Not Boring by Packy McCormick - Astro Mechanica

Welcome to the 702 newly Not Boring people who have joined us since our last essay! If you haven’t subscribed, join 222,725 smart, curious folks by subscribing here: Hi friends 👋 , Happy Monday! Earlier this year, I wrote a piece on Techno-Industrials. I don’t think it’s impossible for startups to take down large, seemingly invincible incumbents, even in the hardest, most physical categories. It’s happened before, it will happen again, and I think Techno-Industrials will be the ones to do it. These companies have some similarities — using technology to deliver more for less in large existing markets — but each contender is necessarily unique. Trying to reshape industries as diverse as chemicals, energy, agriculture, defense, and aerospace takes very different approaches. So this year, I want to write deep dives about a number of Techno-Industrials and the industries they’re trying to pull out of stagnation. The best way to understand the general trend, I think, is to zoom in on the specific cases. The companies I’ll write about are still very young and the odds are that each of them will fail, or at least fall short of their very big goal. But I hope that a few will succeed, and that these deep dives will be the first thing you read about the companies and entrepreneurs that one day have whole books written about them. I’m certainly rooting for them. Today, we’re starting off with Astro Mechanica. Ian Brooke’s company wants to ride its new engine all the way to becoming The Aerospace Company, offering supersonic flights anywhere in the world for about the same as a normal flight costs today. Better technology is necessary, but not sufficient, to remake an industry. When I saw Ian’s engine reach escape velocity on twitter a few weeks back, I wanted to learn more about the business side of this new technology. This is what I learned. Let’s get to it. Astro Mechanica: The Aerospace Company(This is a long one. Click the link 👆 to read the full thing online.) There’s an old joke in the aerospace industry that goes like this: What makes airplanes fly? Money. A modern twist may ask “What makes airplanes fall apart?” and arrive at the same answer. Whichever way you tell the joke, like all great jokes, it gets at a deeper truth. Technologies and business models are more deeply linked than most people appreciate. New technologies can unlock new business models; old ones can break even the best businesses. To whit, in May 2014, Boeing’s then-CEO Jim McNerney addressed a room full of Wall Street analysts in Seattle’s Fairmont Olympic Hotel. A departure from Boeing’s engineer-CEOs of old, McNerney was financialization personified. Harvard Business School, Procter & Gamble, McKinsey, General Electric, 3M, then, in 2005, Boeing. “All of us have gotten religion,” McNerney preached, “Every 25 years a big moonshot … and then produce a 707 or a 787 – that’s the wrong way to pursue this business. The more-for-less world will not let you pursue moonshots.” That’s a tragic statement from the leader of a company that made its name pursuing moonshots, but McNerney was simply parroting the agreed-upon wisdom of the era. What he called “the more-for-less world,” Clayton Christensen called the New Church of Finance in a scathing 2012 essay. The New Church prioritized ratios – IRR, EPS, GM %, RONA, ROIC – over “cash.” So companies hollowed out denominators in the race to go “asset-light.” Ambitions crumbled like 737 MAXes as mechanical engineering gave way to financial engineering. Innovation moved from the drafting table and assembly line to the spreadsheet. A decade later, we know how that turned out. Trawling through the wreckage of a once-great company, analysts have created a litany of crash reports. My favorites are David Perell’s Why Did the Boeing 737 Max Crash? and Charles Wing-Uexkull’s Boeing’s Uncontrolled Descent. These pieces blame leadership, mergers, financialization, MBAs, lack of competition, America’s general decline, even wokeness. What they all miss is that this was inevitable. Boeing is an interchangeable actor in an ongoing story about the death and rebirth of technological paradigms. From Ford and GM to Tesla; from IBM to Apple and Microsoft. The airline industry is now in the 66th year of the Jet Age, the era that Boeing defined and dominated from the start. There’s simply no room left for real improvement – today’s turbofan engines carry planes as fast and efficiently as they physically can, airlines squeeze as many passengers into the same sized airframes as possible, airports squeeze as many planes into their gates as they can each day. Financialization can slice up a fixed pie. Only technological progress can grow the pie. The Turboelectric AgeTo fix air travel, we need technology to lead us into the next age: The New Jet Age. Or maybe the Turboelectric Age. That will depend on who wins. The new Age of Air Travel will need new airframes, new business models, and fresh new companies. The shift that Tesla caught in automobiles, and that Apple and Microsoft caught in computing, someone will catch in air travel. Whatever the shape, we can be fairly certain it will start with a new engine. The Jet Age launched with the introduction of the 3x faster turbojet engine. This New Jet Age might launch with the introduction of the 3x faster Turboelectric Adaptive Engine. A few weeks ago, Ian Brooke unveiled a prototype of the engine he’d been dreaming towards practically his whole life: Ian didn’t think much of the video. The prototype was a year old; he and his team were already deep into building the next version: the bigger, more powerful flight-ready engine. He prefers machining to tweeting, so he hadn’t shared much at all about the engine or the company behind it until Christian Keil invited him to come on First Principles, at which point, why not share a little engineporn?  The tweet blew up: 7.9 million views, 26k likes, endless comments and quote tweets. And for good reason. That engine is special. It excites people, even people who have seen a lot of exciting things. When Ian met Y Combinator founder Paul Graham a February YC event, the two spoke for several hours, prompting this mysterious tweet from PG: During the conversation, the legendary investor compared Ian’s invention to no less than James Watt’s steam engine, the machine that spawned the Industrial Revolution. Watt improved on Newcomen’s engine design by separating the condenser from the cylinder; Ian is improving on existing engine designs by separating the compressor from the jet engine. What does that mean? We’ll go into more detail on the how, but for now, let’s focus on the what:

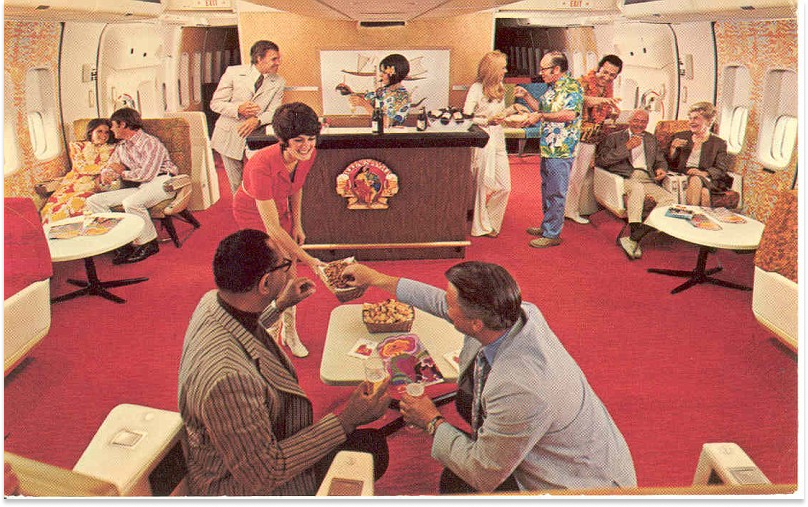

It will unlock new business models, too. Ian thinks that extreme vertical integration is the right way to play this technological shift. Ian’s company, Astro Mechanica, wants to become The Aerospace Company, with a “The.” It plans to use its engine to launch satellites, then private planes, then commercial planes, all of which it will manufacture, maintain, and operate. You’ll book flights from Astro Mechanica like you book rides from Uber, if the plan goes just right. That’s an insanely ambitious roadmap bursting with challenges. It’s vertical integration and horizontal integration with technical and engineering risk all rolled into one. If Astro Mechanica nails practically everything – if it’s right that aerospace is going Turboelectric, if it can be the company that builds the turboelectric adaptive engine, if it can parlay that engine into a successful small launch business, then a successful supersonic private flight business, then a successful supersonic airline – then it has a shot at becoming the first trillion dollar aerospace company, with a “T.” Will it work? The odds are against it, but the opportunity is so large that the expected value is worth the pursuit. Astro Mechanica’s goals are so obviously moonshots, and its odds so obviously long shots, that the far more interesting thing to do than dismiss them is to take them seriously. But either someone will win or our kids won’t fly. Stagnation is death. Air travel needs fixing, and it needs to be fixed outside of the current system. So what would it take for Astro Mechanica to be that company? Why now? How will it fund its vertical integration in a more-for-less world? Can it help usher back in a more-for-more world? We’ll explore those questions and more. I’ll be your pilot on this flight – a wordcel who last took a physics class in the aughts – so fasten your seatbelts, ignore the turbulence, and enjoy the ride. Where Air Travel Went WrongCommercial air travel feels gross – smaller seats, fees for everything, delays, crumbling planes. I’ve always taken a shower when I get off a flight, because of the germs. Now I feel like I need to take a shower after every interaction with an airline, because of the tricks. Yes of course I’ve seen the Louis CK skit. Yes it is cool to partake of the miracle of human flight. The problem is, the air travel experience is moving backwards. We remember one thing, and we get a different, worse thing. Happiness is expectations minus reality, and airlines continue to squeeze every last bit of happiness out of the reality of flight. This is what air travel looked like in the 1970s:

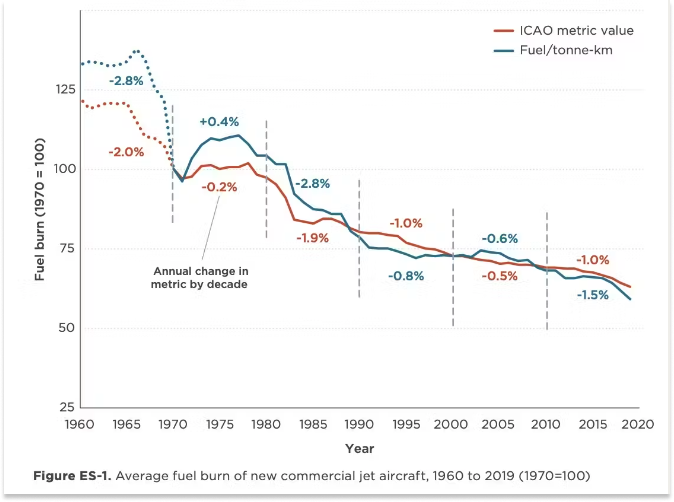

This is what air travel looks like now: It’s not really Boeing’s fault, or United Airlines, or even Spirit Airlines. It’s not one’s fault really; it’s just what happens when an industry stands still. So why doesn’t someone just fix it? Fix what? The whole industry? Without technological progress – the ability to actually do more with less in the physical world – you’re left rearranging the economy chairs on a Boeing, as it were, cutting a fixed pie into ever-thinner slices to feed more people a little taste. The technological and commercial are intricately linked; to understand what went wrong, and how someone might fix it, we need to look at both. Technological Stagnation Christian Keil changed the way I think about Boeing. “Boeing isn’t crazy or incompetent,” he argued when we were talking about this piece. “They’re really good at making planes. They’re just at the end of their tech tree.” When you think about the good ol’ days of air travel, you think of Pan Am. Air travel was so sexy in Pan Am’s golden years that ABC made a TV show about the airline starring Margot Robbie. Air travel was so sexy in the Pan Am days because the technology that powered it was so new. In October 1958, when my mom was 1 month old, the Jet Age was born when Pan Am flew the first Boeing 707 from New York to Paris. New is exciting. New is sexy. Before the 707, propeller planes like the Lockheed Super Constellation took 14-15 hours to travel from New York to Paris, with refueling stops on the way. The jet engine cut the time in half. The jet engine made travel more luxurious – the “Jet Set” made frequent trips across the Atlantic – and more accessible – the number of airline passengers more than quadrupled from 1955 to 1972. Jet engines – first turbojets, now turbofans – go much faster than the propellers they succeeded. But the turbofan can’t go supersonic. Christian explains why in this great jet airliner explainer. Airplane manufacturers have pushed about as fast as they can go with the turbofan – most travel Mach 0.85 to Mach 0.9 – and most of the innovation has been in increasing bypass ratios to fly more efficiently and quietly at those speeds. The Boeing 707, released in 1958, traveled 600 mph. The Boeing Dreamliner was released 51 years later and cruises at 560 mph. To their credit, planes have gotten incredibly efficient. As Anna-Sofia Lesiv highlights in her excellent piece, The Future of Aviation, the airline industry “has managed to achieve impressive gains in fuel efficiency over the preceding decades with average fuel consumption of new commercial jet aircraft falling by 50% since 1960.” But at this point, we’ve basically reached the limits of turbofans’ performance. We came very close to a new era with the supersonic Concorde, but it ran into a whole host of issues, from sound (it couldn’t fly overland because the supersonic boom was so noisy) to cost. It was designed in a time when fuel was cheap in the 1960s, but by the time it took flight in the 1970s, the Oil Crisis had hit, and the supersonic plane’s fuel consumption became a big issue. The Concorde was ~10x more expensive to operate than a 747, because fuel consumption increases with the square of velocity! Still, it was a valiant attempt, and it’s worth noting that the attempt was waged outside of Boeing. The leader has too much to lose, or at least too much to unwind. It’s positioned.  For Boeing, which introduced the Jet Age, to continue to progress, it would need to completely shift the paradigm in which it operates. It would need to bet on a new type of engine, and then adapt the complex web of relationships and interdependencies to that core decision: new airframe designs, new supply chains, new manufacturing processes, new everything. It would need to relinquish its comfortable duopoly position and convince its customers to buy something new and unproven. That’s both difficult and risky. So instead, it tries to squeeze every last drop out of the existing paradigm by tweaking designs here and there, outsourcing everything it can, and focusing on efficiency. It stands still and holds on for dear life. But the problem, as Christian reminded me, is that the quality assurance problems Boeing is experiencing are exactly what happens when you stand still. If you’re not progressing, entropy kills you. That’s true for the airframes themselves, and it’s true for the experience of flying. Because as airlines compete to serve more customers with basically a fixed set of resources, experience suffers. Slicing Up a Fixed PieOne of the reasons airlines were so luxurious in the 1970s was that the pie was growing and airlines competed for their slices based on the quality of experience they offered passengers. In fact, experience was one of the only things airlines could differentiate on. Airlines were tightly regulated by the Civil Aeronautics Board (CAB) under the Civil Aeronautics Act of 1938. The Journal of Air Law via SMU The CAB controlled routes, fares, and market entry and exit. The CAB set fares based on a “fair return” to the airlines, keeping prices relatively high. New airlines needed CAB approval to enter the market, which limited competition, and airline M&A was subject to CAB approval, which limited consolidation. The CAB promoted air travel as a premium service in order to keep fares high and ensure airlines’ financial stability, and airlines couldn’t compete on price, so they competed on offering the best service to mostly first class customers.

