The Signal - Hindenburg unwind nears end

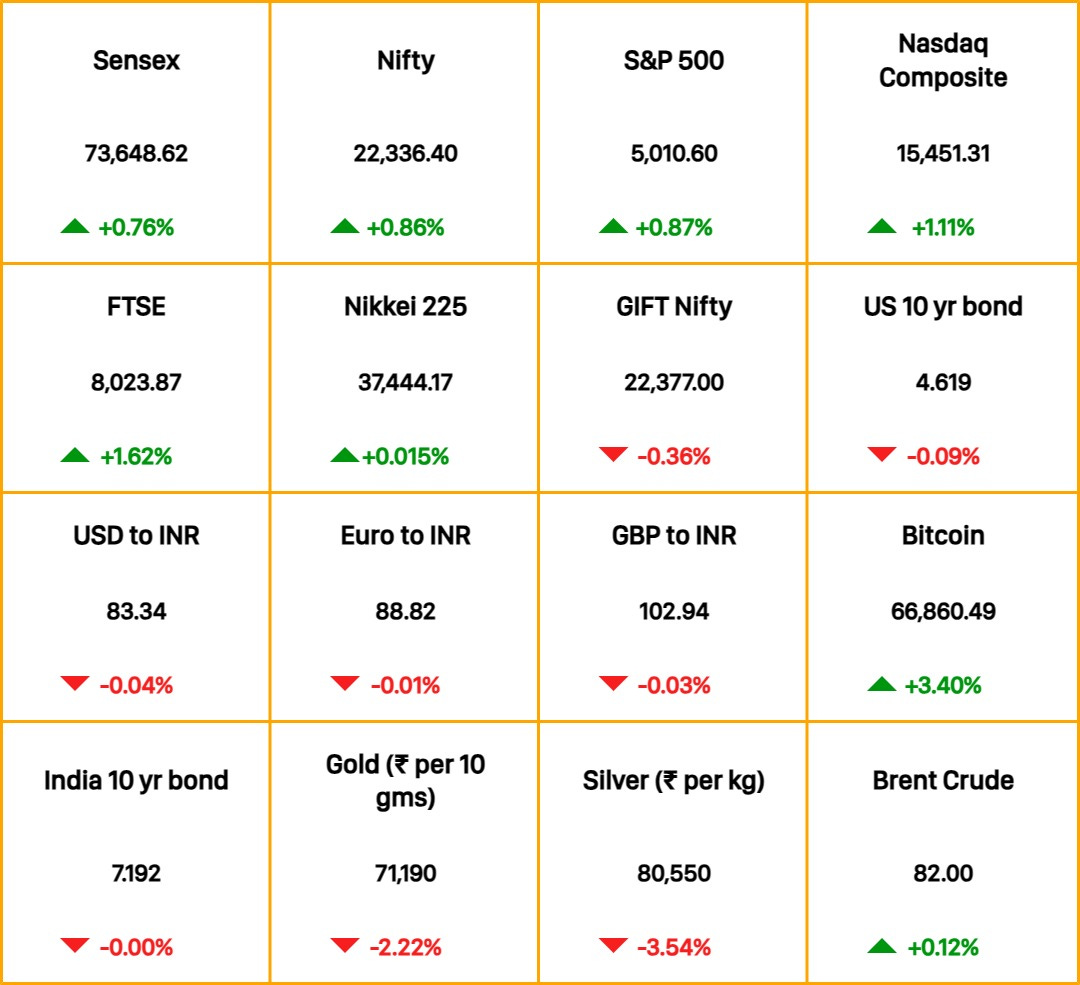

Hindenburg unwind nears endAlso in today's edition: Deadly sugar and spice; What’s on the other side of pollsGood morning! It's been a year, and we can make it official: India and Apple are going strong. Last April, Tim Cook flew down to India to open Apple’s very first retail stores in Mumbai and New Delhi. A year on, he must be a happy man as both Apple stores, chic and seductive, have posted impressive revenue of Rs 190-210 crore each, per The Economic Times. The word is Apple is now in serious talks for new stores in Noida, Pune and Bengaluru. This is, well, a love story, and India is Apple's new sweetheart. We approve. 🎧 A year on, how are Apple Stores doing in India? Also in today’s episode: boba tea billionaires. Tune in on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. Soumya Gupta and Anup Semwal also contributed to today’s edition. The Market Signal*Stocks & Economy: Reliance Industries’ revenue crossed Rs 10 lakh crore (~$120 billion) in FY24 and despite a dip in the fourth quarter, it became the first Indian company to clock a pre-tax profit of Rs 1 lakh crore. Net profit at Rs 79,020 crore was 7% more than the previous year’s. US markets rebounded after a week-long drubbing even as investors awaited Big Tech earnings. About 180 companies in the S&P 500, including those known as the Magnificent Seven, are due to report their quarterly performance. Asian markets took the cue as equities gained in early trade. Oil prices, which had eased, have begun to move up again as tensions in West Asia continued to simmer. Gift Nifty indicates Indian equities may start the day flat or in the negative zone. ENERGYAdani Is Spring CleaningAmong research firm Hindenburg’s most damning allegations against the Adani Group was the charge that its foreign portfolio investors were shell firms closely linked to the Adani family. Sebi has reportedly found many of them violated disclosure rules and investment limits. They are hoping to settle by paying a penalty without admitting guilt. Eight of them — including Adani-linked Elara Capital - have filed settlement applications and agreed to pay fines, The Economic Times reported. Besides, in FY24, Adani has freed shares worth Rs 26,500 crore ($3.17 billion) of five listed group companies from pledges with lenders. Fewer pledged shares indicate a company is earning cash and paying down debt. 