Is It Morphing Time Yet? | Layer 2 Review

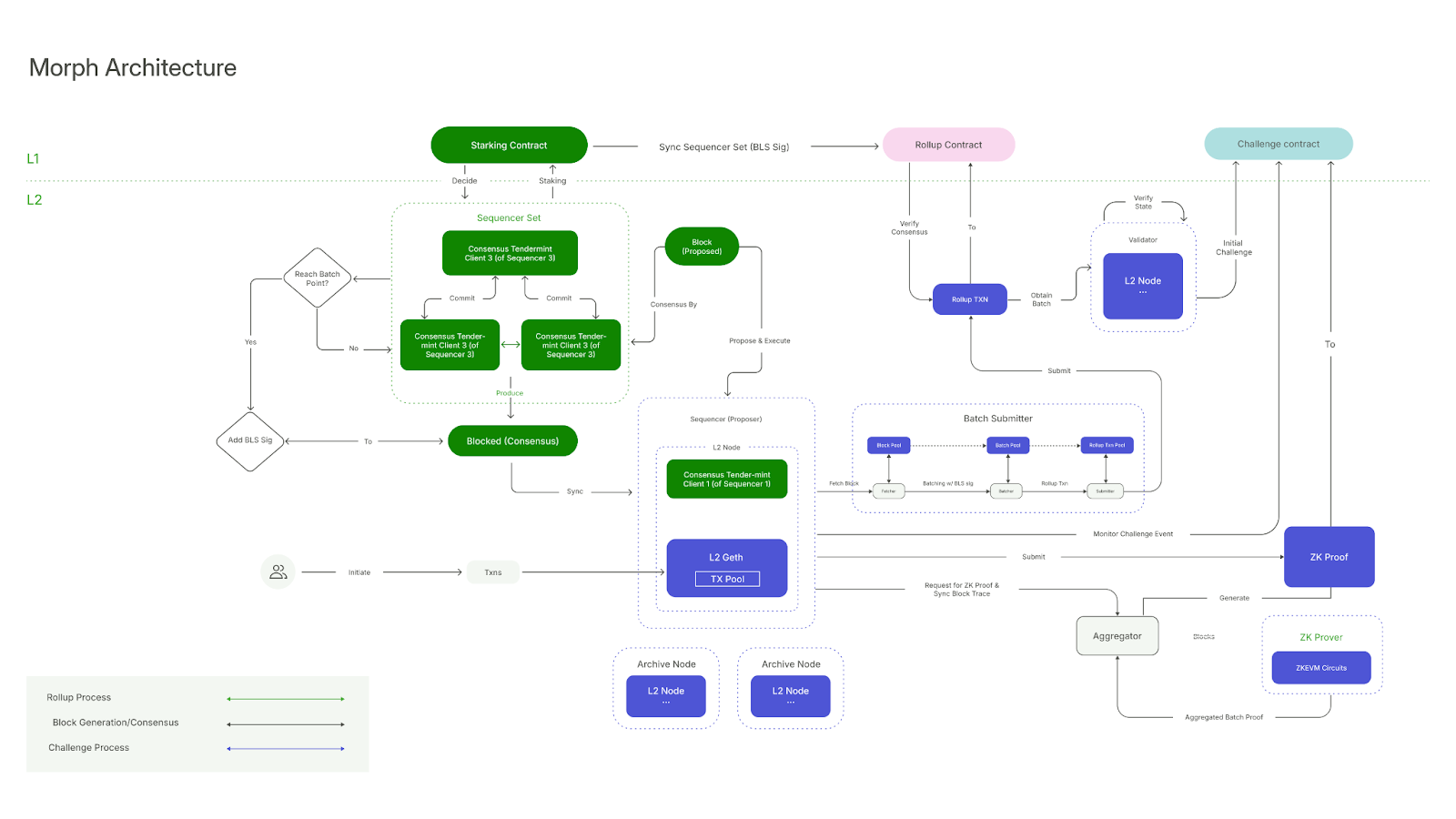

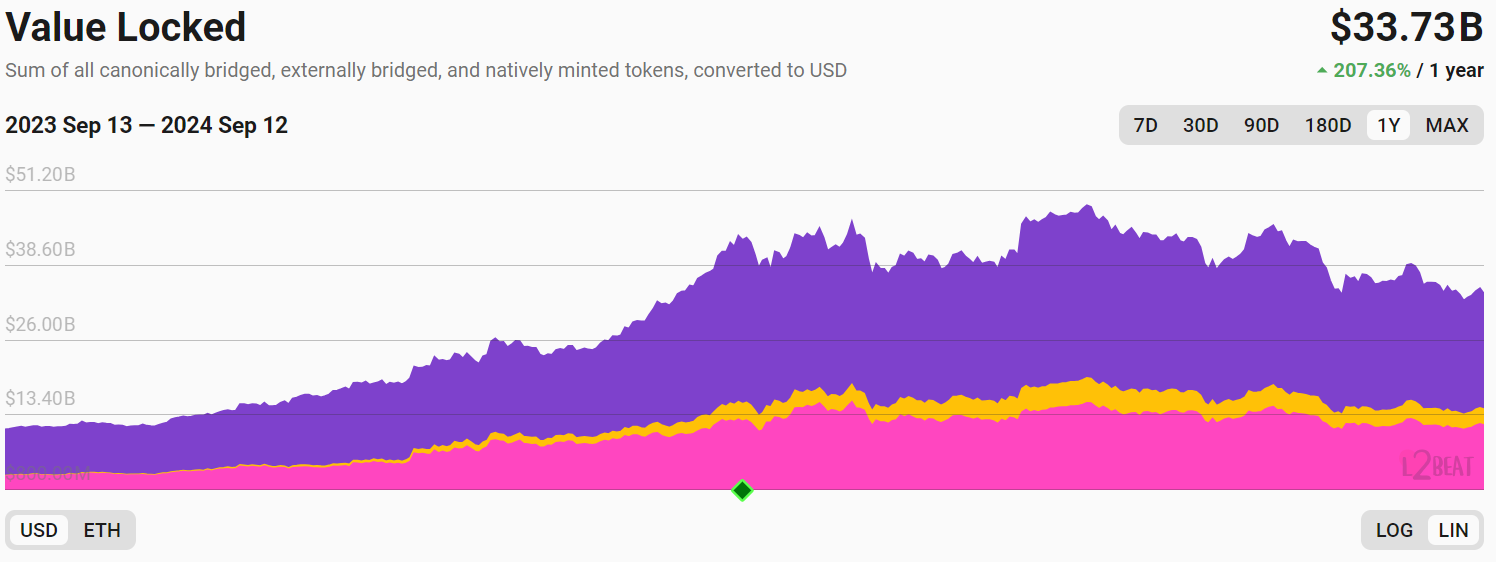

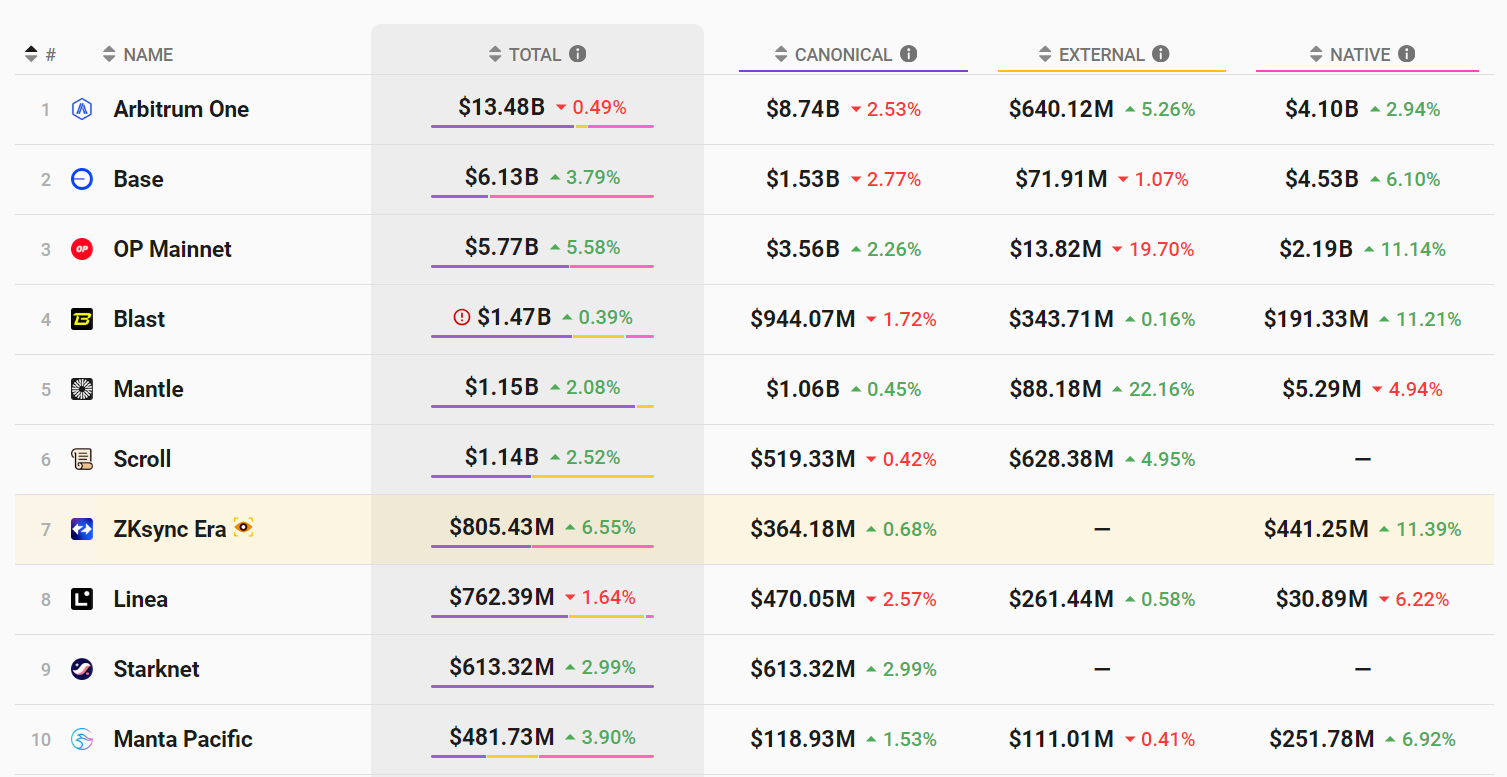

Is It Morphing Time Yet? | Layer 2 ReviewQuick Reads and Hot Links Covering the People and Projects Who Are Scaling EthereumDear Frens, We may be seeing some drastic measures regarding rollup nomenclature and standards as Vitalik Buterin recently announced his decision to only recognize L2 solutions that are at least Stage 1 as from next year. Projects that remain at Stage 0 decentralization may not be recognized or regarded to as rollups on Ethereum. Stylus went live on Arbitrum mainnet on September 3, flinging the doors wide open for traditional developers to build on the network using WebAssembly (WASM)-compatible languages. This exciting development unlocks powerful use cases with WebAssembly smart contracts which are interoperable with solidity contracts. Base is poised for another significant growth phase following the launch of Coinbase’s wrapped Bitcoin, cbBTC. According to the announcement, the wrapped BTC token will be supported on the layer 2 network and Ethereum. In this issue’s editorial, the author introduces us to Morph, a budding layer 2 network on Ethereum. Will the network find sustained use cases or just fade away after initial hype? Stay tuned as we provide you with latest insights and developments around the world of Ethereum’s layer 2. Contributors: Lucent, Ritaakubue, Melasin, Tonytad, Boluwatife, Kornekt, WinVerse This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps. 🗞️ Ecosystem Updates🆕 OP Retro funding 5 sign up has ended 🔀 Arbitrum Stylus: Now Live on Mainnet ➿ Arbitrum Security Council Election: Call for Candidates Now Open! ⚡The Arbitrum Portal is the home to all Orbit chains ⭕ Integration Announcement: Bubbly finance partners with Arbitrum 🔒 gTrade surpasses $50 billion total trading volume on Arbitrum! 