Americans Are Very Long The Stock Market And It Is Making Them Millionaires

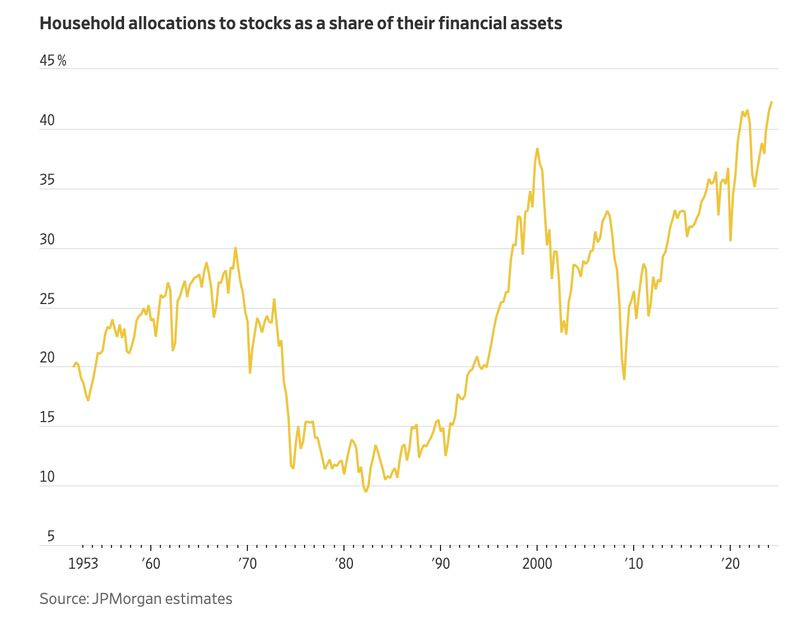

To investors, Inflation has been the story of the decade so far. We went from sub-2% in early 2020 to over 9% by the summer of 2022. Today, one of economists favorite metrics sits at just under 3%. This roller coater ride has had a significant impact on asset prices and investor psychology. On one hand, investors who have been allocated to the stock market continue to see their portfolio value increase as indexes push higher. The classic adage “time in the market is more important than timing the market” stands for a reason. The S&P 500 is up 85% over the last 5 years. Russell 2000 has appreciated 42% and the Nasdaq 100 is up 141% during the same time period. Investors simply had to invest in indexes and chill. Monetary and fiscal policy did the rest for them — inflation took off, the dollar was devalued, and asset prices went up. As stocks went higher, investors gained more confidence that higher prices were just around the corner. Add in the fact that existing capital in the market was also gaining value and you can see how we arrive at the new all-time high of stock allocation as a percent of financial assets. Wall Street Journal's Gunjan Banerji writes yesterday:

There is a debate raging due to this data — are investors merely riding the trend that will continue for the foreseeable future or are investors over-confident and a market correction is just around the corner? The short answer is no one knows, but I think the framework for evaluating the situation is wrong. Only short-term oriented investors should be concerned about the week-to-week or month-to-month oscillations in the stock market. Majority of investors should simply have a long-term orientation. They can be oblivious to price movements and merely continue dollar cost averaging into their preferred index. Given enough time, the stock market will continue going higher and is essentially guaranteed to be at new all-time highs. The United States debt requires dollar devaluation, which in turn pushes all assets denominated in dollars to be worth more in dollar terms. So the only people in the market who should be worried about short-term price movements are older folks who have less time to benefit from. Anyone under the age of 50 years old has at least a decade, and probably longer, to weather potential market downturns. The beauty of ignoring short-term predictions is that an investor is exposed to the market if prices go up and they are continuing to dollar cost average if the market goes down. If the market is up, your portfolio is worth more. If the market is down, you are buying more assets at cheaper valuations. Regardless of the scenario, being long the US stock market over decades is a cheat code — the US stock market is the greatest millionaire minting machine ever created. You just have to be able to allocate capital, stomach volatility, and stay focused on the long-term. And based on the latest data, it looks like more Americans are deciding to go long stocks. We’ll see what they do if there is turbulence in the coming months. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Reader Note: BUILD Summit, our annual conference in NYC for founders, is coming up next month on September 26th. The event will provide top tier speakers, networking opportunities, and insightful business discussions on raising capital, scaling businesses, and building products. Current speakers include angel investor Balaji Srinivasan, Khosla Ventures’ Keith Rabois, Perplexity CEO Aravind Srinivas, Eight Sleep Founders Matteo Franceschetti & Alexandra Zatarain, and Passes CEO Lucy Guo. The event is free to attend and will be full of insights on how to operate a company at world-class level. Darius Dale is the founder & CEO of 42Macro. In this conversation, we discuss inflation, productivity, asset prices, political impact, federal reserve interest rate decisions, and outlook for 2024. Listen on iTunes: Click here Listen on Spotify: Click here Darius Dale Explains Why Inflation May Come Back In Q1 Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Did The Government Push Rents To All-Time High Prices?

Tuesday, September 3, 2024

Listen now (4 mins) | Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Monday, September 2, 2024

Open this on your phone and click the button below: Add to podcast app

The Fed Just Got The Certainty They Needed For Interest Rate Cuts

Friday, August 30, 2024

Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Friday, August 30, 2024

Open this on your phone and click the button below: Add to podcast app

Nvidia Employees Prove Capitalism Still Works

Thursday, August 29, 2024

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these