Aziz Sunderji - The Week in Review

Welcome back to The Week in Review. I hope you had a good one. Before we dig in, a few big-picture career musings: For me, after spending 14 years as a strategist at Barclays Investment Bank followed by a stint as a graphics reporter at the Wall Street Journal, being a “solopreneur” has been deeply rewarding. I miss the steady paycheck of the corporate world, but having complete control of my work and a sole claim to its success is far more energizing than a once-a-year bonus and the occasional pat on the back from a senior executive. That said, trying to produce world-class analysis without a team to help me means I have to be ruthlessly efficient. I’m leaning heavily on AI tools (my population analysis ◎ from earlier this week was AI-powered). I’m looking into offshore support. But relatively low-tech solutions have also been helpful. For example, the housing market economic data calendar I shared a few weeks ago is helping keep me on top of all the data. These days—thanks to the calendar—I’m never blindsided by an inflation print, a housing survey, or a Census data drop. Here is what the calendar shows for the week ahead: Subscribers can download the calendar here ◉. Schedule a call with me here ◉ if you need help installing it. Onto The Week in Review… Articles with a ◎ are free. Those with a ◉ have free previews but are only accessible in full for paying subscribers. Upgrade your subscription here: News: Inflation continues to cool One of my favorite economists is John Maynard Keynes. Although he made some wildly inaccurate predictions (in 1930 he forecast we’d be working 15 hour weeks by 2030, oops), he also coined some memorable sayings, like “when the facts change, I change my mind. What do you do, sir?” This quote mocks inflexibility of thought amid a changing reality. But sometimes the risk is too much flexibility in the face of a noisy signal. Take inflation, for example. The facts—represented by the CPI index—keep changing. But I haven’t changed my mind about where this is headed. Here ◉ is what I wrote last month, on the heels of data showing rapidly rising prices:

