Hot in Enterprise IT/VC - What’s 🔥 in Enterprise IT/VC #414

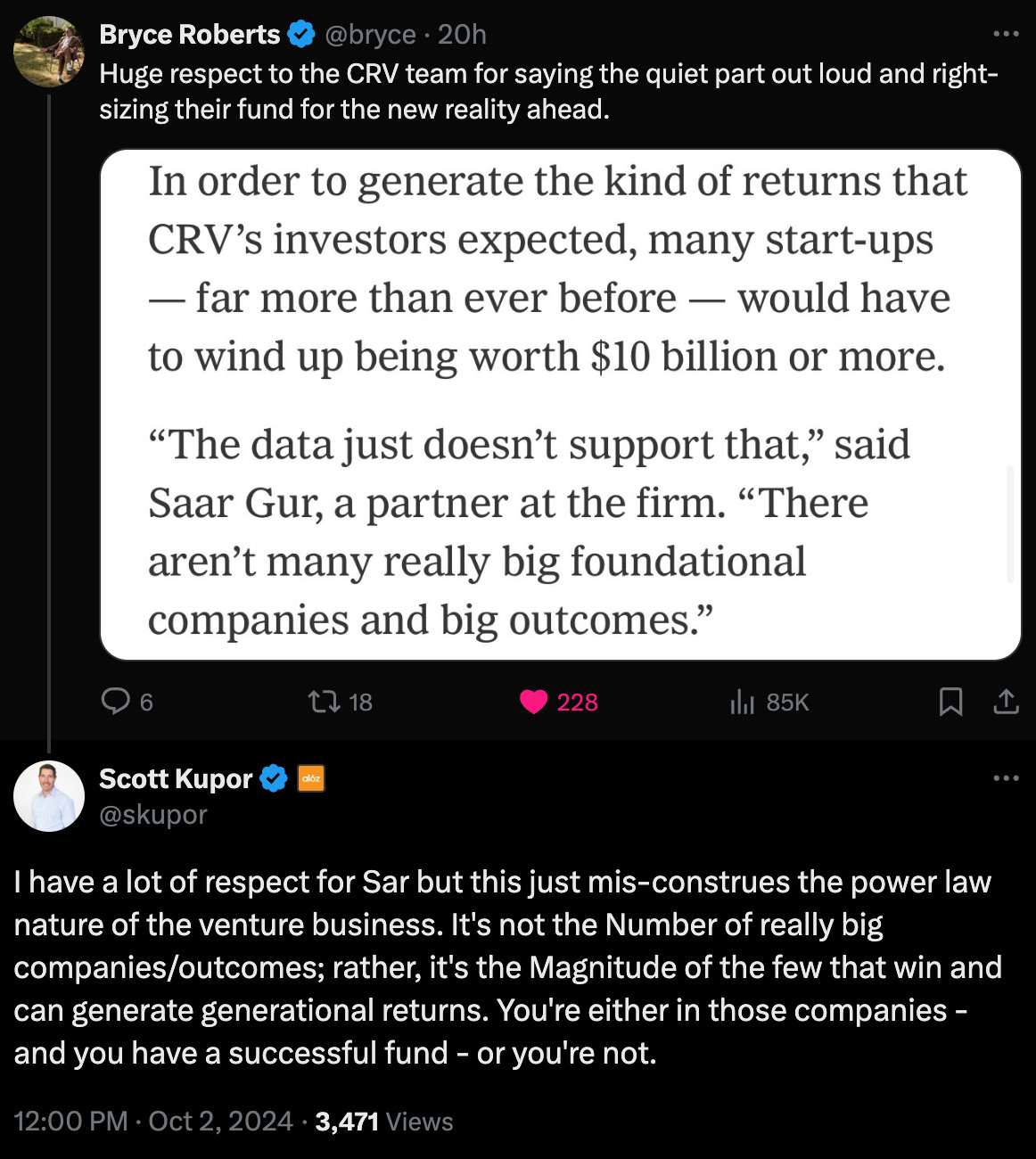

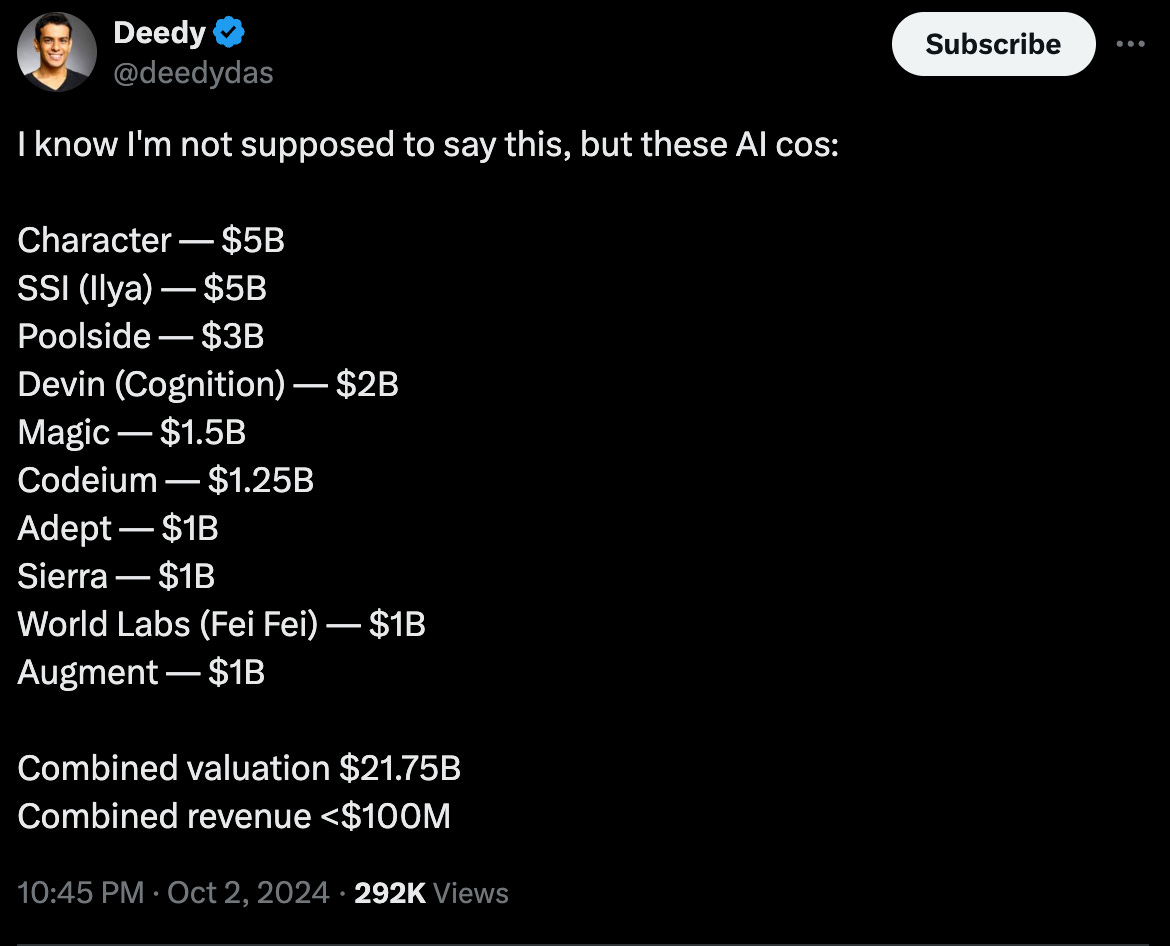

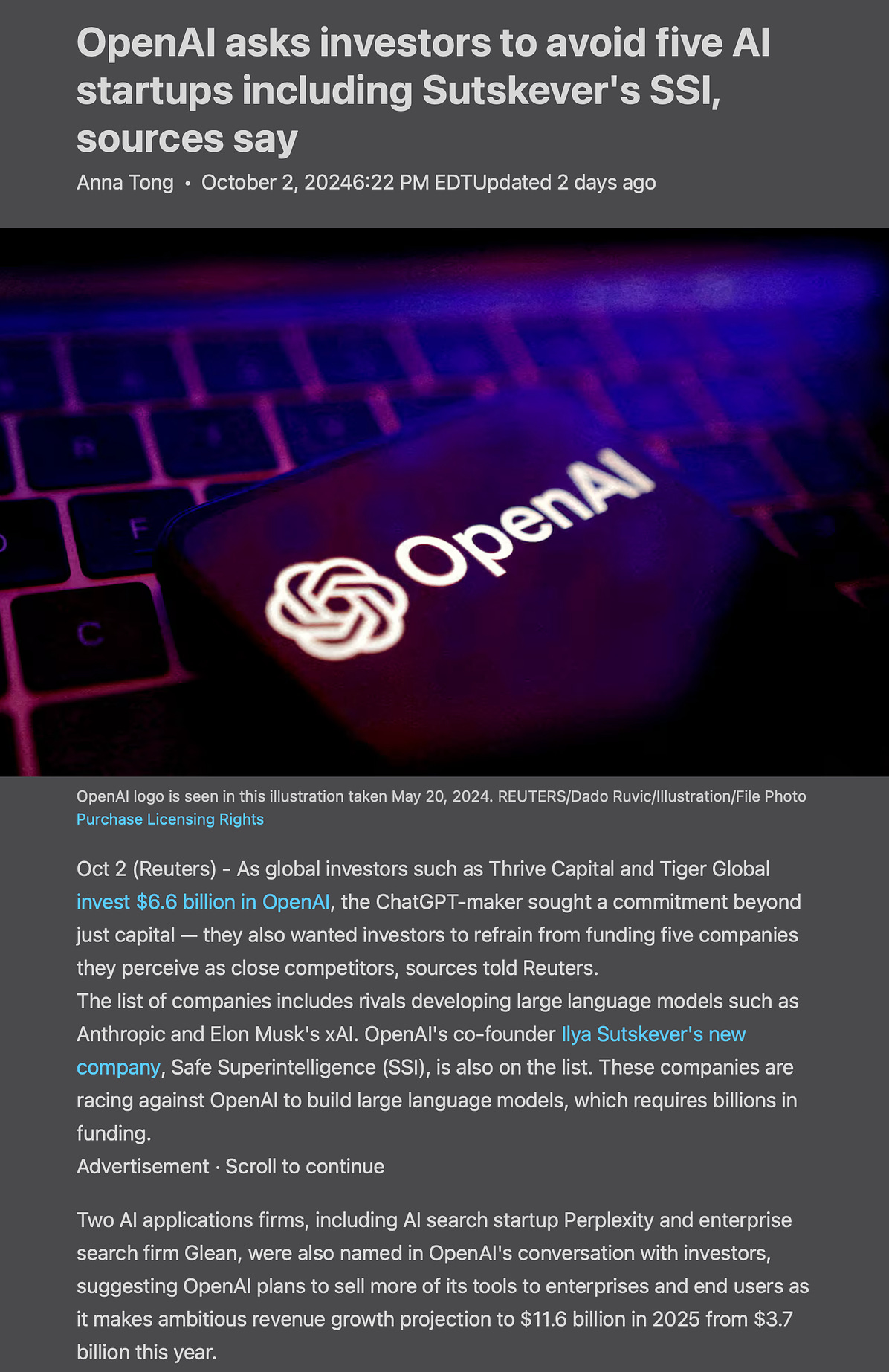

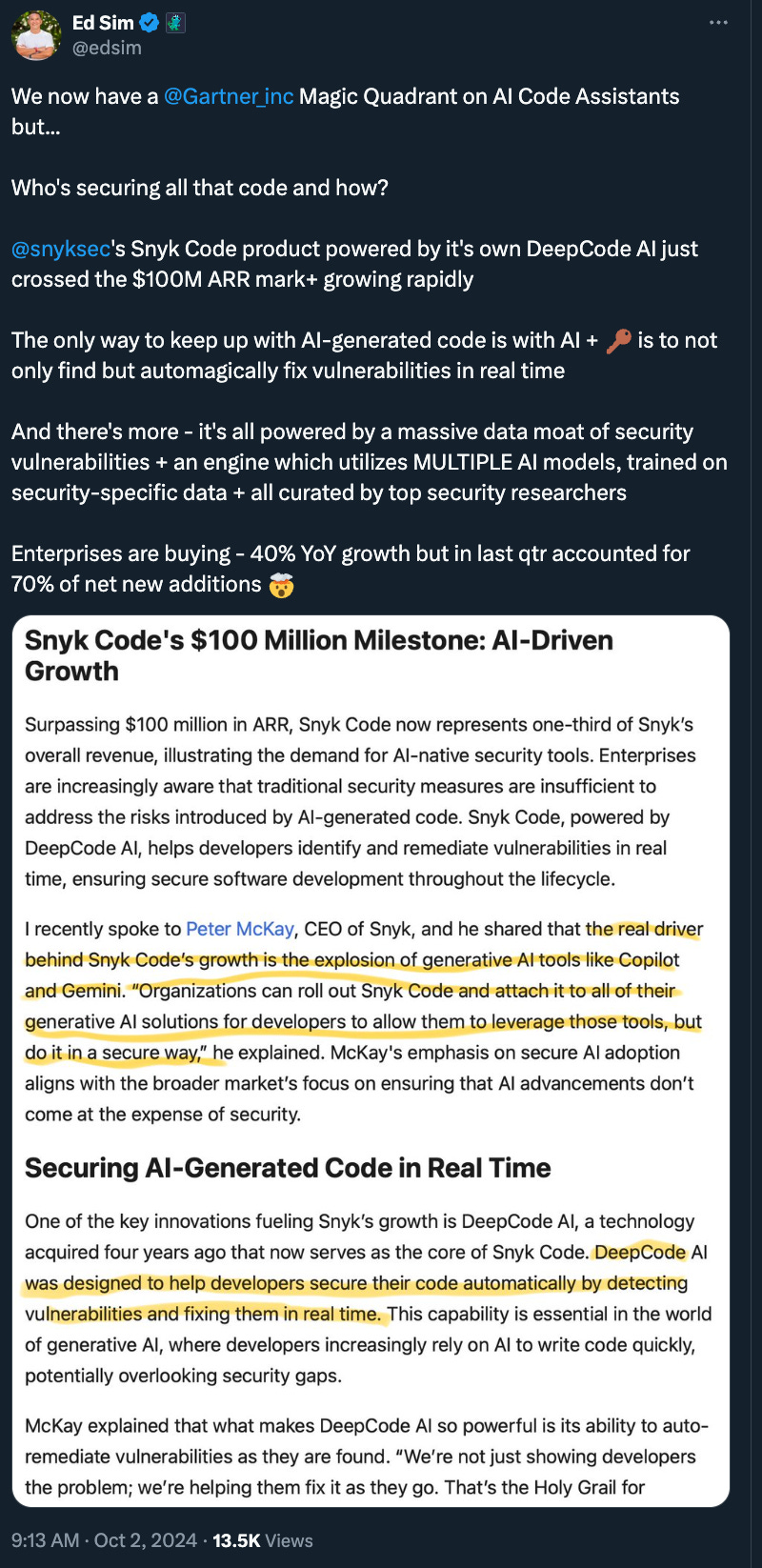

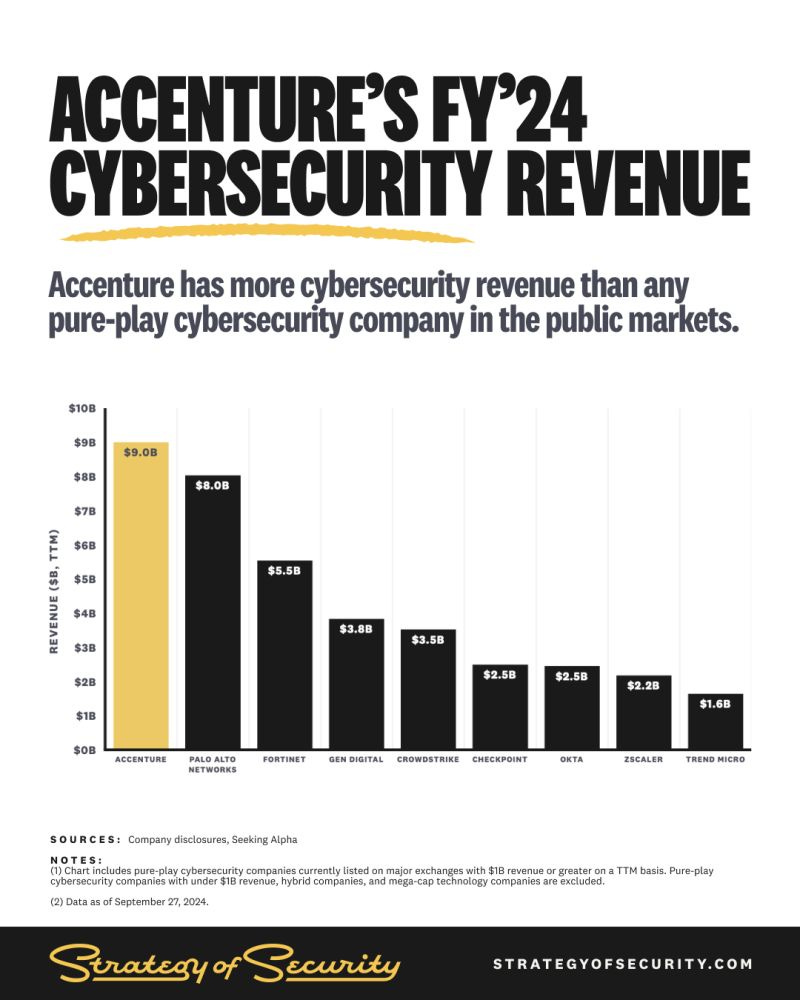

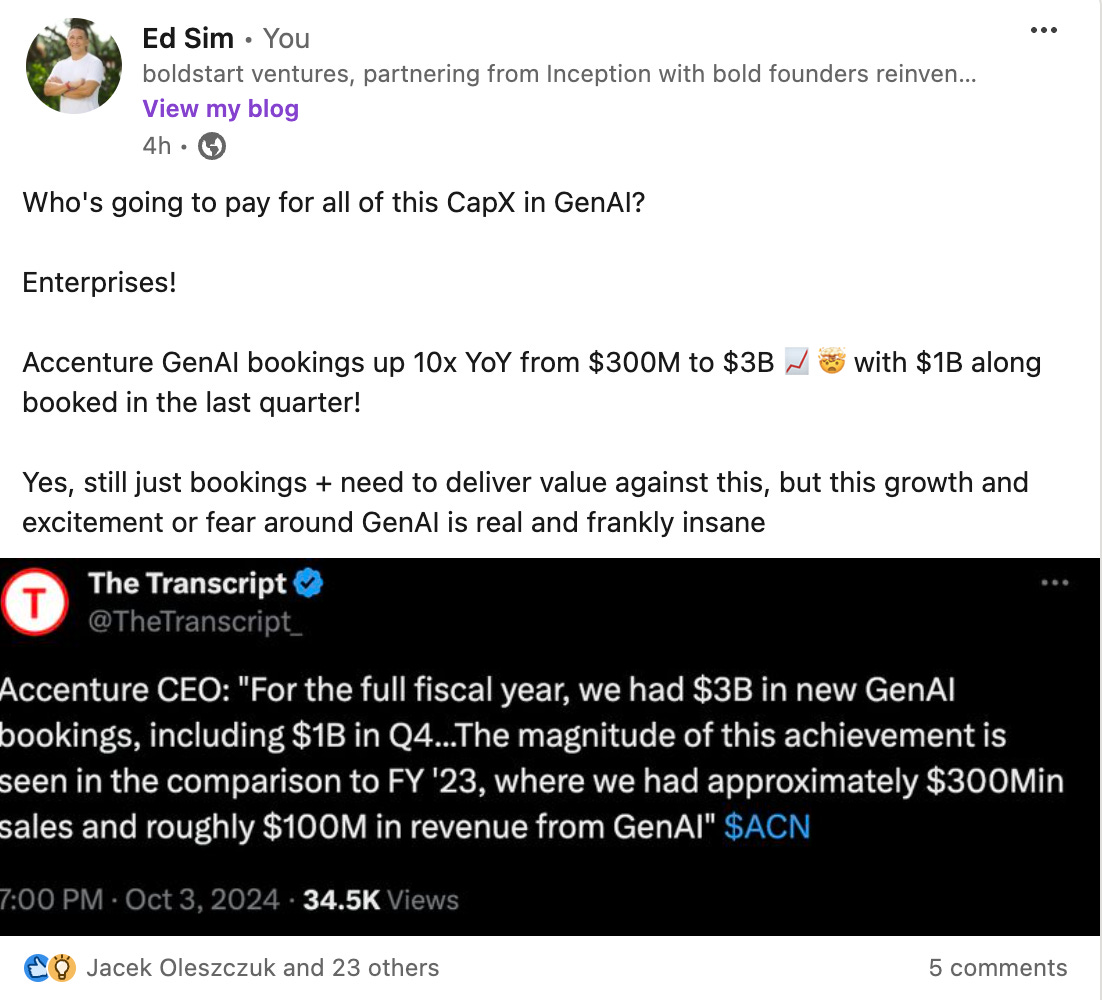

What’s 🔥 in Enterprise IT/VC #414VCs giving 💰 back - dot.com vibes or AI vibes - will there be more or less $10B outcomes?CRV’s announcement that it’s giving back $275M to focus on early stage investing had the venture and startup world abuzz this past week. There are shades of the dot.com era when CRV and many others gave back significant pools of capital, but IMO there is a caveat. The $275M CRV is giving back is from a $500M Select pool for later stage opportunities which is not their core expertise. CRV is much better known for its early-stage experience, and I do have mad respect for them on that stage. And while the headline has people thinking about the future of venture capital and exits, I have to remind everyone that CRV still has a $1B fund for early-stage investing - which is ginormous! Once again, “the valuations for start-ups are too high relative to their potential for a