Ethereum's Layer 2 – Post Dencun | Layer 2 Review

Ethereum's Layer 2 – Post Dencun | Layer 2 ReviewQuick Reads and Hot Links Covering the People and Projects Who Are Scaling EthereumDear Frens, Layer 2 solutions are at the vanguard of scaling Ethereum but right now it turns out not to be just a scaling solution but a revolution. Layer 2 is the buzzword resounding through the Ethereum ecosystem — from the explosive growth of Arbitrum and Optimism and projects like Base built on the OP stack to the emergence of some amazing standards like zkSync and Starknet. zkSync projects are currently demonstrating the potential for zero-knowledge proofs to revitalize not just DeFi but a wide range of applications, from gaming to supply chain management. Speaking of gaming, Polygon joined forces with Immutable to launch a 100 million USD gaming investment fund. Optimism is also moving as they are back with a more targeted form of RPGF — more on that under the Hot News section. Indeed, Layer 2 has generally transitioned from a concept of the future to a practical reality solution that enhances efficiency and accessibility in blockchain technology. Sit back as we journey into the latest updates and advancements in this fast-paced L2 space. Contributors: Ritaakubue, Warrior, jengajojo, Tonytad, Boluwatife, Kornekt, WinVerse This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🗞️ Ecosystem Updates⛓️ Inscriptions Push Blobs To Reach Set Utilization Limit on Ethereum 🆕 Coinbase To Store More Corporate and Customer USDC Balances on Base as TVL Tops $1 Billion 🔀 Altlayer Enables Token Staking, Unveils Fast Finality Service for Rollups ➿ Spartan Capital Leads $10 Million Strategic Funding Round for Bitcoin Defi Developer ALEX ⚡ Fantom Plans to Leverage Sonic To Build a ‘Shared Sequencer’ for Other Blockchains ⭕ Polygon zkEVM Blockchain Resumes Operation Following 10-Hour Outage 🔒 Ethereum Layer 2 Morph Raises $20 Million From Dragonfly, Pantera and Others 📈 Aavegotchi Chooses Base as Settlement Layer for Gotchichain 🔥 Hot News850M OP Dedicated to the Evolution of Retro FundingOptimism has allocated a total of 850M OP tokens to incentivize impactful work across the Optimism Collective and the Superchain. The Retro Funding program has been revamped to operate through specifically targeted and categorized rounds, each rewarding different types of contributions. Upcoming Rounds and Submission Deadlines:

To assist builders, Optimism has curated Builder Ideas aligned with the Collective's mission, available here. Optimism emphasizes that Retro Funding is not a charitable endeavor but a system where contributions are valued and rewarded accordingly. By aligning contributions with broader ecosystem goals and providing clarity, Optimism aims to empower builders to shape their future. For more information on the evolution of Retro Funding, refer to: https://optimism.mirror.xyz/nz5II2tucf3k8tJ76O6HWwvidLB6TLQXszmMnlnhxWU. 🏛 Governance💬 Proposals in DiscussionArbitrum

