Numlock Sunday: Akshat Rathi on digging a net-zero future out of the ground

By Walt HickeyWelcome to the Numlock Sunday edition.This week, I spoke to Akshat Rathi, who wrote “Net Zero Needs More Metals, But Less Extraction From the Earth” for Bloomberg. Here's what I wrote about it:

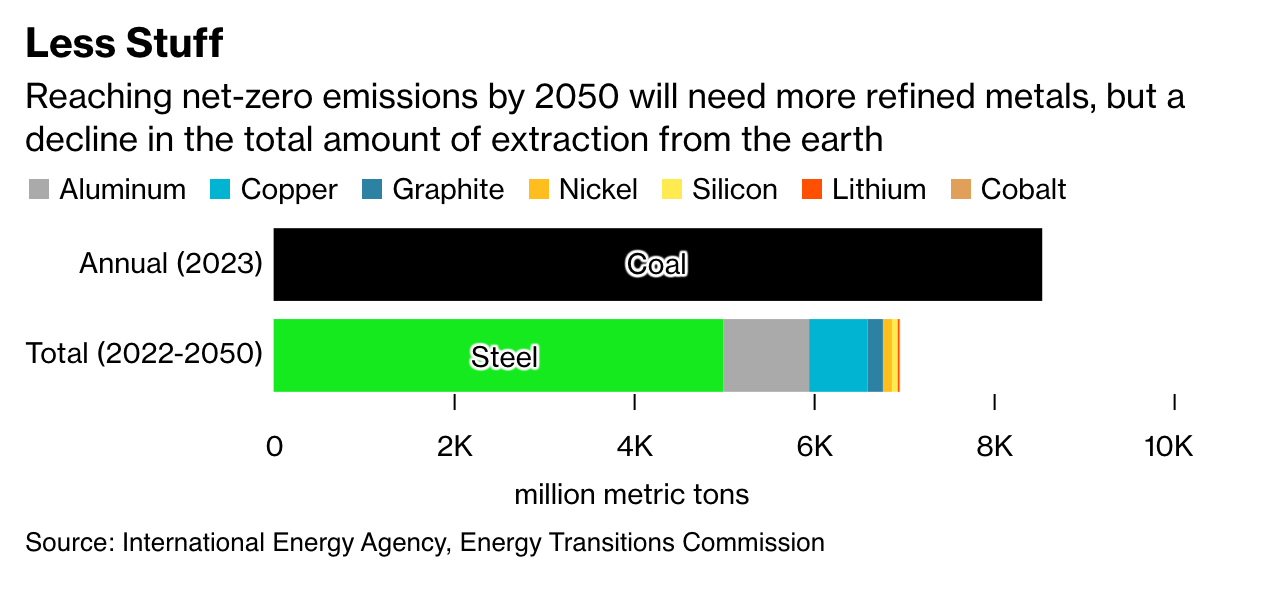

I loved this because it illustrated a way around a pretty key tension I’ve observed in the green transition, namely that executing it will require a whole lot of mining that runs the risk of fouling the environment. This really puts things in perspective, given that the aggregate amount of mining over coming decades is just like one year worth of coal. We spoke about the trade-offs of mining for metals instead of fossil fuels, how we can learn from different industries around the world, and the importance of policy to drive climate solutions. Rathi can be found on BlueSky, Bloomberg, or his podcast, Zero. His book, Climate Capitalism, is available wherever books are sold. This interview has been condensed and edited. You wrote this really interesting story for Bloomberg all about a side effect of the energy transition and what that looks like as it relates to mining and just the act of taking stuff out of the ground. Do you want to talk a little about what the difference is between the very metallic future we have compared to the very coal-based past? In the energy transition, there are a lot of questions that are thrown. Many of those questions have very good answers, and this is one of those questions, but I don't think it's very well understood. You talk about a climate solution and somebody will go, but what about this thing? Typically, with a lot of the energy transition, because we're going to have to build it based on metals, increasingly using a lot more metals than we’re using in today's economy, people go, but what about cobalt? What about lithium? Or what about all that steel we're going to have to create? It's a question that without knowing the numbers, you cannot do a convincing job answering. You'd be like, okay, maybe you're fine with the numbers, but look at the human rights abuses that mining companies cause. You just keep going down this “what about…?” road. Having spoken to a few people about this, I realized there is actually a definitive answer that we can give, which is that the amount of stuff we extract today from the earth, the vast majority of it is fossil fuels. In a net-zero world, we’re going to have to use very few fossil fuels, so coal will go to almost zero, oil will decline by at least 75 percent, and gas will decline by maybe 50 percent or so. The billions of tons will decline drastically. There's a fascinating chart in this story that backs that up and shows exactly how much. People really underestimate the amount of coal alone. We're using billions of tons of fossil fuels versus millions of tons of metals today. And the cumulative amount of metals does add up to billions of tons, but that's over the entire energy transition to 2050, whereas we are consuming billions of tons of fossil fuels on an annual basis. Now that calculation is a very interesting one to juxtapose on a chart, but there is a caveat there, which I make clear on the chart, which is that it’s refined metals. When we extract metals from the earth, we have to refine it afterward, so there's a lot of waste earth that comes alongside it. But I also ran through the numbers on how much waste earth is pulled out from metals mining. Even after accounting for all the waste earth, fossil fuels far outweigh metals mining. So on an annual basis, mining for metals is still less of an extractive exercise than mining for fossil fuels. You also made this really interesting point that you can't recycle coal, right? Coal gets used once, whereas the recycling rates that you wrote about in this piece were really encouraging, as well. Yes, and that is also underappreciated: Fossil fuels are just a single-use product, where metals aren't. For sure, we do not recycle as much as we should, or can. There's a ton more to be done on recycling and improving recycling rates. But already, the metals that have been around for very long — like iron ore, so steel, nickel, cobalt, lithium, copper — have clear value. We are getting to a place where recycling rates are more than the majority, so more than 50 percent of that is typically recycled. We can go all the way to 90 percent, 95 percent. There's a lot of room to be less extractive in that future, too. It is interesting that mining and extracting is the thing that sometimes gives your more traditional environmentalist pause. Having this discussion about where exactly the metals come from, it feels like there's a bit more friction around it, both within the folks who are trying to advance the climate transition as well as folks who necessarily aren't. I'd love your thoughts on what you make of that and what this data shows. It’s understandable. In a way, the climate movement is powered by the environmental movement that came before it, and that movement started very much from a place of conservation, a place of seeing polluted water, seeing polluted land, and trying to avoid that in a future where we are hoping to reduce environmental damage. So it's a very understandable position to come from. But it also misses the point that fossil fuel extraction itself has a huge environmental impact, a huge human rights abuse impact. While ideally you should have no human rights abuse or indigenous rights abuse or pollution alongside mining, it is worth noting that fossil fuels have many times more of that impact. In a net-zero world, we will reduce those damages from fossil fuel extraction already, and we can certainly do more, because we’re aware of the impact from mining for metals and hold the companies that do that accountable. It’s not really addressed in this piece, but even nuclear, which is an attractive option for a lot of the electrical generation when it comes to potentially replacing long-term fossil fuel usage on the electricity grid — that also touches on mining elements that seem to get people anxious. It was just a really interesting story that says, listen, any anxiety folks feel about the next couple of decades of this kind of extraction, it's like one year's