Permissioned or Permissionless? | BanklessDAO Weekly Rollup

Permissioned or Permissionless? | BanklessDAO Weekly RollupCatch Up With What Happened This Week in BanklessDAODear Bankless Nation,🏴 As we approach the end of the year’s first half, things seem to be falling into place. From trimming down the community to contributor engagement in the tlBANK Snapshot, the future of the DAO appears to be taking shape. The recent community call served as a reminder of how the DAO should function moving forward, with discussions focused on our future. This week's editorial arrives at a crucial moment. It highlights a critical debate within the BanklessDAO community: should our organization operate on a permissioned or permissionless model? This debate started after a member’s request for Farcaster control was denied, creating tension between centralized control and decentralized participation. Amidst these discussions, remember that our goal as a community is to stay united without losing sight of our purpose. To achieve this, we must remain strong and focused. Take some time to relax and have a wonderful weekend. Contributors: Lucent, Boluwatife, Tonytad, Paulito, Kornekt, WinVerse This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🏃♀️ Catch up: Listen to this week's Community Call recording. Permissioned or Permissionless?Author: Boluwatife A recent conversation within the BanklessDAO community has brought to light a fundamental question: should the DAO operate on a permissioned or permissionless model? This debate was ignited by a situation involving Farcaster control, where ownership was requested but ultimately denied. The incident has prompted broader questions about how BanklessDAO should organize its communication channels. BanklessDAO's marketing department (MD), currently holding control over certain channels, decided not to post due to the pause in operations. This decision has highlighted the tension between centralized control and decentralized participation within the DAO. Some members are advocating for a more decentralized approach to communications, while others support the MD's cautious stance. The members who advocated for a more decentralized approach argued that there should be adherence to established departmental constitutions within BanklessDAO. Another member questioned why people were reluctant to work within or were gating certain channels, especially when there were already laid-down guidelines for departmental operations. This has raised an intriguing question for BanklessDAO: Is it detrimental for groups within the DAO to assert independence and individuality? BanklessDAO's Evolving Modus OperandiThe members who supported MD’s cautious stance highlighted an existing modus operandi where departments, such as Marketing, acted on behalf of BanklessDAO. However, with ongoing restructuring efforts, many members believe there's a push for the DAO to take more direct charge of its communications. This shift led to debates over asset ownership and access rights within BanklessDAO. Ownership vs. AccessA crucial distinction was made between ownership and access within BanklessDAO. Ownership typically managed through cryptographic keys, represents ultimate control over an asset. Access, on the other hand, can be granted to trusted individuals who have demonstrated their capability. This differentiation is vital in understanding how BanklessDAO can maintain security while fostering broad participation. It was then clarified that past ownership issues have made BanklessDAO's marketing department cautious about granting access to brand assets. However, members agreed that there's an openness to proposals that would enable brand asset managers to give access to trusted and capable individuals. This approach aims to balance security concerns with the need for active participation within the DAO. BanklessDAO's Path ForwardThe conversation underscores the importance of clear communication during BanklessDAO's restructuring process. Members are encouraged to focus on current issues rather than borrowing grief from the past. The DAO is grappling with fundamental questions about its identity and future direction, encapsulated in the query: "Who are we, where are we, and what do we want to be?" This situation is viewed by many as an interesting experiment in decentralized governance, requiring active participation from all BanklessDAO members. It highlights the innovative nature of DAOs and the continuous learning process involved in their management. One quote that hits home was made by coffee-crusher, which is “We are all in charge of governance, governance is for everyone”. It is important that we all key into this mindset. The Dissolution ScenarioDuring the discussion, an intriguing point raised was how different groups with ownership stakes would proceed in the event of BanklessDAO's dissolution. This forward-thinking consideration demonstrates the complexity of decentralized ownership and the need for clear protocols even in worst-case scenarios. ConclusionBanklessDAO's current governance debate illustrates the complex challenges faced by decentralized organizations. As BanklessDAO continues to evolve, discussions like these will be crucial in shaping its future and potentially influencing the broader DAO ecosystem. Key takeaways from this discussion include:

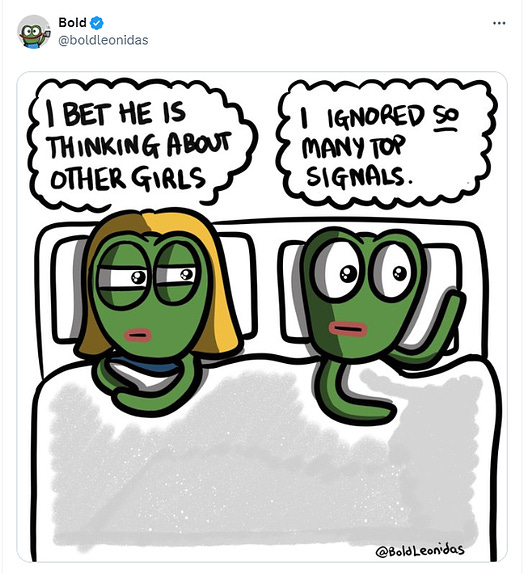

To participate in further governance discussions or state your ideas join the governance calls by 19:00 UTC every Monday. Have an amazing weekend. ⛴️ BanklessDAO Content🧠 Crypto SapiensLayer 2 ReviewThanks, Bold! |

Older messages

Layer 2 Airdrop Revolution? | Layer 2 Review

Wednesday, June 19, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Possible LP Reduction | BanklessDAO Weekly Rollup

Saturday, June 15, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Possible Pause Resolution | BanklessDAO Weekly Rollup

Saturday, June 8, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Blockchain Sequencers | Layer 2 Review

Friday, June 7, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Launching Into the Arbitrum Orbit | Layer 2 Review

Monday, June 3, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