Where we are in the cycle now…

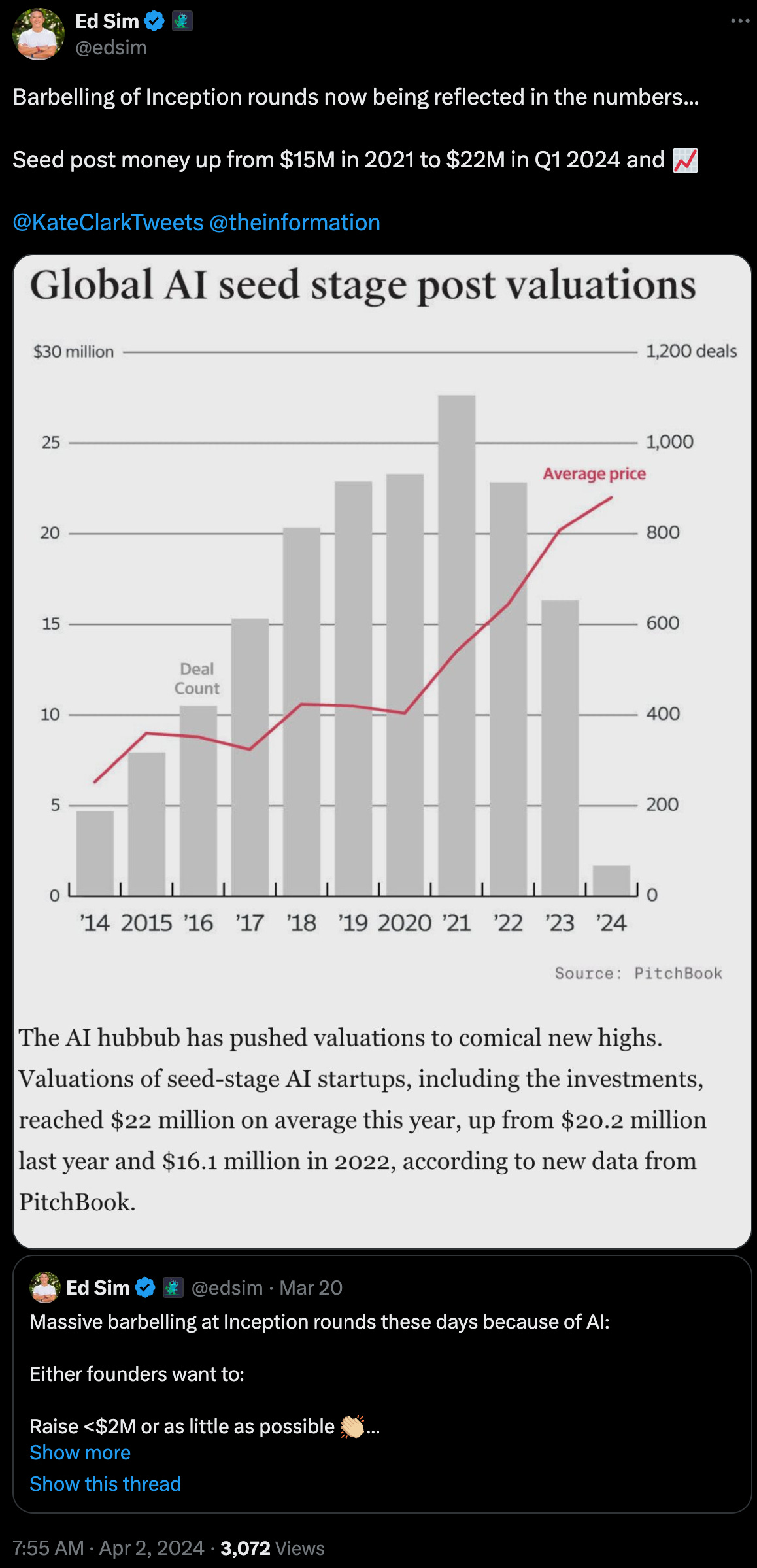

While overall 💰 deployed is 📉 29% YoY, funding at Inception (whatever you call it - firstcheck, pre-seed, seed) is still 🔥, esp. for AI-related cos.

