State of the Network’s Q1 2024 Mining Data Special

State of the Network’s Q1 2024 Mining Data SpecialOur quarterly update on Bitcoin mining, zeroing in on recovering revenues, public miner strategies, and increased energy usageGet the best data-driven crypto insights and analysis every week: State of the Network’s Q1 2024 Mining Data SpecialKey Takeaways:

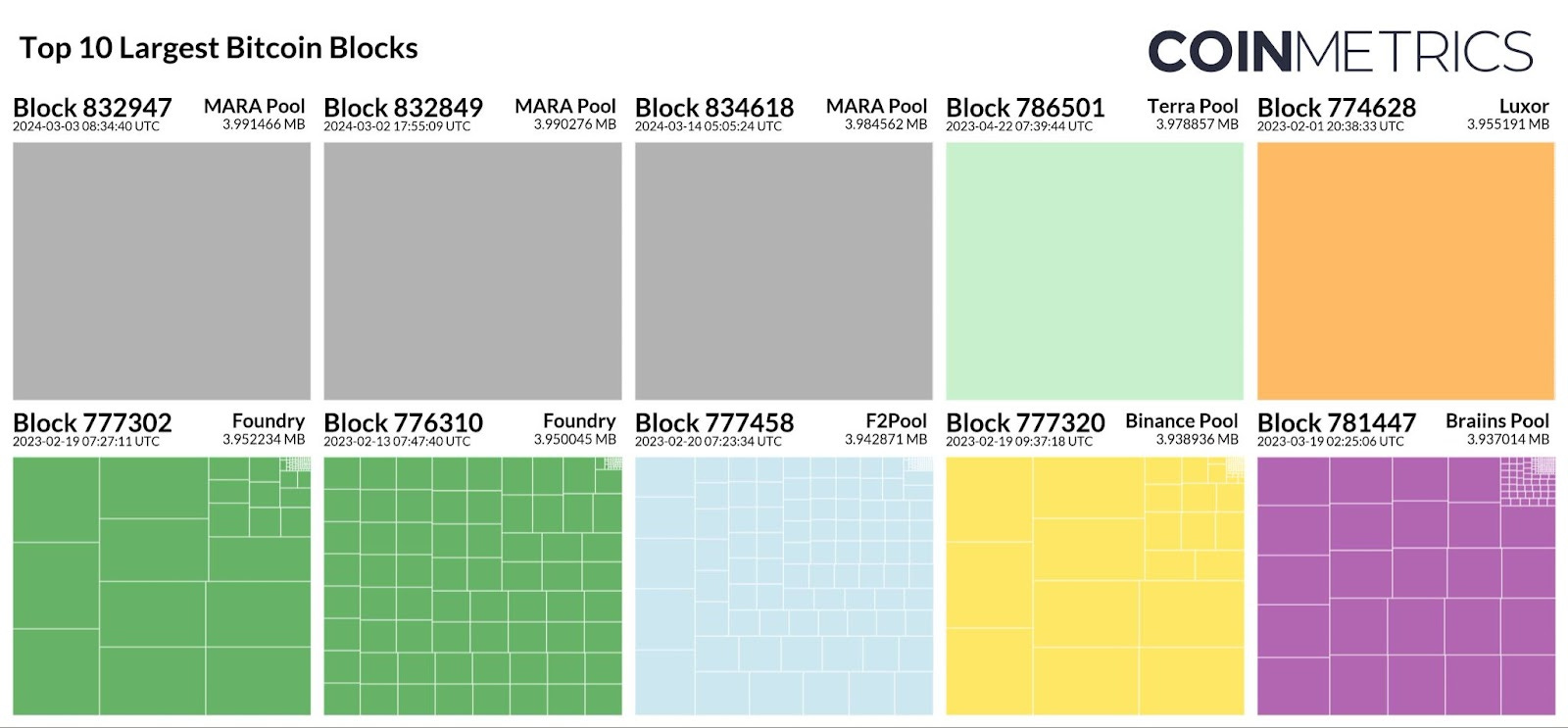

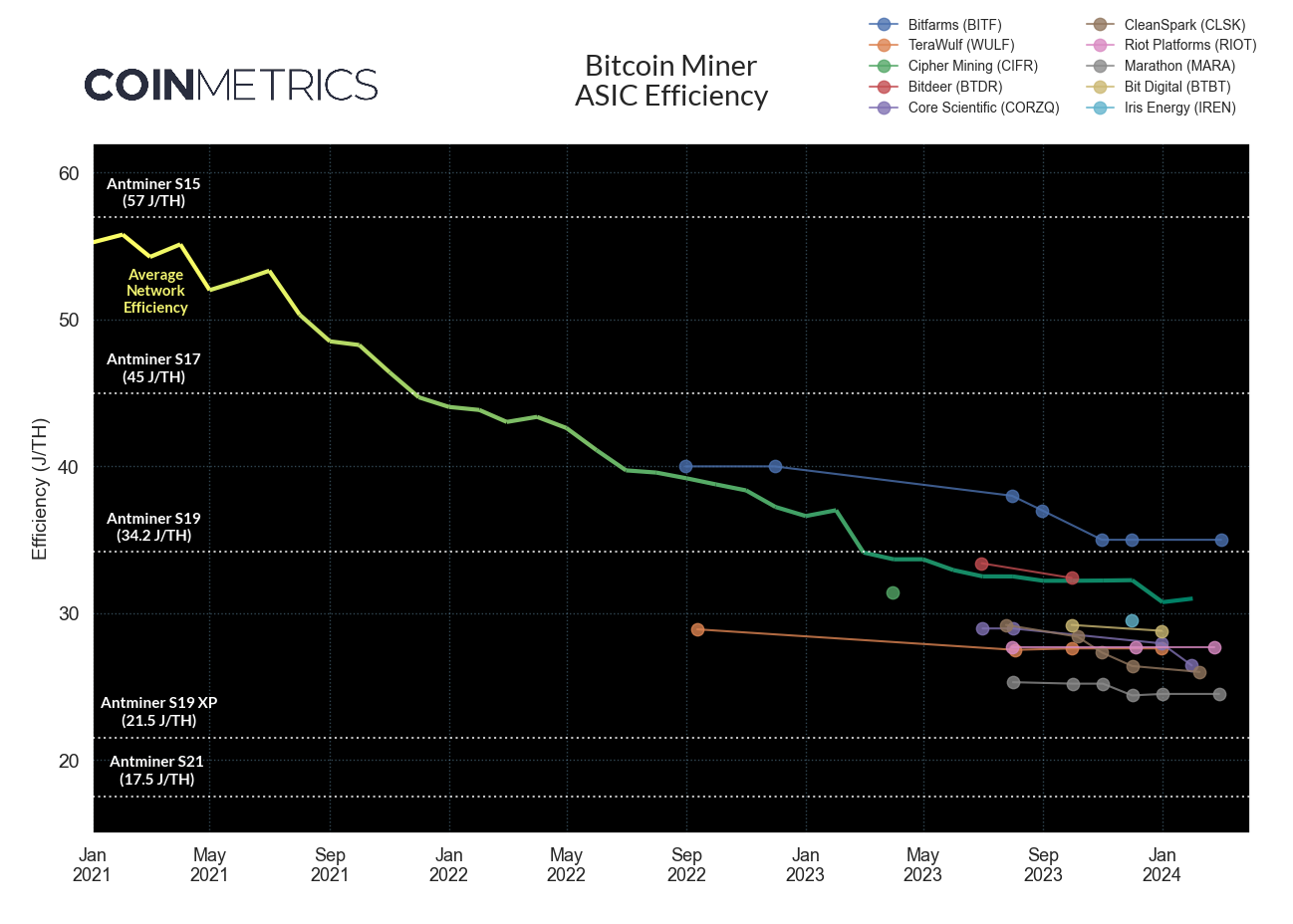

IntroductionThis week’s State of the Network returns to our quarterly update on Bitcoin mining, zeroing in on the impressive recovery of miner profitability amid improving market conditions. Naturally, the introduction of spot Bitcoin ETFs raised mining revenues across the board, boosting the value of the protocol-mandated 6.25 BTC block reward. Like last year, on-chain activity remains a significant tailwind, with Ordinals lifting transaction fees and offering miners novel revenue-generation opportunities. Still, the Bitcoin Halving looms ahead, and miners inevitably face a 50% reduction in top-line BTC earnings. In the coming weeks, miners will experience increased scrutiny of their operations, with on-chain metrics playing a key role in informing the views of stakeholders and strategists. Hashprice is RightThanks to the rally in Bitcoin price, hashprice (daily USD revenue per TH/s, a fundamental unit of hashrate) is back on an uptrend, currently steady at 10 cents per TH/s. Hashprice peaked at 12.6 cents per TH/s in December, the highest level since June 2022, and remains comfortably above the 6-7 cent range it occupied through most of 2023. Meanwhile, hashvalue (daily BTC revenue per TH/s) continues its perpetual trek lower, with more miners competing for their share of the fixed block reward pie. Still, periods of peak on-chain activity (accompanied by elevated transaction fees) intermittently boost BTC-denominated earnings. December saw a sustained increase in hashvalue, earning miners 300 Satoshis (0.000003 BTC) per TH/s deployed. This spike was largely attributed to Ordinals activity, with BRC-20 transfers flooding the mempool for the majority of the month. As of late, hashvalue sits near all-time-lows of 150 Satoshis per TH/s, with BTC-denominated rewards growing ever scarcer. Source: Coin Metrics Network Data Pro Caught between competitive pressures and hardware efficiency improvements, the value of an individual unit of hashrate remains on a steady slope downwards over the long-term, no matter the denomination. As a result, miners are compelled to continuously seek out newer, more efficient machines, producing more hashes for a lower cost, and so on the cycle repeats. Despite the long-term drawdown in earnings per hash, aggregate miner revenue (USD) has skyrocketed