Net Interest - Escaping a Value Trap

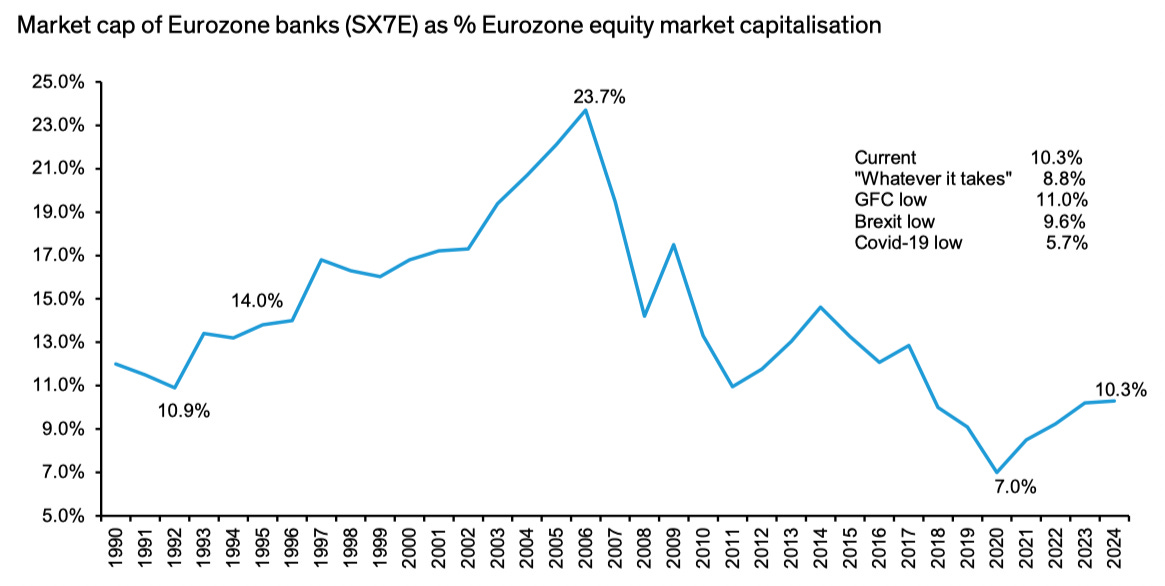

“To remember [European] banks as being anything other than a value trap, an investor would have had to be around in the early 2000s. Very few investors are still active from those days.” — Stuart Graham European stock analysts don’t stay in the game as long as their US counterparts. Dial in to next week’s JPMorgan earnings call and you’ll hear questions from US-based analysts whose careers span decades. The longest serving – Dick Bove – retired in January, aged 83, but three others began filling their spreadsheets in the 1980s, and are still at it today. Last month, Bloomberg profiled Jason Goldberg, a Barclays analyst who has been writing a daily briefing note for 20 years; compared with peers, he’s a newcomer.¹ In Europe, it’s an altogether different affair. When Deutsche Bank opened the line to questions on its most recent earnings call, half came from analysts with no professional memory of the global financial crisis. Over at JPMorgan, only a single analyst on the last call wasn’t also on one before 2006 – and she was standing in for someone else. Experience of the financial crisis isn’t a precondition for the job of a bank research analyst but witnessing the shift in industry dynamics it heralded lends some perspective. One reason European analysts don’t hang around as long is regulation. The introduction of new rules in 2018 changing the way research departments get paid contributed to a hollowing out of the industry. So-called MiFID II laws require European fund managers to pay for research separately from trade execution, and with unbundling came a squeeze on pricing. From its 2017 heights, research spend in Europe has fallen by 30%; in the US, research budgets are down only 12%. With less money to go round, many senior analysts departed, to be replaced by more junior colleagues.² Last week, one of Europe’s longest serving bank analysts finally called it a day. Stuart Graham started researching bank stocks in 1994 at HSBC James Capel (now HSBC Securities) after having spent six years studying the industry at the Bank of England. Following stints at JPMorgan and then Merrill Lynch, he teamed up with colleagues to launch a specialist financials research firm, Autonomous Research, in 2009. The firm was sold to AllianceBernstein in 2019 but remained … autonomous, and Stuart continued to deliver his unique insights.³ From his perch overlooking the European banking sector, Stuart Graham has seen it all. He watched as the sector grew from 13% of total stock market capitalisation to a peak of 24% in 2006 before crashing to a low of 7% four years ago. He covered the demise of some banks and the recovery of others. He consulted with investors, regulators and bank executives to help them steer the ups and downs (mostly downs) of the sector. And he popped up on 112 consecutive Deutsche Bank earnings calls. (“It has been enormous fun,” he says.) To see how 30 years of experience inform his views on European banks today, read on. Spoiler: He’s bullish. He may be checking out, but this isn’t a case of him giving up any hope of a recovery. And because all good analysts start with the footnotes, this week’s piece has some good ones.⁴  Continue reading this post for free, courtesy of Marc Rubinstein.A subscription gets you:

|

Older messages

Private Payments

Friday, March 22, 2024

Nuvei's Time as a Listed Company May Be Coming to an End: Was It Worth It? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Last Challenger

Friday, March 15, 2024

Richard Branson vs. The Big Four ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Big in Japan

Friday, March 8, 2024

The Rise and Fall and Rise of Nomura ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Tony Robbins’ Favorite Asset Class

Friday, March 1, 2024

Inside the “GP Stakes” Business ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Third Network

Friday, February 23, 2024

Capital One's Pursuit of the Holy Grail ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