🔥 Hot NewsMovement Labs Bets on 'Postconfirmations' to Boost Ethereum ScalabilityMovement Labs is reportedly developing a new mechanism for rapid transaction settlements on layer 2 networks, with plans to launch by the end of 2024. According to co-founder Rushi Manche, this system, called "postconfirmations," could potentially reduce confirmation times to under one second. This innovation comes as a result of the significant growth of Ethereum's L2 solutions, with total value locked surging to nearly $35 billion. This surge highlights the increasing demand for scalable solutions that would put an end to limited transaction throughput. Movement's approach aims to address limitations in existing L2 solutions, such as the lengthy finality periods of optimistic rollups and the high costs associated with zk-rollups. The proposed system would allow applications on Movement's upcoming M2 network to optionally use a validator network secured by the MOVE token. To learn more about this recent development, check out the full article here 🏛 Governance💬 Proposals in DiscussionArbitrumOptimismPolygonStarknetIs It Morphing Time Yet?Author: Lucent Morph L2 is a budding layer 2 network on Ethereum that claims to be “powering the global consumer layer for everyday users”. The network hopes to directly address blockchain's biggest challenges: scalability and security, while offering a more user-friendly experience than traditional blockchain infrastructure. In this article, we provide an overview of Morph’s architecture, market strategies, and challenges. With all the development team is putting in place, will