, February 2, 2024

The State of US Regional Banks

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