Hot in Enterprise IT/VC - What’s 🔥 in Enterprise IT/VC #419

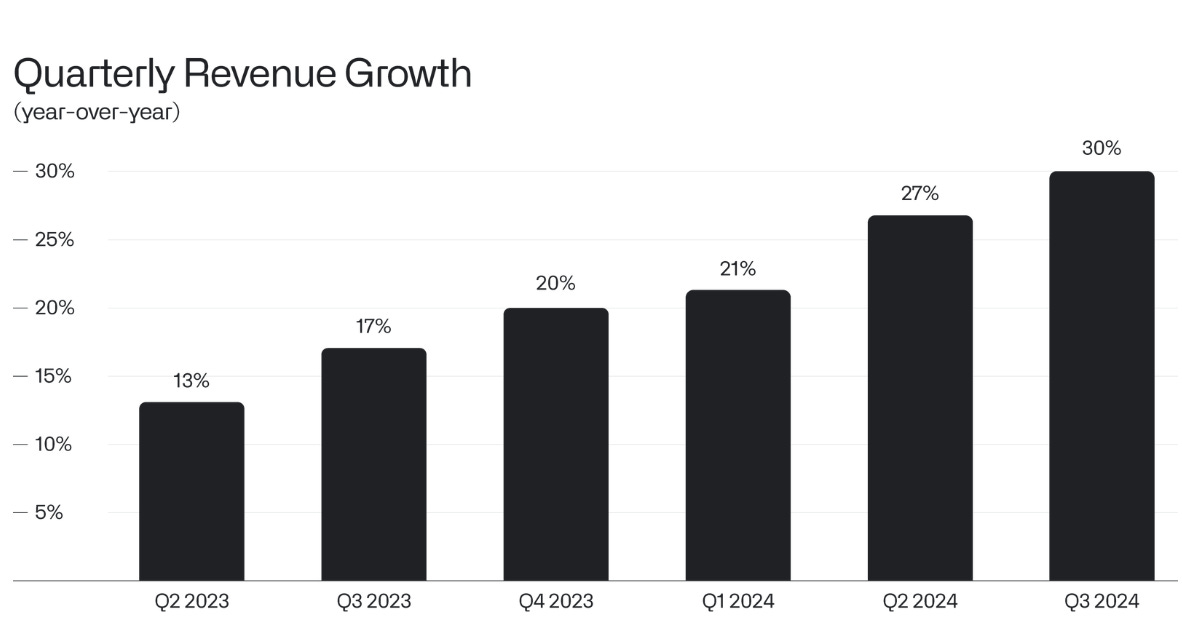

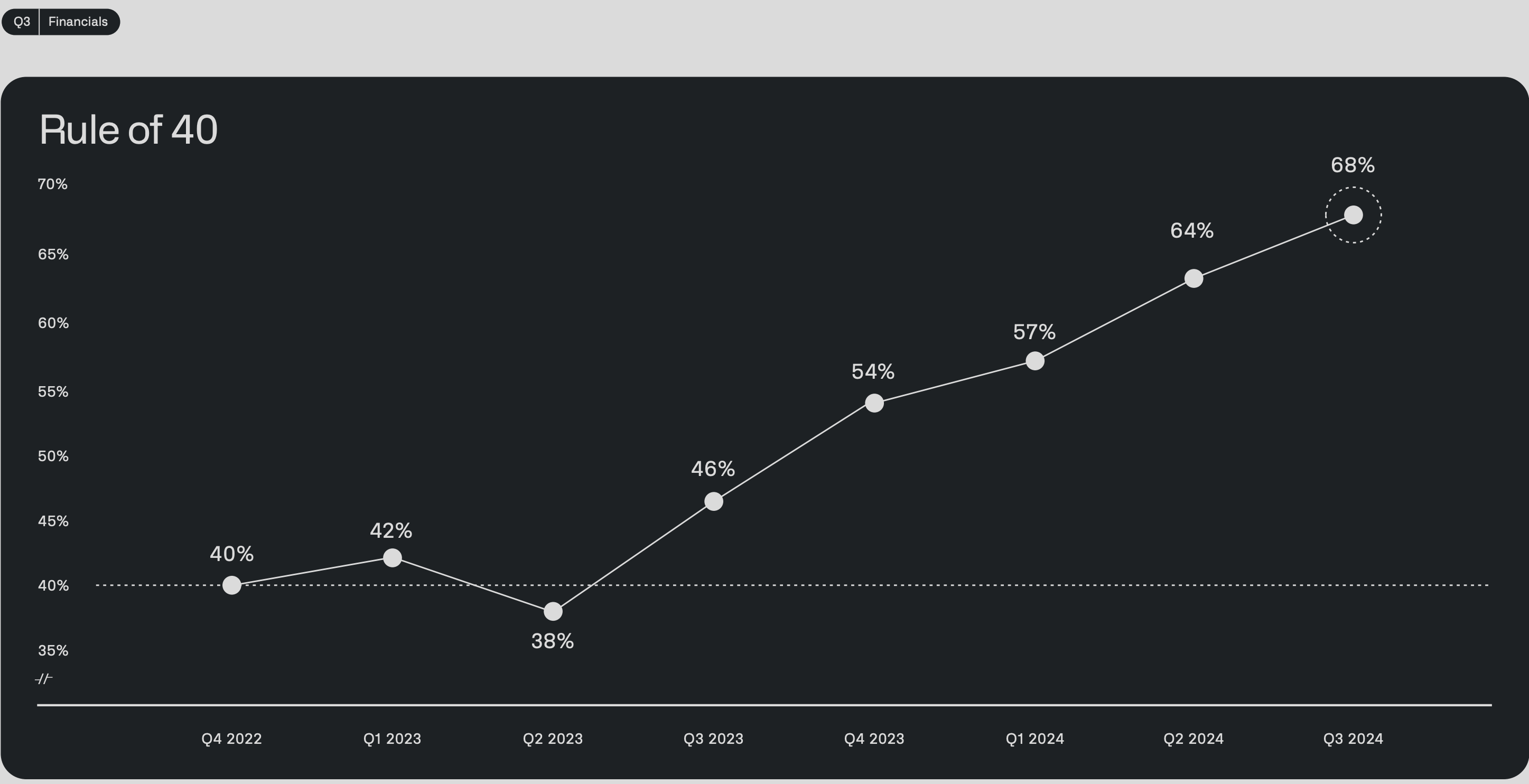

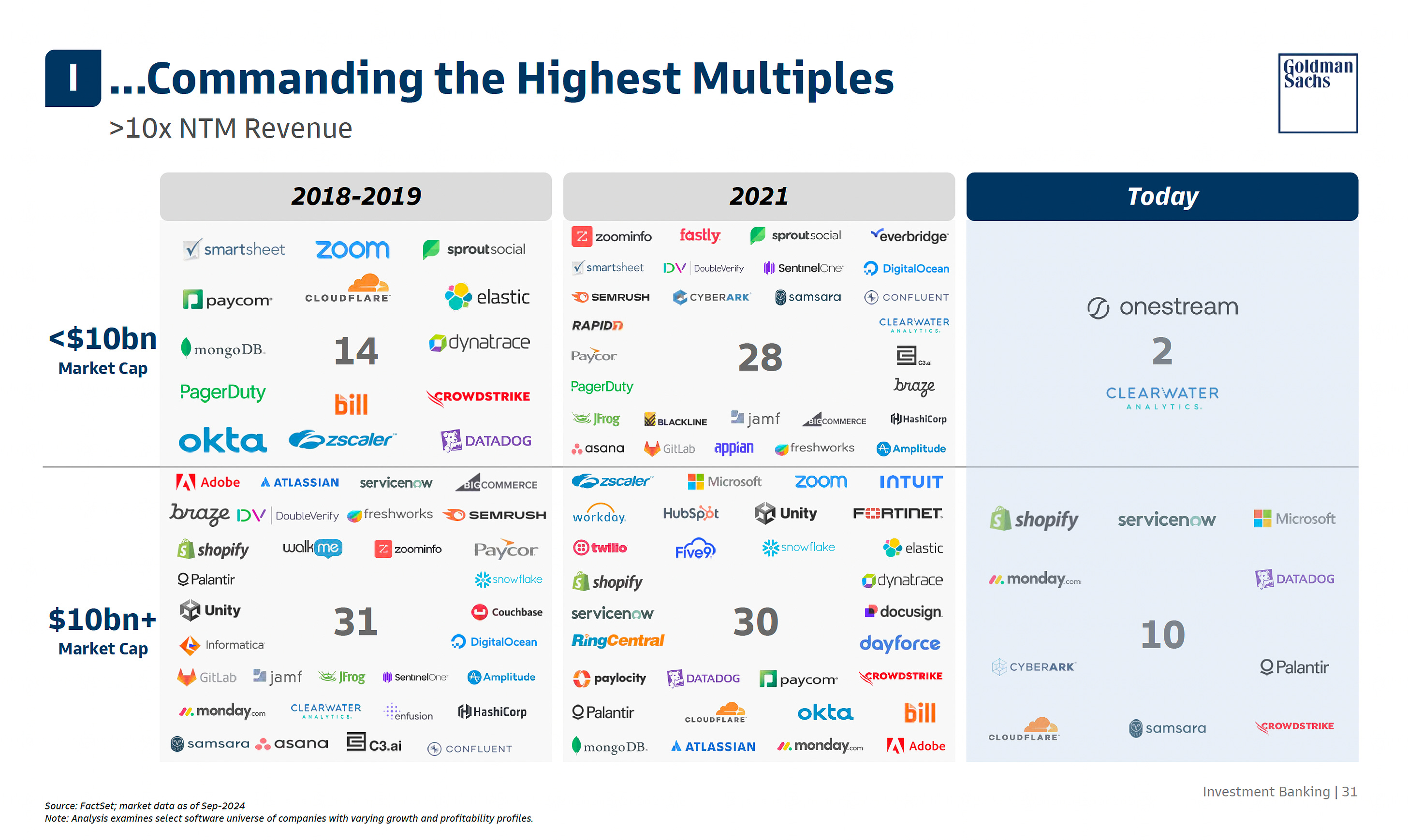

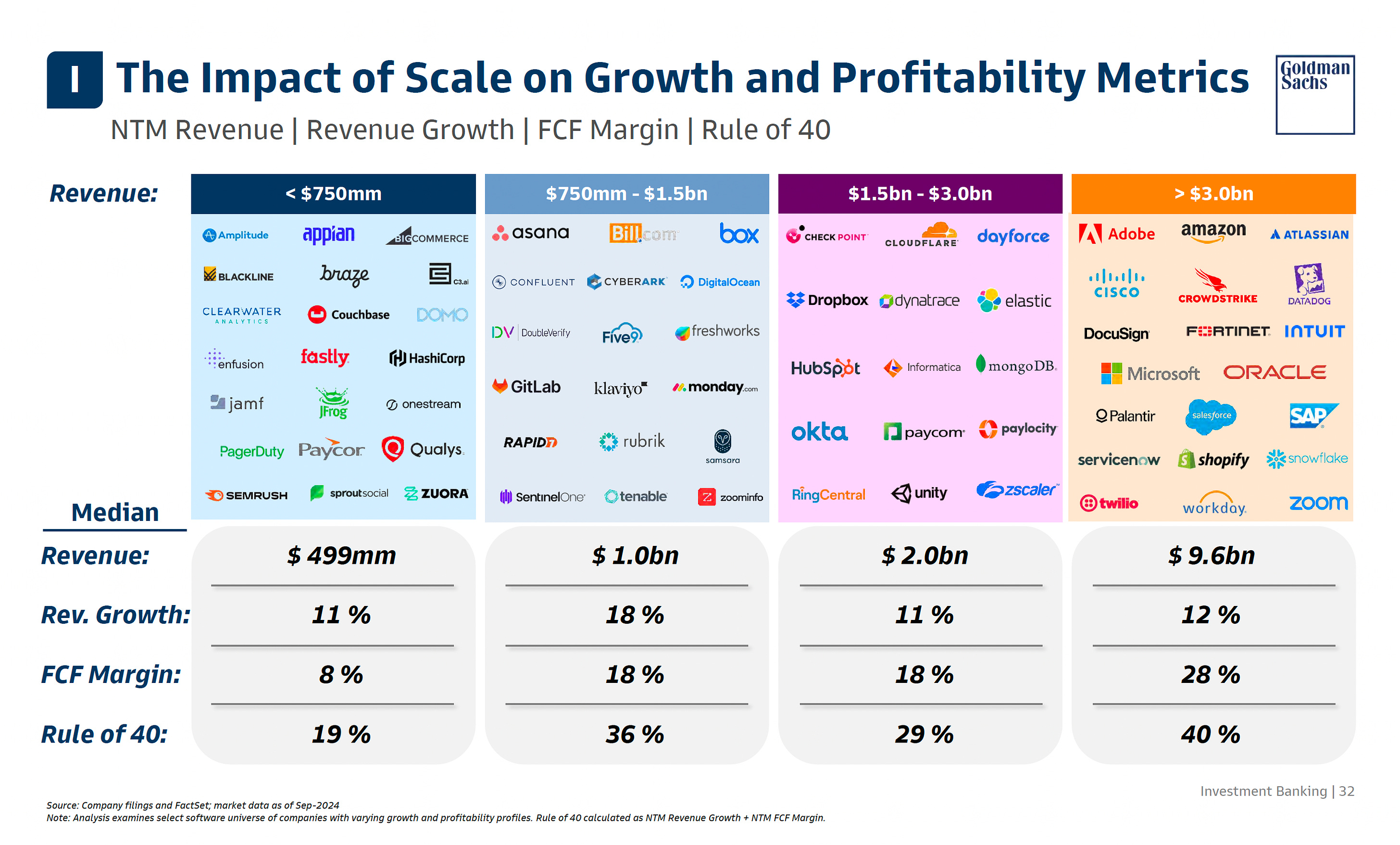

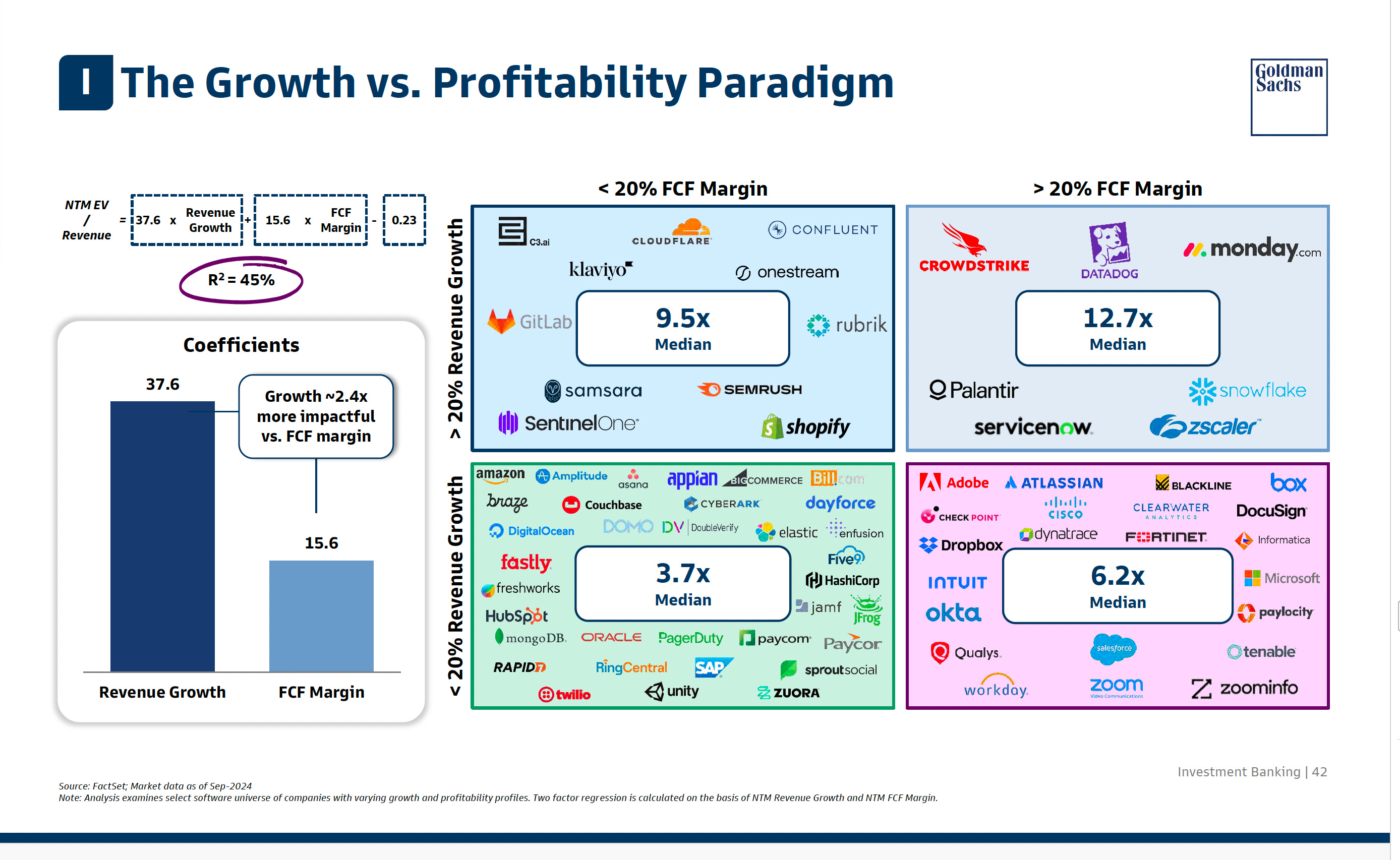

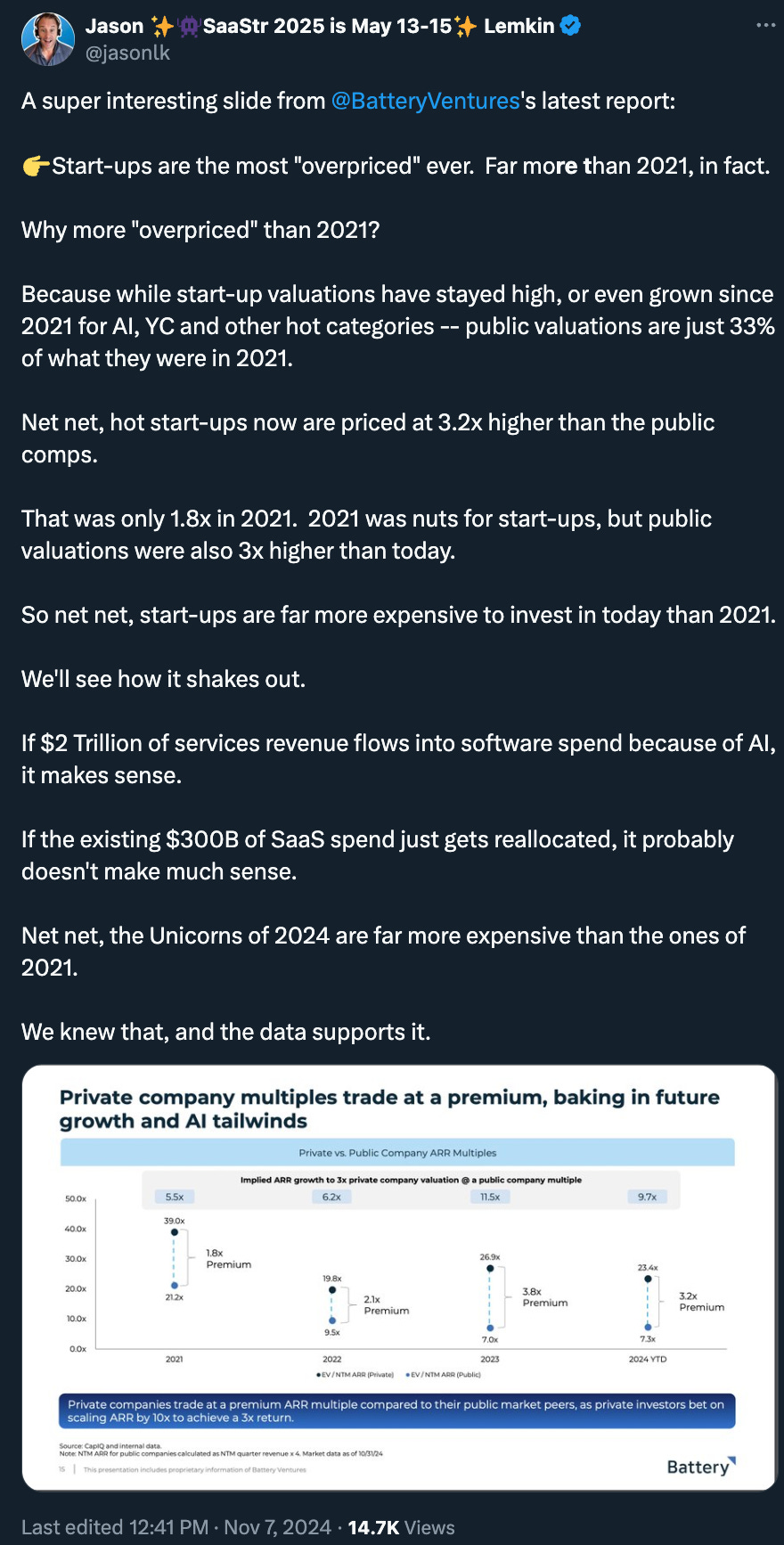

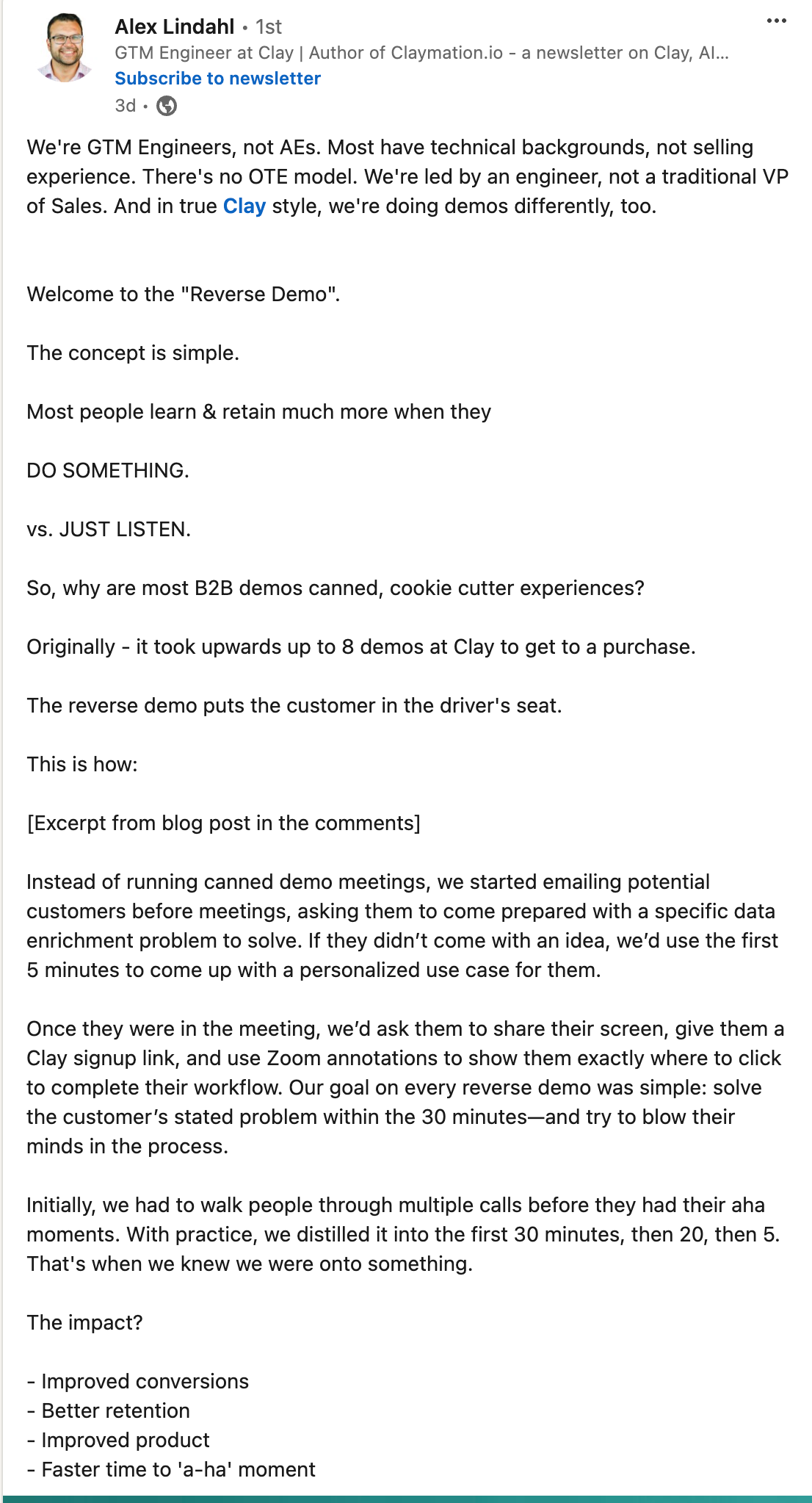

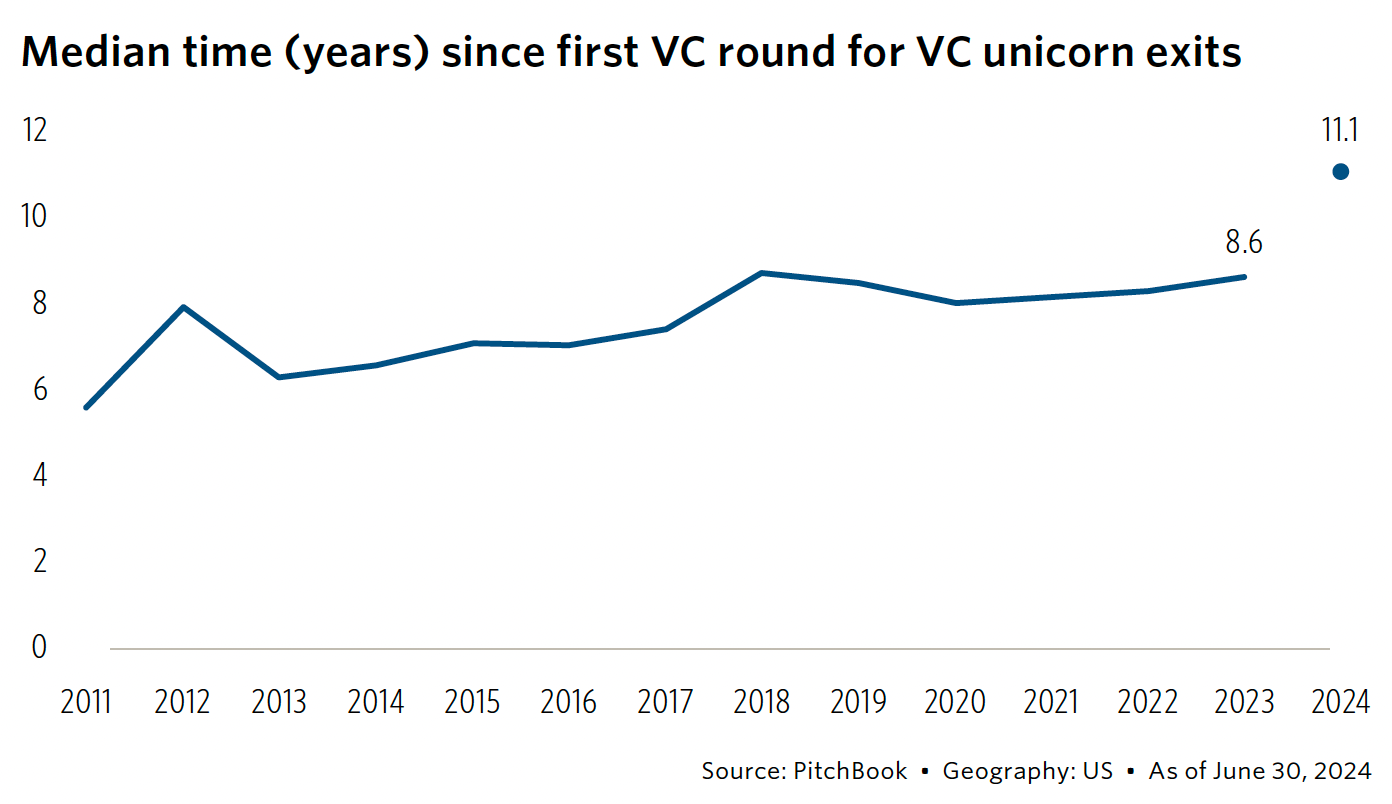

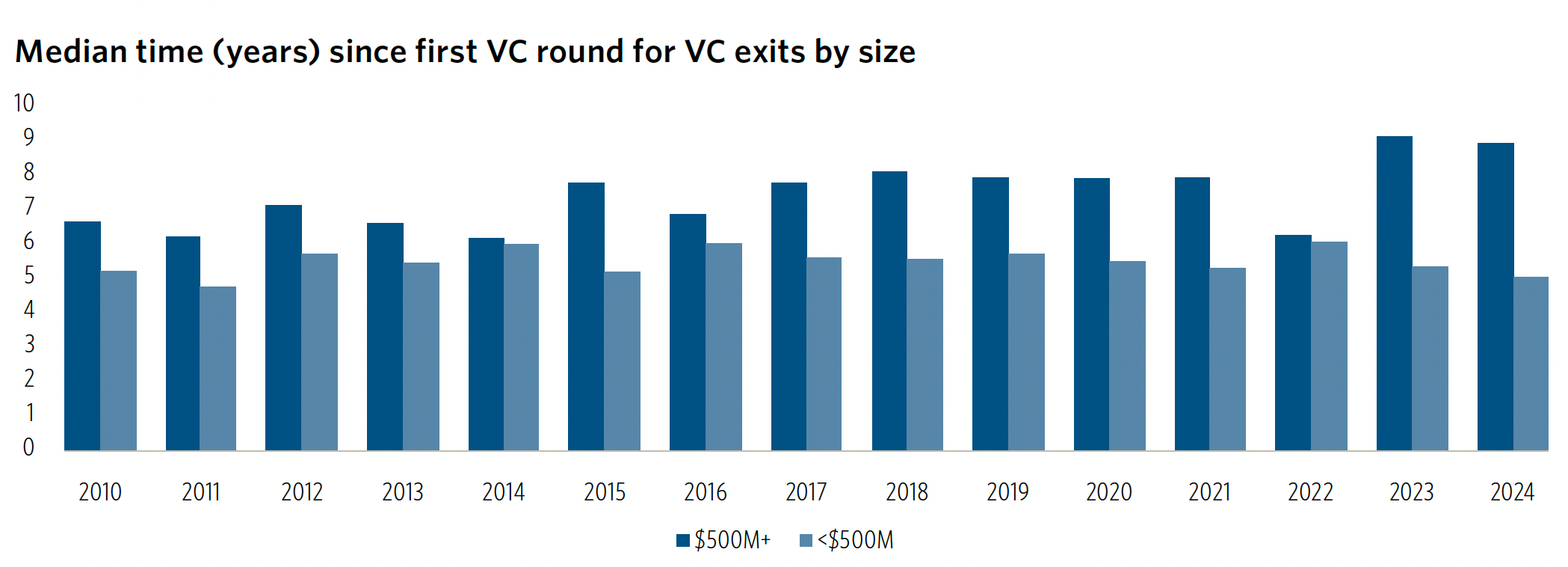

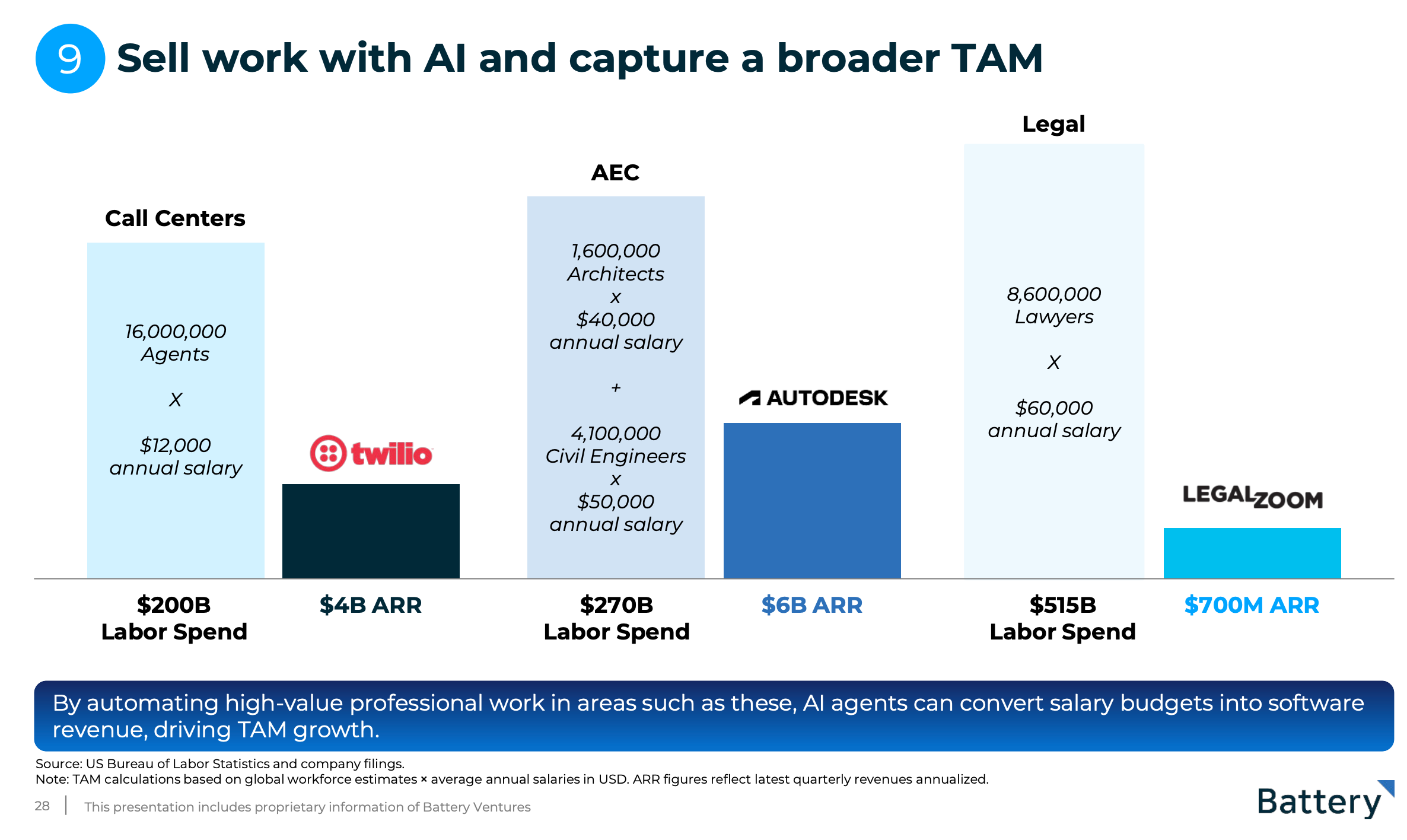

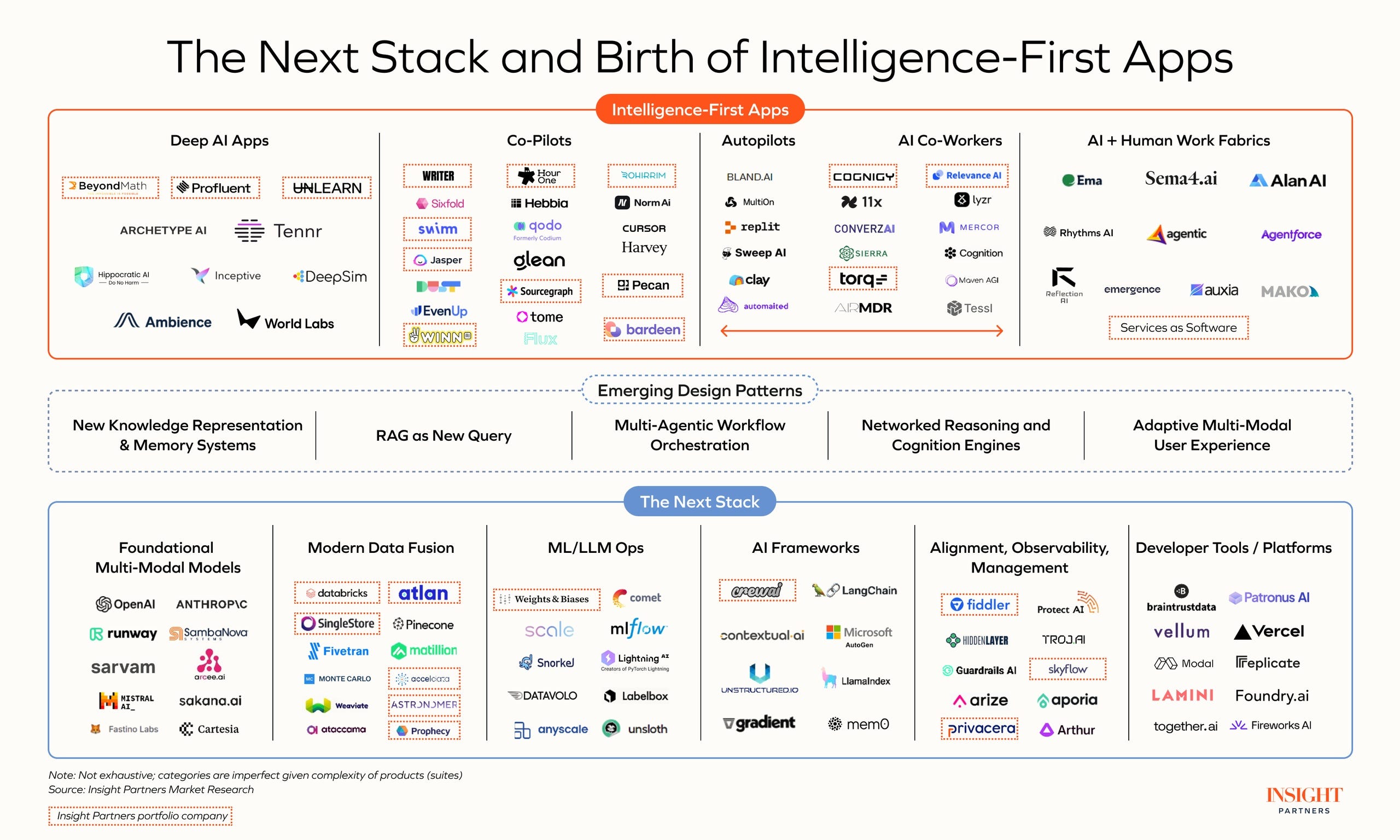

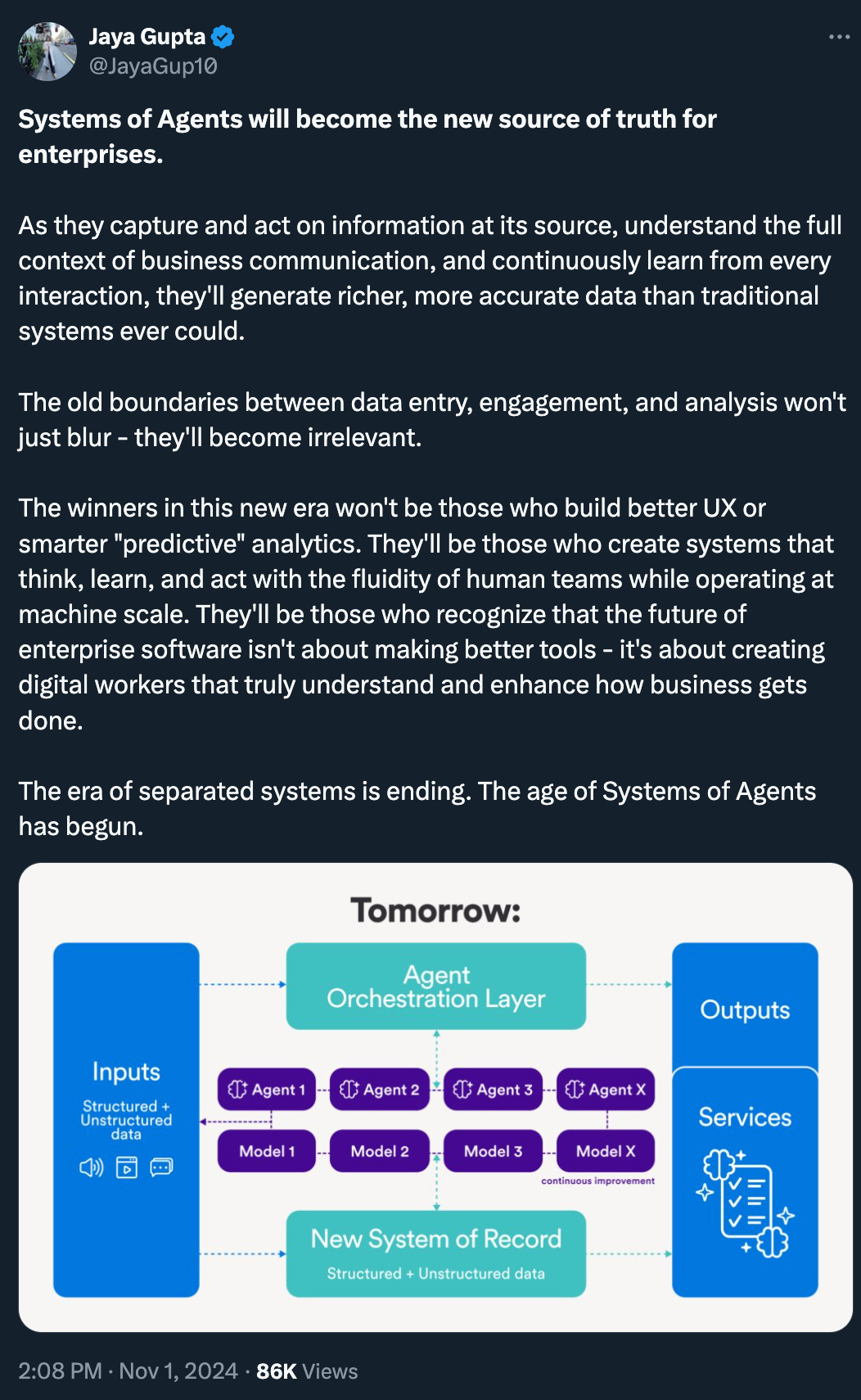

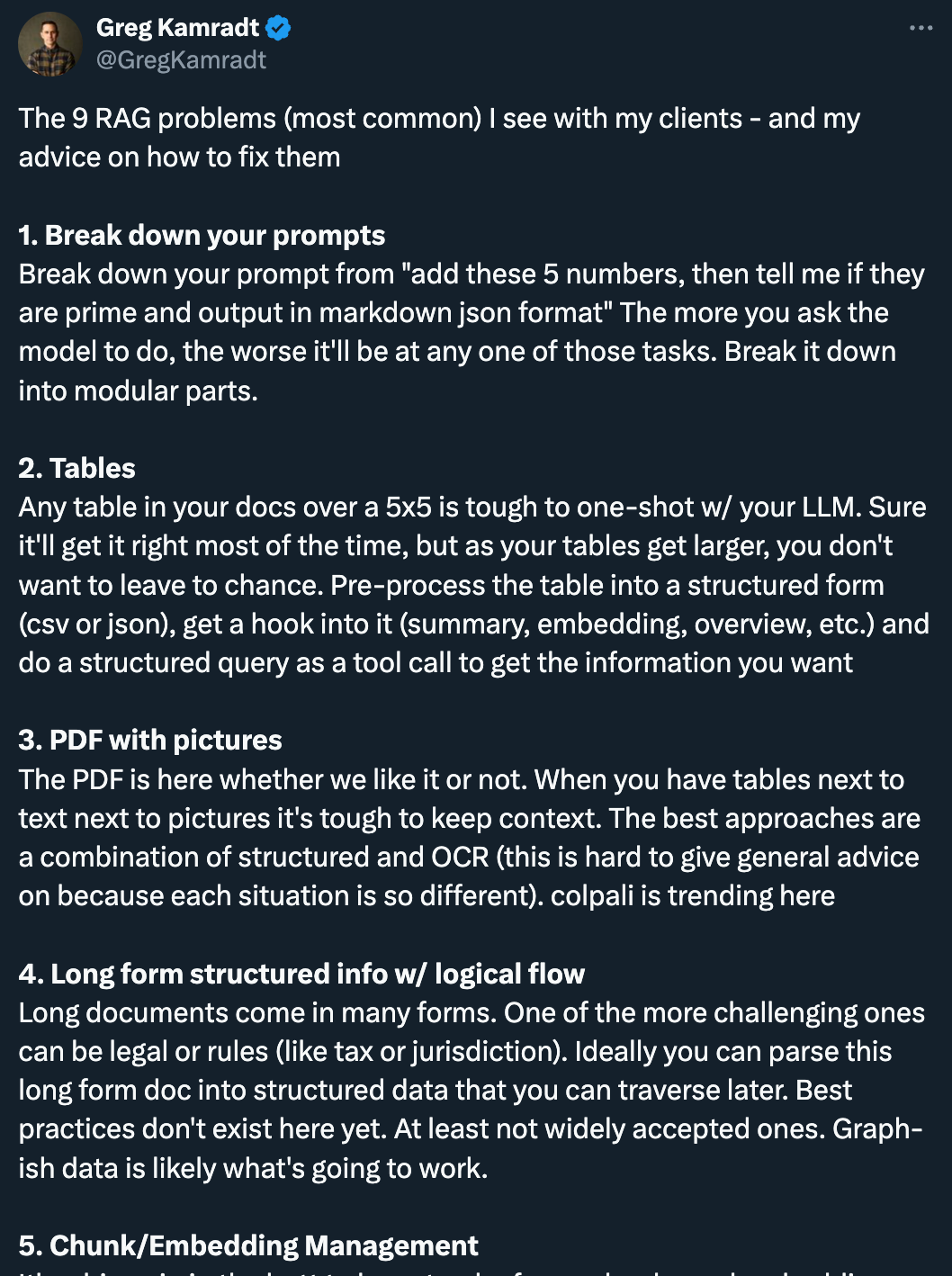

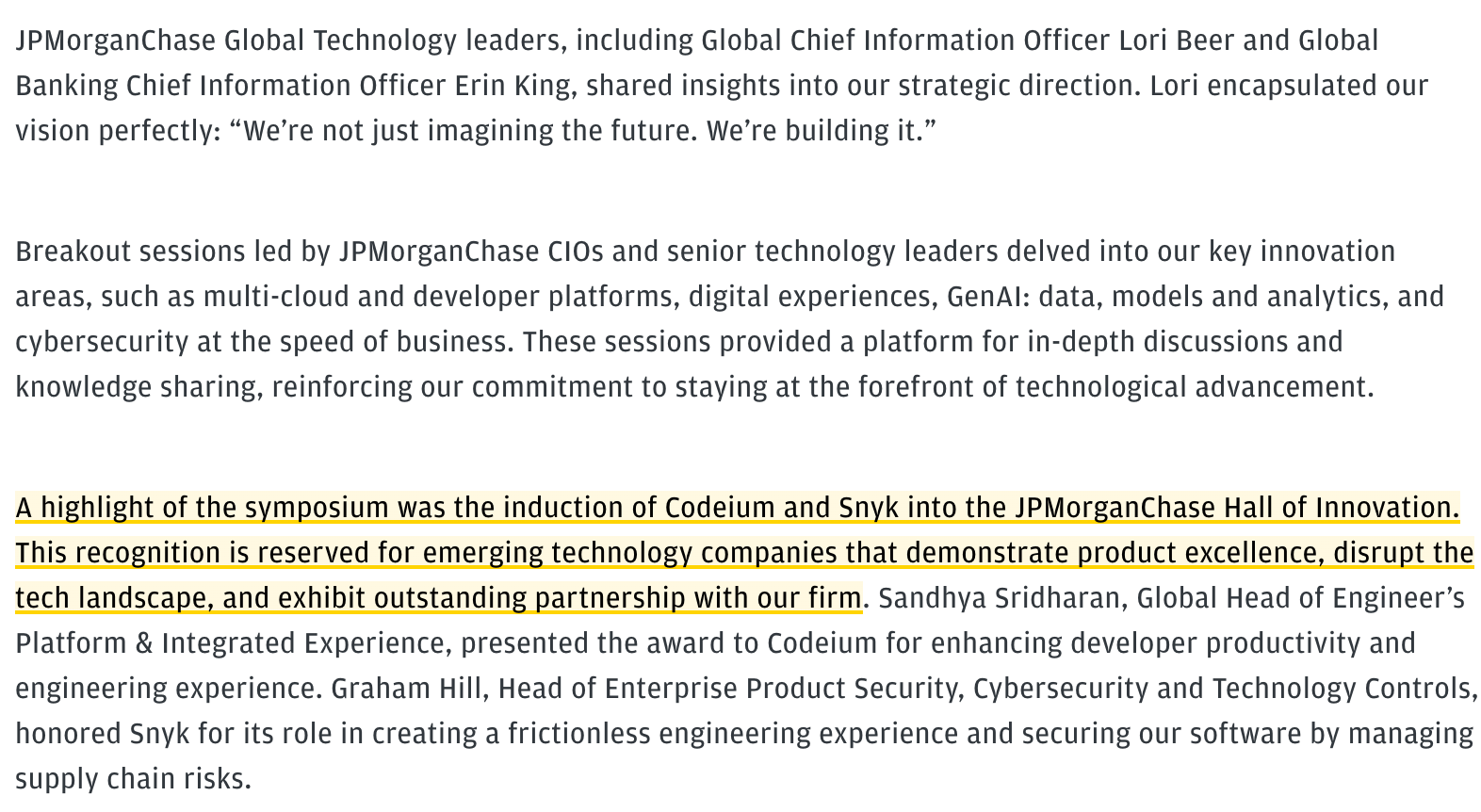

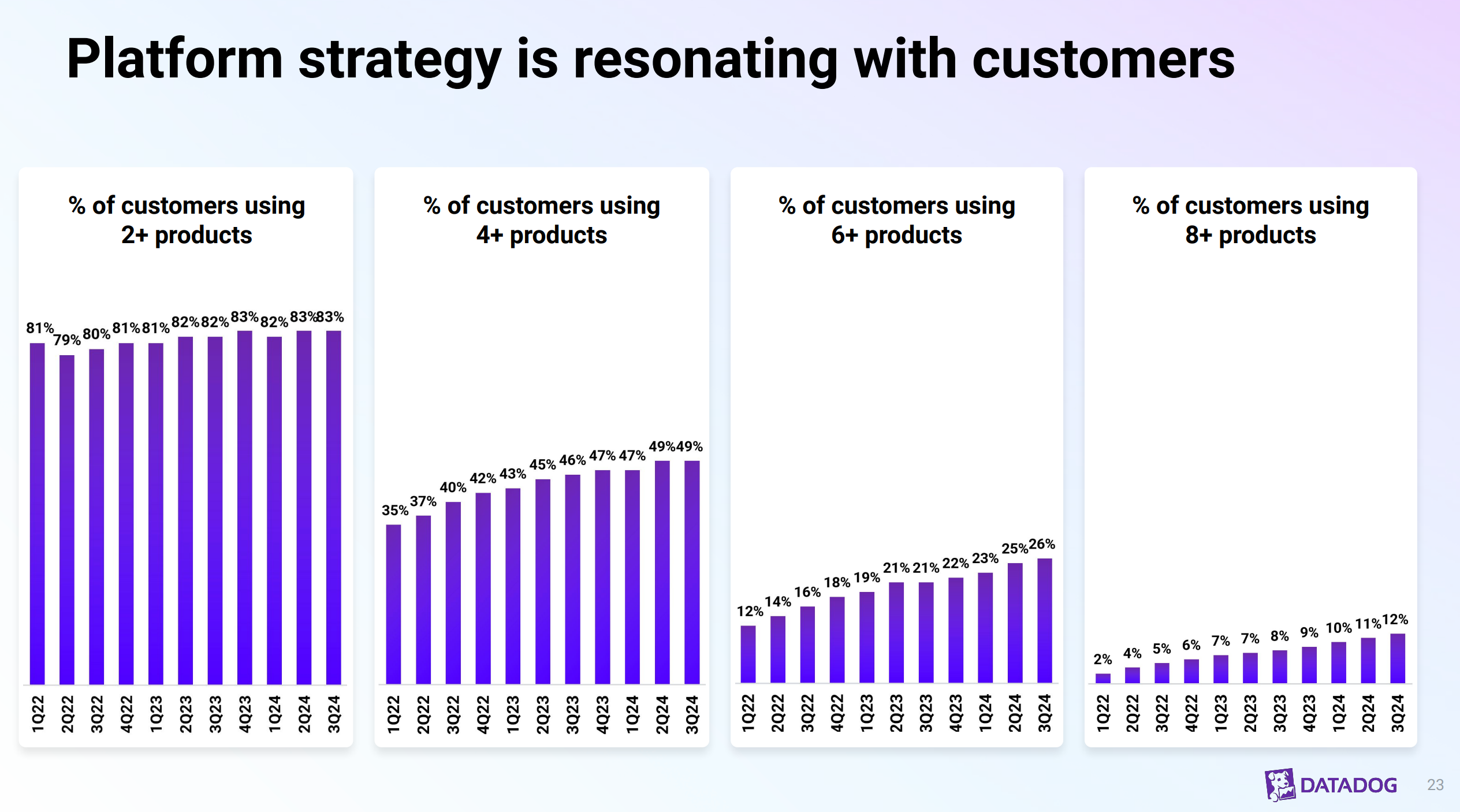

What’s 🔥 in Enterprise IT/VC #419To believe or not to believe, that is the question - AI is eating software but will it also eat labor?Mic 🎤 drop… This is simply unprecedented for a company at this size to reaccelerate growth like this - Palantir is now forecasting $2.8B of Revenue for 2024! While Palantir crushing Q3 is awesome for enterprise AI validation, it also