💰⚡: Meanwhile, Adani is steadily selling equity abroad. Mint reports it is in talks with European funds for $400-500 million for its green energy business. It also wants $4-4.5 billion in bonds in the next four years by 2030. PODCASTTune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy. Today, he speaks to Nilesh Sathe, ex-member, Insurance Regulatory and Development Authority of India (IREDA) about the insurance regulator wanting new health insurance products, including for older people. Will companies deliver? CONSUMER‘Dal Mein Kuch Kaala Hai’This Hindi equivalent of ‘something’s fishy’ could be a premonition. Singapore’s food agency found Indian spice brand Everest was selling fish curry masala mixed with ethylene oxide, a pesticide. It ordered a recall last week. Hong Kong too has banned four products made by MDH and rival Everest, for high ethylene oxide levels. Long-term exposure to the pesticide can cause cancer. It’s especially troubling because MDH and Everest are leaders of India’s branded spices market, expected to be worth ₹50,000 crore by next year. India’s biggest consumer company Hindustan Unilever had recently considered acquiring MDH. Sugar rush: So where is India’s food regulator? The FSSAI is investigating a Swiss NGO’s allegations that Nestle added sugar to its baby food brand Cerelac in India (but not in western markets). ECONOMYPost-Election, The Shoe Could Pinch

No one really predicted that the US dollar would be ruling the roost in the first quarter of 2024. Yet here it is, up 4% since the year began. The dollar’s rise has upended currencies across the world, making central banks hop, skip and jump. Red hot US: The greenback is drawing fuel from the US economy, which is chugging along at a good pace despite the Federal Reserve’s best efforts to slow it down. The Japanese yen fell to its lowest level against the dollar since 1990 a week ago. The Indian rupee followed on Friday, sliding to a lifetime low of 83.57 before recovering. Unless the US economy slows down, the Fed may not cut rates this year. Those who were betting on the dollar weakening are reversing those. That brings us to the question: what awaits the next Indian finance minister who will take charge in June?

