The Signal - The dukes of hazard

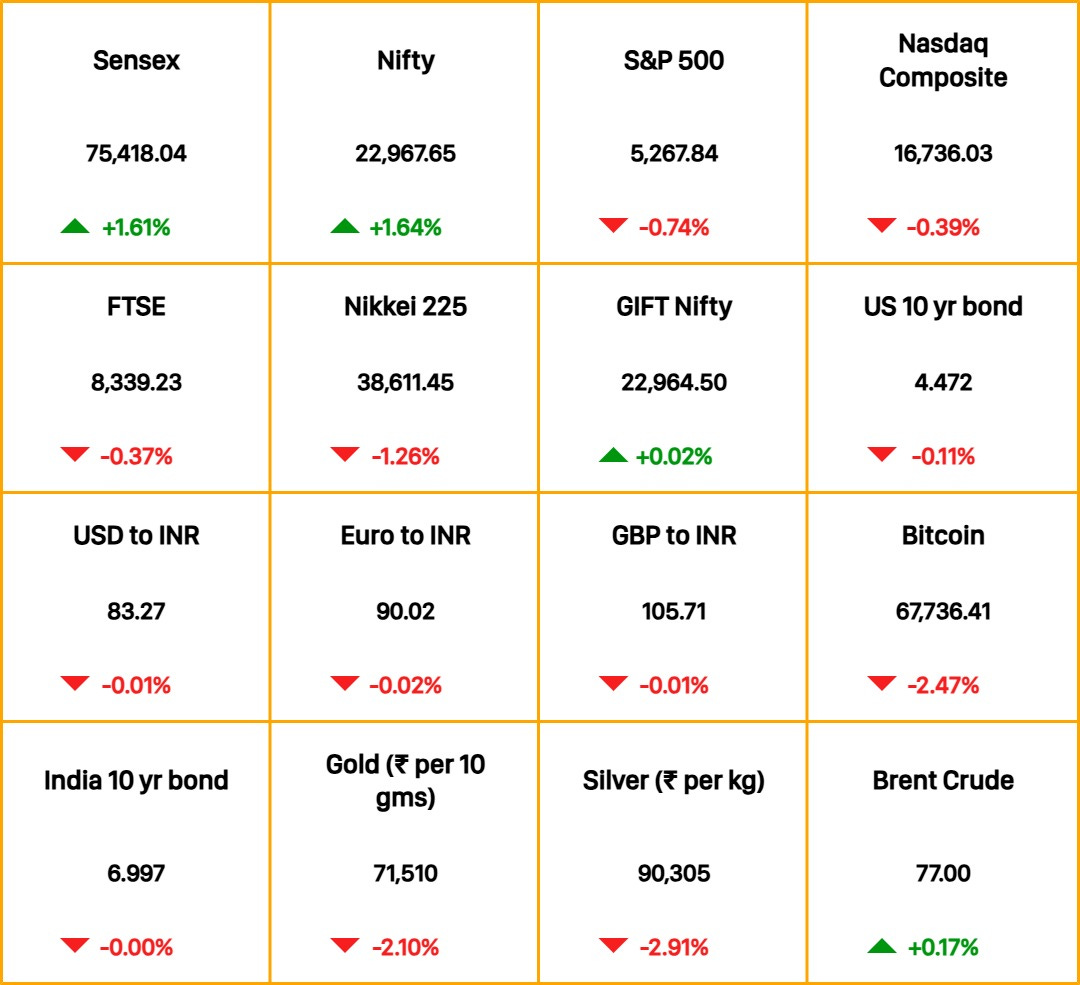

Good morning! Companies are coming up with some wild — and let's be honest, straight-up bonkers — use cases for generative AI. First, Bumble's founder Whitney Wolfe Herd floated the idea of bots doing the flirting for us; now, according to TechCrunch, Truecaller is rolling out an AI assistant who'll answer calls on our behalf. What's next? If AI can date for us and even handle our calls, it might as well start earning paychecks on our behalf too. Too much to ask? 🎧 Gen Z rewrites the workplace playbook. Also in today’s episode: the reality of the $100 billion climate pledge that requires rich nations to mobilise funding for climate initiatives in LMIC countries. Tune in to Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. Zinal Dedhia and Roshni Nair also contributed to today’s edition. The Market Signal*Stocks & Economy: Artificial intelligence chipmaker Nvidia’s blockbuster earnings have delivered a bonanza to investors in the stock. That includes mutual fund investors in India, reports Moneycontrol. The stock is held by most Indian asset managers, with Motilal Oswal leading the Nvidia bulls with an exposure now worth Rs 463 crore (~$55 million). Meanwhile, after being hit by insider trading charges, hedge fund Segantii Capital Management is reportedly selling most of its $4.77 billion holdings in Segantii Asia-Pacific Equity Multi-Strategy Fund in a single day. Asian markets were off colour in morning trade. Indian equities continued to rise as some short positions built up on election uncertainty began unwinding and the RBI’s massive dividend payout boosted sentiment. Odds of the Narendra Modi government returning to power improved in the informal betting market, whose sentiment impacts the stock market too. The GIFT Nifty indicates a flat or positive opening for Indian equities. LOGISTICSHold On To Your Hazard Hats……because the International Air Transport Association has introduced regulations for the handling of dangerous goods. Under the new rules, shippers have to fill out a declaration with every granular detail about their goods. They can no longer depend on third-party agents for their dangerous goods. Mess things up, and they face potentially nasty consequences. These bombshell regulations were introduced in 2023, but India wasn’t ready and requested an extension until August 31, 2023. That got pushed to April 1, 2024 so training academies could catch up. Spoiler alert: they haven’t. India’s aviation regulator, the DGCA, has started receiving applications for re-certifications, but has hit the pause button on training, and officials are confused about how to go forward. The ones who have submitted documents for re-certification have been waiting to hear from the DGCA for months now. Head to The Core to know the entire story. PODCASTTune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy. In today’s episode, he speaks to Sanjeev Hota, VP and Head of Research, Sharekhan, about how domestic institutional investors may play the peaks. MININGIn Search Of A Marketing MiracleBHP’s takeover of Anglo American (AA) was supposed to be one of the biggest megadeals of 2024. But AA has since rebuffed BHP’s overtures thrice, before agreeing to entertain it yet again. The question over De Beers’ (DB’s) future will loom even after the conclusion of this will they-won’t they situation. AA is offloading all 85% of its stake in the company synonymous with diamonds. But who’s buying? Options include Gulf sovereign funds and LVMH-owned luxury jewellery brand Tiffany’s. Whoever buys DB will be tasked with positioning mined diamonds as “forever” products again: almost half of all diamond engagement rings sold in the US this year had lab-grown stones. As for DB’s division for lab-grown diamonds, it faces stiff competition from Chinese and Indian rivals. The trick lies in not only spurring people to buy DB’s lab-grown stuff, but also in positioning mined diamonds as more desirable than their cheaper counterparts. ECONOMYBankable Savers