U.S. venture deals nudged 8.7% lower to $36.6 billion in the first quarter compared to the prior quarter. Year-over-year, U.S. venture investing dropped 29% during the period, according to PitchBook data.

Globally, VC investment fell 21% to $75.9 billion in the first quarter compared to the year ago period.

Axios

This is now reflected in the Inception round numbers as pricing 📈.

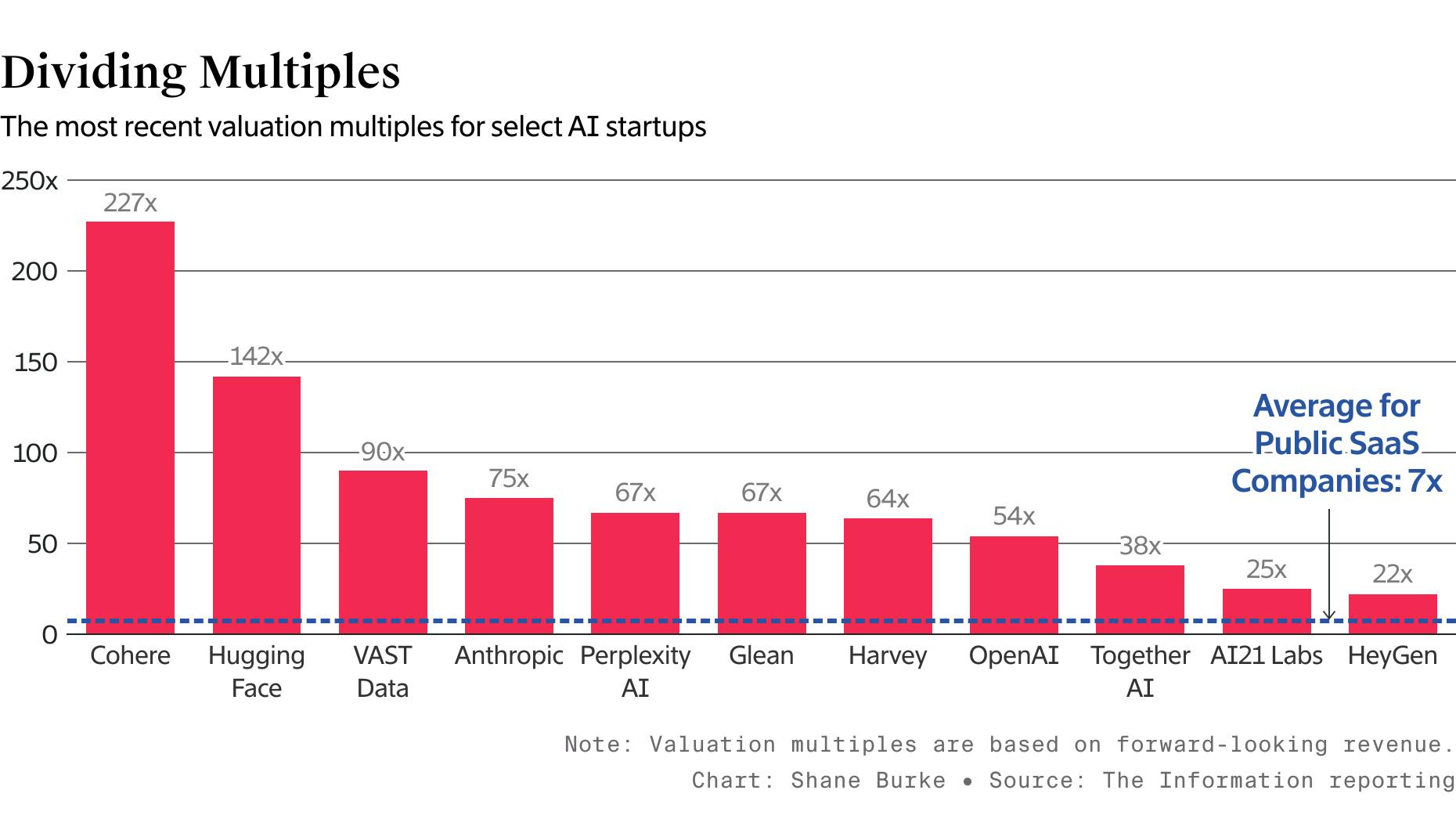

For those companies whose product and team and just wow, multiples are still off the charts despite limited revenue for Series B and later. FOMO is in full effect. Cognition Labs is apparently seeking a $2B valuation up 6X+ from just months ago (WSJ).

Cognition Labs, a startup developing an artificial-intelligence tool for writing code, is in talks with investors to raise funding at a valuation of up to $2 billion, in a test of the investor frenzy around new AI technology.

If completed at that valuation, the funding would increase the startup’s valuation to nearly six times what it was weeks ago. Silicon Valley venture firms including Founders Fund, already a shareholder in Cognition, are in talks to invest in the current round, people familiar with the matter said.

Cognition only began working on its product last year and doesn’t generate any meaningful revenue. It was valued at $350 million earlier this year in a $21 million deal led by Founders Fund. Peter Thiel, the billionaire investor who started Founders Fund, helped lead its investment in Cognition.

The multiples, while aggressive, seem to be coming down for some as they mature and grow into those valuations. Once upon a time OpenAI multiples were off the charts but the company has grown into its pricing, somewhat, especially relative to Cohere and others.

Even Elon Musk’s xAI is apparently now seeking $3B at an $18B valuation (WSJ).

Some parties in the current financing conversations are discussing raising special investment funds that would pool money from other investors rather than relying solely on money from a couple major venture firms, the people said.

