The Generalist - Ho Nam on an Investor’s Legacy

Ho Nam on an Investor’s LegacyThe Altos co-founder talks about hard times, being a great partner, and building a venture firm to last.🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Friends, Venture capital firms and wolverines have similar lifespans if I had to guess. Wolverines survive approximately ten red-eyed, furious, and murderous years in the wild. Many die much sooner. Though the average venture capital shop must wait a decade, at least, to see how their portfolio companies fare, there are more expeditious ways to die. You could incinerate capital in a terrific fit of exuberance, never to be trusted with LP money again, for example. Alternatively, you could limp along meekly, waiting for an opportunity that never arrives. There are dozens of such failure modes, and even practitioners of sound minds and morals may find them unavoidable, such is the inherent volatility of the underlying assets that make a firm. The industry’s precarity makes enduring firms all the more impressive. Slice into the gnarled and worn trunks of firms like Kleiner Perkins, Sequoia Capital, and Greylock Partners, and you will count more than fifty concentric rings earned through a half-century of investing. Bessemer Venture Partners, founded in 1911 by a co-founder of Carnegie Steel, boasts double that number. These are the outliers. They are also the benchmarks. It is not a prerequisite that practitioners of the asset class aspire to longevity. But there is no greater testament to your abilities as a manager than to cultivate a franchise that outlasts your contributions. After nearly 30 years in operation, Altos Ventures has already outperformed and outlived many of its peers. Since its inception in 1996 – the year the first “clamshell” mobile phone was released – the firm has not simply survived but thrived. Though luck plays a role in every investing journey, such durability does not occur by happenstance. It is the consequence of consistent excellence and thousands of good decisions, including those made by co-founder and Managing Partner Ho Nam. Over the previous two editions of my correspondence with Ho, we explored his investments in Roblox and Coupang, his preferred founder archetype, the importance of leaning into your winners, respecting the power law, venture’s unsung legends, and much more. In this final part of the series, Ho and I discuss legacy. What does it take for a firm to build an enduring franchise? How do you guard your mind against outside noise? How do you build a productive, aligned partnership? What near-death moments must you endure together? And how can you prepare to hand over the reins to the next generation? We also touch on the state of the asset class today and reflect on what it means to have a true venture education. As a final note, right after I sent my letter to Ho from London, he responded by saying he was in town. We met for a lovely breakfast, during which we discussed many of the themes in this and previous pieces. You’ll see it referenced below. Lessons from Ho