Morph be the next big deal on Ethereum or will it simply join the already long list of layer 2 “solutions”? The Morph ArchitectureMorph employs a Responsive Validity Proof (RVP) System, which combines the strengths of optimistic and zero-knowledge (ZK) technology. This hybrid system allows for faster finality, lower transaction costs, and greater scalability — all critical components for consumer-facing applications. As blockchain technology evolves, balancing these factors will be essential for attracting mainstream developers and users. Another of Morph’s innovations is its decentralized sequencer network, designed to resolve the limitations of traditional centralized sequencers which several L2 solutions currently operate. Typically, a single sequencer can become a central point of failure, exposing the system to transaction censorship and monopolization of Miner Extractable Value (MEV). Morph has taken the decentralized approach for its sequencers, looking to provide scalability while ensuring fairness and efficiency. Their sequencer design features Byzantine Fault Tolerance (BFT) consensus, BLS signatures, and a modular design to enhance functionality. Market StrategyMorph allows users to stake their native tokens to participate in the network's security. Token holders can delegate their tokens to nodes, known as sequencers responsible for processing transactions. The more tokens a node has staked, the higher its chances of producing blocks, creating an alignment between participation, rewards, and network decentralization. In May 2024, Morph introduced the "Morph Zoo", a multi-stage program aimed at engaging and rewarding participants within their testnet, hoping to keep users actively engaged. The campaign started Season 1 with The Genesis