Bitcoin Hits New All-Time High & Wall Street Is More Interested

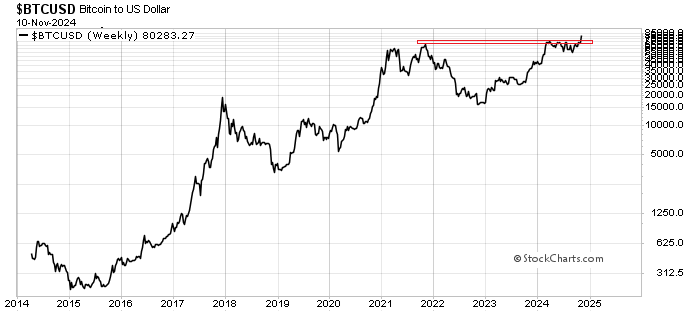

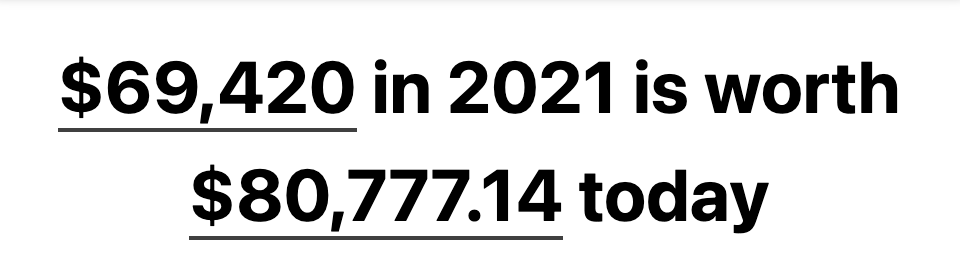

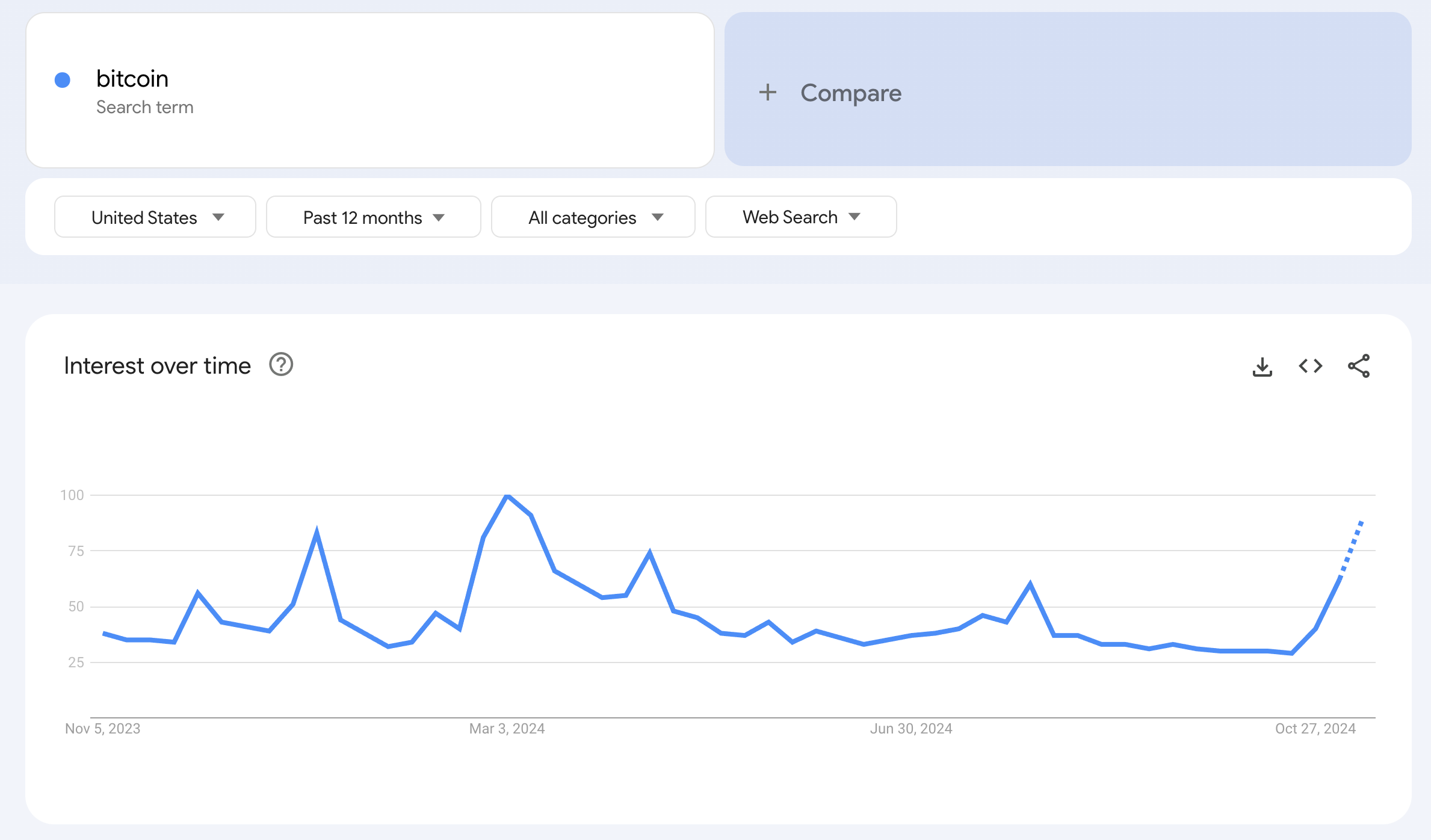

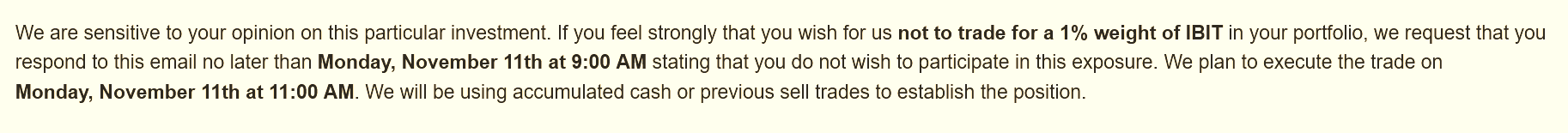

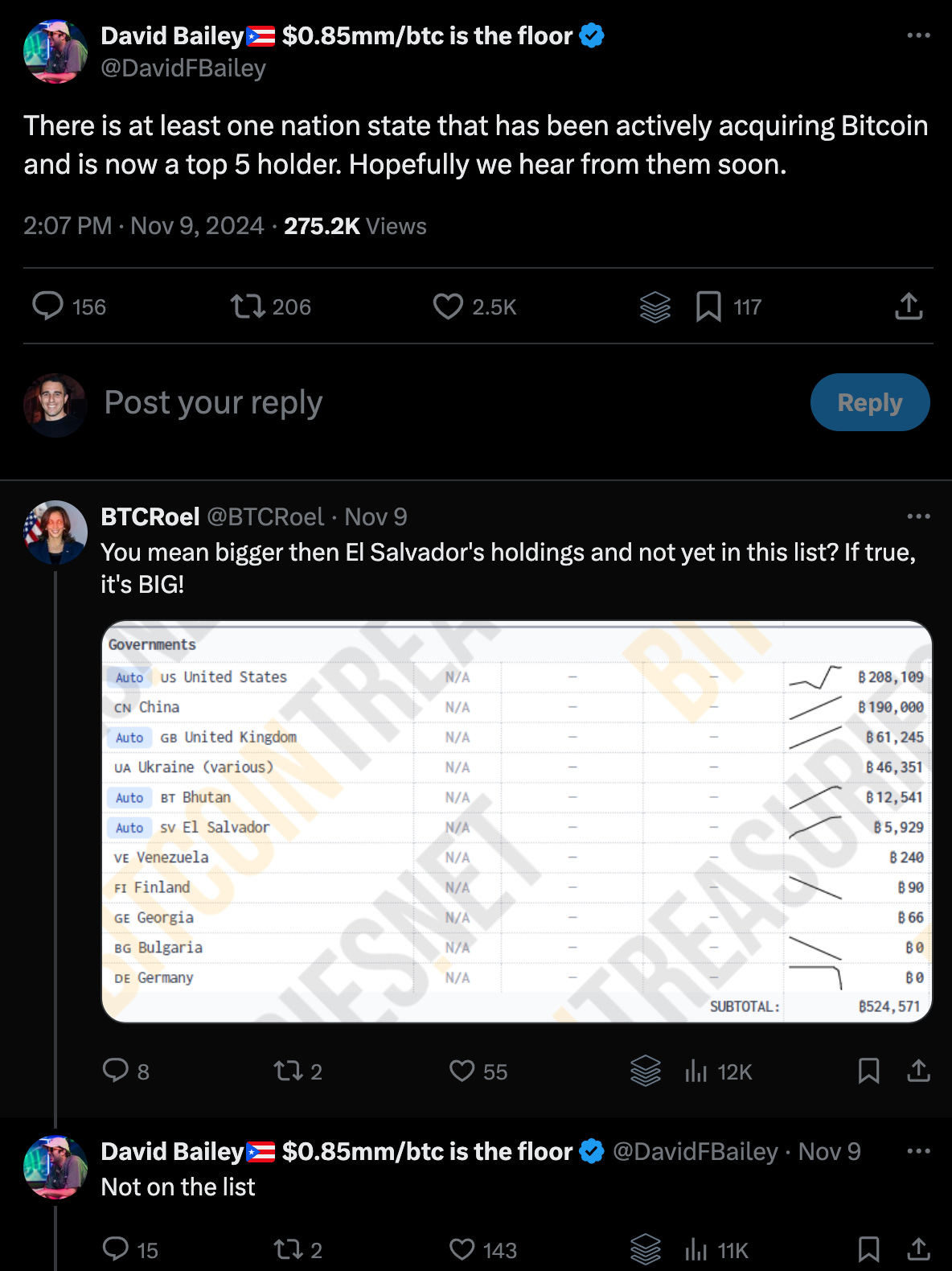

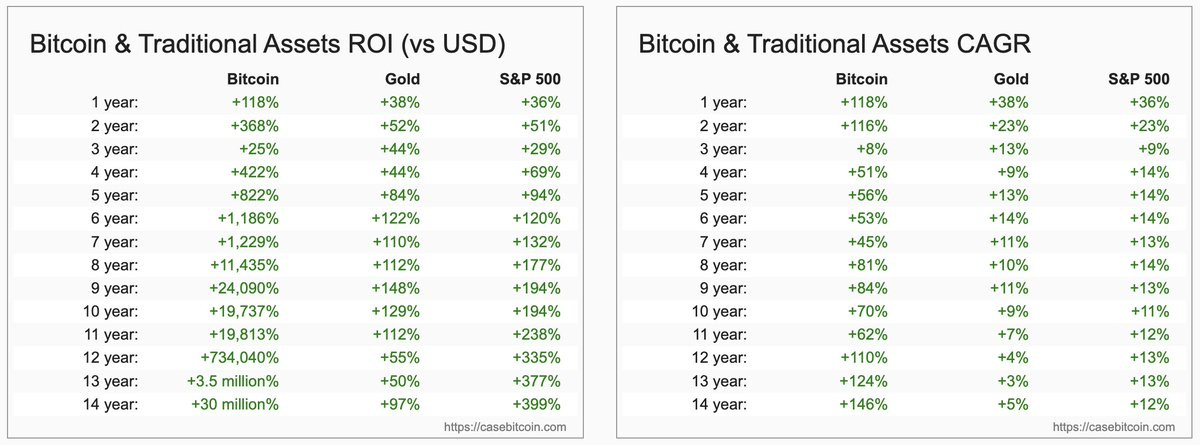

To investors, Bitcoin hit a new all-time high of more than $82,300 this morning. This means the digital currency is up over 18% in the last 7 days. The market seems to like that a pro-bitcoin President was elected. The latest all-time high is going to be particularly important for the trajectory bitcoin will travel in the next 12 months. I believe crossing $80,000 — which is a nice, big round number — will catch the eye of many investors and capital allocators. Bitcoin is now in a price range that has never been covered before. The charts look incredibly good too. Mark Ungewitter called it the “best chart on planet” yesterday. More importantly, the cross of $80,000 signals the first time in years that bitcoin has hit a new all-time in inflation-adjusted terms. Daniel Sempere Pico highlights the previous all-time high of more than $69,000 is actually equivalent to over $80,000 in today’s dollars. This weekend’s price appreciation put us over the new inflation-adjusted threshold. Institutional