payoff,” the partners said. Make sense right? But here’s the bigger question that Bryce Roberts highlights - is this a fundamental flaw in venture capital or in massive venture outcomes in general? (I encourage you to click through and read the 🧵 which includes LPs and founders.) As per CRV, “the data doesn’t support enough $10B+ venture outcomes to support a fund of that size.” But CRV still has a $1b early-stage fund which means they and all of us have our work cut out if this is true. Let’s do some venture funds math for a second. If you have a $1B fund for early stage and you own an average 10% at exit, in order to return 4X gross and 3x net one has to have a fund that delivers $40B of exit value at IPO or M&A (10% of that is $4B and that is 4X gross the $1B fund size). That is still a tall order!!! Scott Kupor from a16z chimes in that it has always been about manager selection and the outcomes will always be there. I also wrote more about the impact of declining growth in enterprise software companies along with multiple compression and how that impacts venture funds math. But luckily, we have AI! I can assure you that the VCs who invested in the below companies with limited revenue were thinking outcomes bigger than $10B. For that to occur, the idea that AI eats more than just SaaS but people, yes labor productivity, a $5 Trillion+ opportunity, must be true. The other question is where will value accrue - will it be made at the model layer, infra layer or app layer? At the moment, investors have placed significant early bets on models and compound plays with models/apps with coding assistants like Poolside. It’s still early but VCs thrive on hopium! One other caveat, we have to remember that most at the model layer know that the race to stay in front is expensive and challenging and that they need to move up the stack to capture more value…at the app layer. Here’s a perfect example - OpenAI just closed the biggest private round in history raising $5.6B at a whopping $157B valuation and investors had to sign up to this 👇🏼. While not investing in other model providers like Anthropic and xAI or Ilya’s new company makes sense, notice 2 other cos - Perplexity in search and Glean for enterprise search. The latter is the one that should get everyone’s attention - OpenAI wants to be the default search and workflow engine for all enterprises. It’s also going to go after Github CoPilot