China Dumps Treasuries, But Stablecoins Could Save The Day?

Today’s letter is brought to you by Consensus 2024!Consensus 2024 is happening May 29-31 in Austin, Texas. This year marks the tenth annual Consensus, making it the largest and longest-running event dedicated to all sides of crypto, blockchain and Web3. Don’t miss Bitcoin: We Are So Back, where Anthony Pompliano will discuss what the next bull market will look like, how it will differ from previous run-ups and the broad macro investment thesis for bitcoin and crypto more broadly. Consensus has tailored programming for Bitcoin maxis and multi-chain mavericks alike, covering everything from post-halving strategies to mining and more. Plus, you absolutely won’t want to miss the epic BTC (Nic Carter) vs ETH (David Hoffman) battle at Karate Combat. That’s just a taste of what's to come at crypto’s only big-tent event. Join Consensus in Austin alongside 15,000+ investors, founders, brands and more to take in all that blockchain has to offer. Get your pass today and use code POMP to save 20%. To investors, We are headed towards a multi-polar world. This is the perspective from an 18-month old podcast called Multipolarity. The hosts Andrew Collingwood and Philip Pilkington write for various publications on topics across finance and macroeconomics, while hosting the podcast which presents itself using the following description:

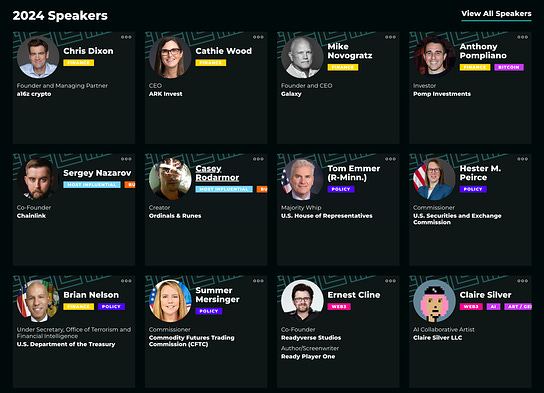

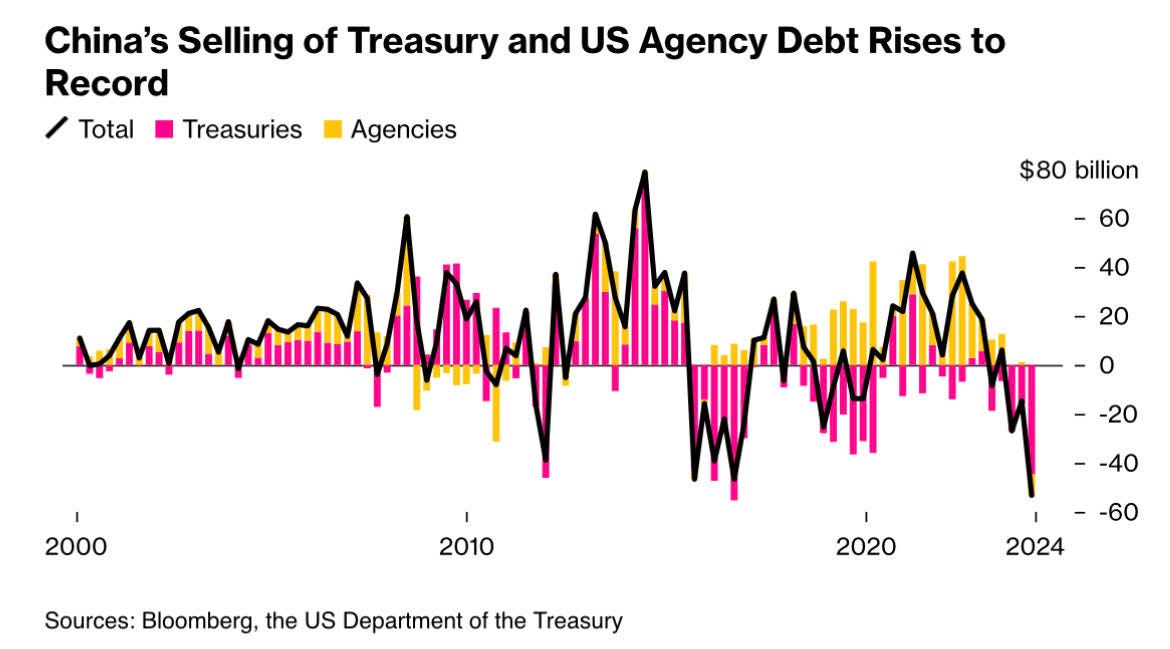

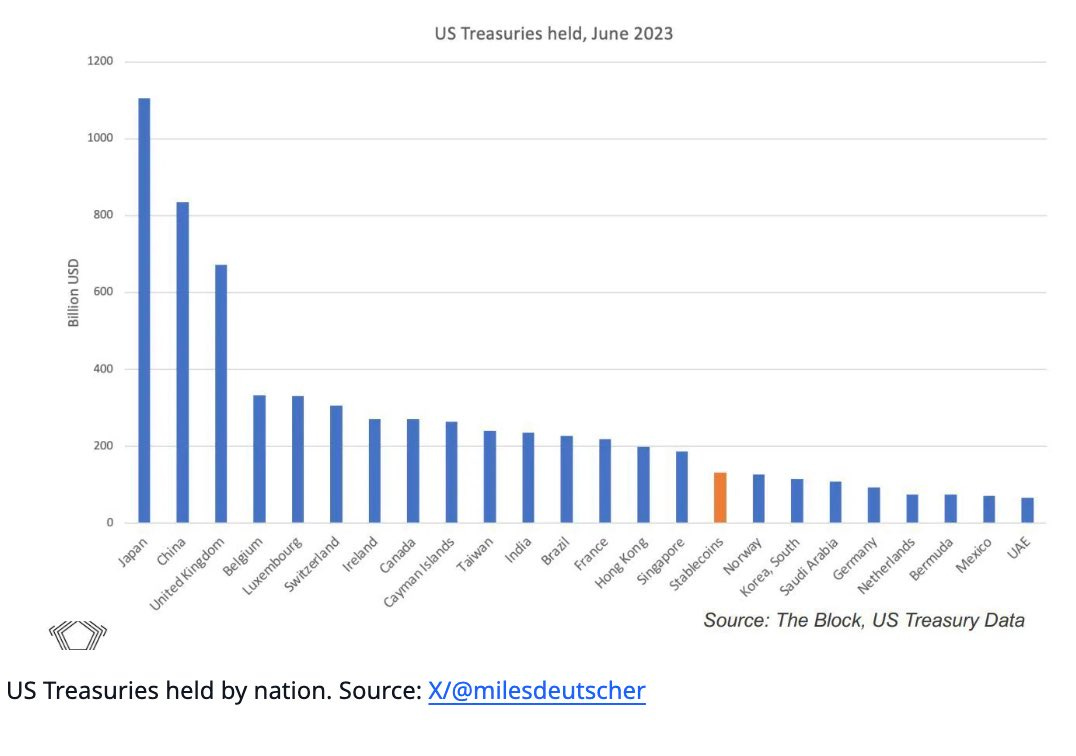

This context is important because Philip Pilkington recently put out an excellent Twitter thread on China’s continued selling of US debt. Normally when you see these opinion-laden posts, you can ignore majority of them because they were created by armchair critics. Pilkington may or may not be right in his conclusions, but at least he has credibility in evaluating geopolitical developments. So what is Pilkington worried about? China has been dumping US treasuries and debt at an accelerated clip, which has driven the measurement to an all-time high. This is not necessarily concerning by itself. But China is selling this debt at the same time that they are accumulating gold for their central bank reserves. This accumulation is still slightly below 5% of their total reserves, but that number is up more than 50% since the start of 2020. You