The Pomp Letter - The Public Market Pivot

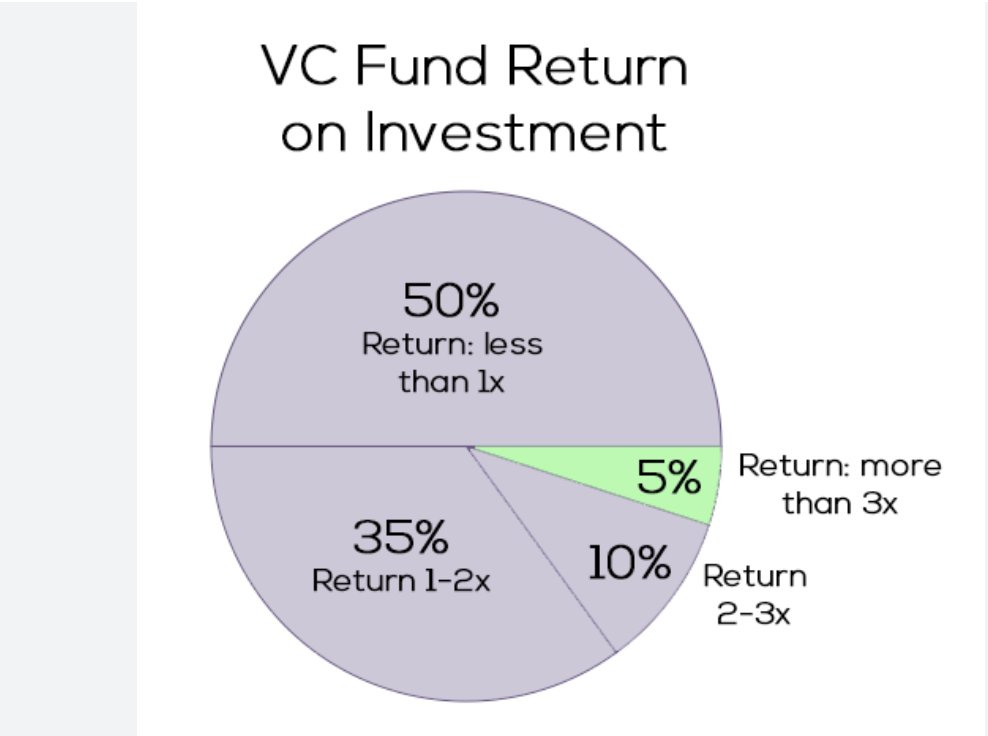

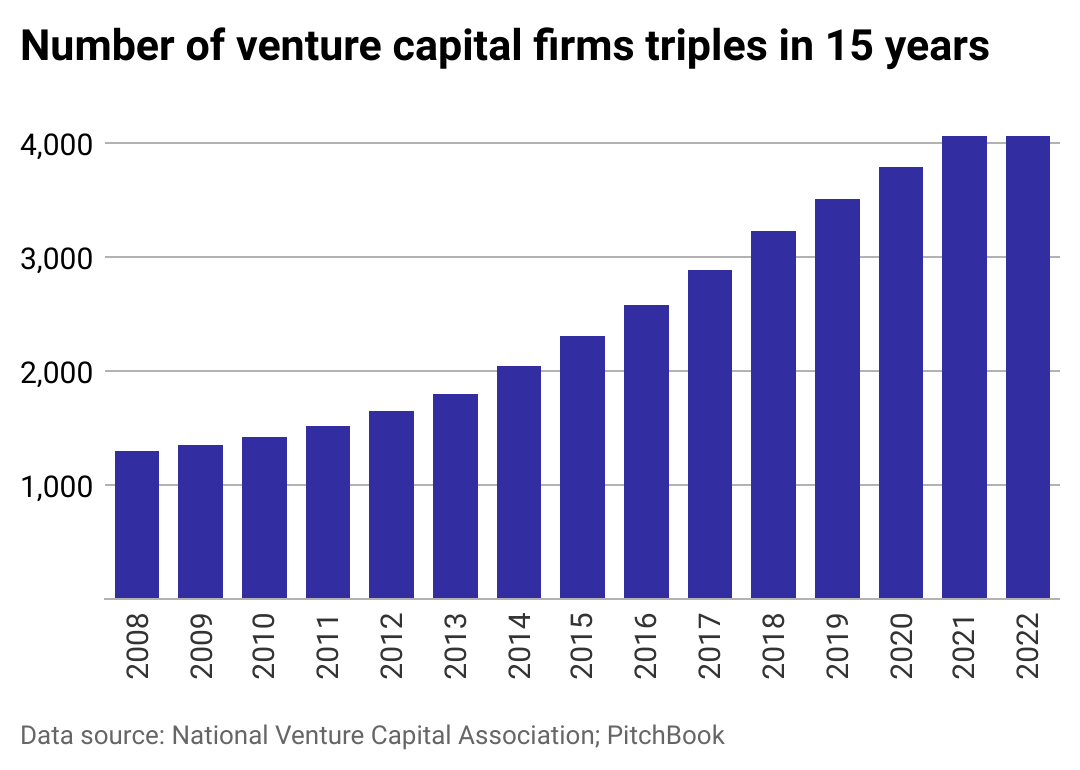

To investors, The last 15 years of investing have been dominated by private market investors. The average venture capital fund returned ~ 17% compounded. During the same time period, QQQ compounded at 13% annually. This 400 basis points of outperformance would make any market participant salivate. But the analysis is not that simple. First, the average venture fund is probably holding shares in companies that haven’t been marked-to-market, so those companies are worth much less than currently stated. Remember, the data can be very confusing. On one hand, reports are that about 50% of venture funds fail to return their original investors’ capital. But other reports claim that 50% of all venture funds actually outperform the stock market. Regardless of which it is, everyone agrees that venture funds keeps investors illiquid for 8-12 years. The story seems messier now, right? Are venture funds worth the complexity and uncertainty? Just wait - it is only going to get more complex. There are nearly 3x more venture capital funds today compared to 15 years ago. On top of the increase in venture funds, investors are also gaining new ways to access private market deals. The secondary market is more liquid than ever and we even have a closed-end, publicly traded fund that gives investors exposure to the most popular private companies. These developments mean that competition is significantly increasing for venture capitalists. When competition increases, returns begin to compress. My guess is that the average venture fund will not outperform QQQ by 400 basis points moving forward. The best VCs in the world will continue to dominate (and beat the market by a large margin), but the new competition is going to arb the outperformance away for the average fund. Why is that important to understand? Because I believe we are about to see a renaissance of public market investors. In a way, this is not some profound insight. Crypto has popularized publicly available, liquid financial markets. These digital assets are now collectively valued at more than $2.5 trillion. So if you combine the popularity of crypto with the incoming competition in venture capital, you can see why the younger generation will start investing in the public stock market more often. You have already seen public market hedge funds crossing over to invest in private markets, but now I am starting to see private market investors crossing over to invest in public markets. The largest example is Sequoia, but there are many others who have not explicitly stated their strategy expansion. Critics of the “public markets will become more popular” view will point to the decline in number of US public companies. According to Google AI, “the number of publicly traded companies in the United States has been declining since the 1990s. In 1996, the number of companies peaked at around 8,090, but by 2019 it had dropped to 4,266. As of April 2024, the number was around 4,300.” Proponents of the view will simply point to the current trend of public market infrastructure blending with crypto assets, which is highlighted by the ETFs, mainstream exchanges evaluating crypto, and legacy finance investment firms allocating billions of dollars to the new asset class. I will take it one step further though — the best investors of the new generation won’t