The Pomp Letter - Will The Stock Market Trade 24/7?

To investors, The crypto market has been trading 24/7/365 since the first coins traded hands nearly 15 years ago. Anyone in the world with an internet connection can buy or sell assets, regardless of the time of day. Weekdays? Market is open. Weekends? Market is open. Midnight? Market is open. Holidays? Market is open. This type of always-on market is how assets should trade. It allows market participants maximum flexibility to express their views at all times. The US stock market hasn’t followed suit though. Stocks still trade in the normal 9:30am to 4pm EST timeframe. While these hours of operation have worked for investors over the last few decades, there are new types of investors showing up who want better access to markets. Lu Wang and Katherine Doherty wrote the following in Bloomberg over the weekend:

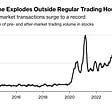

According to Lu and Katherine, the benefits of trading outside the normal hours is obvious:

And these benefits are leading to increased trading volumes for pre- and post-market trading hours. So who are these people that want to trade outside normal hours? The first example is a rise in algorithmic trading. Software doesn’t need time to eat or sleep. It doesn’t get sick. Computer code isn’t required to go to their child’s little league baseball game on Saturday. The code can execute 24/7/365, which means that money can be gained or lost at any time of day. Another example is the young retail investor who has grown up with a phone in their hand. Persistent access to the internet created a desire to have persistent access to financial markets as well. These young people already have 24/7/365 access to the new financial system, so they want the same access for the old system. This is proven when Lu and Katherine explained “after-hours trading accounts for as much as 25% of Robinhood’s total volumes.” Retail is at the gate. Now before you roll your eyes, remember that many of the largest financial institutions are expanding their product offerings to court self-directed retail investors. Wall Street is beginning to realize how much money these individuals have, along with their willingness to invest in various ideas. This brings me to where I think we are headed — the stock market will eventually trade 24/7/365. There are many nuances around things like clearing and settlement that need to be figured out, but persistent access to the market is coming. This means that attractive investment opportunities are coming too. There will be points of illiquidity or mispricing that are introduced when market trading hours are expanded. The kinks will be worked out over time, but in the short-term those opportunities will be present. Additionally, expanded hours of operations will lead to more trading volume, which most likely leads to higher prices across the stock market. This would be a welcomed tailwind by equity investors who are constantly looking for more catalysts to drive assets higher. And lastly, 24/7/365 trading hours will be another building block for the automated future we are headed towards. Many are excited about artificial intelligence at the moment, but there is a larger trend at play. Assets are going to be digitized, they will be traded by algorithms, and settlement will be instantaneous. I don’t know how long this evolution will take. The writing is on the wall though. Superior technology tends to triumph over people’s feelings. I am spending time thinking about where opportunity will exist in the new world so I am prepared. You may want to spend a few hours doing the same. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Alex Thorn is the Head of Firmwide Research at Galaxy Digital. In this conversation, we talk about bitcoin, bitcoin mining, ETFs, regulation, politics, global adoption, potential problems, token unlocks, Galaxy Digital, and more. Listen on iTunes: Click here Listen on Spotify: Click here My Conversation with Galaxy’s Alex Thorn Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Prepare For A Volatile Second Half Of The Year

Thursday, June 27, 2024

Listen now (2 mins) | To investors, Many financial assets are trading sideways as we enter the summer months. This can cause investors to question whether certain investment ideas have been disproven

Should The Fed Cut Interest Rates?

Tuesday, June 25, 2024

To investors, Carlyle Group's David Rubenstein told CNBC's Andrew Ross Sorkin yesterday he believes the Fed will hold off on cutting interest rates until after the Presidential election in

Podcast app setup

Monday, June 24, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Monday, June 24, 2024

Open this on your phone and click the button below: Add to podcast app

Inflation May Have Been Much Higher Than We Thought

Monday, June 24, 2024

Listen now (3 mins) | To investors, Former Secretary of the Treasury Larry Summers put together a Twitter thread back in February which was widely ignored. In his comments, Summers makes an argument

You Might Also Like

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