and offer its own coding assistants. This is going to be fascinating to watch as models move up the stack and compete with apps. One last example - open source is catching up fast. Runway has already raised over $236M of funding and now we have free from Meta. Matt Turck summarized the week quite well and I encourage you to check out the comments as well! So let’s go back to the CRV story - the intention is for them to focus on what they do best, early stage investing. And with that, once again it’s pretty clear that no matter who wins, the best place to be as an investor is first, at Inception! I’ve written about Inception Investing so many times starting with What’s 🔥 #365. A couple of days ago, I took several posts, tweets, podcasts and uploaded them into Google Notebook LM and voila, here’s a summary podcast it created on Inception Investing. It’s pretty mind blowing 🤯. Listen in! And here’s the briefing doc Google created. I highly encourage you to try Google Notebook LM as it can help you become an expert in anything in minutes!!! Upload your favorite videos, podcasts, charts, PDFs, screen shots, and it will synthesize the data, summarize it, allow you to chat with it and create the pod for you. It’s like having your own analyst in anything! Whether or not you believe there will be less $10B outcomes or more, I have to say that is one of the most fun times I’ve experienced as a VC over 28 years! The pace is insane, the tech is mind blowing, and there is no true consensus which means lots of opportunity to generate alpha if you play it correctly. LFG! As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups#anecdotal state of markets at moment #great 🧵 from co-founder of Hubspot of all he learned as a founder #IMO product and thinking about distribution down the line goes hand in hand - if you are building a bottoms up co, well, the product better reflect it #Reminder on greatness #Saturday morning inspiration - listen to the 🐐 #speaking of the above - just sharing 🤔 🏋🏼♂️ Enterprise Tech#if AI coding copilots are generating tons of code, who’s going to secure all of that in real-time? Well you need AI of course - congrats to portfolio co Snyk on this huge milestone - the AI tailwinds are real 🤯 #AI coding copilots are huge but the next big thing is in IT and cloud ops as Observe AI raised $145M Series B for AI powered observability and Resolve.ai raised $35M inception round as the world’s first AI production engineer #Accenture cybersecurity related revenue > Palo Alto Networks 🤯 - makes sense as who is going to implement all of this software and make it work! (Cole Grolmus) Founders have to control their own destiny to get to their first $10M but if they want to scale to $25M and beyond to $100M channel partners matter 👇🏼 #speaking of Accenture, who’s going to pay for all of that CapX for GenAI? #👇🏼 are old school SaaS incumbents at risk? #💯 #OpenAI growing 📈 and burning 💰📈 (NYT) #9 YC startups that stood out on Demo Day 2 (TechCrunch) #The gap continues to narrow between open source and closed models - also tiny and edge will be big in future #185 real world AI use cases from Gemini - good list - mostly agents, gets your mind 🤔 #cybersecurity for this is going to be a must have… #🤣🤣🤣 Markets#applies not only for publics but also venture - ownership matters and also knowing when to keep doubling down on pro rata and also staying put #❤️ this sentiment when building an investment firm, startup or anything! What's Hot 🔥 in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot 🔥 in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What’s 🔥 in Enterprise IT/VC #413