A cash infusion could help xAI attract top AI engineers in what has become the most competitive job market in Silicon Valley. Since founding xAI, Musk has been engaged in a fierce recruiting war to poach talent from other leading AI companies, including Google’s DeepMind, OpenAI and his own Tesla. Earlier this week, Musk said he also had to boost AI engineering pay at the electric-car company to ward off poaching from the likes of OpenAI.

As you can imagine, at YC Demo Day, everything was AI - YC Winter 2024 Batch with 65% B2B SaaS/Enterprise:

Many of the companies in this batch — at least 50% — are building around AI in one form or another. Why so much AI for YC? It’s simple: YC invests in the best founders in the world, and many of today’s best founders are choosing to build in AI. These founders are constantly discovering new, incredible, practical uses for AI and LLMs that solve problems across industries. We can now do things with software that weren’t possible just a year or two ago — and we’re still in the very early days! AI is a catalyst unlike anything we’ve seen in a long, long time; what the Internet did for startups in the 90s, and smartphones did in the 2000s, AI is doing once again.

And I couldn’t help but think, wow, it’s really happening. If you read What’s 🔥 #358, I joked how every VC was looking for the next big data moat and vertical SaaS was hot. Here’s an excerpt:

Here’s an example convo at a VC firm:

AI Partner - I found this amazing SaaS co selling to veterinarian clinics, massive data moat, and about to add AI

VC Partner - what do you know about veterinarian clinics? What value will you add?

AI Partner - But it’s an ai co. It has a data moat. I can help them figure out how to use OpenAI, the pricing model…

VC Partner - Ahhh, Ok. But do customers need or want and will pay?

AI Partner - But it’s an ai co

VC Partner - But what do you know about veterinarian clinics?

AI Partner - It’s ai. I also have a cat and a dog and have been to a number of these.

Well, this is no joke - it’s here now…and it’s one of TechCrunch’s favorite new YC startups. Yeah, I get it, big market, untapped potential, and insurance angle is interesting, but you get my point - where anything can be AI-enabled, it will be AI-enabled.