Optimism

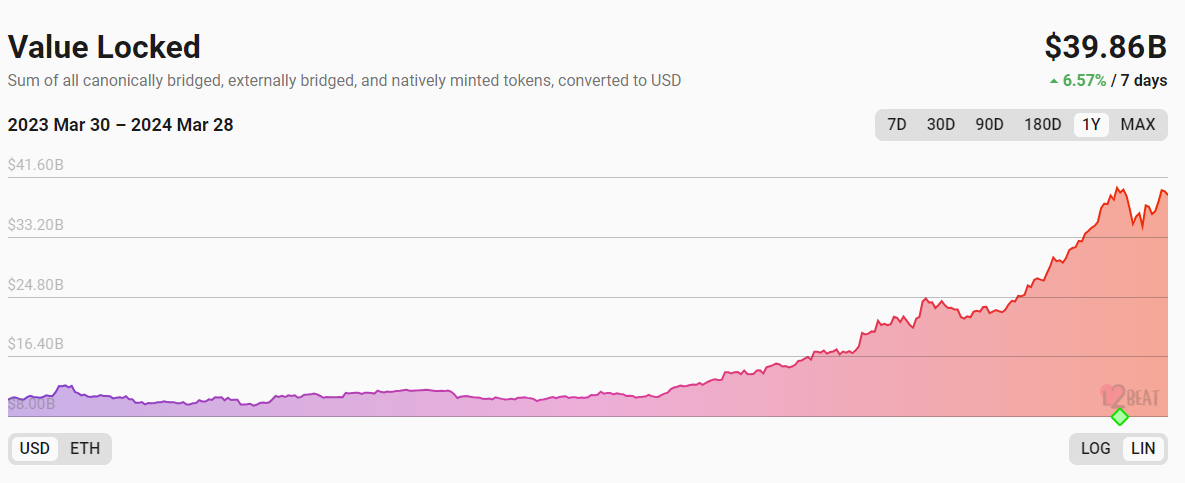

CeloEthereum's Layer 2 – Post DencunAuthor: Kornekt Following the implementation of EIP-4844, referred to as Proto-danksharding, we've seen drastic reductions in fees on Layer 2 networks. This reflects the positive impact of the upgrade on Ethereum's overall scalability and cost-effectiveness. Gas fees on Optimism, Arbitrum, and other major L2 networks have been reduced by over 90%, making transactions more affordable and accessible to a broader user base. These fee reductions have encouraged greater participation in decentralized applications and DeFi protocols built on Layer 2, fostering innovation and growth within the L2 ecosystem. All these are thanks to the introduction of blobs, which serve as temporary storage systems for large data packets in the consensus layer, reducing the overall storage burden and transaction costs associated with Layer 2 operations. The temporary nature of these blobs seems to raise eyebrows because it sort of contradicts the idea of immutability and permanence associated with blockchain technology. However, it is essential to understand that blobs live on Ethereum’s consensus layer and all that’s necessary is to ensure they are there long enough for all participants to verify their validity. As such, the data can be deleted after specified periods but may still be available on other off-chain storage solutions. Since rollups are the major beneficiaries of the Dencun upgrade, now would be a good time to go back to certain basics to understand how rollups inherit mainnet security. How Rollups Derive Security From Ethereum Layer 1Rollups scale Ethereum by leveraging the security guarantees provided by Ethereum Layer 1 while significantly improving transaction throughput and efficiency. At the heart of the rollups lies the fundamental principle of anchoring transaction data and state updates to the Ethereum main chain, ensuring the integrity and security of Layer 2 operations. The security model of rollups is derived from Ethereum Layer 1, which serves as the ultimate arbiter of truth and the source of trust for all transactions and smart contract executions. Rollups inherit the robust consensus mechanism of Ethereum Layer 1, relying on its decentralized network of validators to validate and confirm transactions submitted to the L2 network. Transactions processed on Layer 2 are batched and compressed as blobs, which are then submitted to Ethereum Layer 1 for verification on the blockchain. This process ensures that all Layer 2 transactions are ultimately secured by the underlying Ethereum network, providing