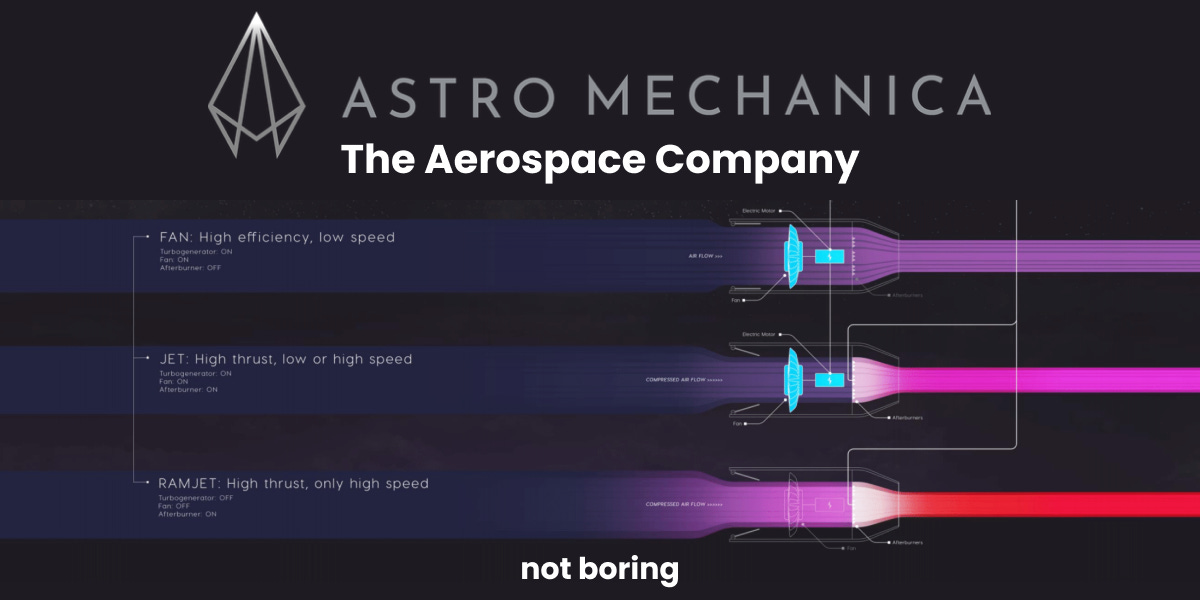

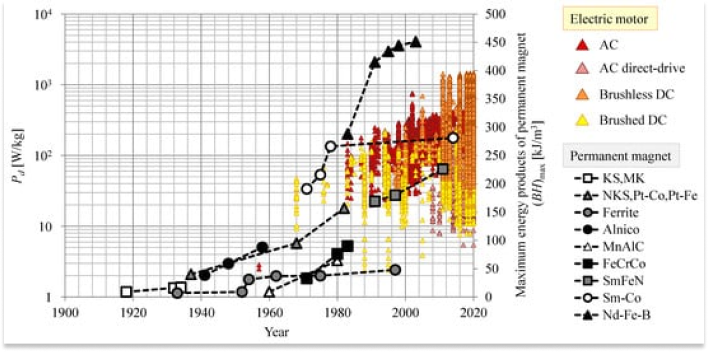

It looked awesome, but the pictures don’t show the many people who were not able to fly because of the high prices. In 1978, Senator Ted Kennedy championed the Airline Deregulation Act of 1978 and President Jimmy Carter signed it into law. The Act did a lot of the things we celebrate here at Not Boring; its goals were to increase competition, lower fares, and improve efficiency through free market forces. And it worked. Between 1980 and 2019, the number of annual airline passengers grew from 800 million to 4.6 billion. More than half of the people on earth fly through the air like a bird every year. That’s magnificent. But it also marked the beginning of the end of air travel as a great experience as it moved the vector of competition from experience to price. As the market expanded, it naturally brought in more price-sensitive consumers, and the industry bent itself to win their business. Low-cost carriers and price shopping via online travel agencies forced airlines to rip all the nice things out of the ticket price and sell them back to you a la carte. Jamming more low-price fliers into essentially the same planes into airports that struggled to expand meant thinner seats, less legroom, more delays, less room for your bags, and all of the features of modern air travel you know and hate. It’s great that more people can travel, but if it feels like air travel is getting shittier and shittier, that’s because from the experience of each passenger, it is. Airlines are stuck in a competitive downward spiral, trying to steal and squeeze more out of a technologically and infrastructurally fixed pie. Between the technical limitations and the commercial price wars, we’re stuck with a stagnating industry. And stagnation is death. Air travel is so obviously ripe for disruption that the only surprise is that no one’s made a real run yet. The challenge is, the problem isn’t with any company but the whole system. Which means that you have to reimagine the whole system to even have a shot. Toppling the Jet Age institutions will start with a technical breakthrough as big as the leap from propellers to jets. Astro Mechanica is betting that the Turboelectric Adaptive Engine is that breakthrough. Turboelectric Adaptive Engines for Dummies This is a rendering of Astro Mechanica’s Turboelectric Adaptive Engine: The engine on the left is the turbogenerator – it makes the electricity. The engine on the right is the propulsion unit – it makes the plane go fast. Normally, they’re part of the same thing, but Astro Mechanica separates them. Here’s how it works: Air flows in through the turbogenerator (which Astro Mechanica buys off the shelf) to produce electrical power. That electrical power is used to power an electric motor. The electric motor can be used to adaptively control the propulsion unit (which Astro Mechanica makes in-house) on the left with precision, making it behave like a turbofan, turbojet, or ramjet depending on the speed. Here’s why that’s important: Normally, in jet engine design, there is a trade-off – efficient and slow, or inefficient and fast. That trade-off is represented by the Specific Impulse Curve. Specific impulse, or Isp, is a measure of the efficiency of rocket and jet engines. Essentially, how fast can you go for how long with a given amount of fuel. Normal jet engines aren’t adaptive – they are what they are. So they need to optimize for a thing. If you’re a commercial airliner, you want to optimize for efficiency at cruising speeds and altitudes. A turbofan engine is most efficient there, so they use turbofan engines that cap out at around Mach 0.9, or 90% the speed of sound. Fuel efficiency is critical to operating costs, and going faster would make tickets prohibitively expensive, so you prioritize efficiency at fast enough. If you’re using the plane for military or reconnaissance purposes, however, price is no object. Performance is all that matters. So you can trade efficiency for speed. The fastest plane of all time, Lockheed’s SR-71 Blackbird, used the J58 Pratt and Whitney engine, which operates as both a normal turbojet for speeds up to Mach 2, and switches to Turbo Ramjet for speeds up to Mach 3.3. It’s very expensive and inefficient, but very fast. Rockets are the most extreme version of the trade-off. They have to carry all of their own fuel and oxidizer (essentially liquid air) to create the combustion reaction that makes the exhaust that pushes out the back of the rocket to propel it upwards. Carrying everything it needs for the whole journey instead of using the earth’s free air makes it super inefficient in earth’s atmosphere at low speeds, but rockets are the only way to fly in space, and the only way to go very fast, like orbital velocity at Mach 25. It’s super inefficient and expensive, but the only choice at those speeds and altitudes. The hope for the Turboelectric Adaptive Engine is that it can eliminate the trade-off between efficiency and speed. Astro Mechanica’s Turboelectric Engine isn’t the fastest way to go fast – that’s a pure rocket – but it aims to be the most efficient way to go fast. It can go supersonic without breaking the bank. On paper, it’s both more efficient and 3x faster than the modern jet engine. If the engine does what Ian thinks it can, it can maintain maximum efficiency at every speed up to Mach 3.4. It does that by behaving like different engines – turbofan, turbojet, ramjet – as it picks up speed. This sounds like something that all engine designers would simply do. Why now? That electric motor we talked about earlier lets Astro Mechanica decouple thermodynamics from propulsion. It’s like having a power plant onboard that produces electricity that you can use however you need, including spinning the propulsion unit’s turbine at just the right speed for the task at hand. It’s only now possible because electric motors can deliver enough Watts per kilogram to make their inclusion worth their weight.