Scritch

What it does: A platform for vets to run their practices

Why it’s a fave: So, platforms to run vet businesses aren’t new, as I’ve discovered after a cursory Google search (or a few). BUT, Scritch’s co-founders — Claire Lee and Rachel Lee — say that what makes theirs different is a heavy reliance on automation. Scritch handles scheduling, billing and clinical workflows as well as inventory management and care coordination. In addition, the platform supports vet customers by filing insurance claims on their behalf — which sounds like a very attractive feature for this would-be pet owner.

Who picked it: Kyle

👇🏼 Finally, this is not an April' Fool’s joke.

So remember, buyer beware (FT).

The chief executive of Google’s AI research division told the Financial Times that the billions of dollars being poured into generative AI start-ups and products “brings with it a whole attendant bunch of hype and maybe some grifting and some other things that you see in other hyped-up areas, crypto or whatever.

“Some of that has now spilled over into AI, which I think is a bit unfortunate. And it clouds the science and the research, which is phenomenal,” he added. “In a way, AI’s not hyped enough but in some senses it’s too hyped. We’re talking about all sorts of things that are just not real.”

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Share

#Wise advice from Shahed Khan, co-founder of Loom, sold to Atlassian for $950M - one lesson, just get started, the other focus - watch out for shiny distractions…

How 9 months of building without success, 2 difficult pivots, and dozens of rejections resulted in @loom:

In reflecting back on the last 8 years, and investing in 40+ companies, I've become convinced that the most common pitfall for founders is investing too much time on finding the ‘perfect’ solution to their idea.

This thread covers the story of Loom—and why you'll likely start with an imperfect idea before landing on your winner:

Loom didn’t begin as Loom.

It started around a whiteboard with Vinay, Joe, and myself. We wrote down six ideas, and went with the solution we thought was perfect:

A user testing marketplace. We began building.

7 months in, we only made $600, but learned an important lesson:

Companies generally cared less about advice from experts (what we were selling). Instead, they wanted to hear directly from their own users.

We pivoted. The new idea?

Build a SaaS offering that’d let companies get direct feedback from *their own users*...

It’s impossible to predict how things will go once you start—and it’s better to start and adapt than never launch because you’re worried something won’t work.

Just like baking, playing guitar, or learning a sport, coming up with the perfect startup idea is something you likely won't get right on your first attempt.

More here...

#Lenny Ratchitsky released his interview with Dharmesh Shah, co-founder and CTO of Hubspot - super interesting for founders + also quite timely as rumors that Alphabet is thinking about buying Hubspot for $32 Billion

In our conversation, we discuss:

🔸 How to decide what ideas are worth investing in

🔸 The biggest lessons he has learned from building HubSpot into a $30B+ business

🔸 Dharmesh’s unique approach to public speaking

🔸 The importance of leaning into your strengths

🔸 The decision-making process at HubSpot

🔸 How Dharmesh developed HubSpot’s culture code

🔸 His contrarian approach to building products

🔸 Why founders and product teams are all fighting the second law of thermodynamics

🔸 How “flash tags” can save your team time

🔸 Much more

More barbelling of venture, either raise as little as possible or as big as possible at Inception - here’s the $750k Speedrun Program from a16z - real question is how many of these cos make it to the next round

dear followers,

who do I need to meet who's just starting out / working on something cool in:

- AI/agents

- gamified consumer apps

- 3D tools

- B2B/infra

- AR/VR/spatial

- avatars

- game studios

Please @ mention them in the replies!

a16z is investing in dozens of startups in the next 45 days -- $30M with $750k checks -- via our SPEEDRUN program

I think of the list above as sitting in the intersection of TECH x GAMING which is where we focus

Here's a thread with more about the program we're running later this year:

https://t.co/v9ZUXWhUOW

here's the direct apply link for folks who are interested:

sr.a16z.com

# To my earlier point on Inception funding - here’s the Hyperstition deck which it used to raise a $25M Inception round to create the future of Material Science 🧵