users with the same level of security and truthfulness as mainnet transactions. Furthermore, rollups incorporate additional security mechanisms to further enhance the integrity and reliability of Layer 2 operations. One such mechanism is the use of fraud proofs or validity proofs, which allow users to challenge invalid transactions or state transitions by providing cryptographic evidence of fraudulent behavior. Moreover, rollups benefit from Ethereum's economic security model, which incentivizes validators to act honestly and follow the protocol rules. Validators are required to stake a certain amount of cryptocurrency as collateral, which they stand to lose in the event of malicious behavior or non-compliance with the protocol. Future of Ethereum Scaling – Full DankshardingDencun was only a precursor for the future of Ethereum scaling which involves full Danksharding. Full Danksharding expands Proto-danksharding by increasing the number of blobs per block from 1 to 64. This substantial increase in data blobs allows Ethereum to process a significantly higher volume of transactions. With full Danksharding, users can expect faster confirmation times and lower fees, making Ethereum even more accessible and affordable for a broader audience. While scalability and efficiency are paramount, full Danksharding prioritizes security and decentralization. The upgrade maintains Ethereum's robust security model by incorporating mechanisms for data availability sampling and proposer-builder separation. Data availability sampling ensures that transaction data remains accessible and verifiable across the network, preventing data manipulation or censorship attacks. Similarly, proposer-builder separation mitigates the risk of collusion or manipulation by separating the roles of block proposal and construction. By upholding these security measures, full Danksharding ensures that Ethereum remains resilient against potential threats while scaling to meet the demands of a growing user base and ecosystem. Wrapping It All UpThe Dencun upgrade represents a significant milestone in Ethereum's journey towards scalability and efficiency. With lower fees on Layer 2, the introduction of blobs, and the assurance of rollup security derived from Ethereum Layer 1, Ethereum is poised for a future of enhanced performance and accessibility. As we look forward to future upgrades like full Danksharding, Ethereum continues to solidify its position as a leading force in the blockchain space, driving innovation and paving the way for the decentralized future. 📈 DataTotal Value Locked on L2s is almost $40 billion!