Jungle. This event is helping to drive user engagement and gather feedback in preparation for the mainnet launch. Participants earn Morph Points for interacting with various decentralized applications (dApps). On the financial side, Morph raised $20 million in a funding round led by Dragonfly earlier in March to fund development. The Ghost Chain TrapA Ghost Chain is a blockchain with minimal activity and user engagement until it becomes obsolete. So far, Morph is trying to prevent this pitfall through community engagement and developer participation, which are important ingredients for an active ecosystem. One of Morph's initiatives to avoid becoming a ghost chain was the SparkLoom Incubator Program, which encouraged developers to build on its testnet. This, with strategic partnerships, expands Morph's reach, potentially creating a wider user base. Morph recently announced the creation of the Centralized Exchange Coalition, partnering with exchanges such as Bitget, HTX, MEXC, and Poloniex. These partnerships ease the listing process for vetted projects, making it easier for developers to access liquidity and for their projects to gain visibility and by extension, strengthen Morph’s position in the ecosystem. Will Morph L2 Succeed?From the roadmap, it’s clear that Morph has ambitious goals, but achieving success will require more than innovative technology. While its decentralized approach and user-friendly vision are admirable, the true test lies in execution. Has Morph built a strong community to stay in the top L2s? Will the applications built on the platform offer real, tangible value to users? Time will answer these questions. This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains. 📈 DataTotal Value Locked on L2s is About $34 billion!