Are Indian households saving more? They are, going by two analyses, one by rating agency Crisil and the other by Wall Street bank Goldman Sachs. Crisil estimates (pdf) that household savings rose in FY24. Bank deposits climbed 13.5% in FY24 compared with 9.6% in FY23. It believes higher interest rates drew savers, who had diversified into mutual funds and real estate, back to banks. The net financial assets of Indian households, which account for about 61% of gross savings nationally, increased to 6% of GDP in FY24 from an 18-year low of 5.1% in FY23. Goldman Sachs reckons they invested heavily in real estate assets using borrowed money, which reflected in the property inventory to sales ratio falling to a 15-year low. Crisil says in FY24, home loans accounted for the largest share in bank retail lending at 47.4%. Physical assets constituted 60.1% of household savings in FY21 but rose to 70.2% in FY23. Yet, affordable homes aren’t selling. While home sales climbed sharply between 2019 and 2023, the share of those costing below Rs 40 lakh (~$48,000) halved to 19%.

FYIStuck: Vodafone-Idea may have to wait until after the election to receive equity funds from the government; it is converting the struggling telco’s government dues to equity. Pay up: Zee Entertainment has formally asked Sony Corp’s India arms to pay $90 million in termination fees for the botched merger between the two firms. Ticking the boxes: Reliance and Disney India filed paperwork with the Competition Commission of India, arguing their merger and combined cricket rights won’t hurt advertisers, Reuters reported. In style: India’s largest airline IndiGo will launch business class seating on select routes by the end of this year. Ship it: Google has tied up with Taiwanese manufacturer Foxconn to make its Google Pixel smartphones in the latter’s Tamil Nadu facility. THE DAILY DIGIT51,000,000The total number of hours of work a week Indian workers may be able to save by 2026, thanks to generative AI (The Economic Times) FWIWEat up!: Are you tired of spending on insipid restaurant meals? Perhaps you’ll be tempted by a gene-edited salad, or a takeout order home-delivered via… subterranean rail? Restaurants in the US are pushing the boundaries of normal dining to get customers spending on eating out again. They’re hoping to woo people tired of high prices by delighting them with the personal (menus customised to your past orders) and the plain weird (who wants a vegan leg piece with sugarcane ‘bones’?). They’re employing robots and scraping TikTok trends to offer meals made for the ‘gram. Clearly, just serving a hot plate of well-made, reasonably priced food is no longer enough 🤷🏽 The Signal is free today. But if you enjoyed this post, you can tell The Signal that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Can Google fix its mega Pixel flub?

Thursday, May 23, 2024

Also in today's edition: How climate change is making air travel riskier; China's tit-for-tat tariffs ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Indian mall operators turn ghostbusters

Wednesday, May 22, 2024

Also in today's edition: A Scarlett letter for Sam Altman; UK, India ply their trades ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Shadow banks gasp for air

Tuesday, May 21, 2024

Also in today's edition: TV pays to be free; Living with the virus ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Good Pass, Microsoft

Monday, May 20, 2024

Also in today's edition: India's growth targets are too hot to handle; More bad medicine ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How will foreign policy fare after the world's biggest election?

Saturday, May 18, 2024

Multiple diplomatic challenges await the new government that takes charge in New Delhi in June ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Where Are The 2021 Unicorns Today?

Tuesday, March 4, 2025

60% Are Stuck In Limbo To view this email as a web page, click here saastr daily newsletter Where Are The 2021 Unicorns Today? 60% Are Stuck In Limbo, Per Carta By Jason Lemkin Sunday, February 2, 2025