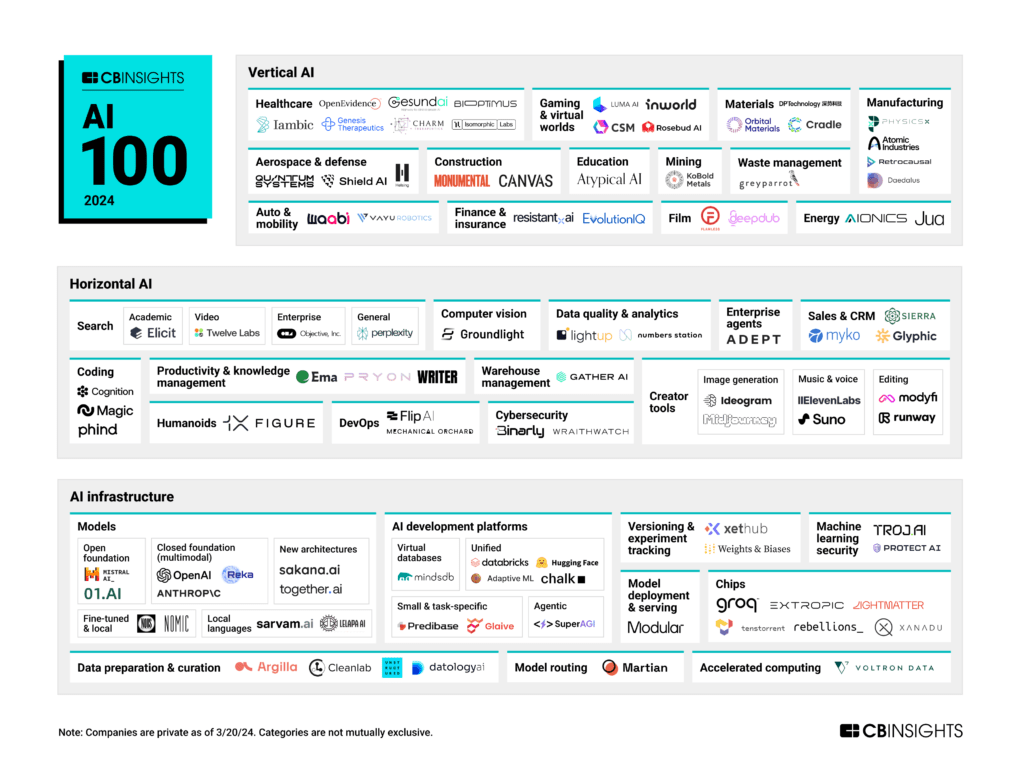

#CB Insights AI 100: The most promising artificial intelligence startups of 2024 - congrats Protect AI (a portfolio co) in ML Security market (Bottom right)

#Calling all developers (Kelsey Hightower) - thoughts? Comments are great…

Developers, what marketing strategies work on you?

The tech industry spends billions marketing to you and I'm curious if any of it is working.

#AI war for talent - just so you know and also why some of these AI Inception rounds so large - talent + cost of training (The Information)

Meta still faces hurdles in hiring and keeping highly coveted AI researchers, including that its pay packages often aren’t as rich as those at DeepMind and OpenAI. Meta’s top AI researchers, particularly those hired into senior roles from outside the company, earn total annual compensation of around $1 million to $2 million, three former employees said. Meanwhile, OpenAI recruiters told some Google AI researchers last fall that their annual compensation, mostly in the form of stock, would range from $5 million to $10 million after OpenAI completed a then-pending share sale, The Information previously reported. And DeepMind has given some researchers large grants of restricted stock worth millions of dollars.

For AI researchers who join Meta early in their careers and advance through the company, it is more difficult to receive compensation exceeding $1 million, a former employee said. That can make employees receptive to other offers, this person said.

#Even Elon Musk says it’s the craziest he has ever seen.

Ethan is very talented, but “vision chief” would be overstating things.

There are over 200 excellent engineers in the Tesla AI/Autonomy team. Tesla’s pace of progress with autonomy is accelerating.

The talent war for AI is the craziest talent war I’ve ever seen!