just upleveled the bar for a super attractive IPO - Rule of 68 🤯 Otherwise, public investors can just keep loading up on $PLTR with more scale, profitability, and accelerating growth 📈 versus any new issue. Here’s a great chart from a recent Goldman Sachs Report on IPOs and public software companies - multiples accrue to scale - look at that - only 2 companies <$10B in Market Cap trade at a >10X NTM Revenue multiple 🤯 Another way to look 👇🏼 - why buy companies <$750M in Revenue when you can buy more durable, predictable software companies with >$3B of revenue who are also growing faster with a Rule of 40 that is 2x better! When it comes to the Rule of 40, Wall Stret wants it all; >20% growth and >20% FCF which yields a 12.7X Median NTM Revenue multiple. Jason Lemkin nails it here 👇🏼 To believe or not to believe, that is the question! AI is eating software, but will AI also eat labor? Will every worker have an agent or dozens or hundreds of agents augmenting or even replacing some of their work or not? How much of work will become personified? If you believe, then you play the game on the field and invest. Hopefully you’ve chosen wisely and if so, you’ll ultimately be rewarded with TAM and multiple expansion. If you’re a non-believer, then you just wait it out. Matt Harney also has a great breakdown here which also addresses why venture investors continue to “race to be first” and inception invest. Ok back to Palantir - this is why I’m super excited about the enterprise AI future. It’s still super early! Here’s an excerpt from Alex Karp’s Q3 Letter: Enterprise AI is real folks and don’t forget where the value is as Alex Karp says: Video here 👇🏼 And the investment to be ready for right place right time has been in the making for years! And a reminder from Alex - “This is still only the beginning.” As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups#so good from Alex Lindahl at rapidly scaling Clay (a boldstart portfolio co) - always adapt your sales GTM and even be open to the profile of your hire - it’s a new world with AI and new playbooks are needed. It’s working btw in a