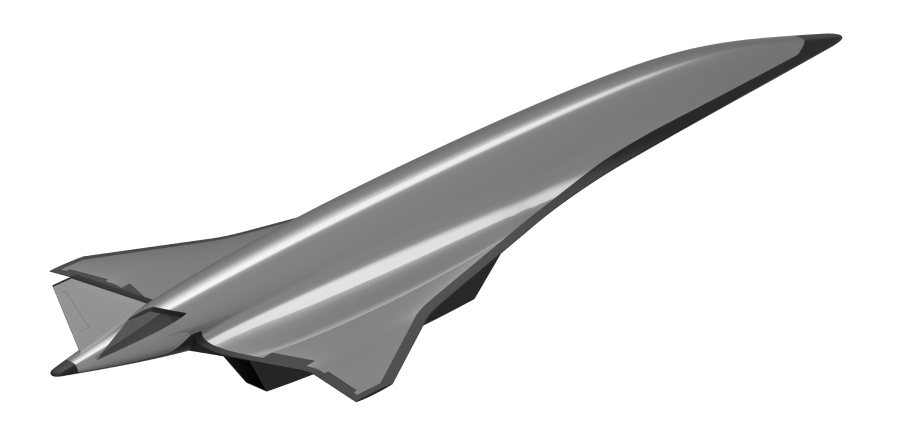

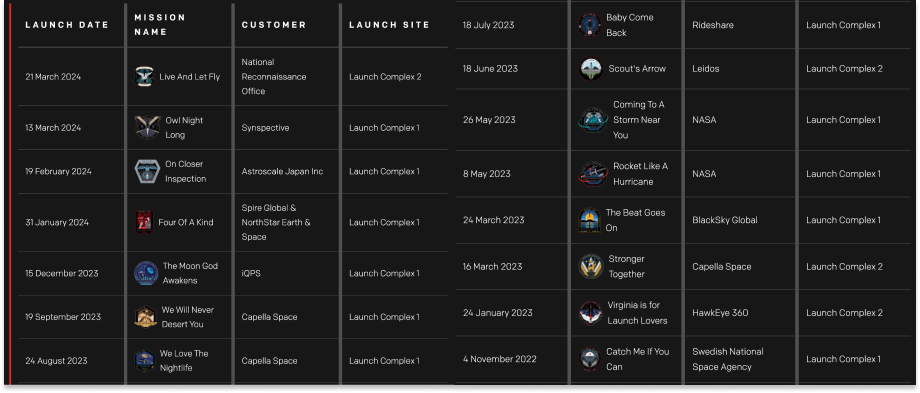

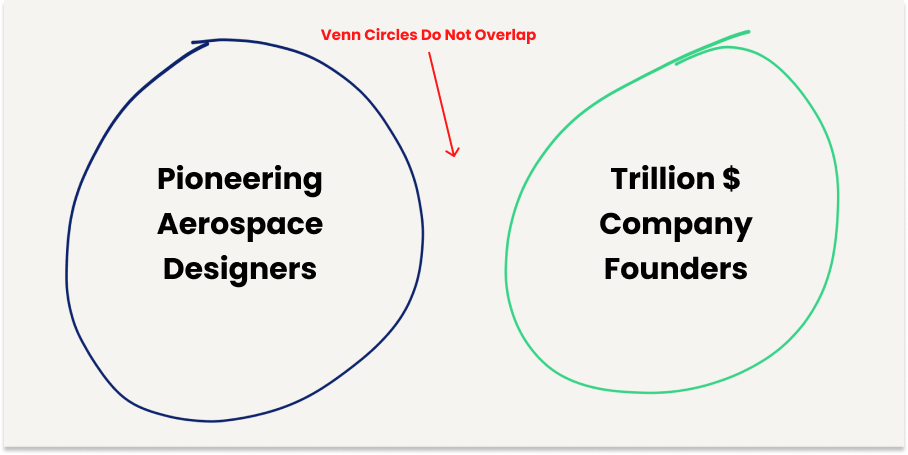

In other words, the mass of the electric motor is finally less than the mass of the fuel it lets the plane save by being more efficient. Over time, these motors should continue to get more efficient, making the trade even more favorable. The Turboelectric Adaptive Engine, by making 3x faster flight affordable, might be the technological breakthrough needed to propel us out of the crumbling Jet Age. But new technology is necessary, not sufficient. The engine is a platform, a starting point from which to design new airframes and business models that match its capabilities. How would you design a business around supersonic planes that can be built and operated more cheaply than their subsonic counterparts? You’d have the opportunity to rethink everything. Whereas Boeing ushered in the Jet Age using Pratt & Whitney JT3C turbojet engines on planes flown and operated by Pan Am, Astro Mechanica wants to usher in the Turboelectric Age on Astro Mechanica planes flying Astro Mechanica engines operated by Astro Mechanica itself. But no one’s about to hand a two year old company $10 billion or so to rebuild the airline industry from scratch. (Whether maybe they should is another discussion for another essay.) So like the engine itself, Astro Mechanica is designing its business model to be efficient at all speeds and stages, too. Staging The Aerospace CompanyAt some point in the future, call it twenty years from now, Astro Mechanica wants to be synonymous with air travel the way Apple is synonymous with phones or Uber is synonymous with rides. Start with the engine, build a company that owns the trillion dollar aerospace industry. When you want to fly somewhere – a little hop from SF to LA or a globe-spanning trip from New York to Tokyo – you book it directly with Astro Mechanica. You get there three times faster on planes designed and built by Astro Mechanica, powered by Astro Mechanica engines. That’s the big goal, the one that changes the world by shrinking it. But building planes that will fly passengers is a very expensive endeavor, thanks in part to the years and many test flights it takes to get a plane flight certified. A new Gulfstream might take 3 years and $5-7 billion dollars to get to the point at which it can start carrying passengers. So you can’t start there. It would require so much venture capital that the founder wouldn’t end up owning anything at the end, even assuming he’s able to raise all the money. Plus, you’d want to run tests on something that you don’t mind blowing up. So: to build the airline of the 21st Century, begin by launching rockets. Duh. Space launch is the Roadster in Astro’s Tesla strategy: start at the highest end of the market and move cheaper and more mass market over time. From space launch to private planes (Model S), from private planes to commercial airliners (Model 3), building the airplane gigafactory along the way, until it’s churning out planes of all sizes cheaply and reliably. But first, space launch. Stage 1: Space LaunchOne way to tell Astro Mechanica’s story is that it needs to compete with SpaceX in the launch market to pass the first gate. That’s not quite true. Never compete with SpaceX head-on. Instead, Astro Mechanica will sell dedicated small launchers capable of carrying up to 1200kg – an order of magnitude less than Falcon 9 and two orders of magnitude less than Starship. Competing more directly with small launchers like Rocket Lab and Firefly, they’ll sell dedicated flights to satellite companies, which can launch on their own schedule to exactly where they want to go without expensive and time-consuming SpaceX integration. And instead of launching traditional two-stage rockets that shoot straight up, Astro Mechanica will fly carrier planes that look like Concordes that drop upper stage rockets that look like Rocket Lab’s Electron. The plane will be powered by the Turboelectric Adaptive Engine, and the rocket will be a rocket. Christian Keil, who works at satellite company Astranis when he’s not interviewing deep tech founders, told me that there’s practically no demand risk if they can launch. The way it works, he told me, is that small launchers go around to the satellite companies and ask, “If I could give you a dedicated rocket at this price, would you buy it?” They say yes, and then sign an LOI. Astro Mechanica has already signed a number of LOIs. The challenge is actually launching – the inability to do that well is what killed small launchers Astra and Virgin Orbit. This is clearly a major risk to Astro Mechanica’s master plan. Launching things into space is hard, but according to the plan, it’s the easy part meant to generate cash flow to fund the harder and more expensive stuff. The bright spot in the industry has been Rocket Lab, which has been pulling off missions with amazing names since 2018. They’ve already done four in 2024. The company, whose Electron is the only reusable small launch vehicle on the market, is worth roughly $2 billion in the public markets. What Rocket Lab has done is incredibly impressive. It’s also taken 18 years since Peter Beck founded the company in 2006, plus over $250 million in venture capital and more when you include SPAC proceeds, to get to this point. Astro Mechanica plans to do one launch per week within the next few years. That’s a big leap to make from Rocket Labs’s one-per-month. Ian thinks it’s achievable, though, because of the simplified design and inherent reusability advantages of planes over rockets. If it hits its launch targets, Astro Mechanica believes it can break even on program costs to develop the first space launch vehicle – which won’t be reusable, at first – in 13 flights. From there, if it sells each flight for $10 million, or $8,400/kg, it can generate $8 million in margin on each flight. By its fifth year of operations, it plans to develop a reusable version that it would sell for $5 million per flight, or $3,571/kg, at almost pure gross margin. The $200 million expected development cost would be paid back in 42 successful flights, after which it would become a money-printing machine that happens to launch satellites. Here, the carrier plane has an advantage over traditional rocket boosters, like Rocket Lab’s. Planes are incredibly reusable. SpaceX hopes to get 100 flights out of a booster; a Boeing 747 can fly 35,000 flights over its lifetime. You should treat all of these numbers as if they’re the middle of a wide range – manufacturing will undoubtedly introduce unexpected challenges and costs. To believe that Astro Mechanica can make it to the next stage, you need to directionally believe that this can become a business that does hundreds of millions of dollars in revenue at positive contribution margins on the program-level, against which the company can raise and borrow loads of money. For his part, Ian believes that space launch could become a $500 million annual business for Astro Mechanica relatively quickly. Stage 1a: Adaptive Business ModelRockets are an important gate for the business, but when I asked Ian what happens if the launch business is slower than expected, he told me they have other options. That they could … adapt. They could just sell the engine and components directly to companies that might need them for drones or other defense applications. Tesla brought in early meaningful revenue supplying powertrains to Toyota and Mercedes; Astro could do something similar. This isn’t a purity contest. Ian has no special love of rockets. The point of this stage is just to build the engine, test the engine, and print cash. Because it can use that cash to make planes. Stage 2: Private Supersonic PlanesAstro Mechanica isn’t a SpaceX competitor, but it does want to take over Boeing’s place at the head of airplane manufacturing. You don’t beat Boeing at its own game, even in Boeing’s current form. Boeing, and its one competitor, Airbus, benefit from scale economies, high switching costs, and cornered resources in the form of contracts and congressmen. Building a 787 competitor and trying to sell it to airlines would be an incredibly expensive fool’s errand. So instead, Astro Mechanica plans to start at the high end of the market by building small supersonic private planes (Supersonic Transports, in industry parlance, or SST) and selling them to customers for whom time is (a lot of) money. I’m oversimplifying, but Astro Mechanica can essentially pull the rocket out of the launch system and replace it with some leather seats and a bathroom to carry humans across the earth instead of satellites to outer space. As mentioned, certifying a plane that carries passengers is time-consuming and expensive, even for established players like Gulfstream, let alone for a new entrant with a radical new engine strapped into a new airframe. To handle the expensive piece, Astro Mechanica plans to borrow the billions required against the cashflow from the launch business. To handle the time-consuming piece, it plans to use flight data it’s gathered from the launch flights to speed up the process with the FAA. SpaceX has shown that the best way to test spaceflight vehicles is to build them, blow them up, and learn. AJ Piplica, the CEO of hypersonic aircraft startup Hermeus, put it bluntly: “If we can build a vehicle for less than the cost of going into a wind tunnel, then if we put a hole in the desert, we’re not losing that much.” The way Ian sees it, “Certification is easier once you’ve flown for space. You’re getting paid to get the valuable flight test data” that the FAA requires. Plus, you can “push to look at certain flight dynamics with the same airframe and no humans onboard. What’s the worst that can happen? We lose a $5 million aircraft and we get data we couldn’t have gotten otherwise.” If Astro Mechanica can pull that off, Ian’s calculations suggest that they can build a 5-to-8-seat SST that can fly across the country for roughly $3,000 instead of the $60,000 it costs to make the same trip on a 14-seat Gulfstream G700. Like the rocket launch schedule, that seems insanely ambitious, but it’s backed up by the Techno-Economic Analysis. There are a few factors that drive the theoretical savings, which are advantages that Astro Mechanica plans to leverage no matter the plane size it produces. First, vertical integration done right saves