Hong Kong Launches Crypto ETFs To Lackluster Trading Volumes

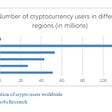

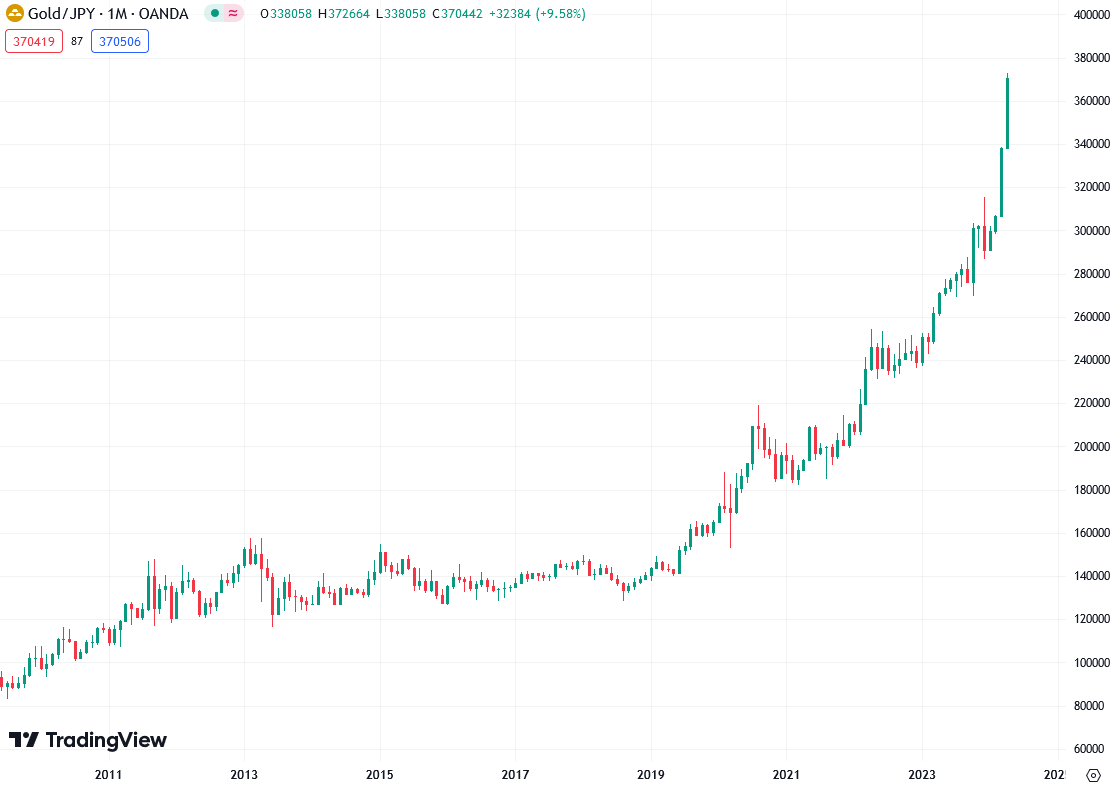

To investors, There were six new crypto ETFs that started trading in Hong Kong on Tuesday. These were the first spot bitcoin and spot ether ETFs to launch in the region, but the trading volumes were quite lackluster. Total trading volume for the Hong Kong ETFs was slightly over $100 million. In comparison, the US debut for the bitcoin ETFs saw more than $4.5 billion in trading volume on day one earlier this year. These new ETF launches are important to watch because Asia boasts a much larger crypto user base than any other region in the world. As Willy Woo pointed out, Asia’s user base is larger than the US and Europe combined. On one hand, you can argue that the overall interest in crypto is higher in Asia, so there should be many more investors interested in these spot ETFs. On the other hand, you could argue that the higher amount of Asian users means that people in the region have already allocated to the native assets, therefore leading to less interest in the publicly traded funds. When you look at it on a percentage basis, rather than an aggregate analysis, I would go with the former argument when talking about retail investors. But the United States capital markets is still the dominant playing field for institutions around the world and these institutional allocators have much more money than retail. It is hard to see a world where the Hong Kong ETFs become larger than the US-traded funds. Another thing to keep in mind is that crypto is still outlawed in mainland China. Unless that legal position is reversed, there are close to 1.4 billion people in Asia who will not be allowed to allocate capital to these funds. Obviously incorporating such a large number of people into the addressable market would be a tailwind for these new ETFs. Additionally, it is important to keep in mind that there are very real currency issues in some of these Asian countries. Let’s use the Japanese yen as an example. Jesse Colombo highlights that gold is up approximately 165% in the last 5 years when priced in yen. This is compared to gold only being up about 85% in the same timeframe when priced in US dollars. That is 2x the performance, which is really just a statement on how poorly the yen has performed. So it is not hard to formulate an argument that Asian investors could seek exposure to bitcoin as relief from their devalued local currencies. The open questions are:

We won’t know these answers for awhile, but with each incremental positive response there should be a stronger tailwind for bitcoin through this bull market. It is obvious that the idea of a decentralized currency has become a global phenomenon. People are watching their currencies get debased at an accelerated rate, so they are seeking a long-term store-of-wealth. Bitcoin appears to be one of the solutions that has become an accepted answer. Now we must wait and see how that popularity translates to capital flows over the next 12-18 months. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Bill Barhydt is the Co-Founder & CEO of Abra, a new type of digital cash payments app and network enabling the transfer of cash between any two smartphones. In this conversation, we talk about the brand new regulatory approval as a registered investment advisor, what that means for Abra, how they can service both credited & uncredited investors now, why allowing basic financial services has been so difficult, and where the industry is going. Listen on iTunes: Click here Listen on Spotify: Click here Abra CEO Says $50 Trillion Is Coming To Bitcoin & Crypto Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

There Is So Much Money Sloshing Around The System

Monday, April 29, 2024

Listen now (2 mins) | READER NOTE: This Thursday I am hosting a free webinar for anyone who is trying to transition into a new job in the bitcoin and crypto industry. Previously, my team and I have

Podcast app setup

Monday, April 29, 2024

Open this on your phone and click the button below: Add to podcast app

Politicians Want Higher Taxes To Cover For Their Lack of Discipline

Thursday, April 25, 2024

Listen now (4 mins) | Today's letter is brought to you by Shortform! Shortform has the world's best guides to 1000+ nonfiction books. Learn key points and gain insights you won't find

The Banks Don't Want The Crypto Wealth

Tuesday, April 23, 2024

Listen now (3 mins) | To investors, New industries bring new problems. The market has been focused on the various ramifications of bitcoin and crypto adoption, but these conversations have historically

Geopolitical Chess Meets Economics

Monday, April 22, 2024

To investors, There was a flurry of new legislative bills related to foreign conflicts that made progress in recent days. Although it seems absurd to send nearly $100 billion abroad while the United

You Might Also Like

The Daily Coach's 10 Most-Read Pieces of 2024

Thursday, December 26, 2024

Thank you for being part of our journey and allowing us to be part of yours.

New top offers (and CB Summit is coming!)

Thursday, December 26, 2024

Just in time for 2025, we have a plethora of top offers goodness for you – plus a new ClickBank Summit live event you won't want to miss... CB Logo High Res 200x23 ClickBank Newsletter Check out

What the rise of the niche and nano-creator means for influencer marketing

Thursday, December 26, 2024

As the creator economy swells, niche creators stand out capturing user attention and advertiser dollars. December 26, 2024 What the rise of the niche and nano-creator means for influencer marketing As

Numbers mean nothing without benchmarking

Thursday, December 26, 2024

The funds-of-funds conundrum; a comeback year for PE mega-funds; see where European VC went in 2024; ultrafast delivery drives foodtech VC Read online | Don't want to receive these emails? Manage

🔔Opening Bell Daily: Santa makes history

Thursday, December 26, 2024

Historically, the S&P 500's final week of the year is the strongest.

Fixing conversions and killing the business

Thursday, December 26, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

How to Write a Job Description

Wednesday, December 25, 2024

A deep dive into a job description that speaks to the deepest longings of the human spirit.

🎄 Recap: 21 Episodes of AI 101 Guide

Wednesday, December 25, 2024

Take some time to learn or refresh the key concepts, techniques, and models that matter most

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or