FYITank full: Vodafone Idea’s Rs 18,000 crore follow-on share sale has been fully subscribed. GQG Partners, Fidelity and Investments and Capital Group reportedly invested big money. Gone bust: Indiabulls Housing Finance has filed for Zee Entertainment chairman emeritus Subhash Chandra to be declared personally bankrupt. The National Company Law Tribunal has admitted the plea. Unopposed: Bharatiya Janata Party’s candidate from Surat, Mukesh Dalal, has got a walkover after all opposing candidates withdrew their nominations following the Congress’ candidate’s nomination being rejected. Voting is scheduled for May 7 in the constituency. Free for all: Meta has opened up Horizon OS, the operating system that powers its Quest VR sets, for third party device makers. Top that: Private equity firm Blackstone has bid $1.5 billion to buy Hipgnosis Songs Fund, which owns rights to artists Shakira and Blondie’s music. THE DAILY DIGIT$3.5 millionThe price a 1942 Rolex 4113 fetched at the Monaco Legend Group auction. Only nine of a dozen that were made are known to exist. (Bloomberg) FWIWRinse and repeat: There are two ways to think about Unilever's new detergent that purportedly washes away stains invisible to the naked eye. First take: okay, here’s a detergent that can clean away the invisible “cocktail” of sweat, salt, skin cells, body oils, and cellular DNA that our bodies routinely shed onto the clothes we wear. Impressive, isn't it? Or, second angle: what an incredible marketing gimmick! Imagine billboards and ads shouting at us to rinse our clothes daily—or maybe every four hours—because, well, you think your shirt doesn't need a wash, but you're actually wearing your dead skin cells to work. Gross. You pick your side, but we'd like this wonder wash to hit Indian markets, because our ad creatives truly rock at making those detergent ads. It’s time to recall their golden words: daag acche hain! The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Tesla drives into a wall

Monday, April 22, 2024

Also in today's edition: Wither PMJDY's women beneficiaries?; Maldives, split wide open ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

India's EVMs have a trust problem

Saturday, April 20, 2024

Criticism of electronic voting machines is legitimate, but it shouldn't overwhelm the devices' potential to strengthen democracy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sports’ AI frontier: The knowns and the unknowns

Friday, April 19, 2024

Decoding the potential promise and pitfall of the coming era in sportstech ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Amazon, the everything spy

Friday, April 19, 2024

Also in today's edition: Saffron's Southern chill; Oil's fair in love and war ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Time’s up for 24Seven

Thursday, April 18, 2024

Also in today's edition: Who are Tesla's Indian suppliers?; Reading the fine print of IMF forecasts ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The 2025 State of Email is in the works. 🎉 But first...

Thursday, January 9, 2025

Share your thoughts on how you do email—and we'll bring those insights to life. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The 5 “Must Have” metrics for your SaaS

Thursday, January 9, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack The 5 “Must Have” metrics for your SaaS 1. Monthly RECURRING revenue 2. Churn 3. Cost Per

Is 2025 the year you grow your agency?

Thursday, January 9, 2025

Hi there , No one teaches you how to run an agency. You learn every lesson the hard way. Whether you're stuck on pricing, hiring, or scaling – there's no one else to turn to. No perfect answer

What is HtmlRAG, Multimodal RAG and Agentic RAG?

Wednesday, January 8, 2025

We explore in details three RAG methods that address limitations of original RAG and meet the upcoming trends of the new year

My Site May Be Recovering From The HCU!

Wednesday, January 8, 2025

Can you believe this graph?

How to Describe Mood Swings

Wednesday, January 8, 2025

What is it about Katy Perry's lyrics that captures the feeling of a tumultuous relationship in a way that makes you wanna belt out the chorus with her?

Using AI to drive revenue

Wednesday, January 8, 2025

Everyone says marketers need to start using AI for more than content creation, but where does it help the most? NP Digital surveyed 119 companies to find out where using AI translates into ROI –

Enjoy creating things that don’t exist yet!

Wednesday, January 8, 2025

Online shopping breaks records | YouTube's New Tool | Regional Launch of X Money

Just released: The 2025 Sprout Social Index™

Wednesday, January 8, 2025

Consumer data, marketer trends, AI & more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Little Stream Software digest for the week of 2025-01-08

Wednesday, January 8, 2025

Hey there, Here's articles I published over the last week. - Eric Davis Break-time I've decided to take a break from my daily Shopify Tips newsletter. It's been going for almost seven