Bitcoin Runes and the Layer 2 Surge | Layer 2 Review

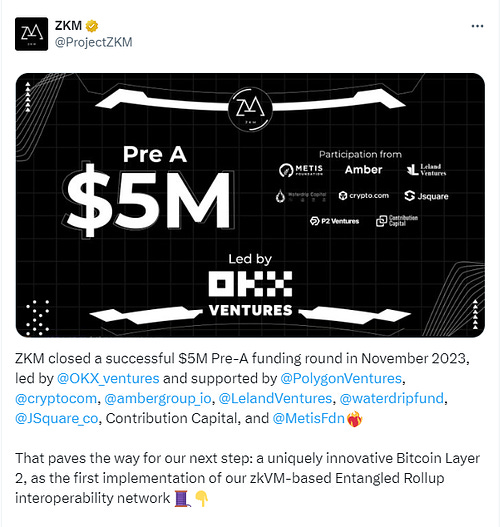

Bitcoin Runes and the Layer 2 Surge | Layer 2 ReviewQuick Reads and Hot Links Covering the People and Projects Who Are Scaling EthereumDear Frens, Welcome back to the L2 Review. Recent analysis has it that Base remains the key draw for fresh investments. This week, Base received over 6,500 ETH in net deposits, outpacing Arbitrum and Optimism by a significant margin. This suggests that investors prefer Base for deploying their capital, possibly because of its established infrastructure or its assumed dependability, despite the growing interest in Layer 2 scaling solutions overall. Arbitrum, on its end, is making a mark in history as the first L2 to surpass the $150 billion total transaction volume on DEX with a TVL of $2.64 billion, solidifying its position as the largest layer 2 by TVL. With this, many projects are integrating Arbitrum to benefit from its scalability and lower fees. In this issue’s editorial, we explore a not-so-familiar topic captured in this newsletter, the Bitcoin Layer 2. What is brewing? What is the cause of the latest surge? What are some of its shortcomings? All these and more. It felt good putting this together, but we’d love to know what you think about it. If you are interested in these kinds of posts, kindly let us know in the poll after the article. Truly, one thing is certain, layer 2 solutions continue to transform the landscape of decentralized applications. Stay tuned and keep your eyes peeled for the latest updates, as the evolution of blockchain technology continues to unfold. Contributors: Ritaakubue, anointingthompson1, jengajojo, Tonytad, Boluwatife, Kornekt, WinVerse This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🗞️ Ecosystem Updates♾️ Ethernity Introduces the Ethernity Chain, an ETH Layer 2 with enhanced AI-driven security 💰 Arbitrum surpasses $150 billion in total transaction volume on Uniswap 🔥 Hot NewsZKM Unveils Revolutionary Bitcoin Layer 2 Network After $5M Funding Success ZKM has announced plans to launch a groundbreaking Bitcoin Layer 2 network following a successful $5M Pre-funding round. The funding round, led by OKX Ventures and supported by prominent investors like Polygon Ventures, Crypto.com, Amber Group, and others, paves the way for ZKM to introduce the first implementation of its zkVM-based Entangled Rollup interoperability network. At the heart of this Layer 2 solution lies a unique security framework that introduces a native BTC Multisig script control and decentralized transaction execution verified by BTC scripts. Notably, it employs an 'Optimistic Challenge Process' to secure off-chain computations, ensuring robust security and transparency. Backed by the Entangled infrastructure, including a general-purpose zkVM and decentralized sequencers, ZKM's Layer 2 network not only guarantees native security but also provides sustainable yield without requiring asset locking. This is a game-changer for Bitcoin investors. To showcase its commitment to the Bitcoin community, ZKM will sponsor and participate in the upcoming Bitcoin Asia conference in Hong Kong from May 9-10, one of the world's biggest Bitcoin events. Additionally, ZKM will co-host the Bitcoin Dragonland Fest on May 8, providing attendees with an opportunity to learn more about the Layer 2 network and sustainable yield generation from BTC assets without staking, secured by ZKM's state-of-the-art zkVM. If you are interested in learning more, check out the tweet below. 