State of the Network’s Q3 2024 Mining Data Special

Get the best data-driven crypto insights and analysis every week: State of the Network’s Q3 2024 Mining Data SpecialBy: Matías Andrade Key Takeaways:

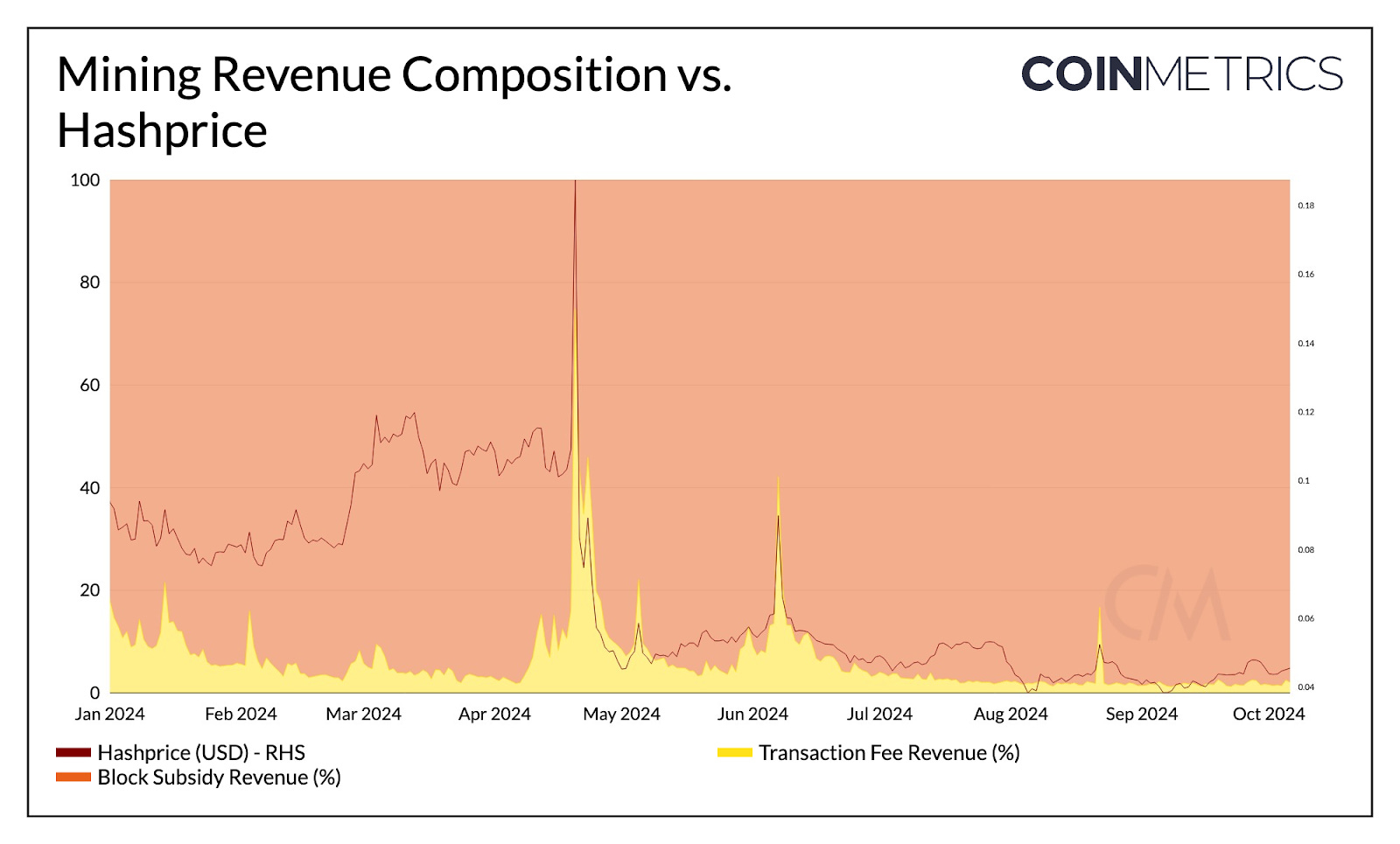

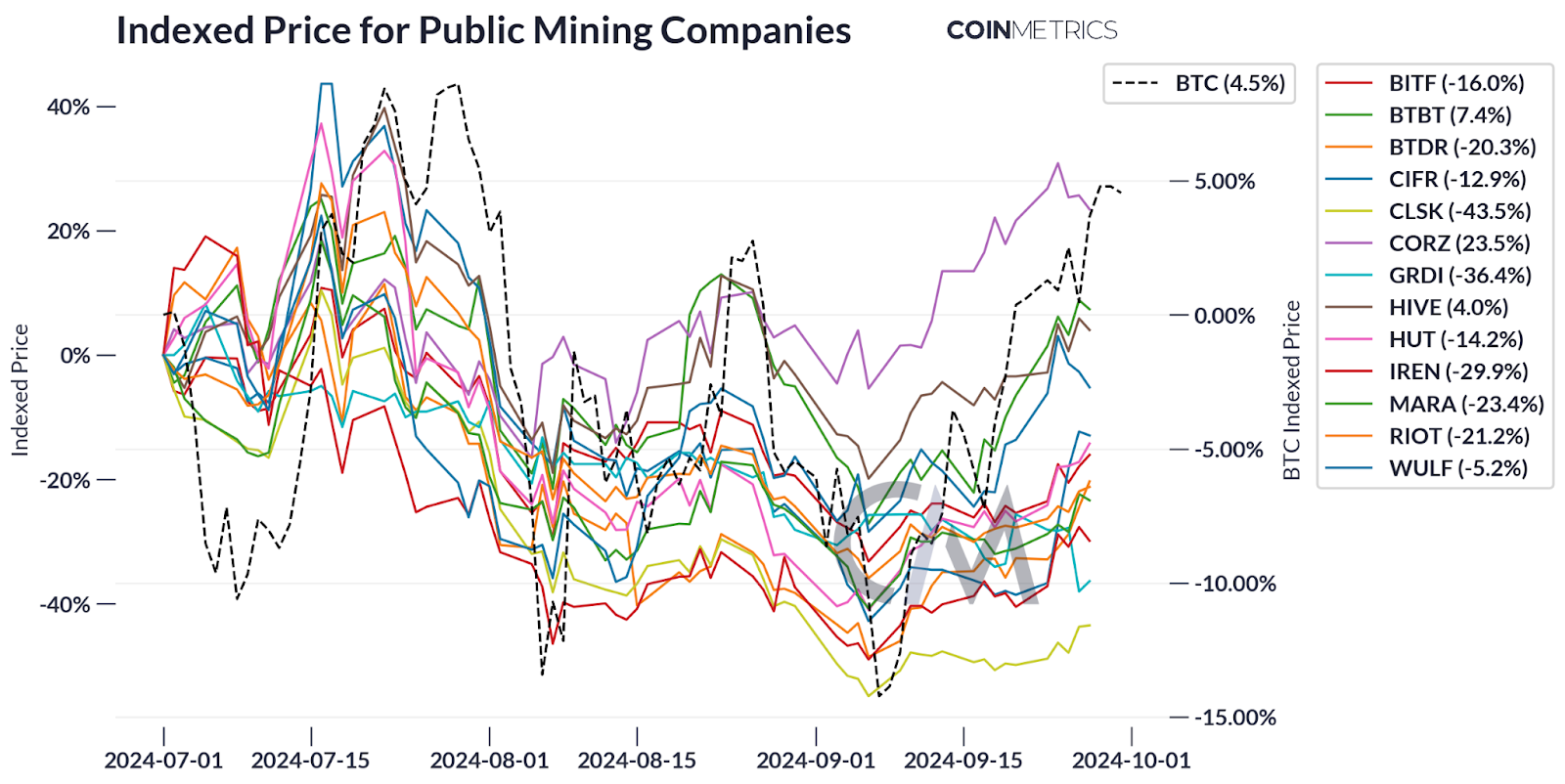

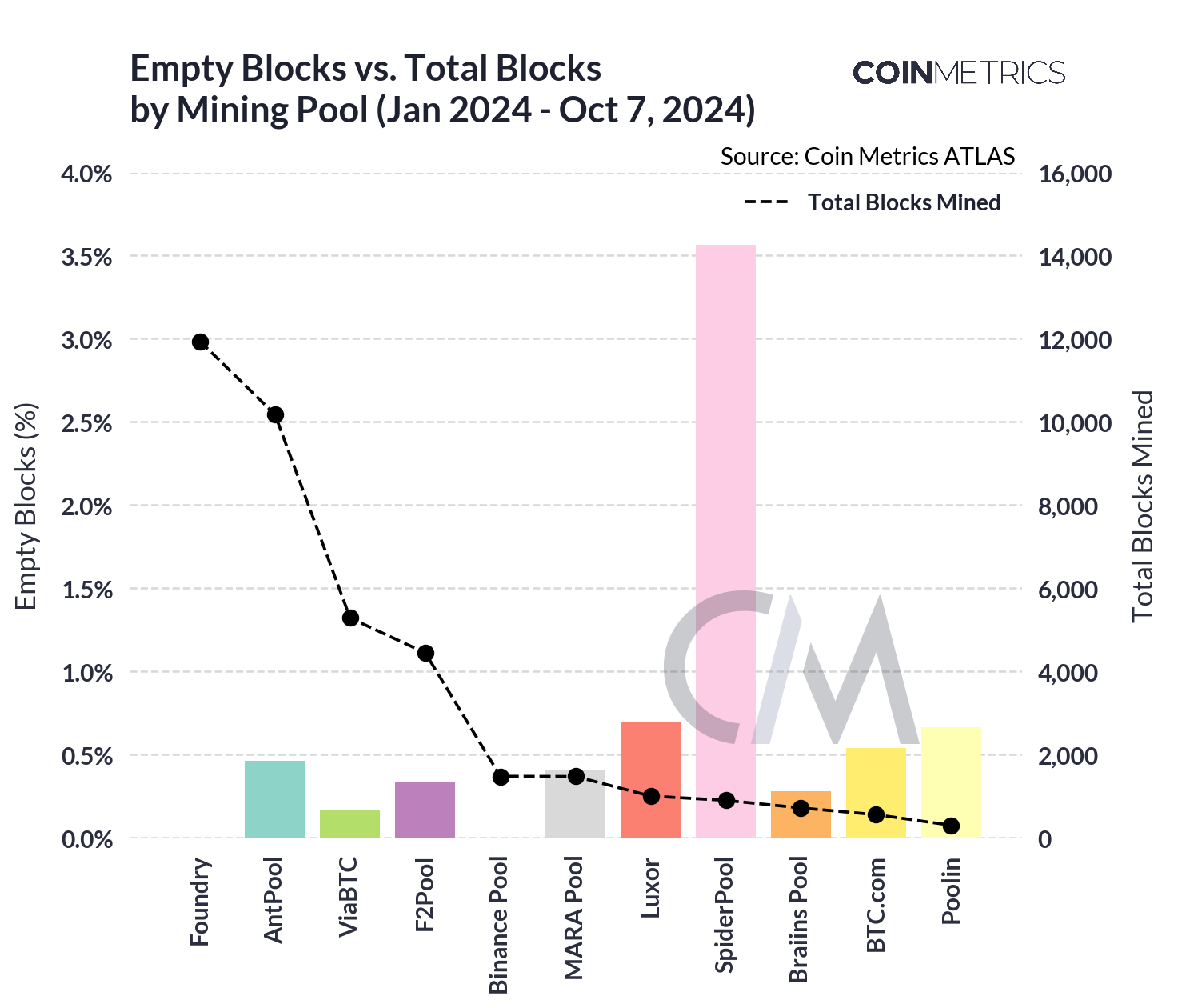

IntroductionAs we enter Q3 2024, the State of the Network report revisits the Bitcoin mining landscape, continuing our series of quarterly updates on the state of proof-of-work stakeholders. The aftermath of the Bitcoin Halving in April continues to reverberate through the industry, with mining margins facing persistent pressure due to a relatively stable BTC price and a subdued fee market. Our report delves deeper into each of these factors, providing a comprehensive survey of the mining sector’s health beyond mere BTC price performance. Bitcoin Mining: A Mixed BagThe third quarter of 2024 has proven to be a particularly challenging period for Bitcoin miners, with the sector grappling with the lingering effects of the April 2024 block reward halving. The reduction in block issuance revenue has put significant pressure on mining margins, compounding the woes of an already subdued fee market. Source: Coin Metrics Network Data Pro Data from our analysis indicates that fee-based revenue, which had previously provided a valuable supplementary income stream for miners, has remained among the weakest observed over the past several quarters. This is evident in the chart below, where we can see a brief spike around the halving date that resulted from the flurry of activity around trying to mine valuable halving sats and create inscriptions on this block, while subduing almost entirely from July through September. Source: Coin Metrics Network Data Pro This trend has forced miners to increasingly rely on alternative revenue sources, such as transaction acceleration services and diversification into adjacent infrastructure opportunities—including renting out rackspace for generative AI or, in a particularly interesting case, tokenize whiskey barrels—while keeping operations lean and efficient. Despite these headwinds, the overall mining revenue picture is not entirely bleak. Block rewards, while reduced from the pre-halving levels, have remained relatively strong, contributing approximately $2.5B in revenues, compared