| Mark Twain once said, “If you don't like the weather in New England now, just wait a few minutes.”

Let me rephrase that, “If you don't like what’s happening in AI now, just wait a few minutes.” That was definitely the state of AI this week with the highest of highs and lowest of lows. Before I get to Nvidia and the $10B it spent on R&D for Blackwell, the non-acquisition acquisition of Inflection AI after having raised $1.3B, and the surprisingly low ARR of Cohere at $13M while trying to raise at a $6B valuation, let me also share what’s happening for new startups at the Inception stage. As of late, I’ve witnessed an acceleration of conversations around less is more or more is more when it comes to fundraising. On the one hand, extreme efficiency leveraging AI has founders charged up again about what’s possible, how to create the elusive $100M ARR startup with as little capital as possible. More on efficiency below… More examples that all add up to doing more with less using agents. Early on I decided to get meta on crewAI, turns out by now crewAI has saved crewAI thousands of hours 📈

And here’s the extreme example from Greg Isenberg - The future of building startups: On the other hand, depending on the sector, some second and third time founders are raising huge 💰 to go big as bar for talent is super high and the costs to train models etc. are quite huge. Inception/pre-seed/seed investors need to figure out which lane(s) they want to pursue, what is necessary to get ball control and lead/co-lead those Inception rounds, and determine fund size to win. For example, it’s tough to lead or co-lead those Jumbo Inception rounds which are $8-$10M+, if you have a $100M fund. On the flip side, if your fund is too big, how many $1M investments can one make to move the needle? The game is changing right before our very eyes. As for my firm, boldstart ventures, we are built to lead any of those rounds as we are big enough to lead a Jumbo Inception Round yet small enough to also co-lead those Discovery Inception Rounds of <$2M and still have each investment continue to be meaningful and impactful to the portfolio. When it comes to investing, one of the largest allocators of capital or compute has been strategic investors ranging from Nvidia to Microsoft. Given Microsoft’s involvement in the Inflection drama (see below), this quote that showed up on X this past week gets you thinking - choose your partners wisely! Your strategic investor is not your friend! Before you celebrate having Microsoft as your lead investor, remember Satya will find a way to own you without having to own you, to buy you by just taking your people.

This is a reminder for founders/investors, strategics have their own priorities so be careful. In fact, you should brush up on your board governance. Keep board decks limited when you have strategic investors who are observers, know what to include and what not to, and always schedule discussion time during the board meeting for board-only, non-strategic investors only to cover any partnerships, M&A, or other topics where your strategic investor may have conflicts. As always, 🙏🏼 for reading and please share with your friends and colleagues.

💯 - Don’t run out of energy - when you run out of energy for your startup, that’s when it time to move on Feeling motivated and energized, we can overcome almost anything. Feeling bored and restless, our minds shut off and we become increasingly passive.

Robert Greene

Reminder that you need sales to sell from Jyoti Bansal, founder of AppDynamics and Harness (read 🧵) This is a dangerous mindset that founders need to avoid: All you need is a good product and it will sell itself.

At the beginning, one of my biggest misconceptions as an engineer turned founder was thinking that your product is your only competitive advantage. I never stopped to think that sales could be a competitive advantage.

In the early days at AppDynamics, we managed to grow to several million dollars in annual revenue, primarily by landing a few big accounts like Netflix. But a fellow CEO pointed out the obvious: If we ever hoped to cross the $100 million threshold someday, we needed to get scientific about sales.

For other founders who want to embark on a sales education, here are some steps I took:

- Accept that sales actually matter. Once a company starts growing, sales, marketing and distribution are as important as the product itself…

Want a PR launch like Cognition Labs which launched Devin, the AI software engineer, from last week (29.6M views on its video)? Well, talk to Lulu who started a new firm, Rostra, to help founders go direct. And this is 💯 and spot on: The best spokesperson for any endeavor is not the one who has the most polish, the longest tenure, or the “right” credentials. It’s the person who holds the secret knowledge upon which the enterprise is built, the person who can not only describe the idea but, in the face of inevitable opposition, fight for it and win.