in 2024, hitting an all-time-high of $76.71M on March 11. Transaction fees aren’t nearly at the level they reached in the late stages of 2023’s Ordinals mania, but they remain relatively elevated in Q1, averaging $2-3M per day. Of course, the primary reason for record highs in mining revenue are record highs in BTC price, with the asset’s 50% gain buoying both revenues and treasuries in the mining ecosystem. Source: Coin Metrics Network Data Pro Though the 2024 Halving seems likely to dial back miners' daily earnings, the upwards trajectory of USD-denominated revenues helps alleviate longer-term "security budget" concerns. Individual operators will come and go, but for the moment, the network's issuance schedule appears sustainable enough to support the costly demands of proof-of-work consensus. Three’s CompanyWhile miners are often viewed as a homogenous group of commodity producers, many of the publicly-listed entities offer a differentiated strategic focus, from value-added services to fine-tuned power purchase agreements. The sector boasts dozens of high-profile names, but Marathon Digital (MARA), CleanSpark (CLSK), and Riot Platforms (RIOT) are currently the top 3 by market capitalization, engaged in a constant tug-of-war for shareholder dominance. With a massive operational hashrate of 28.7 EH/s and a treasury of nearly 17K BTC, Marathon Digital remains the king of the hill with a $5.6B market cap, but the juggernaut isn’t resting on its laurels. Marathon recently rolled out several ancillary services to diversify revenue streams, introducing a white-glove transaction submission service (“Slipstream”) and a suite of merged-mined Bitcoin sidechains (“Anduro”) in February. With the explicit aim to facilitate “non-standard transactions,” Slipstream has been especially provocative in the BTC community. By default, Bitcoin nodes enforce an upper limit on the max transaction size relayed to peers— but extra-large transactions are still technically valid according to consensus rules. As the only public miner with its own pool, Marathon is uniquely positioned to facilitate the inclusion of these transactions, enabling them to earn extra fees through a direct submission service. In March, Marathon mined the 3 largest Bitcoin blocks ever at 3.98+ MB each, surpassing Luxor’s infamous 3.96 MB “Taproot Wizards” block just over one year prior. While the average block contains 2,000 - 4,000 transactions, these 3 blocks have a combined total of just 17 transactions, with the bulk of block space occupied by 3 massive metadata Inscriptions. The first two blocks contained a pair of NFTs linked to the “Runestone” project, setting the stage for a massive community airdrop a few weeks later. The 3rd MARA mega-block contained