money by cutting out layers of margins that would go to various parties. Astro Mechanica will make part of its own engines, whereas Gulstream buys theirs. Astro Mechanica will operate its own flights, so it gets to use its planes at cost. Gulfstream sells airplanes, Astro Mechanica sells flights. That means that Gulfstream has to sell planes at a margin either to private buyers, who will use it less, or to private flight services, who will use the plane more but have to charge a margin on top of Gulstream’s margin. A G700 might start at around a $75 million acquisition price; Astro Mechanica believes it can make its 5-to-8 seater aircraft for $9 million. Second, because Astro Mechanica will both manufacture and operate planes, it’s incentivized to build planes that last. Airplane manufacturers like Boeing make money selling replacement parts to airlines, so they’re financially happy when things break down. Astro Mechanica would be buying replacement parts from itself, and taking planes out of service to maintain them, so it’s incentivized to build things that last. Third, Astro Mechanica is designing its engines to run on liquefied natural gas (LNG) instead of jet fuel. LNG is about one-tenth the price of jet fuel, and is more energy dense than jet fuel. Energy requirements go up with the square of velocity, which kills traditional supersonic aircraft economics, but the improved efficiency of its engine combined with the cheaper, more energy dense fuel increases Astro’s range and dramatically reduces its cost. All told, Ian expects to burn almost the exact same amount of fuel as a Gulfstream per passenger mile while going 3x faster. Because Astro uses LNG, they can spend roughly one-third as much per passenger on fuel as Gulfstream. Finally, less time means less money on expenses with hourly costs. If the plane goes three times as fast, you only need to pay pilots for one-third the time. All of these advantages exist on paper today, so an enormous milestone for Astro will be proving that they hold true, give or take some healthy room for error, in a real plane. If they do, Astro Mechanica should be able to dramatically undercut the cost of flying private while offering a superior product – speed – that allows it to charge high prices direct to customers and capture healthy margins. They plan to charge $80-100k per flight – to book the whole plane – which is more expensive, but gets you there 3x faster. Business travelers make up just 12% of tickets, but can account for as much as 75% of the revenue and even more of the profit on certain flights. Business class travelers are the iPhone buyers of air travel – a smaller market share segment that represents the vast majority of the market’s profits. “We can get all of them,” Ian said. “We’re not charging much more per seat, we’re just making you buy more seats.” Ian expects that at this stage of the business, with less than a hundred airplanes, it can do $5-10 billion in annual revenue. Stage 3: Semi-Private Supersonic PlanesAs Astro Mechanica begins to dominate the private flight market, it can build a larger airframe, serve more customers on each flight, and make supersonic travel more affordable. Ian compares this to the European train model: build a 30-seater, separate it into cabs of four, and make customers buy a 4-seat cab. The 30-seater size is strategic: at 30 passengers, you’re not considered an airline, and can fly out of smaller private airports without the hassles of the TSA, like JetSuiteX does. The JSX Experience Because airlines spend so much on planes – because CapEx dominates OpEx – their model is built around running flights on a schedule, filling as many seats as possible, and flying them at low or even negative margins. Because each of Astro Mechanica’s planes will cost it less, it can both have more planes and only fly them when they’re full enough to be profitable. So unlike a train model, these flights might be unscheduled, like private flights. When a plane fills up, it leaves. Ian calls this stage “semi-attainable private travel,” and if his numbers are right, it might be more attainable than that. In the company’s TEA, he models that each seat on a semi-private supersonic flight from SF to NYC would cost customers just $402 at a 50% margin to Astro Mechanica. That’s cheap enough to be competitive with a commercial plane for a regular customer traveling in a group of four, and the business class traveler in a hurry could buy out a cab of four for the same price they’re used to paying to fly commercial. At this stage, Astro Mechanica really begins to compete with incumbent airlines in a meaningful way. The biggest bottleneck to growth might not be demand or planes, but small airports that could handle the volume. Maybe you vertically integrate even further, owning and operating private airports. Ian has his sights set on one location near SF that would be perfect – “it’s on a landfill, out of the way of traffic” – but at this point, we’re probably getting a little ahead of ourselves. Stage 4: The Aerospace CompanyIf Astro Mechanica successfully builds a profitable space launch business, leverages that into private supersonic transport, and leverages that into semi-private SST, it will have already changed air travel for the better, shrunk the world, and built one of the most valuable companies in the world. From there, it has some more expansion options: it can go shorter or bigger. It could offer short haul subsonic flights between cities like SF and LA, or NYC and DC. Ian said that an obvious application of a hybrid engine that decouples thermodynamics from propulsion is making a safer version of the V-22 Osprey. I’m going to have to take his word on that, but one thing it would do is decrease congestion at private airports. How, you ask? Well, these things could take off from barges operating on the water next to major cities, of course. Book a flight, Waymo to the water, hop into a little boat, jump on the barge, into the plane, and off to your destination. And/or it could go the other direction, building much larger planes and operating them like a traditional airline, schedules and all, but supersonic. Based on the same dynamics that would make Astro Mechanica’s private flights cheaper – vertical integration, cheaper fuel, fewer hours – the company’s TEA shows ticket prices that are half those of traditional airlines for a flight that gets you there in one third of the time. That would require some regulatory gymnastics. Thanks to the Air Mail Act of 1934 and subsequent updates, airplane manufacturers aren’t allowed to operate their own airlines. But if it makes it this far, Astro Mechanica will have the resources to hire some pretty great lawyers and lobbyists, and millions of clamoring travelers willing to write letters to their Congresspeople on the company’s behalf. Large airline or not, if it reaches this stage of the journey, Astro Mechanica will offer flights anywhere in the world, at various price points and levels of convenience, directly through its own booking channels. It will even send payloads, and maybe one day, people, to space. This is the tens or hundreds of billions of dollars per year opportunity. At this point, it would be The Aerospace Company, feasibly worth $1 trillion. To be fair, the plan seems impossibly hard, dependent on a perfectly orchestrated series of technical and commercial achievements that would make Rube Goldberg himself dizzy. It will take a very long time, and billions of dollars. If it starts working, competitors will strike and incumbents will sue. It’s a deeply complex plan, one that should beggar belief. I’m not saying it’s likely to work. But I think there is a real opportunity to rethink air travel right now, and this is the kind of plan it would take to do it. Just as in software, physical industries experience platform shifts – like from the propeller to the jet engine in air travel – that create the opportunity for generational companies. Those shifts are just an opportunity, not a guarantee. They’re not even a very good shot; just the little crack needed to earn the right to try to do something impossibly hard. Then, it’s up to an entrepreneur with the Wright Stuff. The Wright StuffIan Brooke grew up in rural California among the Redwoods, where he learned physics by racing around the redwoods. “If you grow up in the city, you learn human rules. They’re made up rules. They’re not real,” he told me. “We built jumps with tractors and raced through trees, and when you fall from one of those, the fall is real. Building up that intuition is a useful skill to have.” From a very young age, Ian wanted to fly fighter jets, but from a very young age, he knew that it wouldn’t be on his terms, and that he probably wouldn’t qualify for the job anyways. If he made the fighter plane, though, no one could stop him from flying it. That became the goal. The way that Ian laid his path, intentionally or not, seems to have been to work on smaller models of things and then use the intuition earned to make bigger and bigger things. He built model airplanes and became a pilot, learning how planes fit together, and how they feel to fly. “I have some pilot friends,” he said, “who could never explain how or why the plane does the thing, but they have a good built-in model for how things move through the world.” Ian wanted to do both – to understand and feel, to be a builder and operator. “I want to build better things to operate.” He wanted to become a full-stack engineer. He also became a full-stack entrepreneur. Before Astro Mechanica, Ian ran a successful bootstrapped motorcycle company. He made things, handled sales, took customer support calls, and did the books. He designed the thing, machined the thing, and sold the thing. There aren’t many people who do all three. Proof came randomly when I was talking to Matt Parlmer, the founder of Not Boring Capital portfolio company General Fabrication, a couple weeks ago. General Fabrication makes machines that can make anything, starting with 3D printers that make plastic parts. As we were talking through potential customers, about companies full of strong engineers that Matt expects to land, I brought up Astro Mechanica. “That one’s unlikely,” Matt told me. “Ian built motorcycles by hand. That dude can machine anything himself.” That’s absurdly high praise coming from Matt. Anyway, while Ian was making motorcycles, his