Founders need to take their narrative as seriously as they take the rockets or robots. They would never outsource their product — and when it comes to convincing others to support the mission, the story is the product. Outsourcing comms is as bad as outsourcing code.

As evangelists, founders are irreplaceable.

GO DIRECT: THE MANIFESTO

I. TRADITIONAL PR IS DEAD.

For too long, founders have yielded control over their narratives to media and middlemen…

But is the PR for the AI software engineer too good? Here’s Gergely’s take from The Pragmatic Engineer. My take is a little different. What if it’s a well-choreographed show performed out of necessity?

What if AI dev tool startups have been backed into a corner by Microsoft, which has eaten their lunch? The interesting thing about Devin is that in its current form it feels more like a coding assistant that can get some things done. It makes mistakes, needs input, and gets stuck on 6/7 bugs on GitHub. It’s a helpful tool, always available, but not a replacement for a developer. It’s more a copilot.

But we already have a co-piloting AI tool; it’s called GitHub Copilot! Microsoft launched it 2.5 years ago, and it became the leading AI coding assistant almost overnight. Today, more than 1.3 million developers pay for it (!!) across 50,000 companies…

Going to be tough to out copilot Github Copilot, hence super smart to pick a different lane. How Feathery, no code form builder, became profitable after a seed round Lesson 3: Usage =/= Revenue Our successful content marketing strategy helped us scale usage quickly, but our revenue numbers didn’t meaningfully change. We had subscription plans that were great for SMBs, but we didn’t reach enough scale with them to actually support our low price points. We realized a few fundamental things at this stage: Feathery is a tool built for enterprise. Early-stage companies primarily adopted Feathery for simple forms and prototyping, and we were constantly being compared against form builders. Enterprises, on the other hand, were excited about the possibilities of implementing deep use cases that they knew otherwise could only have been built in-house with a team of developers. Our pricing, packaging, and positioning were all optimized for SMB product-led growth, when we should have been optimizing for enterprise, product-led sales. Due to the visual nature of the product, enterprises had their “aha” moment soon after engaging with it.

Once we started optimizing for the right audience, we saw our revenue catch up to our usage.

Lesson 4: Hard times create needed focus…

Microsoft hires Inflection AI team - Microsoft’s brilliant non-acquisition of a failed general purpose LLM for consumers which raised over $1.3B from Greylock and others - frankly, smart move by Inflection investors - they took their shot, called it in early, and got their money back to redeploy. Microsoft wins, no regulatory issues since it was not a M&A - expect more to come. Yes, this was a failure but a graceful exit as well. (The Information). Investors in the company’s first major round of funding, a $225 million investment from venture firm Greylock, hedge fund Dragoneer Investment Group and others, will receive one and a half times their investment, according to the person involved in the deal. Investors in a subsequent $1.3 billion funding round last year will receive 1.1 times their investment, the person said. Microsoft invested in both rounds, but the vast majority of the funding came from other investors such as former Microsoft CEO Bill Gates, former Google CEO Eric Schmidt, Nvidia and Inflection co-founder Reid Hoffman, which together led the later round. (Inflection likely hasn’t spent much of that capital, which means it could also use that cash to give the investors a return.)

Cohere, the enterprise LLM, only at $13M ARR seeking $6B valuation (The Information)? The conversational artificial intelligence boom sparked by ChatGPT boosted funding and valuations for startups in the field, but few of them are making much money.

In the latest example, Cohere, one of the best-known startup competitors to OpenAI, which has raised $445 million from investors, was generating about $13 million in annualized revenue at the end of last year, according to a person who has viewed the company’s fundraising pitch to potential investors. That implies it generated just over $1 million in revenue that month.

Bankers for the company told investors late last year that Cohere was seeking new funds at a $6 billion valuation, which would be more than 450 times its annualized revenue, according to two people who were involved in the discussions. That’s a far higher valuation multiple than for other AI startups, including OpenAI, which was generating about 130 times more revenue than Cohere was at the end of last year and was valued at about 50 times its forward revenue in a recent share sale.