an audio Inscription from rapper French Montana, permanently etching a MP4 file for his exclusive song (“Bag Curious”) into the blockchain. At 16 EH/s, the majority of CleanSpark facilities are concentrated in Georgia, with a handful of deployments in New York & Mississippi. Their focus is on operational efficiency, with cutting-edge immersion tech and clean energy inputs driving their margins to some of the industry’s highest. Though they’ve historically been an underdog in the standoff against Riot and Marathon, in early March CleanSpark flipped Riot to become the 2nd-largest publicly traded miner by market cap, currently valued at $4.6B. Mapping the recipients of mining pool payouts to public disclosures, address 3Km...9ab appears to match CleanSpark’s expected inflow profile. We can see the impact transaction fee spikes have made on CleanSpark’s revenue— in December, daily revenue per EH/s tipped 3 BTC, bringing their monthly production total to 720 BTC. Though hashvalue is substantially lower in March, on-chain flows indicate CleanSpark is still on track for a record month, with 653 BTC mined as of March 25. Source: Coin Metrics ATLAS, Network Data Pro, & CleanSpark Production Updates Riot Platforms is Bitcoin’s poster-child for grid integration, focused on dynamically responding to price fluctuations in the Texas energy market. As a participant in ERCOT’s “demand response” program, Riot ramps down their fleet during periods of grid strain, responding to market signals in real-time. Of the Big 3, RIOT stock is the laggard, returning 54% year-over-year (relative to MARA’s 195% and CLSK’s 807% return). Still, the firm holds strong in the upper ranks, with a market cap of $3.15B. For Riot, economic incentives are well-aligned— last August, a record-breaking heat wave put the Texas grid under pressure, causing power prices to spike to more than $1,000/MWh in the South load zone. Naturally, elevated rates briefly rendered Riot’s operations unprofitable, so the miner curtailed their consumption, quickly freeing up more capacity on the grid. Riot later reported their curtailment was rewarded with $31.7M in energy credits, over 3 times the value of their BTC mined over the same period. Source: Coin Metrics Network Data Pro, ERCOT, & Visual Crossing Weather Data As the miner most closely tied to the energy consumption narrative, Riot has faced substantial scrutiny from climate-conscious regulators. The White House has repeatedly proposed a 30% excise tax on miners’ power purchases, and the Energy Information Administration (EIA) recently issued a “mandatory survey,” requiring miners to report meticulous details about their energy inputs. The EIA’s survey was met with broad pushback from the mining sector, with