simply invest in crypto companies in the public market, but rather they will seek out the best investment opportunities regardless of the industry. Venture capital will always have a place in an investors’ portfolio, especially if you invest with the best VCs. But public markets are going to make a roaring comeback in popularity over the coming years. I see it in my own personal investing. I see it in my friends’ investing. And I can’t find a reason why the trends will slow down. Thankfully, more investors participating in the public market is ultimately a positive development for financial markets. Now we need the amazing private companies to go public earlier. That won’t happen as long as the private market is flooded with cheap capital though. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Matthew Sigel is the Head of Digital Assets Research and Portfolio Manager at VanEck. In this conversation, we talk about bitcoin, ethereum, miners, global adoption, regulation, conversations VanEck is having with their clients, where opportunities exist, and how crypto and politics are intersecting with each other. Listen on iTunes: Click here Listen on Spotify: Click here VanEck’s Matthew Sigel Explains What The $100 Billion Asset Manager Is Doing In Crypto Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Podcast app setup

Monday, June 10, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Friday, June 7, 2024

Open this on your phone and click the button below: Add to podcast app

Altcoins Are Coming To Wall Street

Friday, June 7, 2024

Listen now (2 mins) | To investors, Franklin Templeton is considering a big push into the altcoin market. This is the latest development for large financial institutions based on reporting from Yueqi

The Exchange Wars Are Heating Up

Thursday, June 6, 2024

Listen now (4 mins) | To investors, Robinhood announced this morning they are buying crypto exchange Bitstamp for $200 million. This consolidation in the exchange space is a continuation of what I

Podcast app setup

Thursday, June 6, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

AI keeps its grip on early-stage deals

Monday, December 23, 2024

Playground Ventures pares flagship fund size again; ecommerce startups ring up a funding surge; is 2025 the year of the industrials revival? Read online | Don't want to receive these emails? Manage

Found Ya 📍

Monday, December 23, 2024

Biz directories are still big.

The Pareto Principle in Practice: Why Two Is Better Than Three

Monday, December 23, 2024

By leveraging the Pareto Principle and following these five steps, we can avoid analysis paralysis and concentrate on decisions that truly move the needle.

Marketers may become part of the culture war — even if they didn't intend to be

Monday, December 23, 2024

As consumers put brands' advertising and marketing messages under a microscope, marketers have to be keenly aware of how anything they put out in the world could be interpreted — or misinterpreted.

The Vend-pire Strikes Back

Monday, December 23, 2024

What could be more enticing than a 24-hour business with no payroll or monthly lease? This business could mean “the vend” of your financial struggles.

🔔Opening Bell Daily: Santa Rally at risk

Monday, December 23, 2024

Investors are recalibrating to the Fed's slower pace of rate cuts and higher inflation.

Hack retention like unicorns do

Monday, December 23, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3