mind was always on the skies. Back in 2019, he started to think through how you’d design an engine that would make flying private as cheap as airliners. He knew it was possible. Private jets take 20-30,000 man hours to assemble, which is crazy, because a car, which is more mechanically complicated, takes 40-50. (I like this way of thinking. Valar Atomics CEO Isaiah Taylor made a similar point about nuclear reactor construction on Age of Miracles. Elon Musk has a related concept: the Idiot Index). “What fact of engineering requires that it takes an entire human life to manufacture a private jet?” he asked when we first spoke. Spoiler: there isn’t one. It was just really complex, and hard for anyone to hold everything it would take to make one in their head. Ian thought he could. By starting with very small things, like model airplanes, and moving up to bigger things, like experimental airplanes, he had a sixth sense for how things fit together, and for what it takes to maintain them when they fall apart. On First Principles, he told Christian, “I just know that if you put this thing there, it’s going to be miserable to assemble and expensive to fix. Imagine you have a bunch of planes out there. How does the mechanic interact with it when it comes in for maintenance? You have to think about the Mechanic Experience.” If that seems like skipping a few steps ahead when Astro Mechanica hasn’t built a single aircraft yet, that’s the point as Ian sees it. “Most engineers don’t understand what’s involved in actually making the thing they come up with,” he told me. “My secret sauce is that I’ve spent my life becoming the person who builds the thing. I’m a pilot first and foremost, I know why things are engineered the way they are, and I know the manufacturing process. There’s always some trade-off, and it’s faster to make it if one person is holding everything in their head.” So that Wright Stuff…I wasn’t sure where to put this, but Ian has some strong Wright Brothers vibes. The Wrights’ flight was made possible by advances in motors from the automotive industry. The Wright Brothers started as bicycle repairmen, then manufacturers, which gave them the capital, shop space, and intuition needed to build their plane. When I told Ian about the connection I was trying to make, he laughed, before saying, “I'd like to mention an amusing coincidence, I was born on Wilbur Wright's birthday, April 16th.” Get the fuck out of here. Come on. I could make comparisons with Lockheed Skunkworks chief Kelly Johnson, who designed the P-38 Lightning, the SR-71 Blackbird, and the U-2, and who had such an aerodynamic intuition that his boss, Hall Hibbard, once exclaimed, “That damned Swede can actually see air.” But I’ll save that. The point isn’t to hype Ian up to an impossible altitude. His results will speak for themselves, or they won’t. But given the ambition of his company: to usher in a new age of air travel, win aerospace, and build a $1 trillion business, Ian will have to be as good as the Wrights and Kelly Johnson eventually, and even better at building a business. Few people make breakthroughs in flight. Few people build trillion dollar businesses. The Venn Diagram overlap of the two is exactly 0. But Ian wants to become the first. And to do that, he needed to start by actually building a team and a thing. Enter Astro MechanicaIn late 2019 and early 2020, he started working on that idea for a regular subsonic private jet that could be at cost parity with airliners. By 2021, thanks to time spent tinkering with that idea, he realized that a new type of electric adaptive engine would finally be possible thanks to advances in the performance of electric motors. From idea to prototype took two months and $200k. “You just need to prove the thing you’re trying to prove,” Ian told Christian. “It’s the art of knowing what does and doesn’t matter on this particular thing.” By October 2022, he raised a round from LowerCarbon Capital. By March 2023, funds in hand, Ian had hired his first aerospace engineers. Astro Mechanica was moving out of Ian’s head and into a real company. The Space MongolsIt might surprise you to learn that I am not an aerospace engineer, so to figure out whether an aerospace engineer like Ian is legit, I need to look for clues. One clue might be a video of a working prototype, like the one we started the piece with. Another might be an endorsement from someone like Matt Parlmer. Another, more important one is the ability to recruit badass engineers. On that count, Astro Mechanica is legit. After raising from LowerCarbon, Ian spent the next six months looking for a rare combination: an engineer who was experienced but not jaded. Too grounded, and you end up with an unwillingness to try new things. Too head-in-the-clouds, and you end up untethered from reality. And in engineering, reality always wins. Finally, he found Matt Lehman: an OG SpaceX propulsion engineer who worked on Omelek Island setting up Falcon 1. Matt is a hardcore propulsion PhD with over two decades of experience building rockets at companies including Northrop, Astra, and Ventions, but he’s also a surfer who lives in Santa Cruz and is down to try to catch the next wave. With Matt onboard, the two got to work building out the Dream Team. There’s Patrick McGuire, the Lead Engineer, Propulsion, who worked under Matt at Astra and Ventions. “You can throw anything at Patrick and he thinks about it appropriately,” Ian said. Then there’s Tyler Sandberg, who’s worked on propulsion at Blue Origin, SpaceX, and Astra. “He’s like a younger Patrick.” Most recently, Ian hired his mentor, someone he’s been trying to hire for a long time: Jeff Tiedeken. “Elon poached Jeff for Neuralink, he was one of the first 20 people there and the first person building things. Larry Page hired him at (EVTOL company) KittyHawk. He helped build nuclear reactors at Kairos Power and led manufacturing at Astranis. “He doesn’t have a degree,” Ian said, “but everyone knows Jeff is the fucking man.” The team is now eight people, each of whom is an expert on one thing, but can do most things. Ian compared the way the team works to the Mongol Empire: “Everyone is self-sufficient and everyone can do all the things. Everyone is just very capable.” Ian calls them the Space Mongols. Ian thinks that they can get all the way to the flight engine with just nine people – fewer brains mean less opportunity for losses in communication, so it’s better to keep the team small and excellent, for now. But at some point, they will need to scale. Ian pictures the team growing fractally from strong cores. “Apple became more Apple over time as they hired excellent people,” Ian said, “I see the same thing starting to happen here.” There are three pillars of the business: Engines, Airframes, and Operations. To date, they’ve built the core of the Engine team, because without the engine, nothing else matters. This core – the Space Mongols – will make the next set of hires, which will make the next, and so on out from there. Next, Ian is replicating the Engine team’s structure to build out the Airframes team, which will build the airplanes that the Engine team will bolt its baby onto. This team should be about 12 people to get to a working airframe. Then, they’ll replicate the org structure again to hire an Operations team, which will work with regulators, partners, and customers to get the engines and airframes into the sky. Each one of these core teams will be the foundation for much bigger organizations along those same three lines as the company grows. If they get the foundation just right, Ian thinks it should be able to scale up. There’s a clear parallel between the way Ian designs physical things and the way he designs teams: start with the small model, understand it inside and out, understand how each piece trades off with the others, and only when you have a full intuition of the thing: scale it. One of the bets on Astro Mechanica is that the same pattern holds for organizations, or that Ian will be able to adapt if it doesn’t. But that’s a future problem, one that he’ll have to earn the right to solve. First, they need to prove that this Turboelectric Adaptive Engine does what they think it can. But First, the EngineWith the core team onboard, the past few months at Astro Mechanica have been busy. They raised a $3 million Seed from a16z’s American Dynamism practice and joined the YC Winter 24 batch. Most importantly, they’ve been building the actual flight engine, the first of what the company hopes will be hundreds or thousands that will climb the atmosphere like a ladder and ride the specific impulse curve up to Mach 2.7. Astro Mechanica plans to unveil its engine live at YC Demo day next Wednesday in what has a shot to be one of the most memorable demos in the incubator’s history. Ian gave me a little sneak peek and told me I could show you if you promise not to spoil the surprise: The company has had as smooth a path as possible to this point in the journey, particularly for a company that’s building a new kind of jet engine. I would imagine that VCs are going to be all over it after demo day (and that many are trying to get ahead of that rush as we speak). VC funding isn’t a goal; it’s a destination. But in the case of this business, so much will depend on its ability to find financial partners who support its more-for-more vision of aerospace that financing is as core to the business as the engine itself. Cash is its fuel, and whether it crashes, simply sells a better engine, builds a nice launch business, or takes the baton from Boeing and drags aerospace into the Turboelectric Age will depend in large part on how it balances its own speed and efficiency from here. Pursuing MoonshotsFinancialization couldn’t save Boeing, or the airline industry as we know it. Trying to get more-for-less without technological progress – more revenue on fewer assets by outsourcing, more seats in the same plane by shrinking seats – is a one-way ticket to stagnation and decline. I’ve argued that it’s not Boeing’s fault, or any of the airlines’ fault, but a natural consequence of reaching the end of a technological paradigm that’s had so much juice squeezed out of it already. It was inevitable. Astro Mechanica wants to get more-for-less the right way: through technology. More speed for less cost through adaptive engines. That engine is just the start. Astro Mechanica plans to:

It wants its rockets to fly 1x per week and its private planes to fly 100x per week. To have a rebuild-the-airline-industry impact, its commercial planes will one day have to fly thousands of times per week. There’s nothing inherently defensible about an engine design. The defensibility in this business comes from getting to scale quickly, and from building a unique business around the engine before anyone else does. Against incumbents, it’s counter-positioned, which buys it time to scale, and against potential new entrants, it has a head start, a strong team, and the whole master plan, down to the finest detail, in Andrew’s head. In either case, it will need to get big as fast as it can. Turning out hundreds of aircraft orders of magnitude faster than they’re assembled today will require manufacturing prowess on par with a Tesla Gigafactory, and like Tesla, it will require boatloads of cash. That’s OK. That’s good. We should give our most ambitious projects the most money. We should give them more so that they can give us back more, for less. Astro Mechanica is a Techno-Industrial. It’s using new technology to build better atoms-based products at a lower cost than was previously possible. Instead of simply selling cheaper products into the existing web of mediocrity that is the airline industry, Astro Mechanica wants to rebuild the whole thing. Of course that’s going to take cash. I think we’re all scarred from the more-for-less era into believing that costs don’t shrink, that legacy industries don’t get rebuilt, that change only comes at the margins. But what fact of engineering requires that the way it’s been done is the only way it can be done? Boeing won the Jet Age by harnessing a new technology to reshape an industry, and it improved the way billions of passengers travel in the process. That it’s stagnating now doesn’t mean that air travel is doomed to decay, but that it’s time for a new Age. Boeing dominated through the period that Tyler Cowen calls The Great Stagnation, a half-century on a technological plateau defined by many of the evils that ate at airlines. The Great Stagnation is ending. You can feel it. SpaceX launches multiple rockets a week. Solar is getting very cheap. EVs are overtaking gas-powered cars. Ozempic is helping millions lose weight. Maybe Astro Mechanica will bring affordable supersonic travel to humankind. It’s going to take a ton of work, time, capital, luck, skill, and adaptability. It will take getting the core of each piece of the business right, and then growing fractally out from there while maintaining fidelity with the original thing. It will take becoming great at things that the company has never done. If it really has a more-for-less engine, there are a million ways for Astro Mechanica to make high-margin revenue in the short-term that require a lot less work, time, capital, luck, skill, and adaptability than this crazy plan to build The Aerospace Company over decades. But if Astro Mechanica really has a more-for-less engine, it must pursue the moonshot. I want to live in a world that supports that pursuit. Thanks to Ian for letting me tell the Astro Mechanica story, to Christian for input and feedback, and to Dan for editing! That’s all for today. We’ll be back in your inbox tomorrow with a Weekly Dose. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #87