investors are going to be very interested in understanding bitcoin, and potentially allocating to it, when the media is talking about it non-stop all week. If you don’t think that is going to happen, then you are new around here. You will eventually learn. Retail is leading the charge on word-of-mouth. You can see Google Search queries starting to rise compared to the last 12 months. We still aren’t to the levels we saw for the new all-time high post-ETF approval in March, but we are getting close. I would expect Google Search trends to eclipse March levels by the end of the year. Speaking of history, we should pay very close attention to what happened four years ago. 2020 was the last halving year. We saw bitcoin’s price go from approximately $15,000 in early November to over $60,000 in March of 2021. That is more than 400% price appreciation in 5 months. Not many assets can do that. I am not predicting a repeat of the 400% gain in such a short time period, but I do think history is going to rhyme in the coming months. I wrote to you all on October 28th this year and said “don’t get lulled to sleep by sideways summer. We should be coming out of hibernation soon and decision-makers become much more interested after prices have increased.” It is safe to say we are out of hibernation now. It would not surprise me to see bitcoin catch a very strong bid through the end of the year. Price is reflexive. Everyone on Wall Street copies each other. Financial advisors are starting to put on 1% positions for all clients unless the opt out. Here is an example message that someone posted online: Additionally, there are rumors from some of the most knowledgable Bitcoiners that we will see very large nation state purchases revealed in the coming months. Bitcoin Magazine CEO David Bailey claims a nation state has become a top 5 holder of bitcoin recently but no one is aware they purchased the bitcoin. That would be a fairly important announcement. I will leave the speculation of who it is to all of you. So what does all this data and information tell us — bitcoin is going much higher between now and the end of 2025. I don’t know what the exact price or timing will be, but it is hard to find a compelling argument to be bearish or reserved right now. The world is realizing the importance of a decentralized, digital currency that continues to produce block-after-block of transactions regardless of what happens in the world. The United States has a pro-bitcoin President going to the White House. And investors are realizing bitcoin may be the solution they need. The results speak for themselves. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management READER NOTE: This is a free version of The Pomp Letter. If you want to receive this letter every morning with my personal opinions on financial markets, please subscribe to become a paying member. Adam Kobeissi and Anthony Pompliano Discuss Gold and Bitcoin Adam Kobeissi is the founder of ‘The Kobeissi Letter.’, and Anthony Pompliano, CEO of Professional Capital Management, discuss bitcoin and gold. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Podcast app setup

Friday, November 8, 2024

Open this on your phone and click the button below: Add to podcast app

Stocks, Energy, Bitcoin, and Degenerate Economy Are Up Big With Trump Incoming

Thursday, November 7, 2024

Listen now (2 mins) | 🚨 READER NOTE: Next Tuesday, I am hosting a free webinar for anyone who wants to learn more about Bitcoin self-custody. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump Sends Bitcoin To New All-Time High

Wednesday, November 6, 2024

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What Will Stocks & Bitcoin Do After The Election

Tuesday, November 5, 2024

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Uncertainty Creates Noise And Noise Creates Volatility

Monday, November 4, 2024

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these