Crypto Market Pulse Weekly – 📉 Crypto trading volumes dropped for the first time in seven months in April

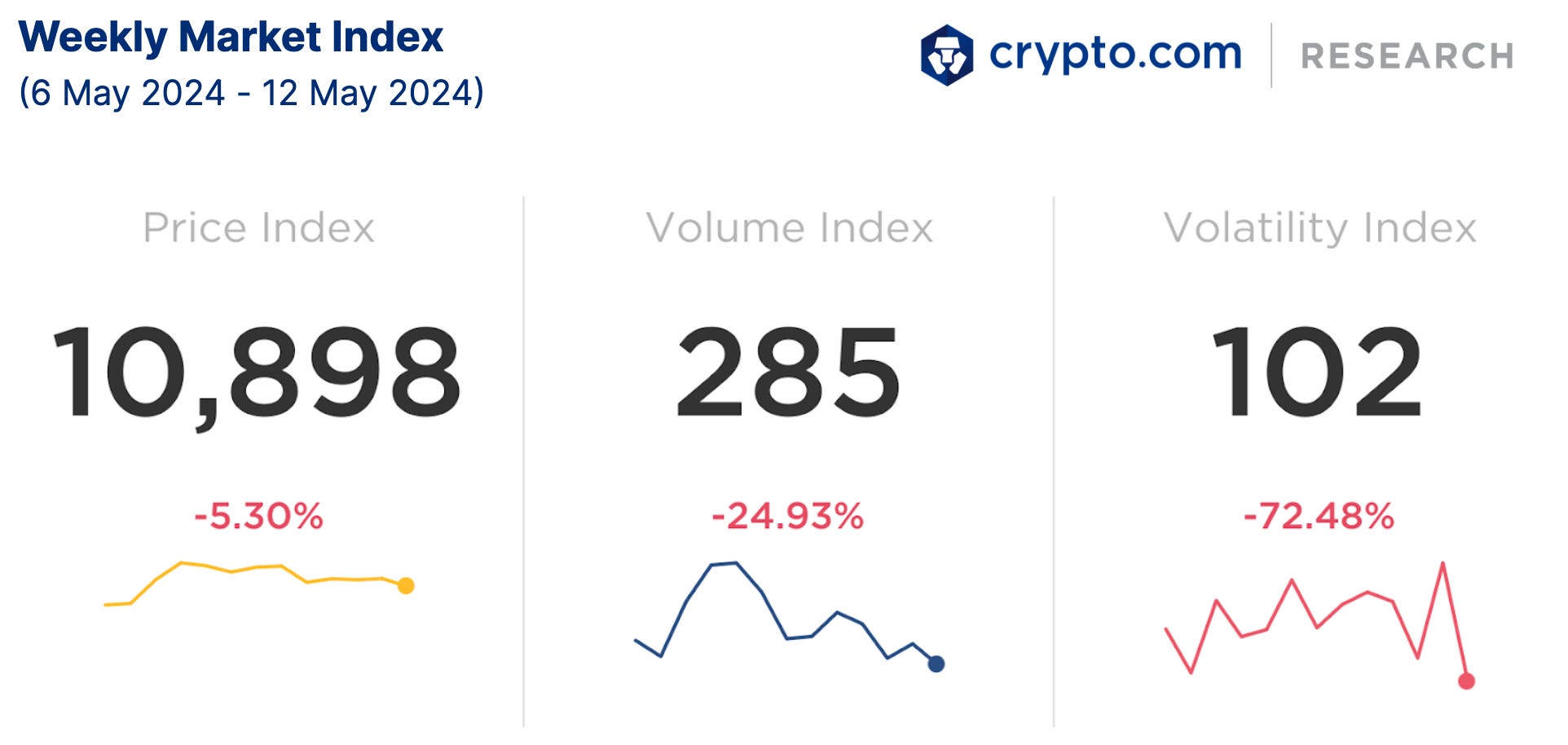

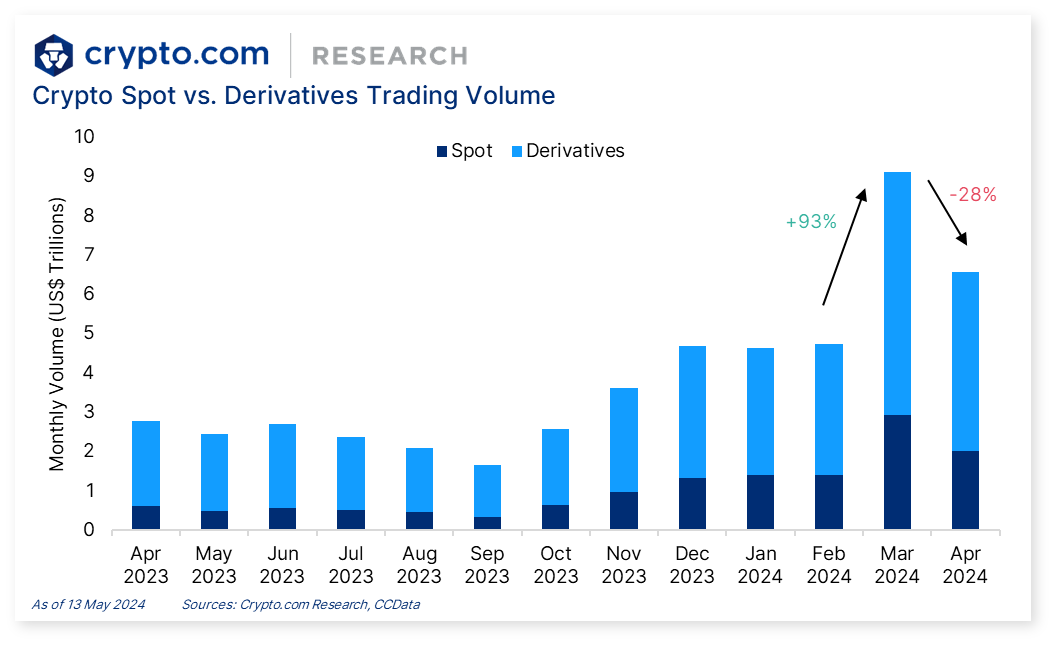

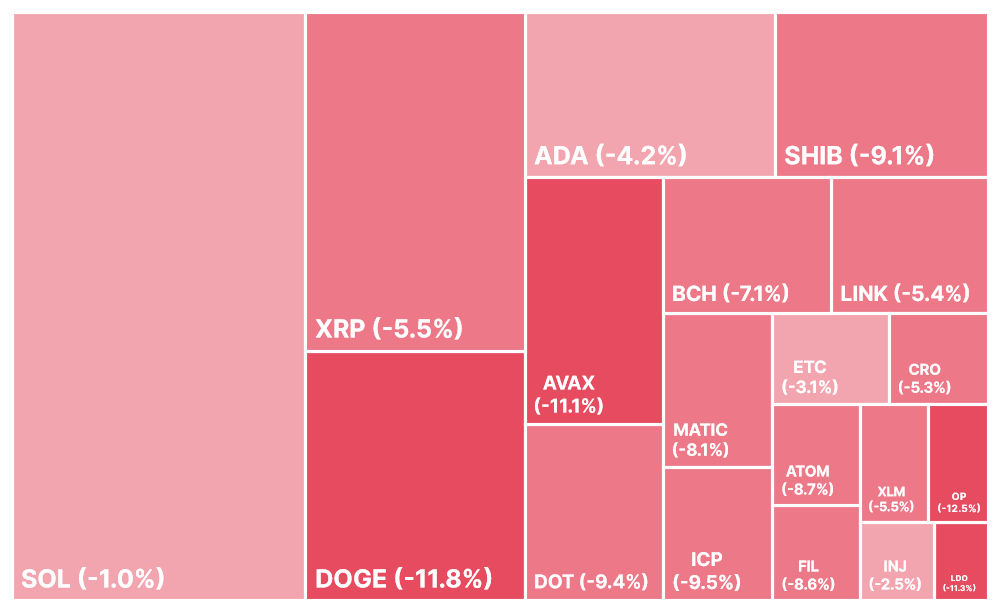

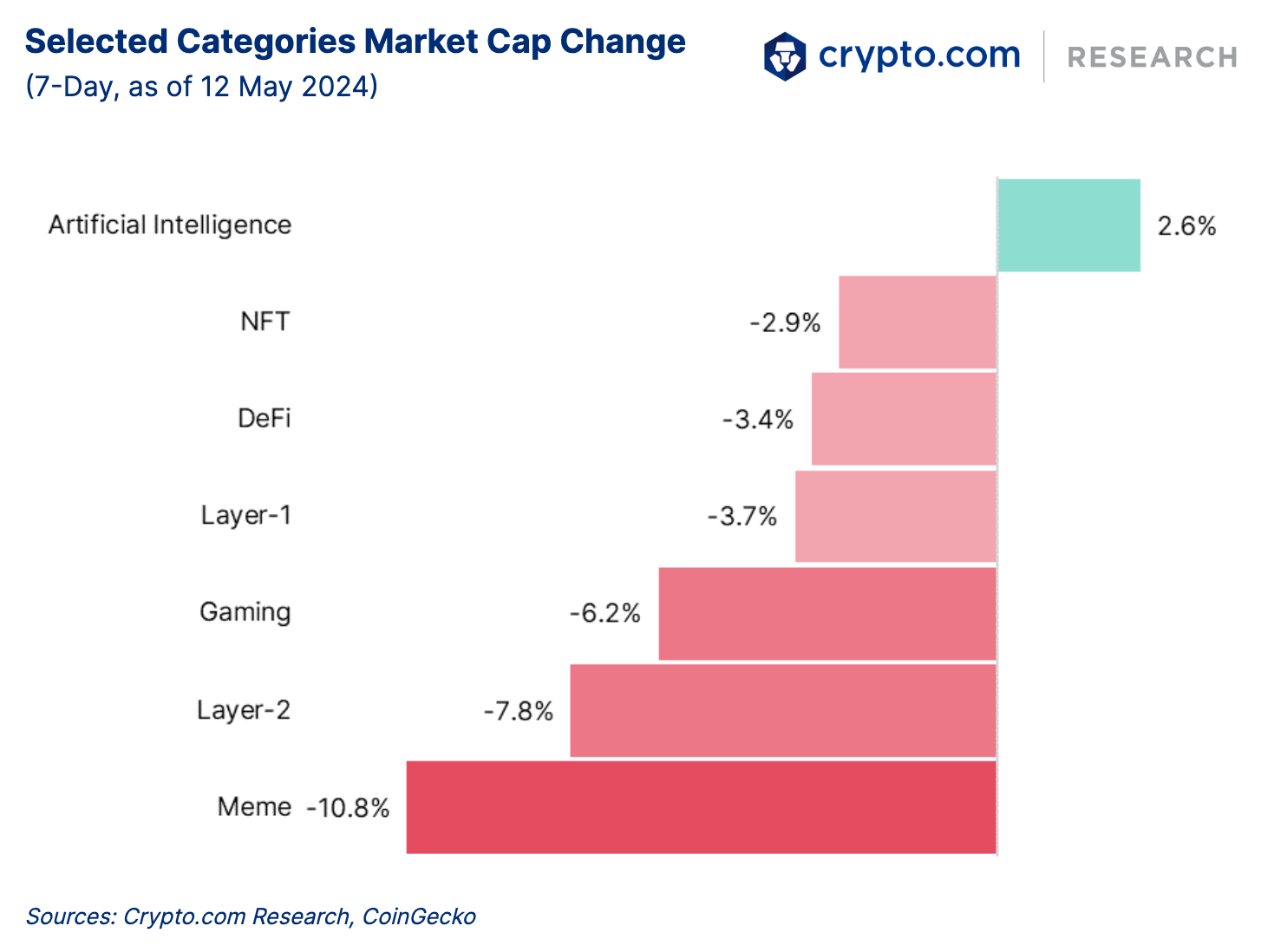

Crypto Market Pulse Weekly – 📉 Crypto trading volumes dropped for the first time in seven months in AprilCrypto trading volumes dropped for the first time in 7 months. EU contemplating integrating crypto into its mutual fund framework. Mastercard collaborates with US banks to trial tokenised settlements.Weekly Market IndexAll three crypto market indices decreased last week. The price