The Signal - C-suite gets blurry

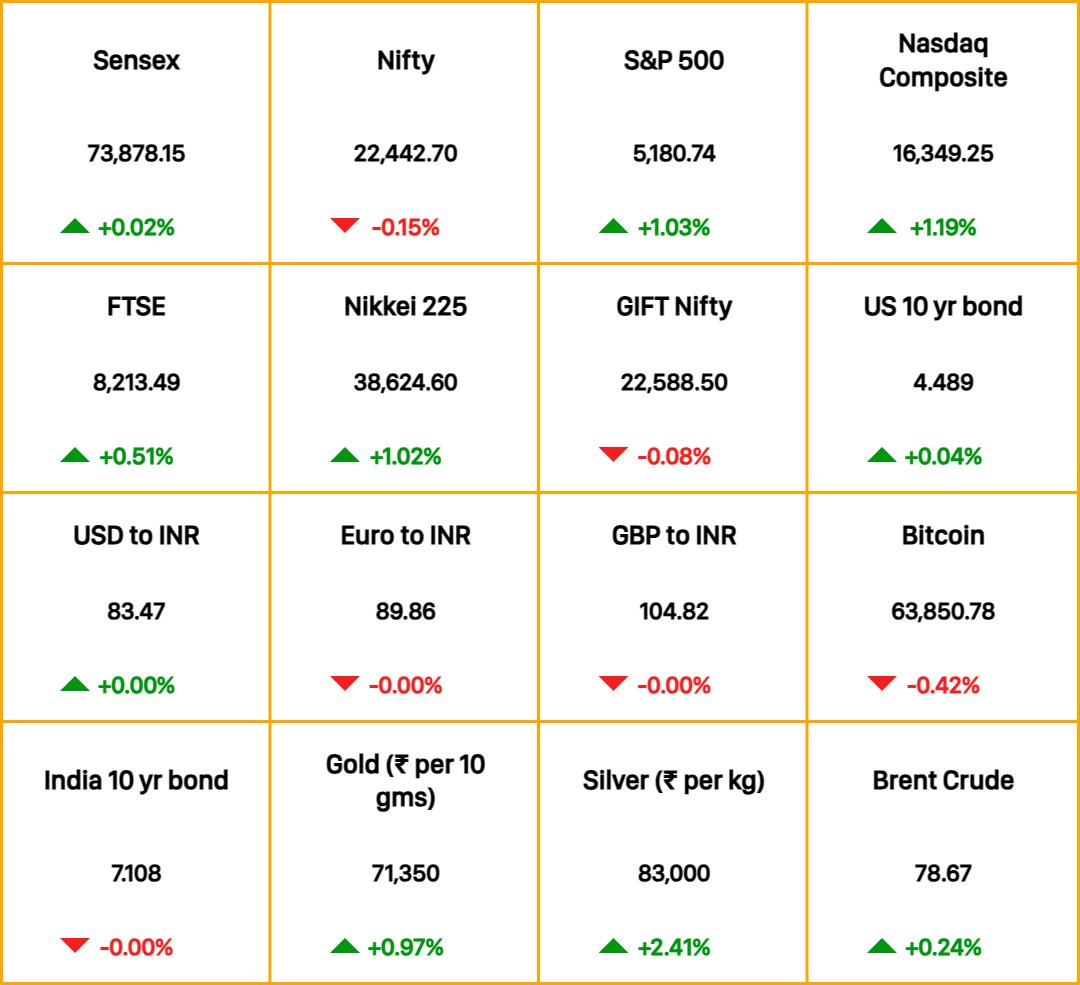

Good morning! It pays to have your client cancel on you. According to The Wall Street Journal, many salons in the US have started charging double the price for a missed appointment compared to if the client had actually shown up and gotten their haircut done. If you find this draconian—why on earth should anyone pay for a service they never received—consider that skipping out on appointments one too many times might even result in an outright ban. We realise that this 'no-show' fee can sometimes unfairly punish people, particularly when life genuinely gets in the way of plans, but overall, we don’t think it’s too terrible of an idea to slap a fine on flakes. Someone must teach ‘em the value of one’s words. 🎧 Climate change is increasing the cost of your favourite cup of Joe. Also in today’s episode: how service-based businesses are increasingly charging fees for no-shows or cancellations. Tune in on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. Soumya Gupta and Anup Semwal also contributed to this edition. The Market Signal*Stocks & Economy: Chinese President Xi Jinping, who is on a European tour, asked his French counterpart Emmanuel Macron to help avoid a “new Cold War” and see the economic opportunity that his country brings to the table. European leaders, however, insist that they need protection from Chinese imports, implying an end to the trade war is not yet in sight. US shares rose sharply as investors swung back to optimism that the Federal Reserve will cut rates. Last week, chances of a reduction were seen as fading for 2024. Taking the cue from Wall Street, Asian equities jumped in morning trade. The GIFT Nifty indicates a flat beginning for Indian shares. Meanwhile, Sebi has declined the NSE’s request to extend derivatives trading hours by three hours daily. It said there was no broad consensus for the proposal. JOBSA Time To SkillFor many years, Indian planners have tried to devise ways to train its young workforce but with little success. The Congress Party has now promised apprenticeship as an entitlement to all diploma holders and graduates if it comes to power after the national elections. To be sure, India has had laws facilitating apprenticeship for over 60 years. It renewed attempts to expand the cohort of skilled workers in 2009 when rapid economic growth created a shortage of talent in many industries. The 2015 Skill India Mission vowed to train 500 million workers in various vocations by 2022. Two years past the deadline, only a tiny fraction of that target has been achieved. Industrial Training Institutes are not finding enough candidates even though there is enough demand for skilled plumbers, electricians, fitters, and other technicians. That is because young people are aspiring for white collar jobs. Head to The Core for more. PODCASTTune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy. In today’s episode, he speaks to Gautam Kalia, Senior VP & Head, Super Investor, Sharekhan by BNP Paribas, on conflicting signals in the stock markets ahead of election results. What should the strategy be? GEOPOLITICSIndia Rides Russian rupeesForget global economic cues, it’s raining cash on India. Thank the Russians. And their oil. Russia is cut off from global payments systems courtesy Western sanctions. But good friend India has been buying up its oil and paying in rupees. The result: Russian vostro accounts—local bank accounts held on behalf of foreign banks—are overflowing with oil rupees. Strapped in: That India is successfully ‘de-dollarising’ trade is great, but Russia doesn’t have much use for rupees outside India. Two years ago, the RBI allowed vostro account holders to invest in government bonds. Now, it may have allowed the pile of oil rupees to be routed through Russian foreign portfolio investors (FPIs) into Indian stocks and infrastructure projects, locking them into long-term positions. In turn, the FPIs can pay Russian oil companies in rubles. In the process, India may also have found a way to pay for Russian weapons. LEADERSHIPThere Is A Blur At The Top