Saturday, September 28, 2024

Seeing, catching and riding big waves 🌊 - signs of early success + framework for building in net new markets vs. existing ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #412

Saturday, September 21, 2024

The impact of raising Jumbo Inception rounds, where the value accrues + >40% of all 🦄 in last 2 years are AI-related cos... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #411

Saturday, September 14, 2024

The future of AI as spoken by the OGs of Tech - Dell, Ellison, Huang, Benioff - keep 🏗️ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #410

Saturday, September 7, 2024

Speed mode + also, is the great unbundling of SaaS powered by agentic workflows? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #409

Saturday, August 31, 2024

Building a customer-obsessed culture from Inception - lessons from Clay and others... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

UK startups roll back hiring

Friday, March 28, 2025

+ Bending Spoons almost doubles in value; Web Summit legal drama View in browser Vanta_flagship Author-Amy by Amy Lewin Good morning there, If I were to take a bet on which of Europe's startups

🗞 What's New: Is Gemini 2.5 the new vibe coding standard?

Friday, March 28, 2025

Also: Vibe coding to $12K in 4 weeks ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⏰ 72 hours left - grab your seat and change your business forever

Thursday, March 27, 2025

We've taken the most game-changing, highly rated sessions and packed them into one powerful day. Hey Friend , The Ecommerce Product Sourcing & Manufacturing Summit Highlights goes live in just

SaaSHub Weekly - Mar 27

Thursday, March 27, 2025

SaaSHub Weekly - Mar 27 Featured and useful products todo.vu logo todo.vu todo.vu combines task and project management with time tracking and billing to provide a versatile, all-in-one productivity

81 new Shopify apps for you 🌟

Thursday, March 27, 2025

New Shopify apps hand-picked for you 🙌 Week 12 Mar 17, 2025 - Mar 24, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Draft Orders automatically removed after 1 year of

🧠 This Week in GrowthHackers: AI Advances, SEO Strategies & Market Shakeups

Thursday, March 27, 2025

Key updates from OpenAI, Databricks, and Tesla—plus tools and how-tos to sharpen your growth edge..

Investors Guides: The Full Series + Exclusive Cheat Sheet

Thursday, March 27, 2025

Tactics from 50 elite investors on finding breakout companies, winning deals, and constructing enduring firms. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

the drug R&D playbook

Thursday, March 27, 2025

AI is rewriting the rules across the entire R&D pipeline. here's what you need to know. Hi there, The drug R&D playbook is being rewritten. Join CB Insights' Senior Analyst, Ellen Knapp

Sneak Peak Of My Latest Podcast & PH Hunt

Thursday, March 27, 2025

Hey everyone 👋 how have you been? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

That magic moment

Thursday, March 27, 2025

Read time: 57 sec. You ever had a moment where something just clicks? Zach, one of our AI Build Accelerator members, dropped this message in Slack the other day: “Had a pretty surreal moment yesterday.