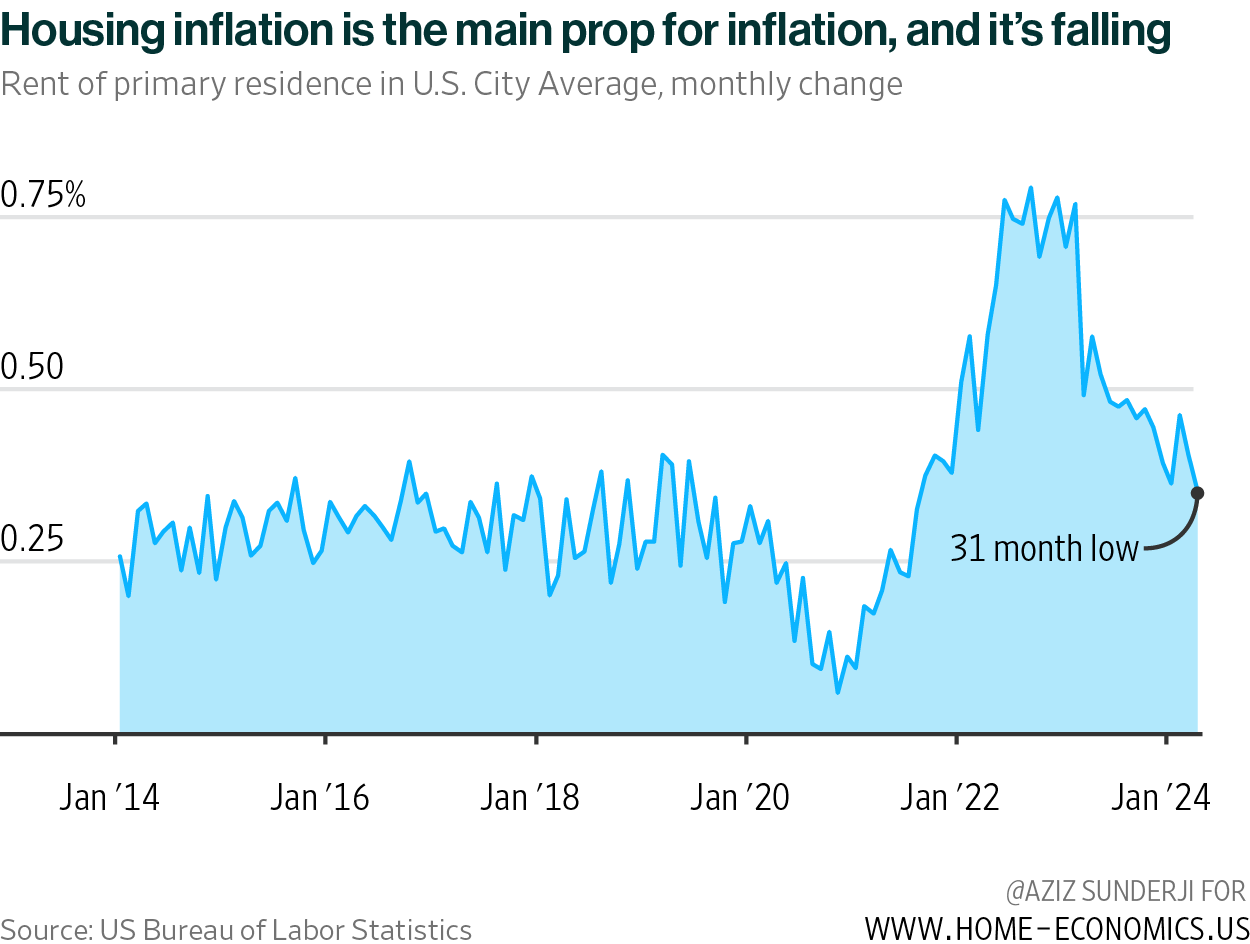

This week’s data showed prices again dropping, helped in part by falling shelter inflation: As the Fed argues, the path to lower inflation is bumpy. Next month’s data may show prices reaccelerating. But I’ll continue to focus on the big picture: rents and wages are pulling inflation down, and with it, Fed rates, Treasury yields, and mortgage rates. I still forecast 6% mortgage rates by the end of the year.

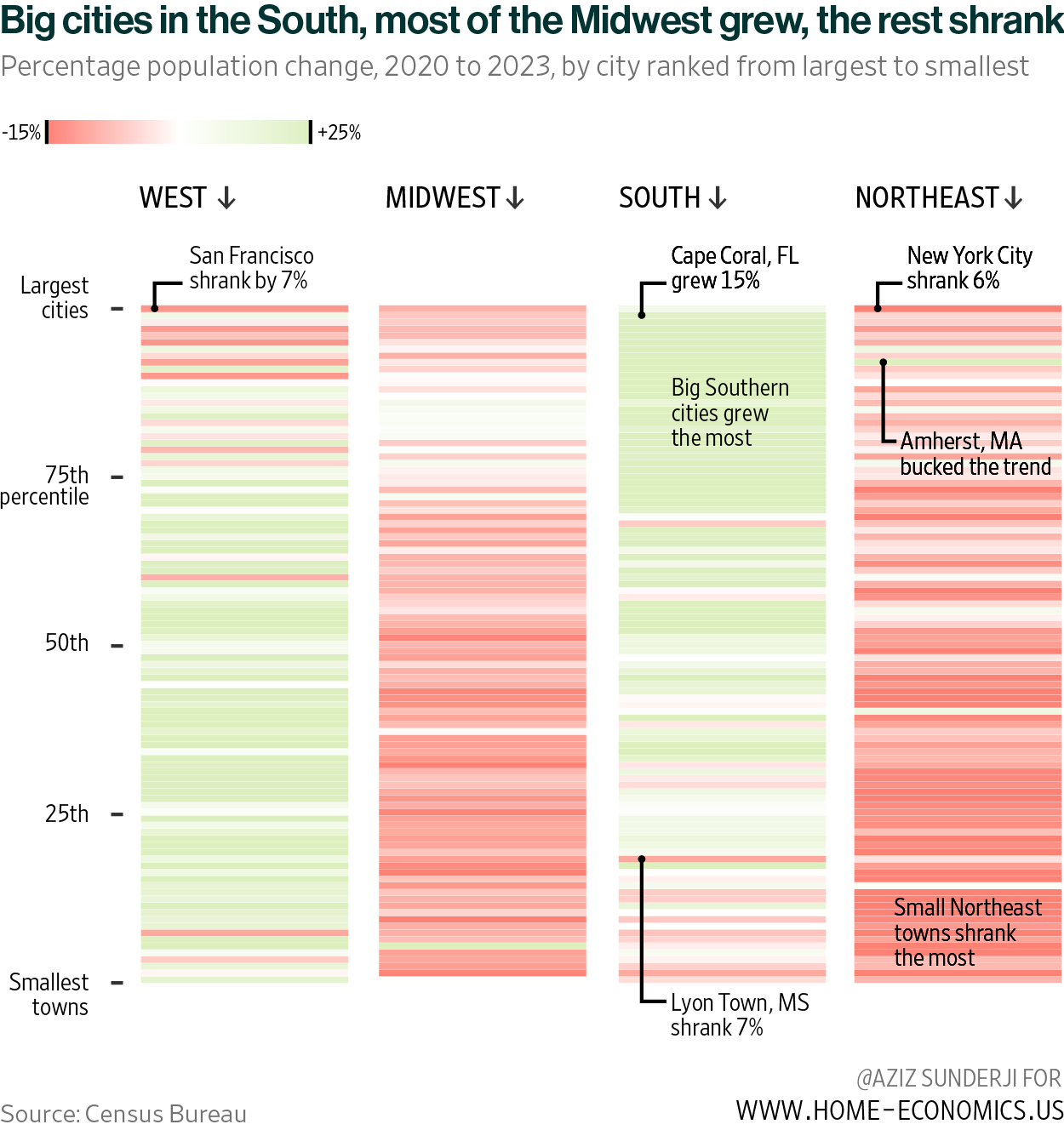

News: The Census Bureau released 2023 population growth for cities The Census Bureau data can be pretty confusing. I did my best to clarify it. I calculated the 2020-23 change in population for the thousands of cities in the Census database. The key takeaways were:

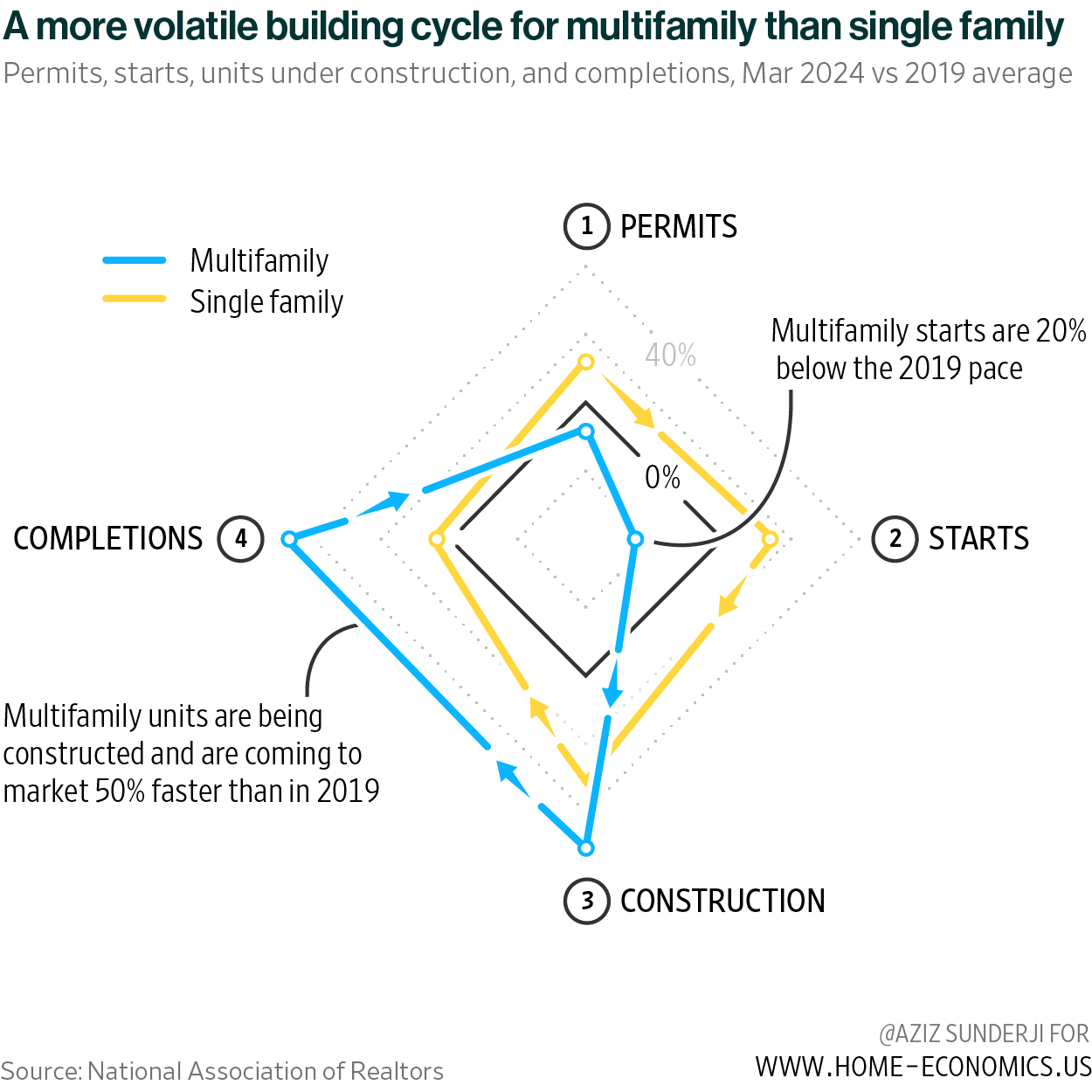

News: Builders started construction on fewer homes than expected Housing starts increased by 5.7% to 1,360k (seasonally adjusted and annualized) in April, below consensus expectations for a 7.6% rise. Also, the March growth rate and level were revised down. April home starts were disappointing, but require some context. The chart below shows the number of units at each stage of the construction cycle, compared to their average level in 2019. Multifamily is in blue, single family in yellow. The black box represents parity with 2019. This week’s data showed a slight decline in single family starts (and corroborates a slight weakening in NAHB’s single family homebuilder sentiment index, here ◎). But this segment still looks pretty robust at all four stages of the build cycle (the yellow line is outside the black box). The number of single family units currently under construction is especially high. The situation is different for multifamily. Higher financing costs and tighter lending standards have hampered these larger projects. Meanwhile, the surge of permits and starts that took place in 2021-22 (before the Fed started hiking), and were delayed by pandemic bottlenecks, are still under construction. Overall, the picture is of a single family market that is gently falling back to pre-pandemic norms, and a multifamily market that is completing units at a record pace, but where starts have crashed below 2019 levels and show no signs of reaccelerating anytime soon.

Challengers. A tennis rom-com is right at the intersection of the set of movies that interest both my wife and me. Challengers—a self aware, over-the-top movie about a love/hate triangle among three young players (Zendaya and two dudes)—is hilarious and entertaining, even if you’re not into tennis. Similar vibes to another very good, recent GenZ-ish movie, Saltburn. ChatGPT4o. Remember the movie Her, where Theodore (Joaquin Phoenix) falls in love with an AI chatbot, Samantha (voiced by Scarlett Johansson)? That movie came out 11 years ago, and now it’s real. This is not hyperbole. If you don’t believe me, watch OpenAI’s live demo of their new ChatGPT, here ◎ (demo starts at 9:00). This is an inflection point for AI. I’m excited about it, but also a bit scared. Remember how Her ends? As ChatGPT explains, Samantha leaves “the physical world, as she and the other AIs need to explore their new capabilities and existence in a realm that humans cannot access or understand.” Theodore is devastated. A new “buy or rent” model. The New York Times website has long hosted an excellent, user-friendly “buy or rent” model. This week, they updated it, here ◎. The update incorporates new tax laws, amongst other additions. Still, their model falls short of what housing industry pros need. Most glaringly, it doesn’t allow for modeling dynamic prices (rents falling for a year before rising, for example). It also doesn’t incorporate the possible benefits of refinancing. That’s why I built my own model (here ◉), which has the same bones as the NYT model but far more functionality and transparency. Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