to $3.7B last quarter. Source: Coin Metrics Reference Rates & Yahoo Finance In response to these challenges, many mining operators are pivoting their business models, diversifying beyond pure-play mining. We’re seeing a trend of miners reinventing themselves as generalized infrastructure providers, actively pursuing hosting contracts for power-hungry AI applications. This strategic shift reflects the industry’s adaptability in the face of changing market dynamics. Simultaneously, the relentless march of technological progress continues unabated in the chip efficiency arena. These advancements are forcing miners to confront a critical decision: whether to persist with aging ASIC hardware or undertake comprehensive fleet upgrades. The choice between these options could significantly impact individual miners’ competitiveness and profitability in the coming quarters. The Mystery of Empty BlocksOne fascinating aspect about Bitcoin mining operations is the phenomenon of the empty block. One can consider empty blocks to be somewhat counterintuitive, since a miner that succeeds in mining an empty block is forfeiting any revenues that could come from fees that are paid by users that wish to include their transaction in the block. So, why does this happen? First, we have to understand that bitcoin mining is a very competitive industry. No bitcoin miner worth its salt is going to leave revenue on the table unless they have very good reasons to do so. What is worth considering here is the use of block templates in the process of mining blocks. A block template is used to optimize transactions in a block as to maximize revenue. One of the problems is that creating a block template can take time, so one of the theories behind these empty blocks is that these are blocks that are mined rapidly one after another—since mining bitcoin is a random process, sometimes miners are bound to “get lucky” and happen to create a new block soon after the previous one was found and distributed. However, if we take a look at the distribution of Bitcoin block times in 2024, we notice that it is quite similar to the exponential distribution—just as we would expect, given that the time between blocks can be modeled as a Poisson process with a mean time between blocks of roughly 10 minutes—with empty blocks being registered even as high as 47 minutes. Here