Agentic workflows are the future - dramatic improvements in accuracy vs. newer models alone (Andrew Ng) I think AI agentic workflows will drive massive AI progress this year — perhaps even more than the next generation of foundation models. This is an important trend, and I urge everyone who works in AI to pay attention to it.

Today, we mostly use LLMs in zero-shot mode, prompting a model to generate final output token by token without revising its work. This is akin to asking someone to compose an essay from start to finish, typing straight through with no backspacing allowed, and expecting a high-quality result. Despite the difficulty, LLMs do amazingly well at this task!

With an agentic workflow, however, we can ask the LLM to iterate over a document many times. For example, it might take a sequence of steps such as: - Plan an outline. - Decide what, if any, web searches are needed to gather more information. - Write a first draft. - Read over the first draft to spot unjustified arguments or extraneous information. - Revise the draft taking into account any weaknesses spotted. - And so on…

GPT-3.5 (zero shot) was 48.1% correct. GPT-4 (zero shot) does better at 67.0%. However, the improvement from GPT-3.5 to GPT-4 is dwarfed by incorporating an iterative agent workflow. Indeed, wrapped in an agent loop, GPT-3.5 achieves up to 95.1%.

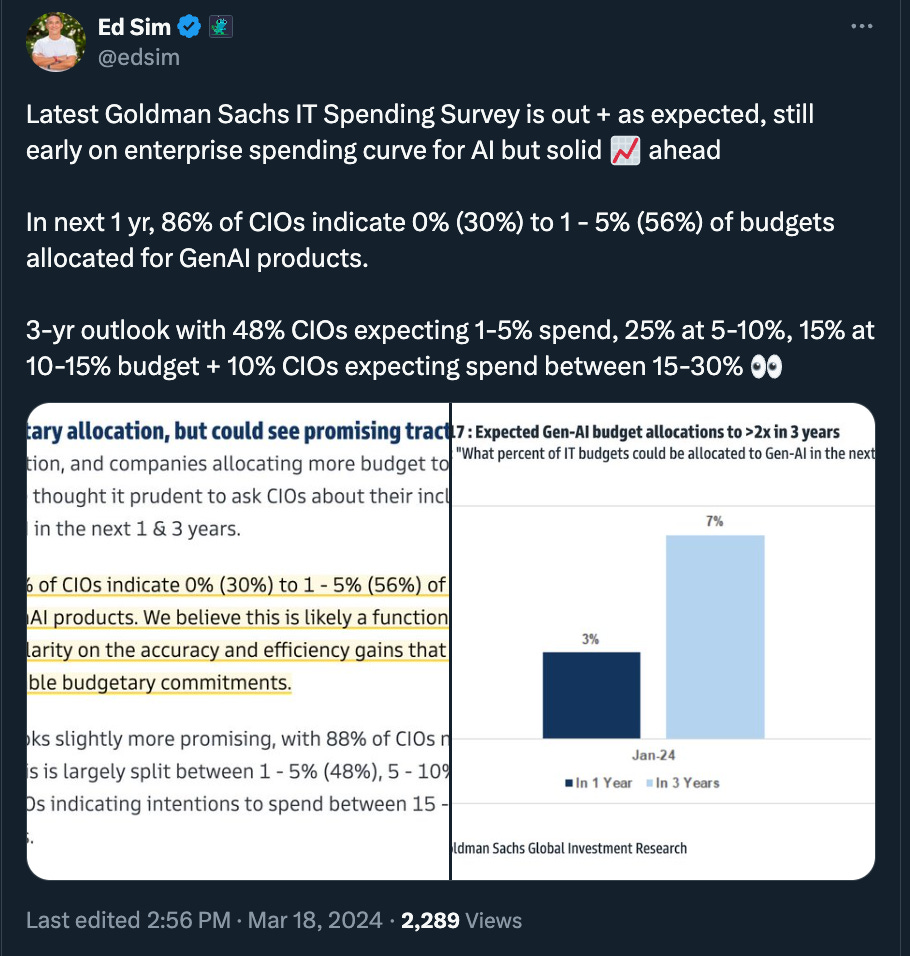

Goldman Sachs IT Spending Survey is out - here’s an excerpt on Gen AI spending You know these numbers seem real especially as some of largest spenders on IT, the big banks, create Head of AI roles to report to CEOs (Morgan Stanley - CNBC) We are pleased to announce that Jeff McMillan has assumed a new position as Head of Firmwide Artificial Intelligence, co-reporting to us.