index decreased by -5.30%. However, the volume and volatility indices decreased more drastically, by -24.93% and -72.48% respectively. Bitcoin (BTC) dropped close to US$61,000 through the week. Ether (ETH) showed a similar trajectory and settled at near-US$2,900 level over the weekend. The University of Michigan Survey of Consumers sentiment index, which measures consumer confidence levels in the US, tumbled to 67.4 in May, down from 77.2 in April and much lower than the Dow Jones consensus estimate of 76. At the same time, one-year inflation outlook rose to 3.5%, higher than 3.2% in April, reiterating worries of inflation. U.S. weekly jobless claims rose to 231,000, the highest level since August 2023 and up from 209,000 one week before, suggesting signs that the labour market is cooling. U.S. Spot Bitcoin ETFs had a week of net inflow totalling US$117 million, compared to last week’s $433 million net outflow. Grayscale Bitcoin Trust ETF’s (GBTC) weekly net outflow settled at $171 million last week, slowing down from a net outflow of $277 million the prior week. H.K. Spot Bitcoin ETFs had a week of net inflow of $2.3 million, while HK Spot Ether ETFs had a weekly net outflow of $1.8 million. Chart of the WeekA significant drop in cryptocurrency trading volume was recorded in April, marking the first decline in seven months. Spot and derivatives markets trading volume fell by 28% month-on-month to $6.58 trillion, as per CCData, with spot volume dropping by 32% and derivatives volume dropping by 26%, respectively. This decline was attributed to escalating geopolitical tensions and slower inflows into U.S.-listed spot ETFs. Weekly PerformanceBTC and ETH both decreased in the past seven days by -3.9% and -6.3%, respectively. The price action for all other selected top market cap tokens were also down. OP led the drop. All selected key categories were down in terms of market capitalisation in the past seven days, except for Artificial Intelligence. News Highlights