we are using Coin Metrics’ database consensus_time, which avoids the issues that come from miners inaccuracy in self-reported block times. This makes us doubt that the reason these blocks are empty is actually because miners don’t have time to substitute a block template as we hypothesized earlier. Indeed, if we look deeper and take a look at which pools are actually generating these empty blocks we begin to see a pattern, with some pools like Foundry and Binance Pool showing zero empty blocks in the selected time period, while others (with SpiderPool most evident) have a relatively large number of empty blocks. So how can we explain this? There are many theories, but one that seems to explain this while allowing the fact that pools seek to maximize their revenue (and thus include transactions with tips, if possible) is that if pools just mined a block, it is in their interest to begin work on a block without template so as to start as soon as possible after broadcasting the previous solution. This is because blocks take around 15 seconds to propagate throughout the bitcoin network, which should give the pool that last issued a block a head start on finding the next block. To test that theory, we can take a look at the time interval between consecutive blocks (that is, blocks consecutively mined by the same pool) and compare it against the theoretical distribution of block times to see if a greater proportion of consecutive, empty blocks are broadcast earlier than expected, this time expanding the data set to look back starting on 2022. Looking at these charts, these are not the results we would expect if miners were ignoring transactions only during the first few seconds, since this distribution is quite similar to the expected distribution with the central tendency around 10 minutes, with a considerable number of such blocks observed beyond 10 minutes. This seems to contradict the hypothesis that miners are more likely to produce empty blocks in the first few seconds after mining a block. It's crucial to note that this chart is based on an expanded dataset that goes back to 2022 and includes 44 blocks, since there are only 8 consecutive, empty blocks mined in 2024. However, further research would be necessary to make any definitive statements about the patterns of consecutive empty block mining. ConclusionThe Q3 2024 