Hot in Enterprise IT/VC - What’s 🔥 in Enterprise IT/VC #420

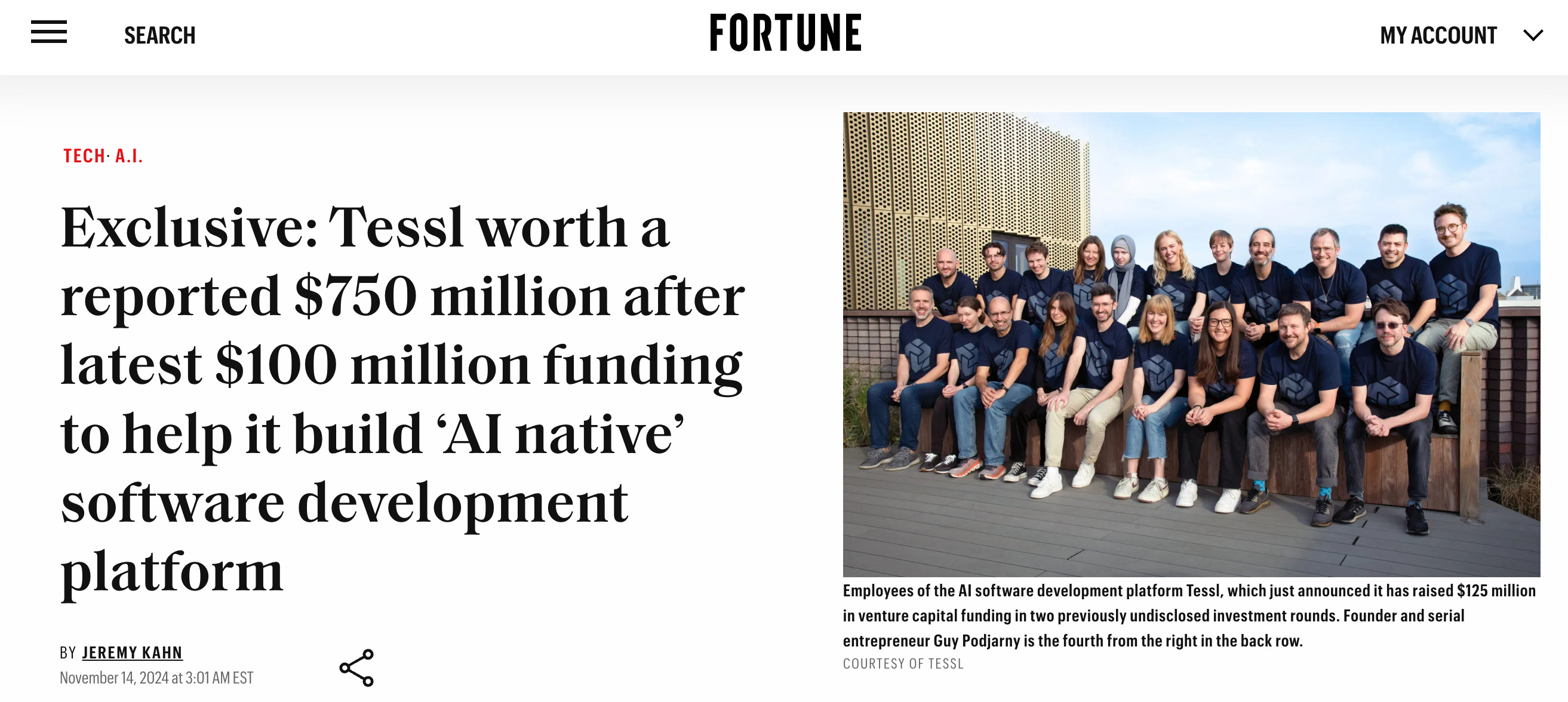

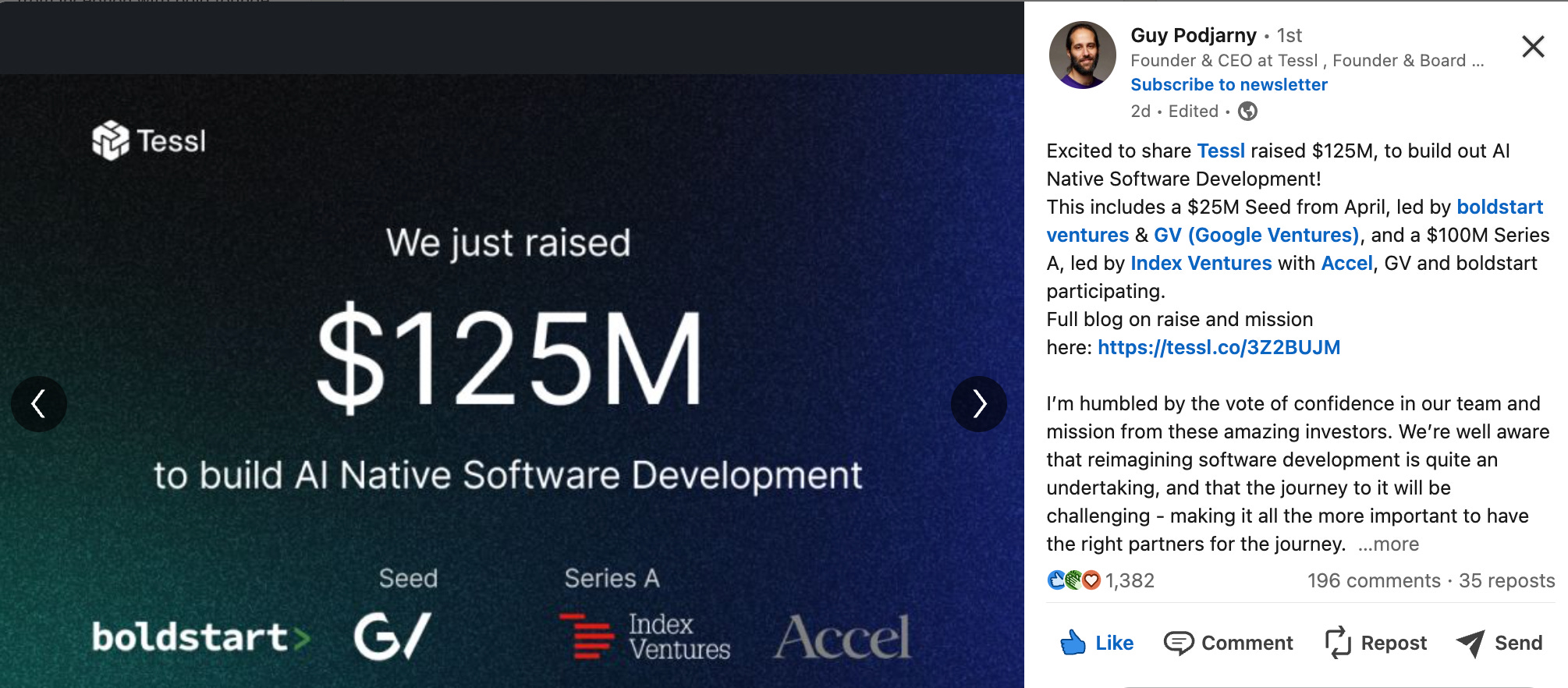