🏛 Governance💬 Proposals in DiscussionArbitrumBitcoin Runes and the Layer 2 SurgeAuthor: Kornekt In the ever-evolving landscape of blockchain technology, innovation continues to push the boundaries of what's possible. Runes is the latest protocol making waves on the Bitcoin ecosystem. Spearheaded by Casey Rodarmor, the mind behind Ordinals, Bitcoin Runes promises to revolutionize the concept of fungible tokens within the Bitcoin ecosystem. At its core, Bitcoin Runes leverages Bitcoin’s native UTXO transaction model to create and manage fungible cryptocurrencies seamlessly. Token issuance, transfer, and storage are performed efficiently, with minimal impact on the underlying Bitcoin blockchain. By assigning messages to UTXOs via OP_RETURN, Runes ensures secure and transparent transactions without the need for off-chain data storage. The launch of the Runes protocol coincided with Bitcoin's fourth halving, marking a significant milestone in the evolution of the Bitcoin ecosystem. This synchronized launch triggered a frenzy of activity, with users flooding into the Bitcoin blockchain to mint Rune tokens. Few days after launch, Runes accounted for about 68% of all Bitcoin transactions. As a result, Bitcoin transaction fees surged due to stiffer competition for blockspace. All these highlight the need for further scaling of the Bitcoin network. Why Bitcoin Needs L2 SolutionsDespite its unmatched security and decentralization, Bitcoin grapples with inherent shortcomings that necessitate the existence of layer 2 solutions on the network. First and foremost, Bitcoin's scalability has long been a subject of debate and concern. The network's limited throughput, capped at a mere six to eight transactions per second, pales in comparison to the transaction speeds offered by traditional payment systems and even some of its blockchain counterparts. This bottleneck often results in congested blocks and soaring transaction fees during periods of high demand, deterring users from engaging with the network for everyday transactions. Moreover, Bitcoin's base layer lacks the flexibility to support complex smart contracts and decentralized applications (dApps). Unlike platforms like Ethereum, which embrace Turing-complete scripting languages, Bitcoin's scripting capabilities are limited. This constraint stifles innovation and hampers the development of novel use cases beyond simple value transfer. Bitcoin layer 2 networks hope to scale the network by introducing innovative solutions that resolve these challenges. Let's delve into some popular layer 2 solutions on the Bitcoin network and explore how they function. Lightning Network (LN)The Lightning Network is arguably one of the most well-known layer 2 solutions for Bitcoin. It operates as a network of payment channels built on the Bitcoin blockchain. Users can open payment channels with each other, conduct off-chain transactions, and settle them on the Bitcoin blockchain when necessary. This enables instant micropayments with reduced transaction fees. LN leverages smart contracts and multi-signature wallets to ensure security and trustlessness in transactions. Liquid NetworkLiquid is a sidechain built by Blockstream, offering fast and confidential transactions for Bitcoin and other digital assets. It operates as a federated sidechain, meaning it relies on a group of trusted entities to validate transactions. Liquid supports the issuance of tokenized assets, such as stablecoins and security tokens, while providing fast settlement times of fewer than two minutes. Confidential Transactions and Confidential Assets features enhance privacy by obscuring transaction amounts and asset types. While Lightning Network and Liquid Network are among the most prominent layer 2 solutions on Bitcoin, several other projects are also exploring off-chain scaling solutions. Projects like RSK, Rootstock, and Stacks (formerly Blockstack) are experimenting with different approaches to enhance Bitcoin's scalability. Bitcoin L2 vs. Ethereum L2Underlying Blockchain

Use Cases and Applications

Community and Adoption

Bitcoin Layer 2 Shortcomings

ConclusionRelentless innovation and collaborative efforts within the cryptocurrency community continue to push the boundaries of what is possible on the Bitcoin network. With ongoing developments in layer 2 technology, coupled with a growing ecosystem of applications and services, the future of Bitcoin's layer 2 ecosystem looks promising.