Friday, March 29, 2024

Young Immune Systems, Terraform, Pipedream, Foodborne Cancer,Energy Transition ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #86

Friday, March 22, 2024

Nueralink, Pig Liver, Intel, Saudi AI Fund, Direct File,Unitree ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Techno-Optimistic Media

Tuesday, March 19, 2024

A Not Boring x First Principles Guide to Modern Startup Storytelling ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #85

Friday, March 15, 2024

Starship, Devin, Thermodynamic Chips, Solar Mirrors, Talking Robots, Blobs, and Elephant Stem Cells ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #84

Friday, March 8, 2024

AWS Nuclear, Gigascale Hydrocarbons, Helium, User-Owned Models, Arms ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The

End 2024 with a BANG💥 (Huge GIVEAWAY!)

Tuesday, December 24, 2024

Over $12K in gizmos & gadgets up for grabs View in browser ClickBank Hi there, We've got something totally different for you today, some good value fun (with no-strings-attached) to wrap up

Survey: Tech VCs ride wave of optimism

Tuesday, December 24, 2024

Crypto headhunter turns VC; unicorn valuations are stampeding; Nordstrom family inks $6.25B take-private for chain Read online | Don't want to receive these emails? Manage your subscription. Log in

The Daily Coach's Picks: 10 Recommended Books of 2024

Tuesday, December 24, 2024

These books promise to help empower your journey of growth and transformation.

Here's everything retail media network experts are asking for this holiday season

Tuesday, December 24, 2024

If retail media network experts could write a letter to the North Pole, here's what they'd ask for. December 24, 2024 Here's everything retail media network experts are asking for this

Hack offline word of mouth

Tuesday, December 24, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