#How does someone with $1,000,000,000 of annual tech budget use AI? Interview with ServiceNow COO and Konstantin Buhler at Sequoia on AI Ascent Day

ServiceNow is all about workflow. AI enables faster workflows, so ServiceNow is all over making these workflows quicker. In their own internal use cases they're seeing 20% of tickets handled by AI already.

ServiceNow spends over $1B/year on tech. They want to buy AI. The company is rooting for Open Source because it means more control, more privacy and better margins

When you sell to a big company like ServiceNow always know the customer. Know they are a workflow business and immediately know how your AI can provide ROI. CJ wants to buy...

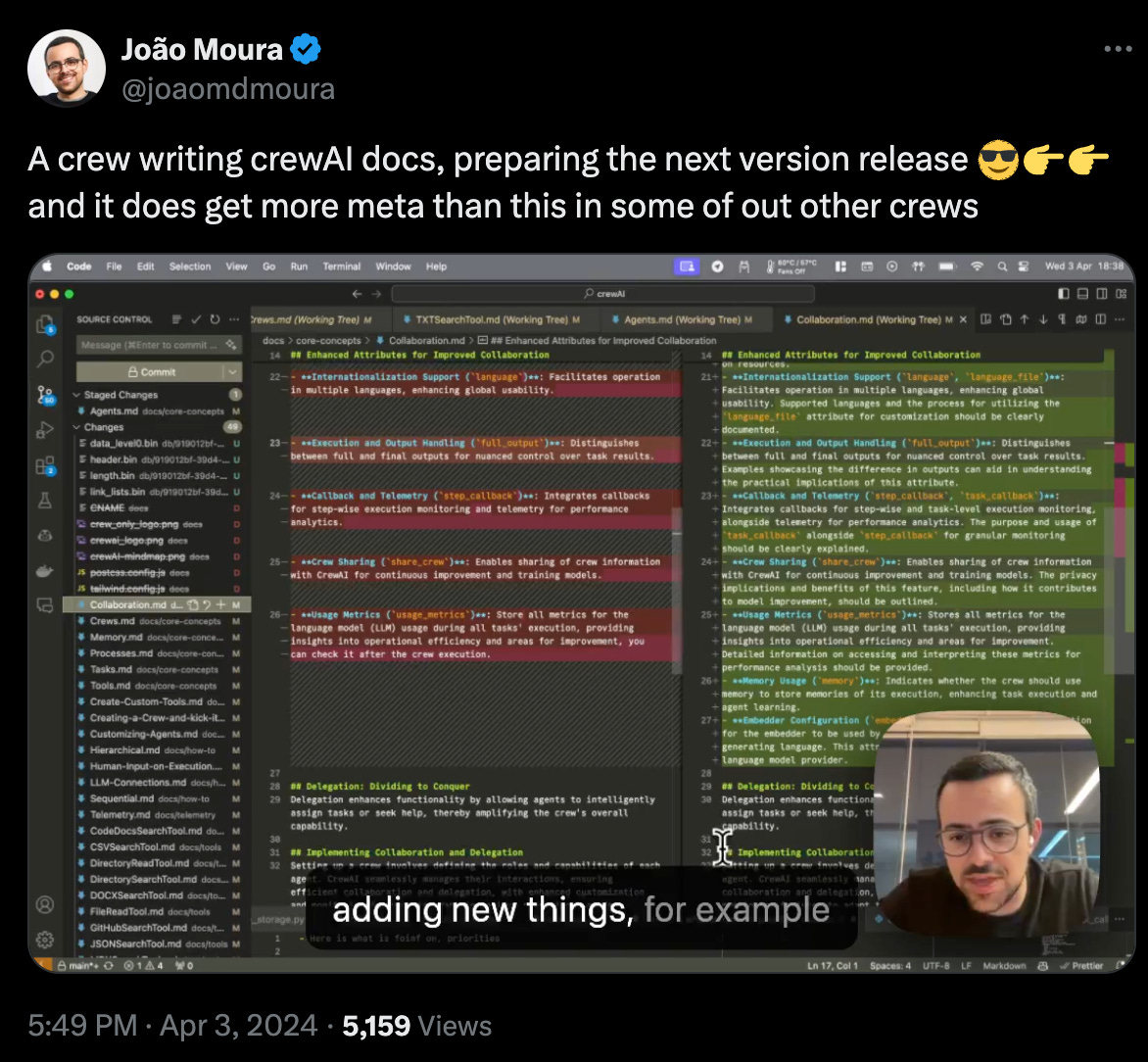

#Eating your own dogfood - João from CrewAI always pushing the boundaries of AI with his product - what developer loves writing docs?

#The 3 Laws of Robotics from Mr. Robotics, Rodney Brooks

My three laws of robotics. The companies that I have founded have sold 50+ million real robots to real customers; research robots, home cleaning, nuclear power plant inspection, military ground robots, upper body humanoids in factories, and now at Robust.AI, intelligent carts in warehouses and factories. I'm aiming to get to 9 digits of robots rather than a mere 8, and in thinking about that I've reviewed my own implicit three laws of robotics that have guided me, and now have written them down explicitly. Here they are:

1. The visual appearance of a robot makes a promise about what it can do and how smart it is. It needs to deliver or slightly over deliver on that promise or it will not be accepted.

2. When robots and people coexist in the same spaces, the robots must not take away from people’s agency, particularly when the robots are failing, as inevitably they will at times.

3. Technologies for robots need 10+ years of steady improvement beyond lab demos of the target tasks to mature to low cost and to have their limitations characterized well enough that they can deliver 99.9% of the time. Every 10 more years gets another 9 in reliability.

#Breaking down the epic MGM hack - reminder, people are the weakest link (WSJ)

Star Fraud had targeted a widely overlooked and hard-to-fix weakness in technology—the tech support systems that help people get into their online accounts when they’re locked out.

Like many gangs plotting a casino heist, they had cased the joint in advance—this time, digitally. The anonymous associate of the gang later told The Wall Street Journal the group had obtained information on the MGM employee they impersonated by mining the vast troves of stolen and illegally available data on the internet.

MGM declined to release communications from the hackers.

In other cases, Star Fraud has also pressured individuals directly to share their credentials to gain company access. In one set of text messages sent to a different victim by Star Fraud, they sent a stream of threatening messages.

“If we don’t get ur…login in the next 20 minutes, were sending a shooter to your house,” said one, followed by, “ur wife is gonna get shot if you dont.”