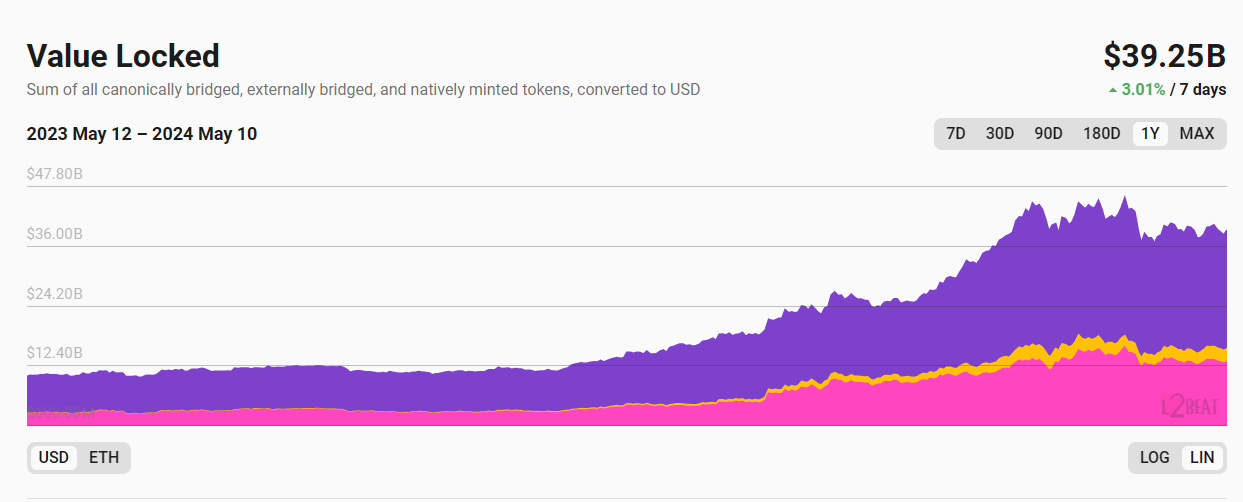

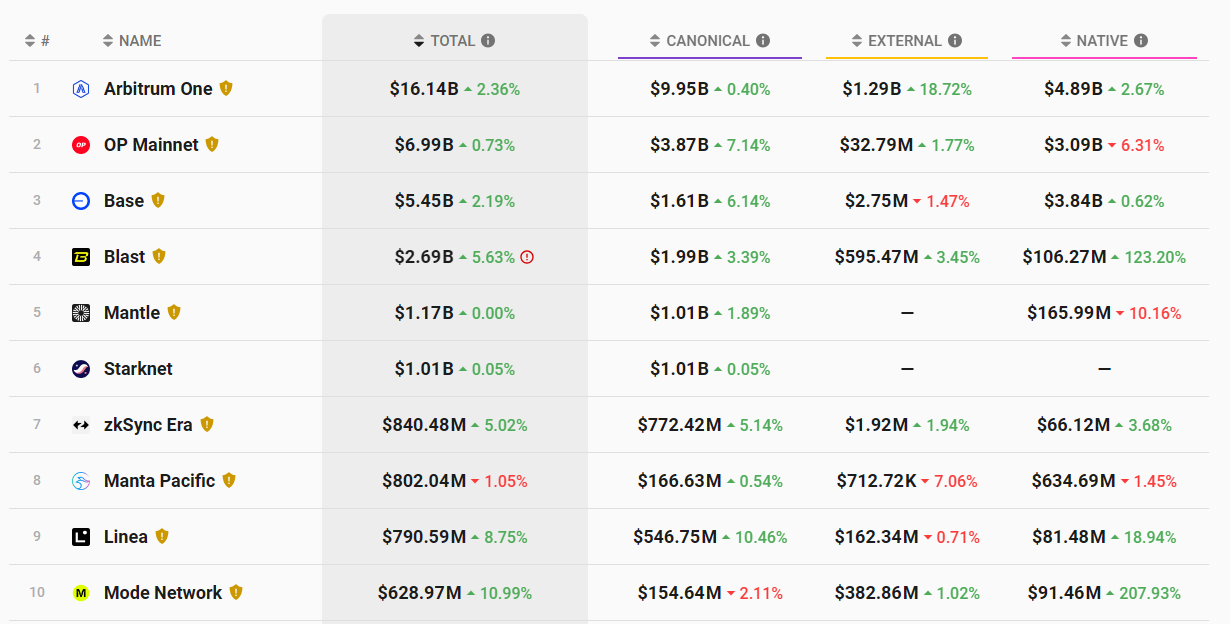

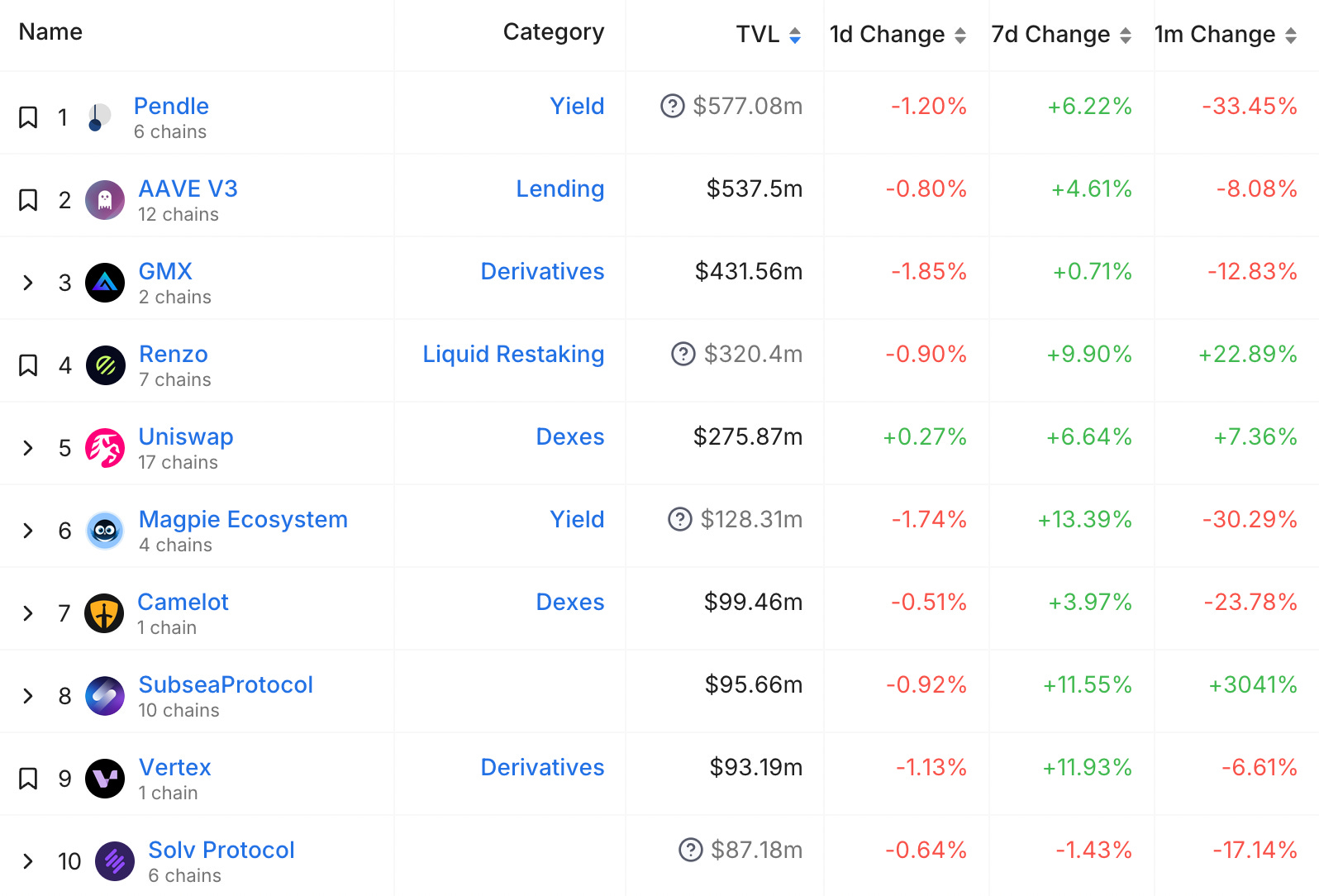

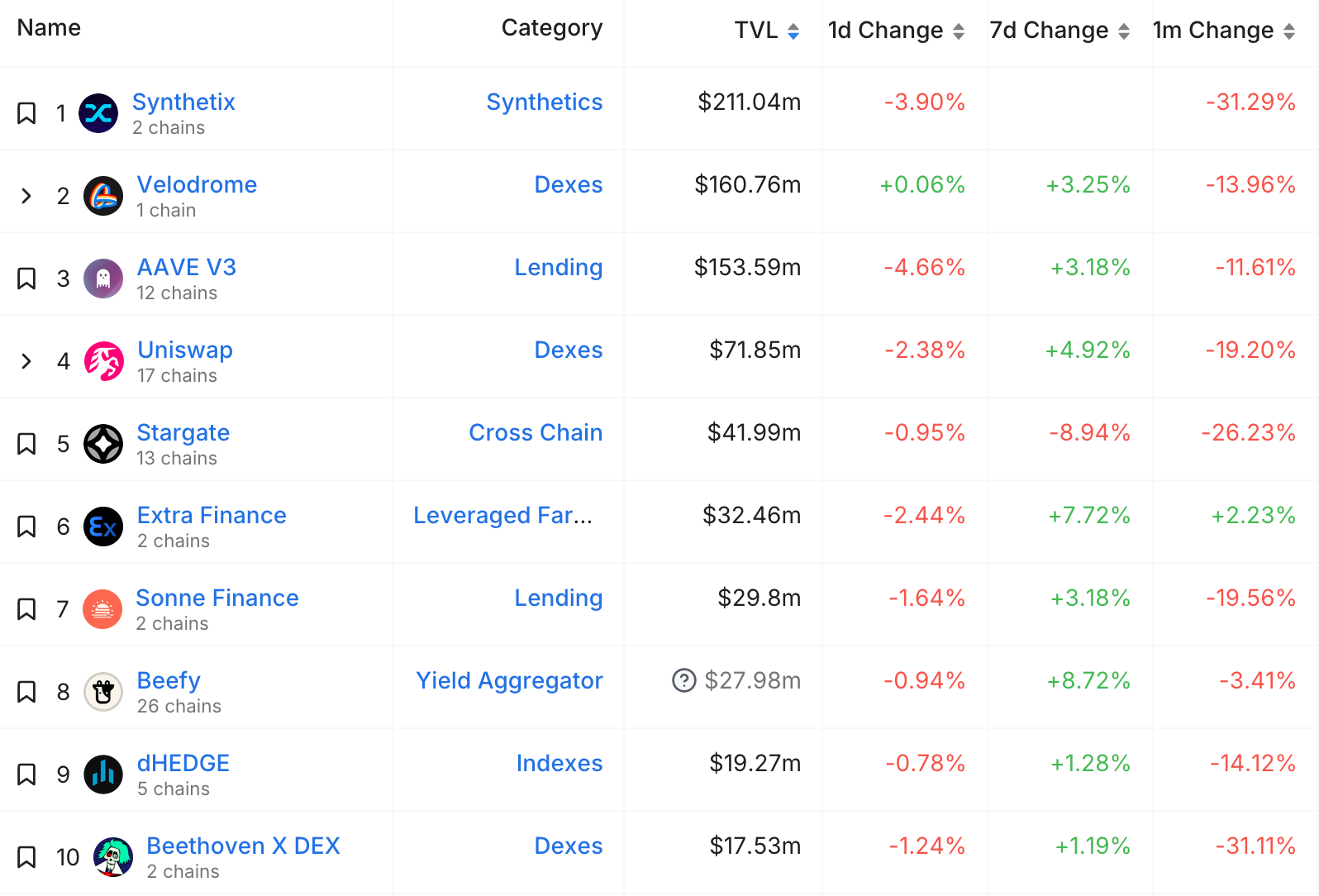

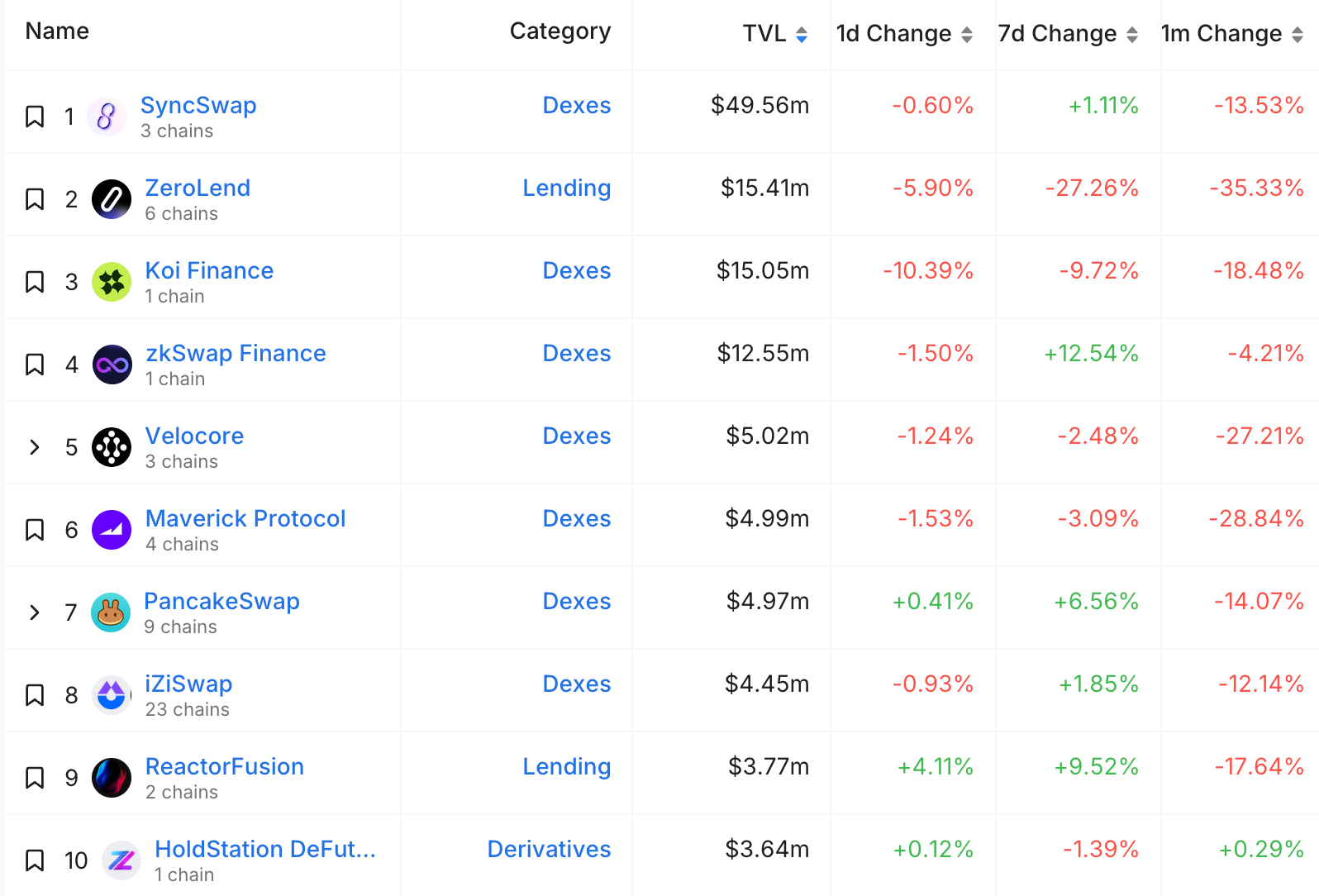