the Texas Blockchain Council and Riot Platforms joining forces to sue the agency on the basis of overreach. In the short-term, Riot’s suit was a success, with a judge granting miners a temporary restraining order and forcing the EIA to retract their “emergency” mandate in favor of a standard public comment period. Miners still remain a major target in regulatory crosshairs, but the industry’s ability to quickly mobilize a defense against political pressure underscores the sector’s maturation, with well-capitalized companies successfully shielding the entire ecosystem from overbearing reporting requirements. Watts HappeningThe mining industry has fended off the EIA’s data collection efforts (for now), but on-chain heuristics still offer a glimpse into the network-wide level of power usage. Following 2022’s bankruptcy flush-out and 2023’s market rebound, hashrate is once again on a steady march upwards, bringing with it a substantial rise in electricity consumption. According to Coin Metrics’ MINE-MATCH methodology, the network’s estimated power draw clocked a new all-time-high of 19.6 GW in February, a 62% increase year-over-year. Source: Coin Metrics MINE-MATCH Miners are consuming more energy, but they’re also squeezing more performance out of their machines. The industry’s favored metric for measuring efficiency is an ASIC’s “joules per terahash” (J/TH) rating, quantifying the amount of hashrate produced per joule of energy consumed. The lower the J/TH rating, the more efficient the ASIC. Hashrate contributed by newer-generation miners like the S19 XP (21.5 J/TH) has grown nearly 60% YTD. Though a steadily rising BTC price appears to have reactivated some older, less-efficient models like the S9, the average network efficiency currently sits at just 30.99 J/TH, a testament to the relentless nature of the hardware upgrade cycle. Source: Coin Metrics MINE-MATCH and SEC Filings Fleet efficiency (in J/TH) is an increasingly popular metric for mining businesses, allowing them to underscore their competitive edge. Based on public disclosures, CleanSpark has lowered their energy consumption to 26 J/TH, while Core Scientific has improved self-mining efficiency to 26.44 J/TH following an emergence from Chapter 11 bankruptcy. With 1 month left to the Halving, miners must continue rolling out high-performance hardware to ensure their survival in the shakeup ahead. ConclusionThe mining industry is still recovering from 2022’s market volatility, with a number of firms making fresh exits from extensive bankruptcy proceedings. Luckily, ETF inflows have softened the landing, and margins are slowly expanding. Equity investors are once again warming up to the notion of Bitcoin exposure via mining stock proxies, with many tickers