can see an acceleration starting in the second half of 2022 in the chart above. Again, China being a net seller of debt has happened a few times before. China buying gold and increasing the percentage of their reserves has been happening for years as well. So what is the big deal? This is all happening at the exact same time that interest rates in the US have been increasing, which suggests that China is selling their debt to investors looking for higher yield. Pilkington points out this is important because it signifies a shift from a yield-insensitive buyer (China) to a yield-sensitive buyer (investment organizations). Everything is fine at the moment with this transition. Trouble will appear if the Fed starts to lower interest rates at a meaningful pace, which could happen if a recession was to hit the US economy, because these investors will start selling the debt as well. If foreign countries won’t buy our debt, and neither will investors like pensions or endowments, then who will buy the US debt? In a surprise development, stablecoin issuers may be the saviors that the Fed needs. I wrote to this group on December 1, 2023 in a letter titled “Are stablecoins saving the Treasury market?” the following:

This is not just the crypto industry talking about this development either. Former Speaker Paul Ryan recently sat down with Bloomberg to promote stablecoin legislation as a way to increase demand for US Treasuries. You can watch the clip here: Castle Island’s Nic Carter nailed the implications of Ryan’s comments with the following comments:

This brings me to my current thinking on this topic — China dropping US debt for gold is not exactly what the US wants to see. The offloading of our debt to weak-handed investors who will bail as soon as interest rates fall creates danger on the horizon. But the crypto industry may be able to save the day with growing popularity related to stablecoins. It is still too early to know for sure, but stablecoins have the best shot out of any other option we have seen to date. Crypto critics will have their brains in a blender reading this. I come in peace. I just want to share the facts and data that I am seeing in the market :) Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Kenny DeGiglio is the Co-Founder of Dream Startup Job and Crypto Academy. In this conversation, we discuss tips and tricks for