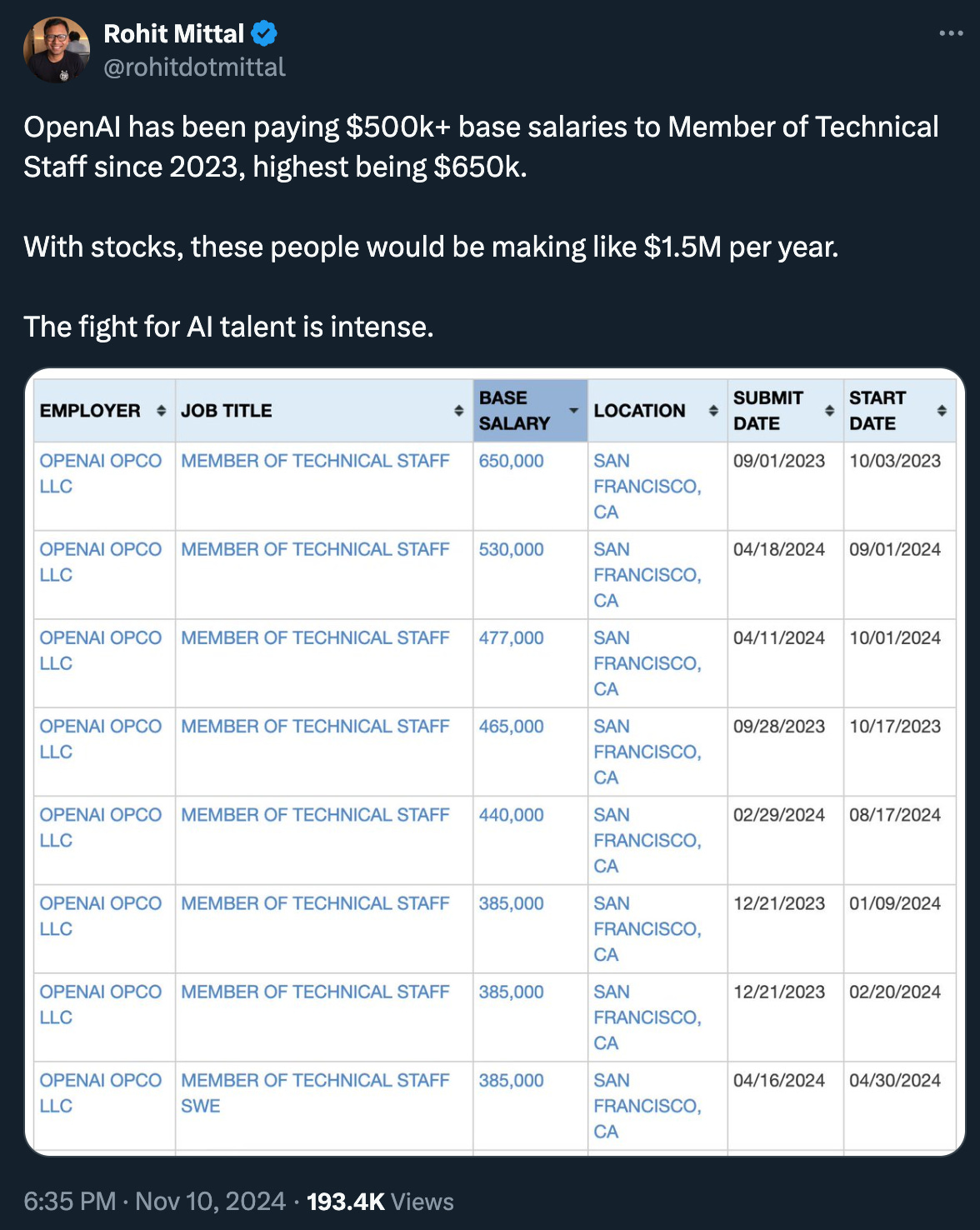