big way for Clay BTW this is very Palantir like - give me a use case and let’s build something together! #VC funds may have to be longer than 10 years by default…(h/t Beezer Clarkson) - exit timeframe only getting longer…esp. for those exits >$500M >$500M exits 📈 from 6 years in 2010 to 9+ years in 2023! Enterprise Tech#fantastic report from Battery Ventures - Inside the Coming AI Market “Supercycle” and How Cloud Startups Can Benefit: The Battery Ventures 2024 State of OpenCloud Report” #2 more VC AI Market Maps, both hitting on the “AI is eating Labor” trend Insight Partners - Intelligence First Apps Foundation Capital - system of agents delivers the labor productivity And my firm boldstart ventures port co is just 📈 #💯 Why Kustomer’s work-based pricing is the future - see last week’s What’s 🔥 #9 most common RAG problems… #SSPM (SaaS Security Posture Management) becomes real as Crowdstrke buys Adaptive Shield for a rumored $300M with $44M of overall VC funding #Speaking of, how does Pat Opet, CISO JPM, think the world of cybersecurity has changed and why Adaptive Shield and SSPM makes sense? (Fortune) #JPMorganChase has a $17B IT budget…yet they are also amazing at partnering with early stage technology companies. And attending its annual Technology Innovation Symposium (2024 was #16) is a must-have for any founder or investor fortunate enough to join. Huge congrats to Snyk, a boldstart portfolio co, on its selection to the esteemed Hall of Innovation - previous winners include companies like Databricks. More here and also from Peter McKay at Snyk who shares some of the journey… Markets#Datadog with another earnings beat and the multi-product platform is one of keys (presentation here) What's Hot 🔥 in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot 🔥 in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What’s 🔥 in Enterprise IT/VC #418

Saturday, November 2, 2024

Who wins in AI? The Incumbent, the AI Native Startup, or...the Goldilocks Startup? The future is here: WORK BASED PRICING! No MORE SEATS - anatomy of the Kustomer relaunch ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #417