Jeff previously led Wealth Management’s Analytics, Data and Innovation organization where he played a key role in driving Wealth Management’s technological evolution, from our Modern Wealth Management platform to most recently our groundbreaking work with our exclusive partner, OpenAI.

In his new role, Jeff will coordinate across the Firm to ensure we have the appropriate AI strategy and governance in place. In doing so, he will partner with the business units and infrastructure areas to identify and prioritize AI opportunities; help position the Firm within the flow of AI development across the industry and ensure that Morgan Stanley continues to be a well-respected innovator in AI.

Accenture is a great leading indicator of future deployments of Generative AI apps in the enterprise and it’s not disappointing at the moment - many of these projects will take 12 months+ so aligns with GS CIO Survey above Huge congrats to BigID (a portfolio co) on it’s “$60M raise at over $1 billion as it closes on $100 million in ARR.” I’m pretty pumped as it’s our 3rd boldstart ventures cybersecurity port co at or >$100M ARR mark that we've invested in from Inception.

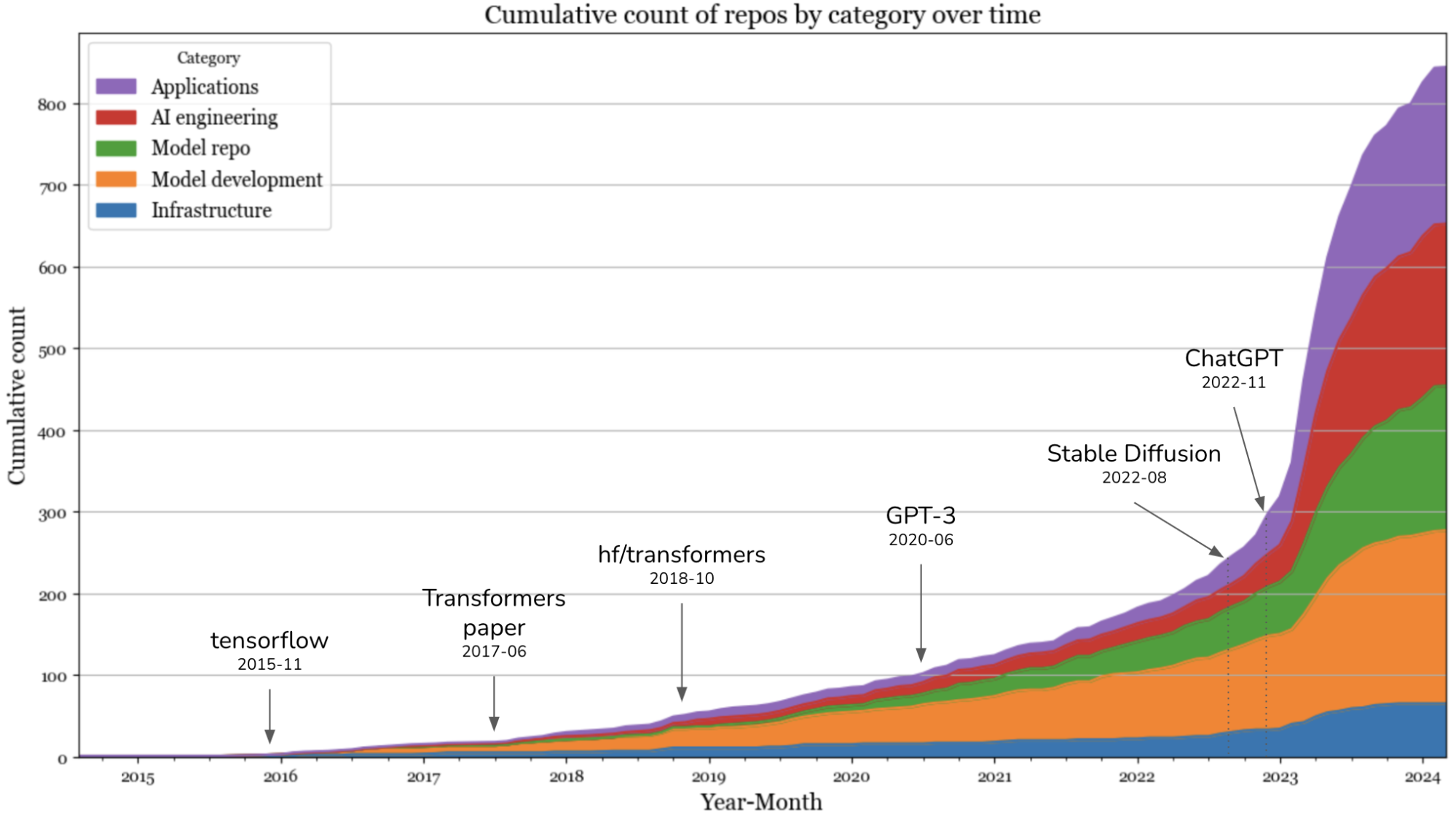

There are also some huge tailwinds ahead as BigID is delivering data security + compliance with a new product for data hygiene capabilities for the generative AI data pipeline. 👇🏼 Where the builders are building when it comes to AI - “What I learned from looking at 900 most popular open source AI tools” - Chip Huyen I only include repos with at least 500 stars in my analysis, and it takes time for repos to gather these many stars. Most low-hanging fruits have been picked. What is left takes more effort to build, hence fewer people can build them. People have realized that it’s hard to be competitive in the generative AI space, so the excitement has calmed down. Anecdotally, in early 2023, all AI conversations I had with companies centered around gen AI, but the recent conversations are more grounded. Several even brought up scikit-learn. I’d like to revisit this in a few months to verify if it’s true.

In 2023, the layers that saw the highest increases were the applications and application development layers. The infrastructure layer saw a little bit of growth, but it was far from the level of growth seen in other layers.

