Earnings+More - ‘Hands off AGS’ plea

‘Hands off AGS’ pleaInvestor goes public on take-private fears, Flutter reaction, Sportradar, Aristocrat, Gambling.com earnings +More

Don't strip my world of this song. Activist laments ‘cheap’ AGS buyoutJust say no: An activist investor in gaming supplier AGS has gone public with fears that the offer from private equity house Brightstar offers shareholders little or no premium and has allowed for little investor understanding of the company’s “exceptional” recent trading performance.

Call that an offer? The $1.1bn take-private bid announced late last week valued AGS at a multiple of ~5.7x FY24 EBITDA. But Rohr said in the letter he does not understand why any shareholder “would be excited to sell” at a relatively low multiple and vs. a flat share price relative to 2019.

Let the dog see the rabbit: Rohr said market participants were not given the opportunity to assess the recent progress made by AGS as the offer came through “just hours” before the release of AGS’ “transformational” first quarter earnings. In Q1, AGS adj. EBITDA grew by 21% to $44m on revenues that rose nearly 13% to $96m.

Reel around the fountain: Rohr pointed to a further reason for skepticism over the Brightstar bid, saying it also failed to reflect any benefit AGS stands to gain from the coming market disruption caused by the IGT/Everi merger.

Less Than 110 Days To Comply Frictionless affordability checks are required from 30 August 2024. No time to waste – email michael@dotrust.co.uk and join other leading operators including Rank and Lottoland on the leading dedicated platform for financial assessment. +MoreShuttered: The Mirage’s new owners Hard Rock have confirmed a mid-July closing date for the Las Vegas Strip property. It is planned to reopen as the Hard Rock Las Vegas in spring 2027. Gaming & Leisure Properties has three regional casinos on a sale-and-leaseback arrangement with Strategic Gaming Management for $105m in Nevada and South Dakota. Betting exchange challenger Prophet Exchange is to shut up shop in New Jersey at the end of the month, according to Sports Handle. This leaves Sporttrade as the lone exchange operating in the state. Read acrossCall the police: In Compliance+More this week, the Commodity Futures Trading Commission has moved to ban event contracts tied to political outcomes as it seeks to avoid playing the role of an “election cop.” Stake in the ground: In the Token Word this week, Stake sets out its plans to build a hub in Bogatá, Colombia; while in the realm of prediction markets, Socios.com parent Chiliz has partnered with on-chain prediction markets liquidity provider Azuro to collaborate on the build of a sports prediction market on the Chiliz platform.