landing a job in crypto, remote work vs in-office, US-based vs. international firms, compensation, bear vs. bull market, Dream Startup Job, an overview of Crypto Academy, and the benefits of going through the training program. Listen on iTunes: Click here Listen on Spotify: Click here How To Get A Job In Bitcoin & Crypto Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Podcast app setup

Monday, May 20, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Monday, May 20, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Monday, May 20, 2024

Open this on your phone and click the button below: Add to podcast app

Redneck Rich Financial Markets

Friday, May 17, 2024

Listen now (4 mins) | To investors, The last few weeks have been filled with fear, uncertainty, and doubt in financial markets once the Fed made it clear that the anticipated interest rate cuts would

Podcast app setup

Friday, May 17, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The

End 2024 with a BANG💥 (Huge GIVEAWAY!)

Tuesday, December 24, 2024

Over $12K in gizmos & gadgets up for grabs View in browser ClickBank Hi there, We've got something totally different for you today, some good value fun (with no-strings-attached) to wrap up

Survey: Tech VCs ride wave of optimism

Tuesday, December 24, 2024

Crypto headhunter turns VC; unicorn valuations are stampeding; Nordstrom family inks $6.25B take-private for chain Read online | Don't want to receive these emails? Manage your subscription. Log in

The Daily Coach's Picks: 10 Recommended Books of 2024

Tuesday, December 24, 2024

These books promise to help empower your journey of growth and transformation.

Here's everything retail media network experts are asking for this holiday season

Tuesday, December 24, 2024

If retail media network experts could write a letter to the North Pole, here's what they'd ask for. December 24, 2024 Here's everything retail media network experts are asking for this

Hack offline word of mouth

Tuesday, December 24, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

🎯 Stop Planning Your Goals Like An Amateur

Monday, December 23, 2024

Here's how to actually crush 2025 while everyone else is nursing their hangover... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌁#81: Key AI Concepts to Follow in 2025

Monday, December 23, 2024

Plus – we become Hugging Face's residents 🤗