outperforming BTC itself. The Halving of block rewards in April will be a do-or-die moment for many miners, and it stands to question whether these firms can stomach the drop to 3.125 BTC per block. Still, the recent injection of institutional capital may yet keep some weaker links afloat, providing a short window of favorable M&A conditions. More consolidation lies ahead, but political risks will also persist, with many miners deploying ASICs beyond U.S. borders in an attempt to decentralize operations. U.S. ventures have dominated mining for several years, but 2024 looks to be a year marked by geographic decentralization. In previous cycles, capital markets have played kingmaker in deciding which operators receive the most favorable financing terms. Post-Halving, however, operators will be forced to balance easy access to capital against the low-cost power rates and relaxed regulatory outlooks offered by emerging markets, unlocking expansion across South America, Africa, and beyond. Make sure to check out our previous issues of the mining data special, as well as our June report The Signal & the Nonce: Tracing ASIC Fingerprints to Reshape our Understanding of Bitcoin Mining. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Market capitalization of Bitcoin and Ethereum slid by 7% and 11%, respectively, over the week. This downturn came as spot Bitcoin ETFs saw 3 consecutive days of net outflows. Meanwhile, the Ethereum Foundation is being investigated by state authorities in an effort by the SEC to classify ETH as a security. BlackRock made a foray into tokenization, launching “BlackRock USD Institutional Digital Liquidity Fund” (BUIDL), an on-chain money market fund on Ethereum. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Appraising Growth in Digital Asset Markets

Tuesday, March 19, 2024

Coin Metrics' State of the Network: Issue 251 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Market Dynamics and Risks of Liquid Staking Derivatives

Tuesday, March 12, 2024

Exploring the market dynamics and risks of liquid staking tokens (LST's) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Following Flows V: Pool Cross-Pollination

Tuesday, March 5, 2024

Examining on-chain flows to better assess Bitcoin mining pool decentralization ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Breaking Byzantine Fault Tolerance

Tuesday, February 27, 2024

An overview of a novel approach in appraising the security of both the Bitcoin and Ethereum networks ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

At the Crossroads: Bitcoin ETFs & Coinbase

Wednesday, February 21, 2024

Latest developments with spot Bitcoin ETFs & Coinbase Q4 2023 Earnings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