worth of coal. Yes. Nuclear is even more concentrated an energy source, both in terms of area consumed and metals resources consumed. The total amount of uranium you need is very small. The total amount of steel and cement you need to build is substantial, but you're also going to need that much steel and cement for your wind power plants and your solar plants. Its total amount of waste, which we know is a long-term issue, can be active for tens of thousands of years, but the volume itself is quite small. So unlike fossil fuel waste volumes, the volume from nuclear waste is very, very small. In fact, it's smaller even than a lot of the waste we might be producing from renewable energy assets, which are going to be distributed and are by nature much more metals intensive. I enjoy your work a lot; I really enjoy what you do over at Bloomberg. You came out with a book earlier this year, and I'd love to talk a little about that. It comes at it from a very interesting angle, which is essentially that climate capitalism is its own form of addressing this crisis, and capitalism will be essential at various different points of this. I would love to hear you talk a little about what motivated you to write the book and what folks might expect from it. If you spend any time trying to think about the climate crisis and what we must do to act on it, you will quickly come to the right conclusion that the economic system we’re in right now is making it more difficult to do anything about tackling climate change, to build the solutions we need, to reduce greenhouse gas emissions. However, the next step that people take most of the time is a mistaken step, which is to say the only solution then must be that we need to break the economic system down and replace it with something else, because otherwise we're not solving this problem. I say it's a mistaken step because nobody has come up with an alternative yet. Not just in theory, but nobody has actually put it in practice anywhere in the world to showcase that that is the solution we must take. Until we get that, to me, it’s much simpler to figure out whether the economic system that does exist can build the solutions we need. That's what I wanted to try to answer in the book. I wanted to go and look at solutions that are working around the world at a country level, at an industry level, and then unpack what made those successes possible in, say, India or China or Denmark or the U.K. or the U.S. Whether those lessons can be applied not just to that specific type of solution or that specific industrial sector, but the world over for all types of different industries and sectors. That's what the book is. It's a book of 10 solutions, looking at technologies that you're familiar with, but also the stories of how those technologies became successful that you might be unfamiliar with. Things like electric cars, batteries, wind, solar, carbon capture, but also the systemic levers that made those solutions become possible: finance, laws, shareholder activism, climate activism. How all of those work together to actually make solutions happen. The formula I come down to is that you need, in any major scale-up of a solution, four ingredients: people, policy, technology and finance. You need the people to be creative because we’re changing or doing something we've not done in the past. Typically, you're going to need technology because we’re going to change how the world works. We have those technologies most of the time, or the ones we don't, we can develop. You need policy because markets on their own aren't going to come up with those solutions. Markets have to be given the reason to exist. We create markets by the demand for the products we want, so governments need to create the demand for emissions-free outcomes. We’ve seen that in other domains, outside of the climate domain, what governments can do. So we need this policy. And, finally, we need finance. If those three ingredients exist, finance typically follows, but sometimes finance can also lead and enable all those three things to come along. That's cool. It's always fun talking to folks who write books about this kind of stuff because you have to file it sometimes as much as a year before it actually comes out. Obviously it's been a few months since it came out here. What's something from the book that you feel has gotten actually more relevant since the time that you were reporting it out and that you think is worthy of attention? I would say the recognition that policy plays the strongest role in driving climate solutions. I finished the book in late 2022, and that's when the Inflation Reduction Act was passed in the U.S. If anything, the U.S. is the large economy that has come the last to the climate party, and even the U.S., which has had divided politics, recognizes that if it wants to tackle the climate crisis, it needs to show up with strong policies to actually get going. So, the relevance of policy has become more important. The thing that I haven’t seen enough of happen since the book has come out is figuring out how to get investment from developed countries to go to developing countries. Right now, the investments are very focused on developed countries and on China. But to solve this problem, you have to figure out the next step of how do you also bring those solutions, the finance, the policy, to developing countries. That is missing right now. Fascinating. Where can folks find you? Where can they find your work and where can they find the book? Well, I hope people are leaving X, but I'm still around on there, @AkshatRathi. These days I'm more of a consumer of BlueSky, so you can find me there with the same handle. And yeah, check out my book. You can get it in all the places you buy books. I also have a podcast now, since we talked last. It's called Zero and I do that for Bloomberg Green. Again, you can find it wherever you listen to podcasts. Thanks again for coming on. Thanks, man. Edited by Susie Stark. If you have anything you’d like to see in this Sunday special, shoot me an email. Comment below! Thanks for reading, and thanks so much for supporting Numlock. Thank you so much for becoming a paid subscriber! You're currently a free subscriber to Numlock News. For the full experience, upgrade your subscription. |