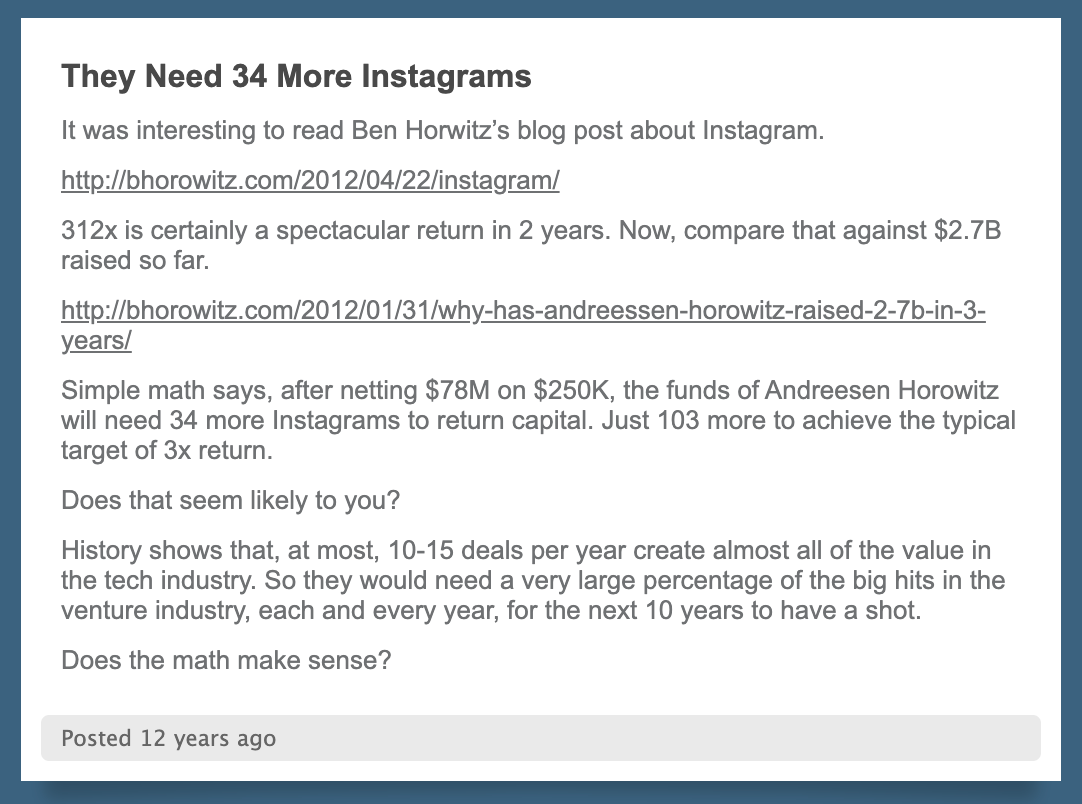

The rest of the letter is packed full of insights and other priceless lessons from a venture capital legend. To access them all and every future edition, become a member today. Mario’s letterSubject: An investor’s legacy Ho, Hello from London! The weather is far from summery (chilly and grey), but it’s a pleasure to be in this part of the world. I’ve been enjoying some long runs through the city’s parks and reconnecting with old friends. I hope your summer is off to a good and significantly balmier start. I so enjoyed reading your last letter on VC’s power law, and the practitioners you’ve learned the most from. Once again, I have to thank you for sending me down a delightful rabbit hole. While I was familiar with Arthur Rock and Don Lucas, I hadn’t heard of Arnold Silverman’s work. As you highlighted, his track record is beyond remarkable: founding investor at Oracle, Informatica, Business Objects, and many more. I hope to find many other investors like him to study in the coming years. To conclude our correspondence (which I have enjoyed greatly), I wanted to hone in on two primary areas: (1) your thoughts on today’s venture landscape, and (2) the principles that have allowed you and the Altos team to build a firm positioned to become a multi-generational franchise. Very few people in the world have the experience to comment on these topics as comprehensively as you do. Considering them is invaluable to every investor who wishes to succeed in the current environment and position themselves for a productive future. The modern venture landscape In 2012, you wrote a piece called “They Need 34 Instagrams.” It’s short enough that I’m sharing it in full in the snapshot below, and because you express the point so neatly. In the piece, you point to Andreessen Horowitz’s impressive $78 million return on their Instagram investment and note that the firm would need 34 more such outcomes simply to return the $2.7 billion in capital they’d raised in their first three years of business. In the twelve years since writing that piece, much has changed. It is increasingly common for the world’s most prominent venture firms to raise multi-billion dollar vintages, without even referencing the crossover funds like Tiger Global or Coatue. A16z has $42 billion in assets under management, split across multiple billion-dollar mini-franchises in crypto, gaming, biotech, American Dynamism, and beyond. Though I certainly don’t have detailed information on a16z’s returns, as early as 2016, the Wall Street Journal reported that the fund had “nearly doubled” invested capital on paper, and returned $1.2 billion by 2015. (The article became somewhat infamous for its focus on how a16z lagged elite peers, though many investors emphasized that comparing across vintages after just a few years was premature.) By that point, the firm had backed Coinbase, Slack, Stripe, Instacart, Robinhood, Airbnb, and others. Without more reliable information, it’s hard to know exactly how significantly those names translated into TVPI and DPI. I share all of this as background for my real question: with the benefit of hindsight, how do you think about your “34 More Instagrams” piece? Do you feel differently about those fund sizes? How about in the current day – do you think it makes sense for firms to raise multi-billion dollar vintages? If so, why? Has the technology opportunity grown so significantly that individual firms can deliver radically more capital? If not, what explains the growth of the asset class? Are we in the midst of a sustained bubble that has yet to truly burst? Are we in the thrall of widespread “cargo cult capitalism” as a piece on Altos’ website describes lemming-like VC? Has venture capital’s definition and performance profile fundamentally changed to allow for larger fund sizes? Beyond the significance of swelling fund sizes, I’m keen to understand how you assess today’s venture landscape. What aspects of the asset class today do you find exciting? Does the solo-capitalist trend make sense to you? How about the push into added services of the past decade? Where are we headed next? What might we regard as foolish or brilliant in ten years’ time? A franchise and a legacy In both your first and second letters, you’ve shared some wonderful details about Altos and the philosophies that guide the firm. It’s a rich topic that I’d love to explore further with you. Many of The Generalist’s readers work at firms that they want to leave better than they found, while others are looking to build franchises of their own (myself included). I am sure that we could all learn a great deal from the thoughtful, principled way in which you and your colleagues have positioned Altos for an enduring life. In particular, I’d be excited to unpack some of the core tactical and strategic decisions you’ve made over the years, and how you’ve made them. Some that are top of mind:

This is not a definitive list. If there are other threads you think have been especially important to the Altos story, please do share them. And, of course, if some of these topics are not particularly interesting to talk through, feel free to elide them. We’re in your capable hands. It has been a privilege learning from you through these past three correspondences, Ho. Thank you very much for your openness and wisdom. With gratitude, Mario Ho’s responseRe: An investor’s legacy Mario, It was great to see you in London. Your questions always make me think. Thanks again for inviting me to do this. In this final letter, there are so many interesting questions that I cannot possibly do justice to them all. So, I will pick a few topics to explore as we wrap up this series. On the first topic of the ever-growing VC industry size, it’s been the case for a very long time (at least since I got my first job in VC 34 years ago) that “too much money chasing too few good deals” is a reality in the industry. Although the importance and scale of the tech sector has grown by leaps and bounds, so has AUM, all chasing after the next big thing leading to intense competition for deals, which doesn’t bode well for returns. The scarce resource always was, and still is, great entrepreneurial talent, not capital. The lure of more (and stacked) management fees is so great that fund sizes keep growing, and I think the problem will get worse over time. That said, I suspect that the top 10% of the industry will continue to do well due to technology and great founders who continue to move society forward. Unfortunately, I believe the vast majority of the industry will continue to struggle to deliver adequate returns required to make up for the illiquidity and risks inherent in investing in fledgling companies. Now I’ll try to address some of your questions around franchise and legacy. To start, how can you be a great partner? I love that phrase because Charlie Munger has said it’s hard to find a great partner. When people ask how you find a great partner, his answer is always to be a great partner. You have to try to do the right thing, not just for yourself but for your partner. You may not always agree, but if your partner knows that your heart is in the right place and that you have good judgment, you can somehow live with the differences, even if you cannot work through them. You might also go along and try something different, especially if your partner feels strongly enough about something, and maybe you’ll learn that it’s not such a bad thing. There is always a ton of give and take in every human relationship, and you should not expect to get your way every time. And there is often no right or wrong path; even in hindsight, it’s hard to know. You just try to make the best decision and change your mind if you are wrong. ... Subscribe to The Generalist to unlock the rest.Become a paying subscriber of The Generalist to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

How to Win a Competitive Deal

Tuesday, June 25, 2024

You need more than sharp elbows. A tactical guide to winning your spot on the cap table. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bryan Everlasting: An Interview with the Tech Executive Spending Millions on Immortality

Thursday, June 20, 2024

Inside the mind of the former tech executive working to become immortal. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to Find a Unicorn

Tuesday, June 11, 2024

A tactical guide to sourcing legendary investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Vinod Khosla: A Case Study of Unreasonable Tenacity (and Frozen Pizza)

Monday, June 3, 2024

If you want to build a legendary company, sometimes, you simply cannot take no for an answer. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to Raise Your First Fund

Tuesday, May 21, 2024

A tactical playbook to kickstart your investing journey and set you up for success. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