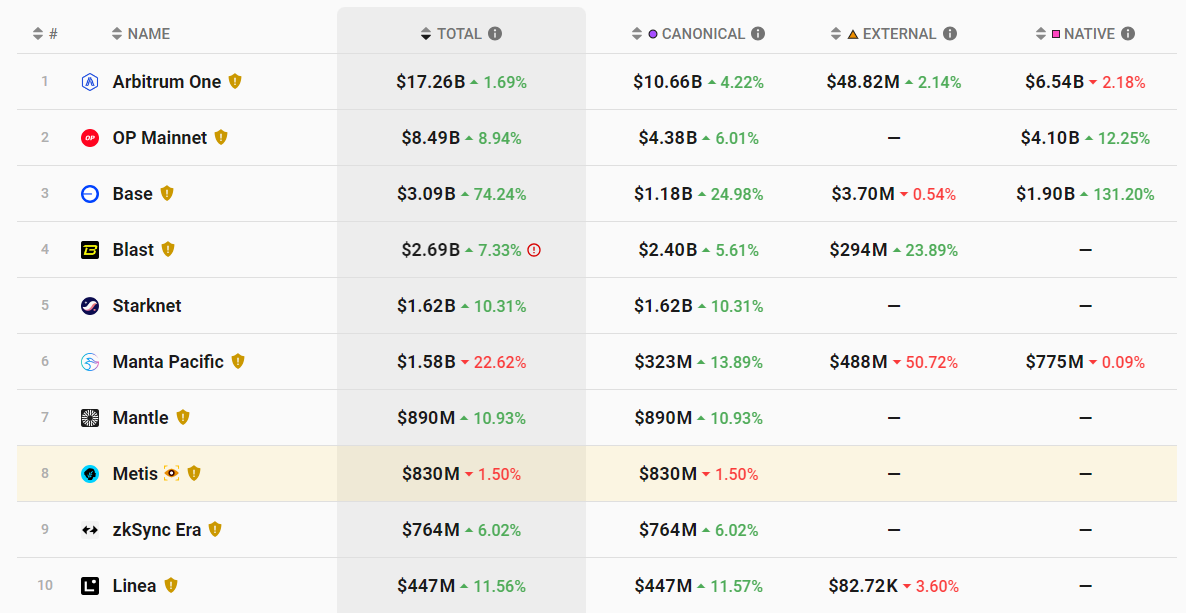

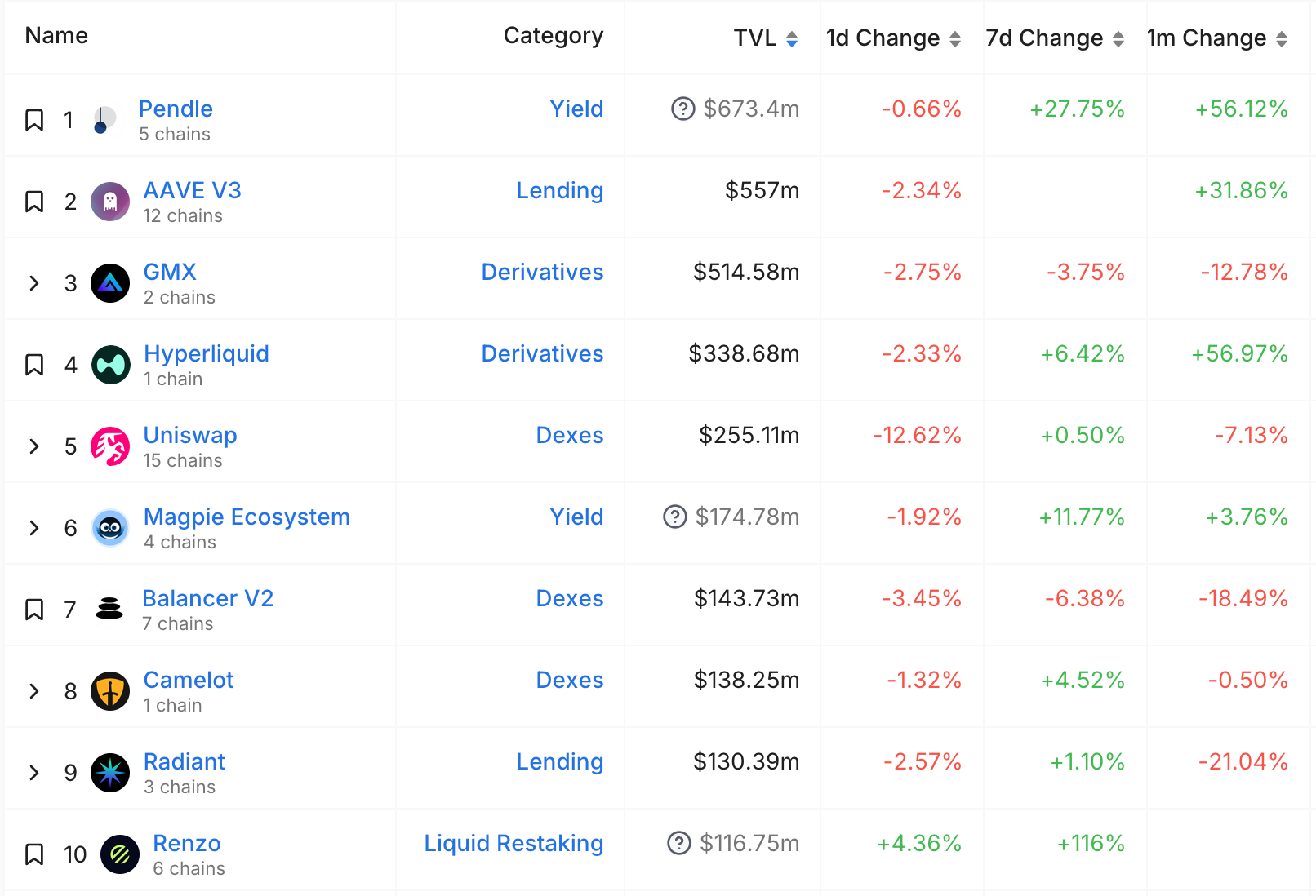