Older messages

Numlock News: September 13, 2024 • Asteroid, Honey Deuce, Bearskin Caps

Friday, September 13, 2024

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Numlock News: September 12, 2024 • Ohtani, Voyager, Boulders

Thursday, September 12, 2024

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Numlock News: September 11, 2024 • Fukushima, Kratom, H-E-B

Thursday, September 12, 2024

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Numlock News: September 10, 2024 • Roblox, Shakers, Xolair

Tuesday, September 10, 2024

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Numlock News: September 9, 2024 • Art Forgeries, Grand Canyon, Hurricane

Monday, September 9, 2024

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

AI costs American renters over $3.6 billion annually, according to new report

Monday, January 6, 2025

The property management software used by many corporate landlords, RealPage, is deploying AI to artificially inflate rental prices in the United States by more than $3.6 billion annually, according to

Numlock News: January 6, 2025 • Nosferatu, Yellowstone, History

Monday, January 6, 2025

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Yes, Gaza Mattered in Michigan

Monday, January 6, 2025

Biden's steadfast support of Israel backfired, leading many Michigan voters to abandon both Biden and Harris. Yes, Gaza Mattered in Michigan By Justin Brown • 6 Jan 2025 View in browser View in

☕ Après-fee

Monday, January 6, 2025

NYC congestion pricing is now in effect... January 06, 2025 View Online | Sign Up | Shop Morning Brew Good morning. Per a decree from Larry David, the statute of limitations to wish someone a “Happy

Best-Of Global Journalism 2024

Monday, January 6, 2025

20 stories you may have missed what happened last week in Asia, Africa and the Americas Hey, this is Sham Jaff, your very own news curator, and constant reminder that the world is bigger than your

Open Thread 363

Monday, January 6, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Pornhub pulls out of Florida, VPN demand 'surges 1150%' [Mon Jan 6 2025]

Monday, January 6, 2025

Hi The Register Subscriber | Log in The Register Daily Headlines 6 January 2025 florida palms lights Pornhub pulls out of Florida, VPN demand 'surges 1150%' State masks up finally – its IP

Monday Briefing: How Trump re-wrote Jan. 6

Sunday, January 5, 2025

Plus, the end of an era for Hong Kong's cabbies View in browser|nytimes.com Ad Morning Briefing: Asia Pacific Edition January 6, 2025 Author Headshot By Justin Porter Good morning. We're

GeekWire's Most-Read Stories of the Week

Sunday, January 5, 2025

Catch up on the top tech stories from this past week. Here are the headlines that people have been reading on GeekWire. ADVERTISEMENT GeekWire SPONSOR MESSAGE: GeekWire's special series marks

For an organized closet

Sunday, January 5, 2025

Plus, how to donate clothes responsibly View in browser Ad The Recommendation January 5, 2025 Ad Today we'll walk you through some of our best advice for organizing your closet—and what to do with