Recent Research Reports

Recent University Articles

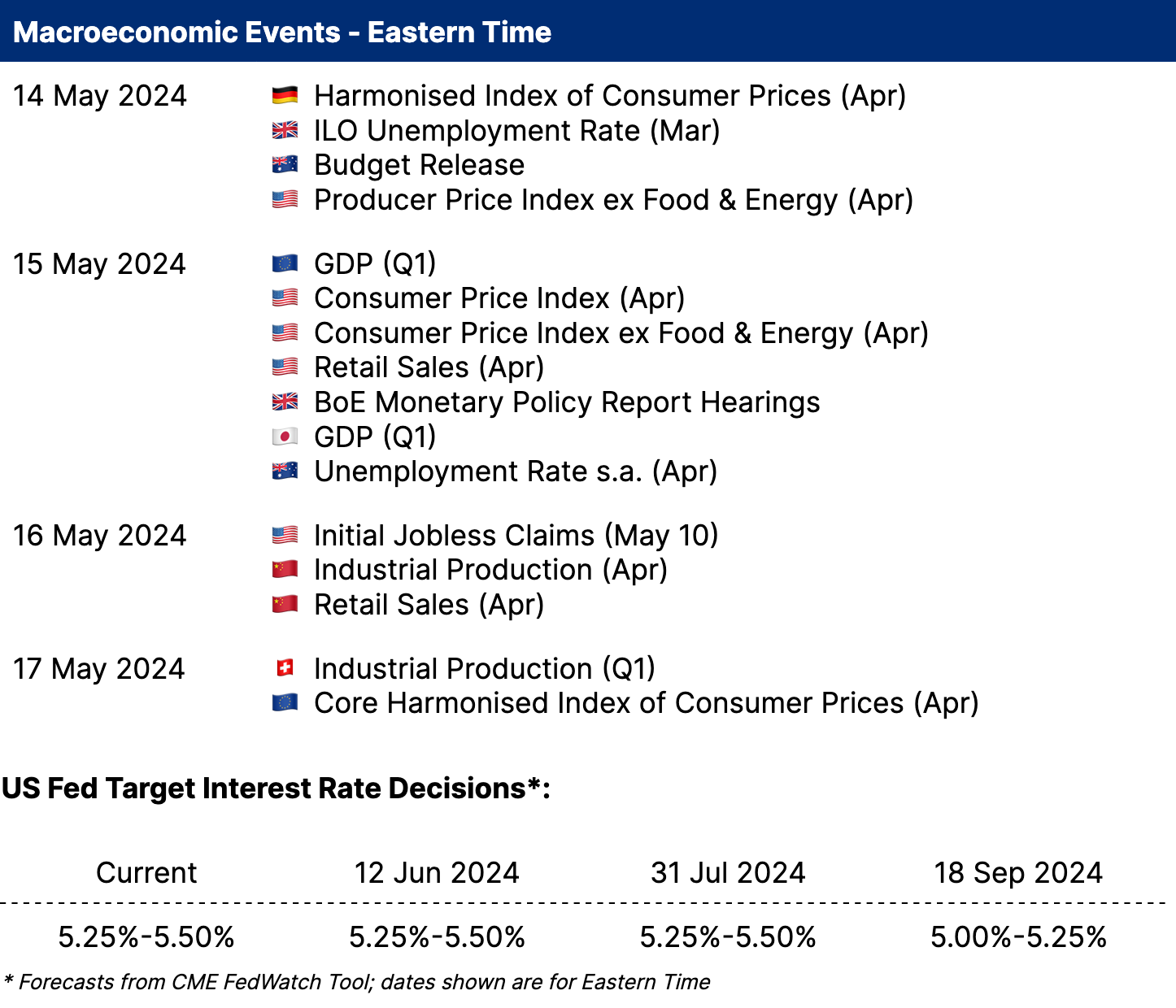

Catalyst CalendarWe’re all ears.Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you! AuthorResearch and Insights Team Disclaimer:The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.The brands and the logos appearing in this report are registered trademarks of their respective owners.Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening! Hungry for more? Visit our Research Hub and University to access other insightful crypto research! Share with a friend if you like our email! Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming is free today. But if you enjoyed this post, you can tell Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

NFT & Blockchain Gaming Weekly - 📈Fantasy Top: NFT Trading Card Game Surges on Blast

Friday, May 10, 2024

NFT Lending Volume Exceeds $2.1B in Q1, Led by Blend. Moonbirds changes copyright policy under Yuga Labs. "Gacha Grab" catapults Azuki NFT sales to $1.1M in a day. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly - 🎉 Crypto.com Reaches 100M Users, BlackRock’s BUIDL Becomes Largest Tokenised Treasury Fund

Wednesday, May 8, 2024

Crypto.com hits new milestone with 100 million global users. BlackRock's BUIDL is now the largest tokenised treasury fund. Ethereum devs propose EIP-7702 to enhance externally owned accounts. ͏ ͏ ͏

Crypto Market Pulse Weekly – 💸 HK Spot Bitcoin ETFs Saw ~$250M Inflows in 3 Days

Monday, May 6, 2024

Hong Kong Spot Bitcoin ETFs saw US$250M net inflows in 3 days. Morgan Stanley filed with the US SEC to permit exposure to Bitcoin ETFs. Australia is reportedly considering the launch of Bitcoin ETFs. ͏

NFT & Blockchain Gaming Weekly - 📈 NFT Lending Volume Exceeds US$2.1B in Q1

Friday, May 3, 2024

NFT Lending Volume Exceeds $2.1B in Q1, Led by Blend. Moonbirds changes copyright policy under Yuga Labs. "Gacha Grab" catapults Azuki NFT sales to $1.1M in a day. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly - 📈 EigenLayer Withdrawal Queue Rises Amid EIGEN Airdrop Controversy

Thursday, May 2, 2024

EigenLayer withdrawal queue count rises amid EIGEN airdrop controversy. Runes make up over two-thirds of Bitcoin transactions since its launch. BlackRock's BUIDL leads the tokenised fund race. ͏ ͏

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