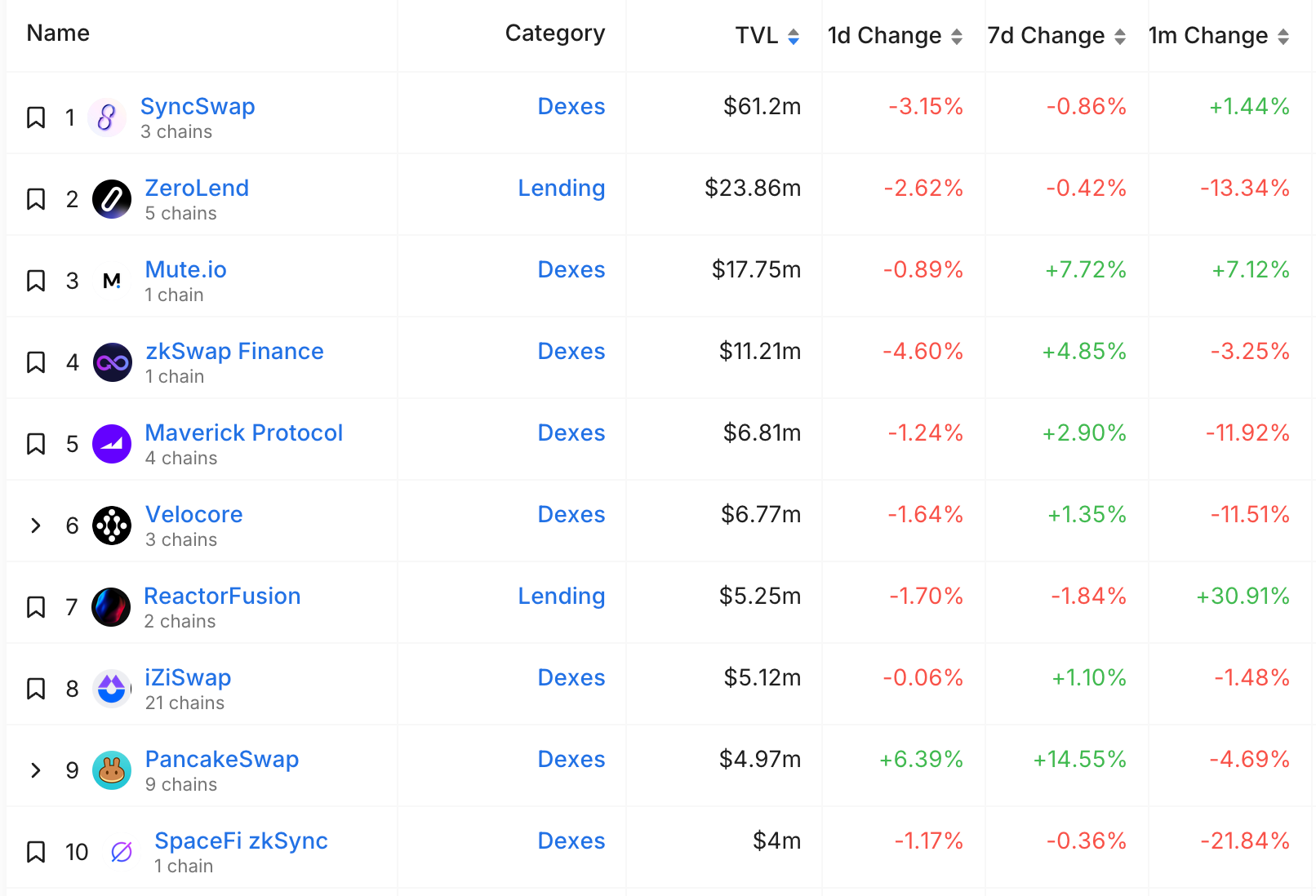

Top Ten Projects by Total Value Locked:

🔭 Project WatchArbitrumTop Projects by TVL

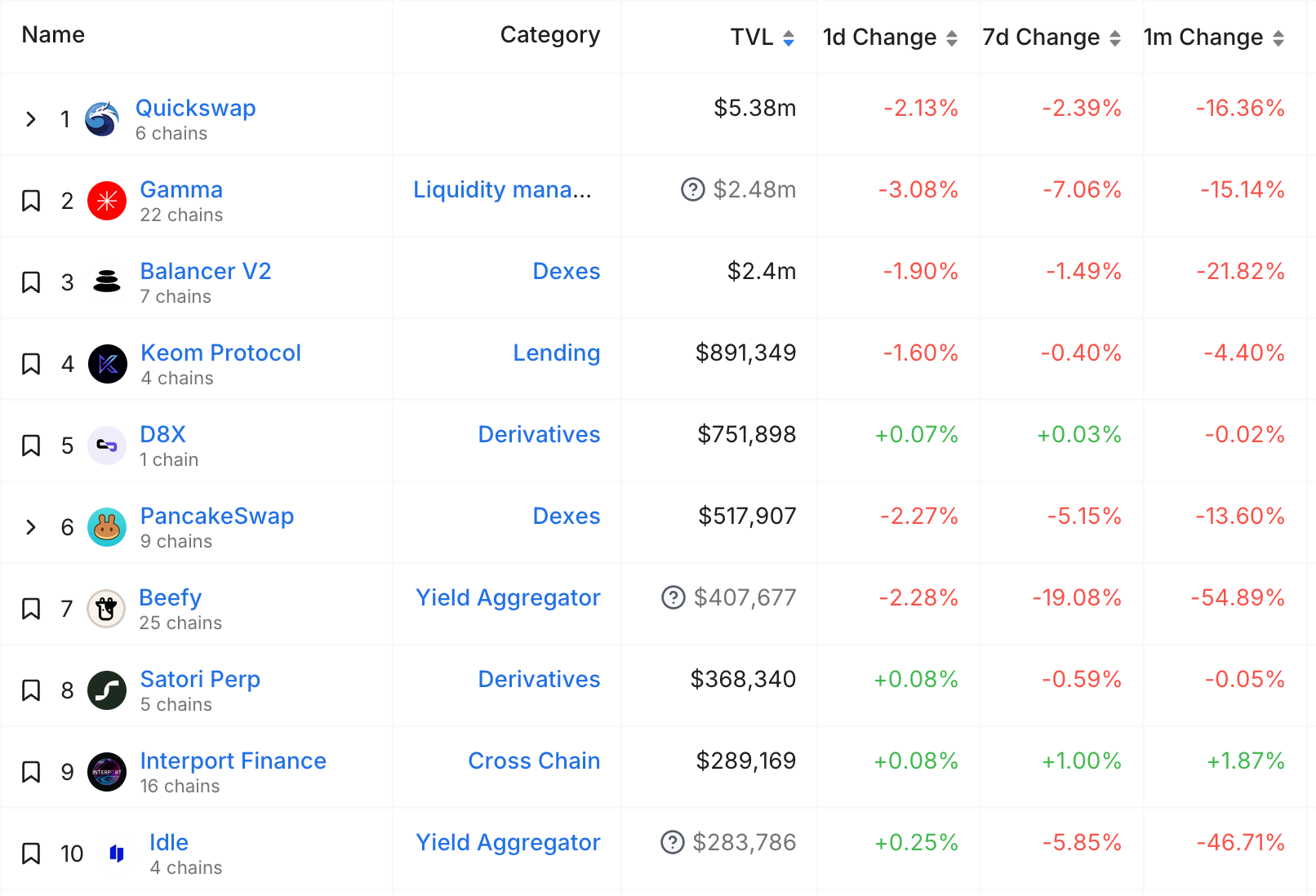

OptimismTop Projects by TVL

zkSyncTop Projects by TVL

zkEVMTop Projects by TVL

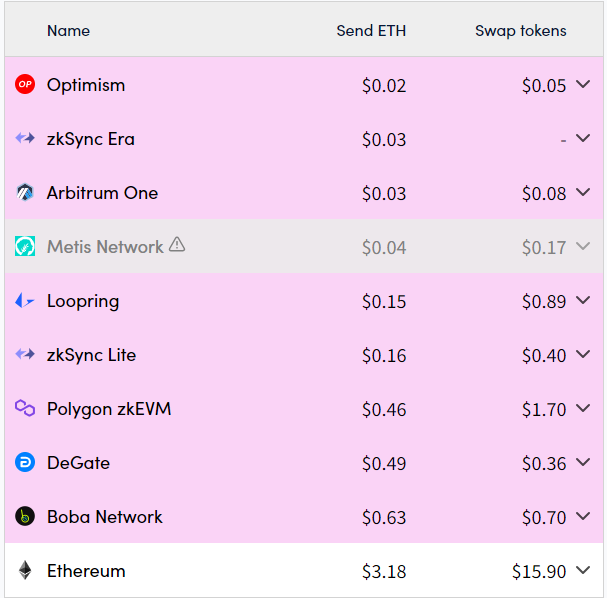

🔥 L2 Fees and Costs UpdateTransaction Fees as of March 28, 2024:

|

Older messages

Matters Arising | BanklessDAO Weekly Rollup

Saturday, March 23, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Keeping up With BanklessDAO | BanklessDAO Weekly Rollup

Saturday, March 16, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ethereum's Blobs Are Slashing L2 Fees | Layer 2 Review

Friday, March 15, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s Up BanklessDAO? | BanklessDAO Weekly Rollup

Saturday, March 9, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ideation II: A Fun-Filled Mission? | BanklessDAO Weekly Rollup

Saturday, March 2, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