Top Ten Projects by Total Value Locked:

🔭 Project WatchArbitrum

OptimismTop Projects by TVL in the Last 7 Days

BaseTop Projects by TVL in the Last 7 Days

zkEVMTop Projects by TVL in the Last 7 Days

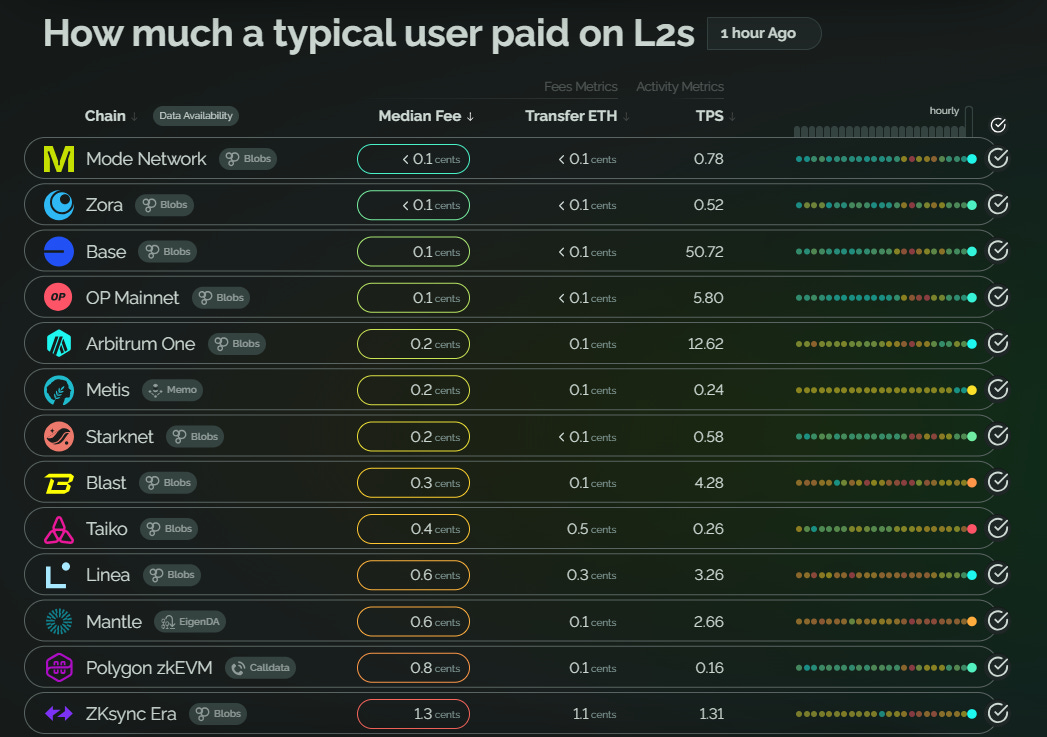

🔥 L2 Fees and Costs UpdateTransaction Fees as of September 13, 2024:

|

Older messages

Growth Through Participative Ideation | BanklessDAO Weekly Rollup

Saturday, September 7, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What Is Our Narrative? | BanklessDAO Weekly Rollup

Saturday, August 31, 2024

Catch Up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The World of zkEVMs | Layer 2 Review

Thursday, August 29, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Importance of Being in Value-aligned Communities | BanklessDAO Weekly Rollup

Saturday, August 24, 2024

Catch up With What Happened This Week in BanklessDAO ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Rolling Up the Decentralization Stages | Layer 2 Review

Tuesday, August 20, 2024

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