Here is a stark number. Of 8,000 C-suite vacancies currently open across companies and sectors in India, less than 12% are for the role of chief operating officer (COO). Most companies are looking for chief technology officers, chief accounting officers and chief financial officers. Few seem to need COOs, a position second only to the chief executive officer (CEO). TCS will not be hiring a COO to replace incumbent N Ganapathy Subramaniam, who retires this month. His work will be farmed out to others. Rival Infosys did away with the position three years ago. Hemant Bakshi, the first professional CEO that Ola Cabs hired, quit last week after barely nine months in the seat. COOs—three of them—at Ola never lasted more than 18 months.

FYIBig and formidable: Microsoft is training MAI-1, an artificial intelligence language model big enough to take on Google and OpenAI’s large language models. It’s all private: US private equity firm KKR will pay $838 million to buy Indian medical device maker Healthium Medtech from UK’s Apax Partners. For an oil pass: Reliance Industries has sought US approval to buy crude oil from Venezuela, which is shackled by Washington’s sanctions. Short relief: Imprisoned Jet Airways founder Naresh Goyal gets bail for two months on medical grounds. No truce: Israel has rejected a ceasefire proposal from Egyptian and Qatari mediators that Hamas agreed to, and continued its offensive in Rafah. THE DAILY DIGIT10The number of companies that accounted for a third of all CSR spending by all NSE-listed firms in FY23, led by HDFC Bank, Tata Consultancy Services, and Reliance Industries. Listed firms spent Rs 15,524 crore in CSR in FY23, up 5%. (The Economic Times) FWIWMoney Not Moneying: In one video, you’re told you’d never make enough money to buy a house of your own; in another, you’re shown a range of moisturisers, sunscreens and handbags that you must buy at all costs. That’s TikTok for you. Young Americans describe their feed as a mix of doomsday economy videos and “consumerism gone wild.” Now if you consider that many 20-somethings in the US go to TikTok for news, it starts making sense why they’d feel what economists are calling ‘money dysmorphia’: that lingering feeling of financial uncertainty despite doing reasonably well. It’s also ironic that feelings of financial uncertainty don't always make you cautious with money. You may splurge on living big today since hours of scrolling through TikTok’s endless videos makes it seem that the future is doomed anyway. That could partially explain why American zoomers have doubled their non-mortgage debt over the last two years—living it up before it all falls apart. But what if it doesn’t? The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This ship has sailed

Monday, May 6, 2024

Also in today's edition: GDP math ain't mathing; A little less Applesauce ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The curious case of Google Trends in India

Saturday, May 4, 2024

For nine of the last ten years, the most searches were for why Apple products and Evian water are so expensive ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

No edition

Friday, May 3, 2024

See you next week ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Hell and Highly water

Friday, May 3, 2024

Also in today's edition: Tough treaty; Embraer challenges Boeing and Airbus ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Licious drops the meat wagon

Thursday, May 2, 2024

Also in today's edition: Ports in a (car) storm; Another RBI crackdown ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

15% more productive team and you

Wednesday, March 5, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack 15% more productive team and you Will your growth double if you and your team's efficiency

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a