Saturday, October 26, 2024

What happens when hundreds of thousands of agents with read/write access run amok in an enterprise - "like hornets fleeing a nest" according to Bill McDermott ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #415

Sunday, October 20, 2024

Old school enterprise sales + delivery needed to solve the last mile problem in the enterprise - yes, services needed! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #416

Sunday, October 20, 2024

8 years of What's 🔥 🙏🏼 - more on Palantir's model from services (FDE) to product and now product + some services + why every startup will have to provide some bodies to deliver to the ente ͏ ͏

What’s 🔥 in Enterprise IT/VC #414

Saturday, October 5, 2024

VCs giving 💰 back - dot.com vibes or AI vibes - will there be more or less $10B outcomes? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

UK startups roll back hiring

Friday, March 28, 2025

+ Bending Spoons almost doubles in value; Web Summit legal drama View in browser Vanta_flagship Author-Amy by Amy Lewin Good morning there, If I were to take a bet on which of Europe's startups

🗞 What's New: Is Gemini 2.5 the new vibe coding standard?

Friday, March 28, 2025

Also: Vibe coding to $12K in 4 weeks ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⏰ 72 hours left - grab your seat and change your business forever

Thursday, March 27, 2025

We've taken the most game-changing, highly rated sessions and packed them into one powerful day. Hey Friend , The Ecommerce Product Sourcing & Manufacturing Summit Highlights goes live in just

SaaSHub Weekly - Mar 27

Thursday, March 27, 2025

SaaSHub Weekly - Mar 27 Featured and useful products todo.vu logo todo.vu todo.vu combines task and project management with time tracking and billing to provide a versatile, all-in-one productivity

81 new Shopify apps for you 🌟

Thursday, March 27, 2025

New Shopify apps hand-picked for you 🙌 Week 12 Mar 17, 2025 - Mar 24, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Draft Orders automatically removed after 1 year of

🧠 This Week in GrowthHackers: AI Advances, SEO Strategies & Market Shakeups

Thursday, March 27, 2025

Key updates from OpenAI, Databricks, and Tesla—plus tools and how-tos to sharpen your growth edge..

Investors Guides: The Full Series + Exclusive Cheat Sheet

Thursday, March 27, 2025

Tactics from 50 elite investors on finding breakout companies, winning deals, and constructing enduring firms. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

the drug R&D playbook

Thursday, March 27, 2025

AI is rewriting the rules across the entire R&D pipeline. here's what you need to know. Hi there, The drug R&D playbook is being rewritten. Join CB Insights' Senior Analyst, Ellen Knapp

Sneak Peak Of My Latest Podcast & PH Hunt

Thursday, March 27, 2025

Hey everyone 👋 how have you been? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

That magic moment

Thursday, March 27, 2025

Read time: 57 sec. You ever had a moment where something just clicks? Zach, one of our AI Build Accelerator members, dropped this message in Slack the other day: “Had a pretty surreal moment yesterday.