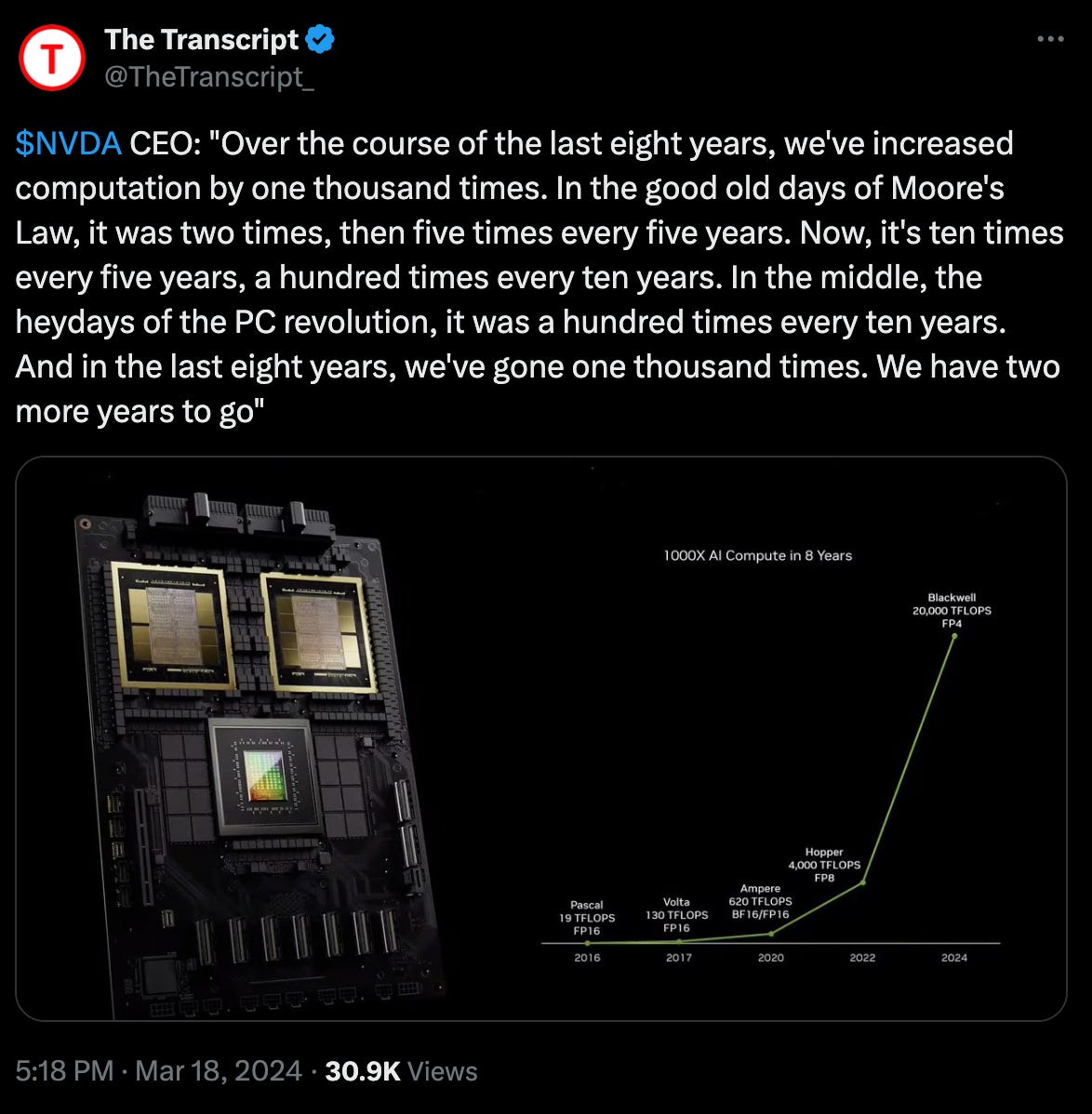

🤯 BTW, Jensen says the total R&D cost to build the new Blackwell chips is around $10 Billion - talk about a moat! Each one will sell for $30-40k Super cool when Superhuman becomes a case study for OpenAI on AI-powered email The simplest use cases are often the most powerful! So glad Superhuman didn't build its own ML team yrs ago in response to Gmail Instant Reply - would have cost lots of 💰 + we would have lost as nowhere near data of Google

But alas...Amazing what an API can do!

https://openai.com/customer-stories/superhuman

We’re all gonna need a bigger boat! “Saudi Arabia Plans $40 Billion Push Into Artificial Intelligence” (NY Times) - this will only fuel the near term AI bubble and certainly accelerate reversion to the mean for VC returns The government of Saudi Arabia plans to create a fund of about $40 billion to invest in artificial intelligence, according to three people briefed on the plans — the latest sign of the gold rush toward a technology that has already begun reshaping how people live and work.

In recent weeks, representatives of Saudi Arabia’s Public Investment Fund have discussed a potential partnership with Andreessen Horowitz, one of Silicon Valley’s top venture capital firms, and other financiers, said the people, who were not authorized to speak publicly. They cautioned that the plans could still change.

🤔 this is simply unsustainable in the long run (The Kobeissi Letter) BREAKING: For the first time in history, interest payments on non-mortgage debt in the US are equivalent to interest on mortgage debt, at $575 billion.

Exactly 3 years ago, interest on non-mortgage debt was at $250 billion.

This marks a 130% increase in household interest expense on non-mortgage items over just 3 years.

Furthermore, 3 years ago interest on non-mortgage debt was HALF of interest on mortgage debt.

Americans are "fighting" inflation with high interest rate debt. How is this sustainable?

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. Pledge your support | |