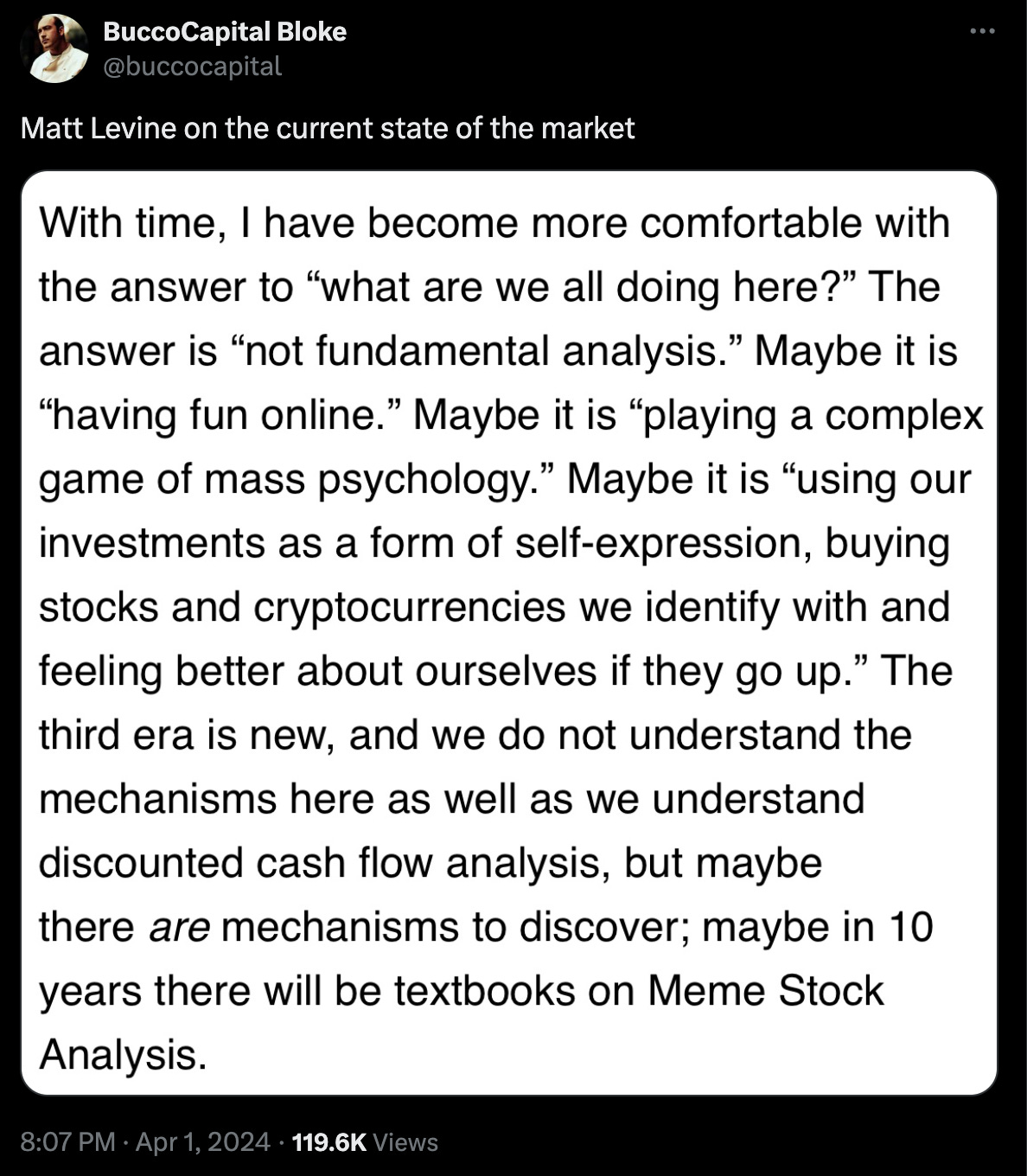

#Matt Levine from Bloomberg writes some of the best commentary on the market, here is BuccoCapital quoting from this week’s newsletter which you can find here

#Rubrik files for IPO!!! From CNBC:

Rubrik, a nine-year-old data security software vendor, filed to go public on Monday, the latest venture-backed company to move toward the public market after an extended lull dating back to late 2021.

The Silicon Valley company got its start selling hardware that companies could use to back up their data in a modernized fashion relative to traditional players in the space. Rubrik then had to evolve to the cloud, where it now gets most of its revenue from software that “detects, analyzes, and remediates data security risks and unauthorized user activities,” according to its IPO prospectus.

Competitors includes Dell, IBM, Veeam and Cohesity.

Get your breakdown from CJ Gustafson and Mostly Metrics.

And Tomasz Tunguz has an interesting take on Rubrik here:

It’s the contribution margin that sticks out.

Contribution margin is the unit profit generated from a marginal license sold : it’s -12%. This means the more software sold, the more money the company loses. The contribution margin has improved from -117% in 2022, to -38% in 2023, to -12% in 2024.

For most software companies, contribution margin is typically very high, around 80-90%.

This is a burn-the-boats strategy which requires a lot of courage, a phenomenal commitment to the long term, & a big balance sheet to sustain the short-term losses & invest in a new product & new sales & marketing strategy to transform a massive caterpillar into an even bigger butterfly.1

The company is well on its way to becoming a pure software business & with the margin trends improving, the big bet may come to fruition.

Congratulations to the entire team at Rubrik on building a massive business with a daring strategy! I know, I know. I’m mixing metaphors.