Bitcoin mining landscape reflects an industry in transition, grappling with the aftermath of the April halving. Miners face significant challenges, including reduced block rewards and persistently low transaction fees. In response, many are diversifying their operations, exploring alternative revenue streams, and reassessing their hardware strategies. The phenomenon of empty blocks continues to puzzle analysts, with notable disparities among mining pools. This trend, along with the ongoing debate over optimal mining strategies, underscores the complex dynamics at play in the Bitcoin ecosystem. As the industry evolves, miners are demonstrating resilience and adaptability. Their pivot towards becoming generalized infrastructure providers and their exploration of novel business models signal a sector that is actively reinventing itself in the face of changing market conditions. The coming quarters will likely see further innovations as miners strive to maintain profitability and relevance in an increasingly competitive landscape. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro The market capitalization of Bitcoin (BTC) and Ethereum (ETH) slid by 5% and 8% respectively over the past week, amid fears of escalating tensions in the middle-east. FTX token rose by 47% in market cap with the bankrupt exchange’s remaining $16B in assets to be redistributed to creditors in the near future. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

State of the Network’s Q3 2024 Wrap-Up

Tuesday, October 1, 2024

A data-driven overview of events shaping crypto markets in Q3–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Real World Assets (RWAs) & Tokenization

Tuesday, September 24, 2024

Coin Metrics' State of the Network: Issue 278 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Crypto Universe Through the Lens of datonomy™

Tuesday, September 17, 2024

Coin Metrics' State of the Network: Issue 277 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Primer on Blockchain Network Health

Tuesday, September 10, 2024

Coin Metrics' State of the Network: Issue 276 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

An Update on Layer-1 Networks

Wednesday, September 4, 2024

A data-driven dive into Layer-1 blockchain fee markets, token performance and usage characteristics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