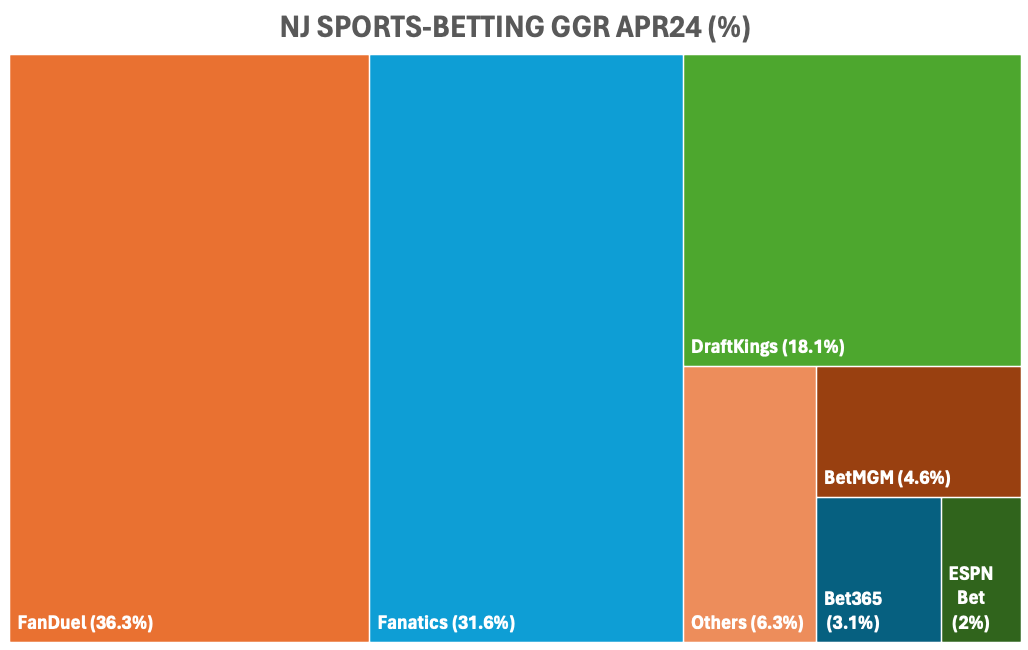

By the numbersCreeping closer: B&M gaming in New Jersey fell over 6% YoY to $217m while iCasino was up a further 18% to $187m. Sports-betting GGR rose 47% to $106m on handle that enjoyed a 25% uplift to $1.04bn.

👀 Fanatics cements second place in NJ with $32.9m in GGR Massachusetts: Total state gaming GGR dropped 8% YoY to $147m in April. B&M gaming was down 3.6% while sports-betting GGR was down by 16%. The gap continued to close between the top two, with DraftKings on 48% vs FanDuel’s 39.5%. Big get bigger: With roughly half the states having reported in April, GGR data showed the top two tightening their grip on the market with a combined 84% market share. According to the team at JMP, FanDuel controlled over 47% of the market while DraftKings hit over 36%, both figures representing an advance on the Q1 shares.

Aristocrat earnings recapSpin cycle: Fresh from completing the NeoGames acquisition, Aristocrat announced a strategic review for the developers elements of its social gaming unit, with both Big Fish Games ex-the social casino business and Plarium Global either being spun out as a separate entity or sold outright. By the numbers: The news came with H124 showing revenue up 6% to A$3.27bn ($2.18bn) and EBITDA up nearly 18% to A$1.2bn. B&M gaming revenue was up 8% to A$1.83bn, Pixel United was down 1% to A$877m while the newly rebranded Aristocrat Interactive enjoyed a 49% increase in revenues to A$71.9m.

Target practice: Asked about further M&A, Croker noted the consolidation in the supply space right now and argued that would “free up opportunity to take more share and for us to be more competitive.”

IGT earnings recapClimb Everi mountain: Analysts said IGT’s ongoing “solid” execution ahead of the planned merger with Everi was of vital importance, after it posted Q1 revenue up 1% to $1.07bn with adj. EBITDA down 1% at $443m. Tutto bene: Key to the performance was Italian lottery, and CEO Vince Sadusky reassured analysts on the call that as the only operator that has held a license for three decades IGT was “confident” about competing for the next licensing term.

Flutter reactionSatisfaction guaranteed: With Flutter CEO Peter Jackson waxing lyrical about the success of Paddy Power’s Super Sub in the UK – which allows punters to swap in a player to keep a same-game parlay alive – the team at CBRE noted how product innovation “remains a theme globally.”

Doing it by the book: Looking into the North Carolina launch, the team at JMP pointed out it was the quality of product in both OSB and iCasino that was now part and parcel of the new state playbook for FanDuel. Sportradar earnings recapServe and volley: The sports-betting data, AV and services provider added beat and raise to its roster in Q1 as it saw revenue of $266m come in 7% above consensus and adj. EBITDA of $47.2m that was 25% ahead of prior estimates.

Ground game: In OSB, Koerl noted the managed trading services offering saw turnover during Q1 rise 28% to over €9bn, which were it a single sportsbook would make it the global leader. He noted the launch of the Alpha Odds sports-trading offering in tennis and said it would soon go live with basketball. Earnings in briefCodere Online: Revenues were up 34% for the Spain- and Mexico-focused operator, while it posted a positive EBITDA contribution of €1.7m. Mexico further enhanced its status as the company’s biggest market. See next week’s LosIngresos+Mas for more. FL Entertainment: The home to Betclic, which will henceforth be known as Banijay, said revenue at the betting and gaming division rose 32% to €322m, with sportsbook revenues up 25% to €247m and iCasino up 67% to €51.2m.