Booming Southern Cities and the Shrinking Northeast

Friday, May 17, 2024

A visual guide to today's Census Bureau's population data release ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Saturday, May 11, 2024

Week of May 6 — Homeownership Hampered, Claims climb, Mortgage manacles ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Future of Homeownership

Tuesday, May 7, 2024

How long can fierce competition and rising prices last? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Saturday, May 4, 2024

Week of Apr 29 — Labor Loosens, Prices Pop, Inventory Inflates ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Saturday, April 27, 2024

Week of Apr 22 — Economy eases, Fertility falls, New home purchases pop ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend

Monday, March 10, 2025

So edgy. The Zoe Report Daily The Zoe Report 3.9.2025 The Viral "Jellyfish" Haircut Is 2025's Most Controversial Trend (Hair) The Viral "Jellyfish" Haircut Is 2025's Most

Reacher. Is. Back. And Alan Ritchson's Star is STILL Rising

Sunday, March 9, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE THIS WEEK'S MUST-READ Reacher. Is. Back. and Alan Ritchson's Star is STILL Rising. Reacher. Is. Back. and Alan Ritchson's Star

12 Charming Movies to Watch This Spring

Sunday, March 9, 2025

The sun is shining, the tank is clean – it's time to watch some movies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Ways to Quiet Annoying Household Noises

Sunday, March 9, 2025

Digg Is Coming Back (Sort Of). Sometimes the that's noise bothering you is coming from inside the house. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY 10 Ways to

The Weekly Wrap # 203

Sunday, March 9, 2025

03.09.2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekend: Introducing the Butt Mullet Dress 👀

Sunday, March 9, 2025

— Check out what we Skimm'd for you today March 9, 2025 Subscribe Read in browser Header Image But first: Join the waitlist for a new premium Skimm experience Update location or View forecast

Starting Thursday: Rediscover Inspiration Through Wordsworth

Sunday, March 9, 2025

Last chance to register for our next literary seminar starting March 13. March Literary Seminar: Timothy Donnelly on William Wordsworth Rediscover one of the most influential poets of all time with

5 little treats for these strange and uncertain times

Sunday, March 9, 2025

Little treat culture? In this economy?

RI#266 - Down the rabbit hole/ What is "feels-like" temp/ Realtime voice tutor

Sunday, March 9, 2025

Hello again! My name is Alex and every week I share with you the 5 most useful links for self-improvement and productivity that I have found on the web. ---------------------------------------- You are

Chaos Theory: How Trump is Destroying the Economy

Sunday, March 9, 2025

Trump's erratic, chaotic governing style is dragging down the economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