The Fear & Greed Index Flashed Another Sign Over The Weekend

To investors, The timeless finance question of whether prices drive sentiment or sentiment drives prices has now come to the crypto industry. Krisztian Sandor had a great piece in Coindesk over the weekend that brought this question to the forefront. Sandor writes:

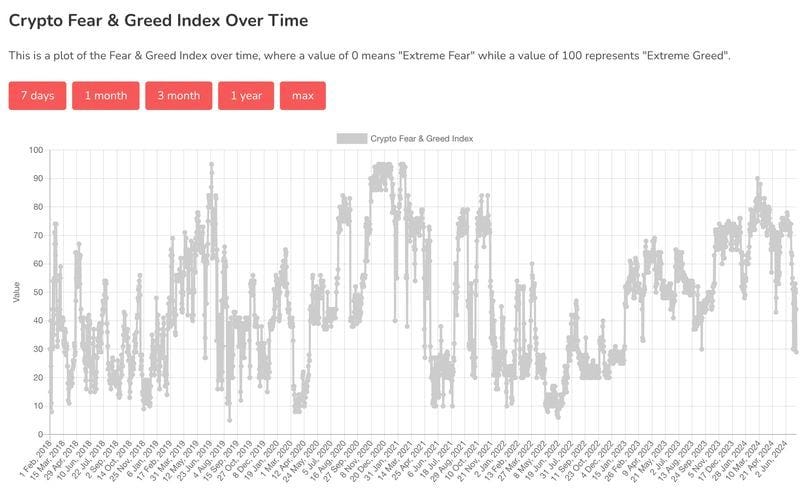

As Sandor correctly points out, the Greed and Fear index perfectly called the local top in March 2024. The question is what drives these volatile swings in the index? In the traditional finance world, Fear & Greed indexes for the stock market are almost exclusively driven by quantitative measurements. For example, here is how CNN describes the data sources behind their index:

Compare this to Alternative.me’s data sources for the bitcoin Fear & Greed Index:

You can see that about 40% of the data source weighting in the bitcoin version comes from social media, surveys, and Google Trends, rather than traditional quantitative measurements from the market. I don’t believe either methodology is better or worse, but it is obvious they are different. Crypto tends to have more social conversations than traditional finance, but the legacy market has more structured markets and mature data sources. The truth is that a perfectly designed Fear & Greed index would likely be some combination of these two approaches. So what does that mean for crypto investors in the coming months? You should use the Fear & Greed index as one of your data inputs for understanding where we are in market cycles, along with potential buying/selling opportunities. It isn’t perfect but the combination of qualitative and quantitative signals in a market like crypto should be a decent signal when things are getting too crazy and overheated. Additionally, I continue to see many bitcoiners throwing out wild price predictions measured in hundreds of thousands of dollars. While these predictions are exciting to dream about, I find it highly unlikely. An asset should get less volatile over time as it gets a larger market cap and higher degrees of liquidity. As I said going into the bitcoin ETF launch, keeping low expectations would be helpful for many people reading this letter. Happiness is having a small gap between expectations and reality. The lower your expectations, the smaller that gap will be. And if bitcoin decides to surprise everyone to the upside, you won’t be upset about that either. Fear. Greed. Happiness. The assets may be different in bitcoin and crypto, but human nature remains unchanged. Hope everyone has a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Phil Rosen, the Co-Founder of Opening Bell Daily, and Anthony Pompliano discuss the US economy, future outlook for the stock market, home affordability, and Presidential solutions for tackling the home affordability crisis so people can chase the American Dream. Listen on iTunes: Click here Listen on Spotify: Click here My Recent Analysis of the US Stock Market Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Home Affordability Has Been Destroyed And It Is A Major Problem

Wednesday, July 3, 2024

Listen now (4 mins) | To investors, Housing affordability has hit the lowest point since 2007 according to a recent article in Bloomberg. Prashant Gopal writes: “Owning a house is less affordable for

Risk-Free Return vs Return-Free Risk

Tuesday, July 2, 2024

Listen now (3 mins) | To investors, US Treasuries have long been considered the risk-free return. You could buy these assets, hold them to maturity, and you were guaranteed a pre-determined return.

Will The Stock Market Trade 24/7?

Monday, July 1, 2024

Listen now (4 mins) | To investors, The crypto market has been trading 24/7/365 since the first coins traded hands nearly 15 years ago. Anyone in the world with an internet connection can buy or sell

Prepare For A Volatile Second Half Of The Year

Thursday, June 27, 2024

Listen now (2 mins) | To investors, Many financial assets are trading sideways as we enter the summer months. This can cause investors to question whether certain investment ideas have been disproven

Should The Fed Cut Interest Rates?

Tuesday, June 25, 2024

To investors, Carlyle Group's David Rubenstein told CNBC's Andrew Ross Sorkin yesterday he believes the Fed will hold off on cutting interest rates until after the Presidential election in

You Might Also Like

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