Galaxy Entertainment: Net revenue came in up 50% YoY to HK$10.6m ($1.4m), while adj. EBITDA of HK$2.8bn represented a rise of 49% as customer traffic improved during the quarter following renovations to the gaming floor at the Galaxy Macau. Know Your Customer (KYC) protocols have changed in the last 15 years, and KYC is now widely used for fraud prevention, regulatory compliance, customer security, and customer support. However, KYC’s evolution is far from complete! There are still opportunities for further development in the gaming industry, like adequately serving thin file populations. Catch up on expert insights brought to you by GeoComply, in our recorded webinar and blog post: Mastering Digital KYC in 2024 & Beyond AffiliatelandBetter Collective buys AceOddsAce Oddity: The leading betting-and-gaming affiliate has snapped up UK-based sports-betting media outfit AceOdds for €42m in cash and shares. Founded in 2008, AceOdds provides betting tools, odds, reviews and streaming schedules through its web- and app-based platforms. The deal represents a multiple of 4x LTM EBITDA.

Gambling.com’s Google snafuSearch and destroy: The negative effect of Google’s new policy on site reputation abuses with Gambling.com’s media partners was evident in a 7.5% share price fall yesterday. A widening net: The company cited Google’s actions as it cut its FY24 revenue forecast to $120m at midpoint vs. the previous guidance of $131m, with adj. EBITDA estimates now at $42m at midpoint vs. $45m previously.

Left a bit, right a bit: Gillespie said Google had “moved the goalposts” on what it deems to be acceptable locations for particular types of commercial content. “Virtually all media partnerships, including the ones in the online gambling industry and our own have been affected,” he told analysts on the earnings call. Affiliate earnings in briefRaketech: Q1 revenues rose 20% YoY to €19m driven by the sub-affiliation segment where revenue more than doubled to €9m, while straight affiliation was down 19% to €8.8m. EBITDA was down 30% to €4.3m. The company said its Casumba business had been impacted by the Google core update. XLMedia: As previously signaled, revenues for the year fell by 29% to £50.3m, while adj. EBITDA was down 36% to £12.1m. The damage was done by the North American operations where sports-betting affiliate revenue fell 42%. The company warned this wouldn’t be rectified soon due to the expected seasonal dip. FansUnite, the company behind fan-activation business Betting Hero achieved a 14% YoY increase in revenues to $8.3m while adj. EBITDA rose 58% to $1.7m, helped by the recent North Carolina launch. Calendar

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Sunk! Games Global abandons float

Tuesday, May 14, 2024

Games Global IPO cancellation, Flutter momentum continues, Penn's ESPN Bet downgrade, Deal Talk – Tipico +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FSB for sale… but who’s buying?

Monday, May 13, 2024

FSB sale rumors, Flutter reports Tuesday, Inspired's earnings recap, startup focus – Sports IQ sale +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Rakin’ Bacon maker fetches $1.1bn

Friday, May 10, 2024

AGS take-private, Bragg reports, shares watch – PointsBet +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Super Group buys an Apricot

Thursday, May 9, 2024

Super Group earnings review, Wynn beats, Light & Wonder on track, earnings in brief +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Exit routes: getting out on top

Tuesday, May 7, 2024

The pathway to getting out, Pelc from BeyondPlay on selling to Flutter, Inside the Raise – Kutt +More ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The

End 2024 with a BANG💥 (Huge GIVEAWAY!)

Tuesday, December 24, 2024

Over $12K in gizmos & gadgets up for grabs View in browser ClickBank Hi there, We've got something totally different for you today, some good value fun (with no-strings-attached) to wrap up

Survey: Tech VCs ride wave of optimism

Tuesday, December 24, 2024

Crypto headhunter turns VC; unicorn valuations are stampeding; Nordstrom family inks $6.25B take-private for chain Read online | Don't want to receive these emails? Manage your subscription. Log in

The Daily Coach's Picks: 10 Recommended Books of 2024

Tuesday, December 24, 2024

These books promise to help empower your journey of growth and transformation.

Here's everything retail media network experts are asking for this holiday season

Tuesday, December 24, 2024

If retail media network experts could write a letter to the North Pole, here's what they'd ask for. December 24, 2024 Here's everything retail media network experts are asking for this

Hack offline word of mouth

Tuesday, December 24, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