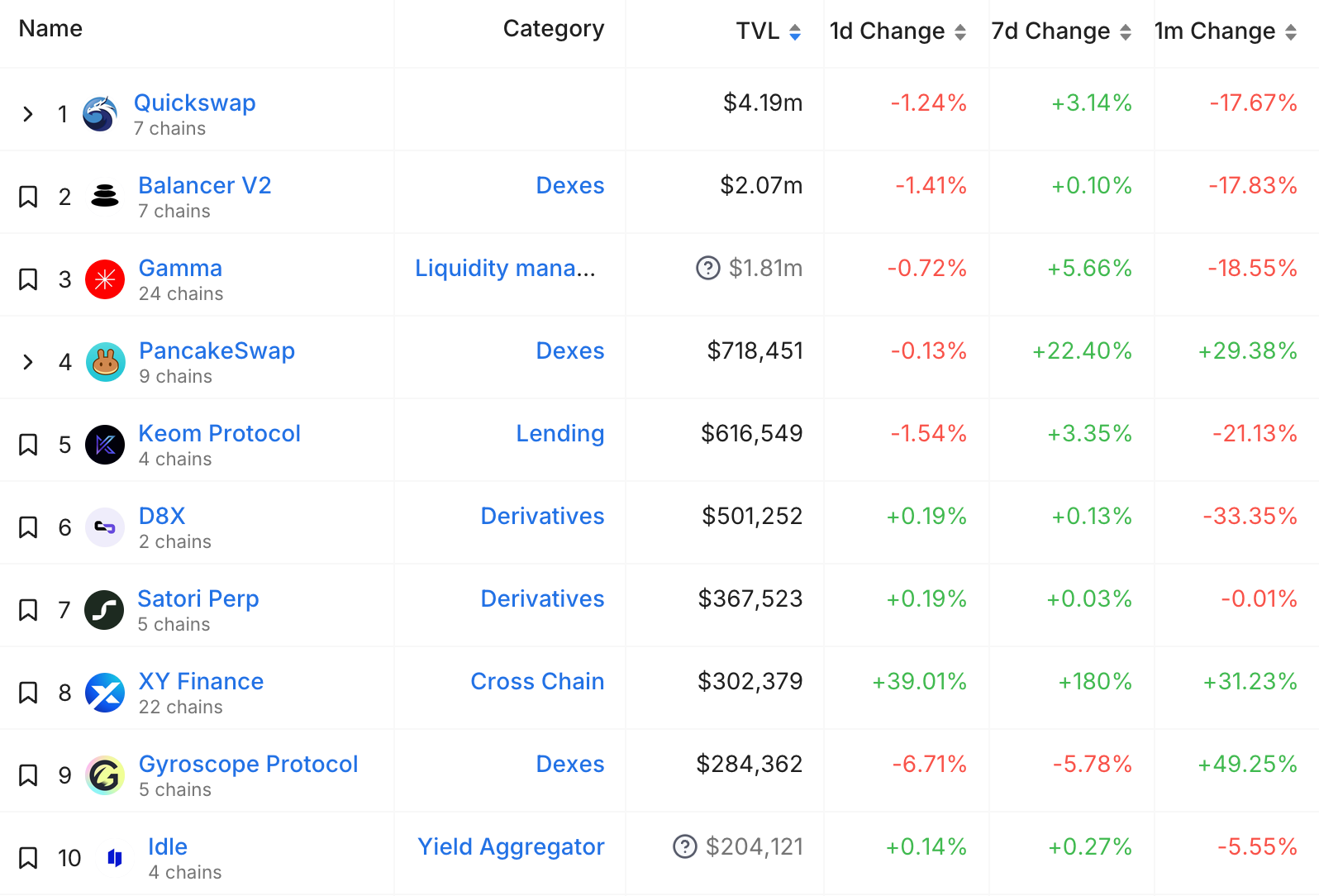

📈 DataTotal Value Locked on L2s closes in on $40 billion!Top Ten Projects by Total Value Locked:🔭 Project WatchArbitrumTop Projects by TVL

OptimismTop Projects by TVL

zkSyncTop Projects by TVL

zkEVMTop Projects by TVL

|

Older messages

The Path to Reorganisation | BanklessDAO Weekly Rollup

Saturday, May 4, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Path Forward: Retro Funding and Revitalization | BanklessDAO Weekly Rollup

Sunday, April 28, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OP's Superchain Vision | Layer 2 Review

Friday, April 26, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

May(or) May Not? | BanklessDAO Weekly Rollup

Saturday, April 20, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Let’s Get Involved | BanklessDAO Weekly Rollup

Saturday, April 13, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