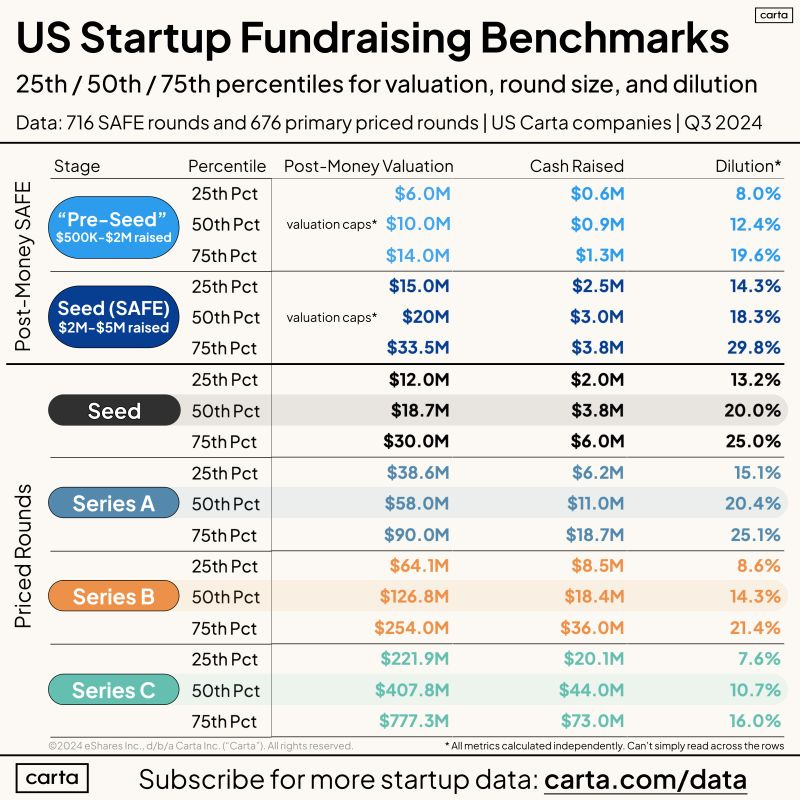

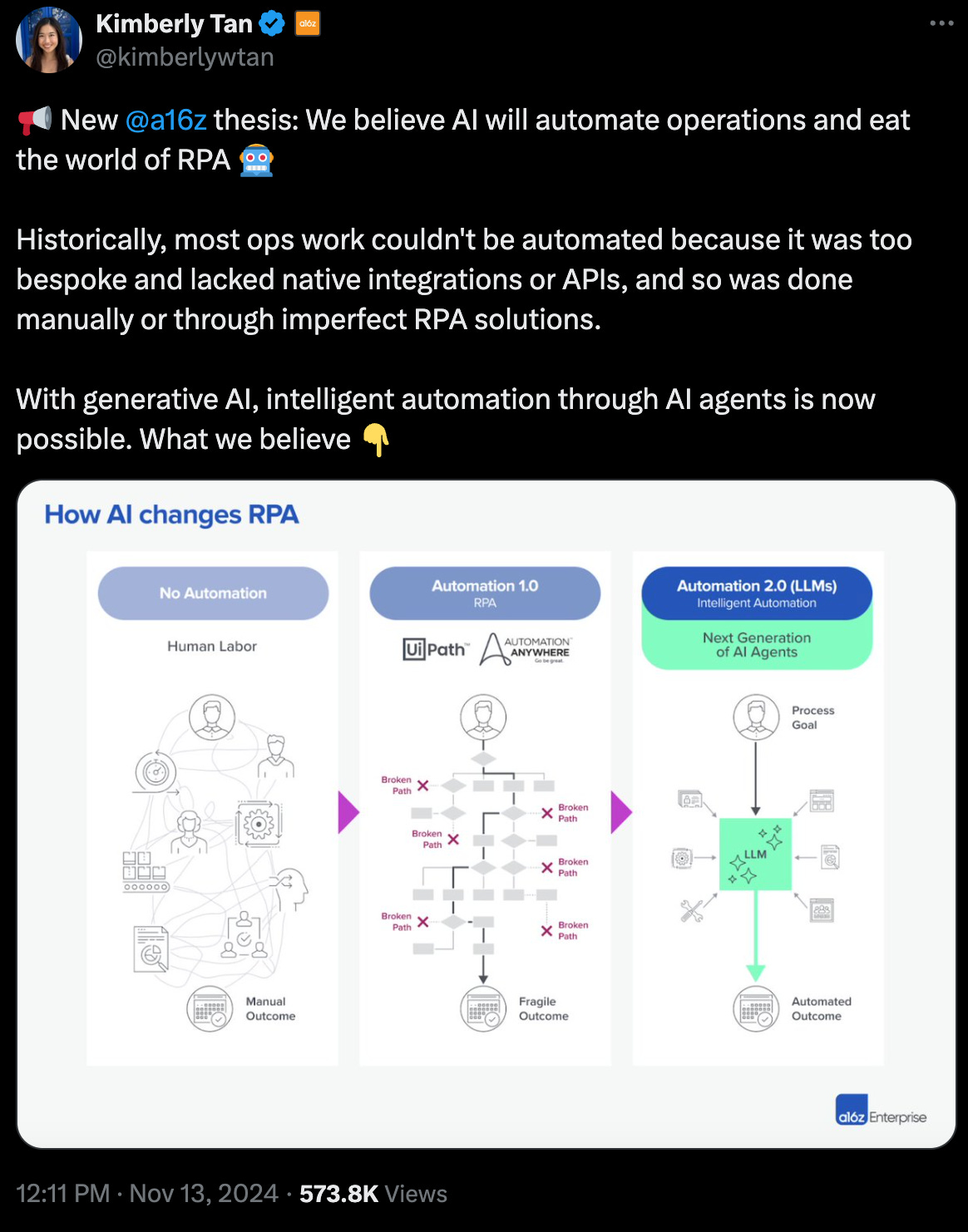

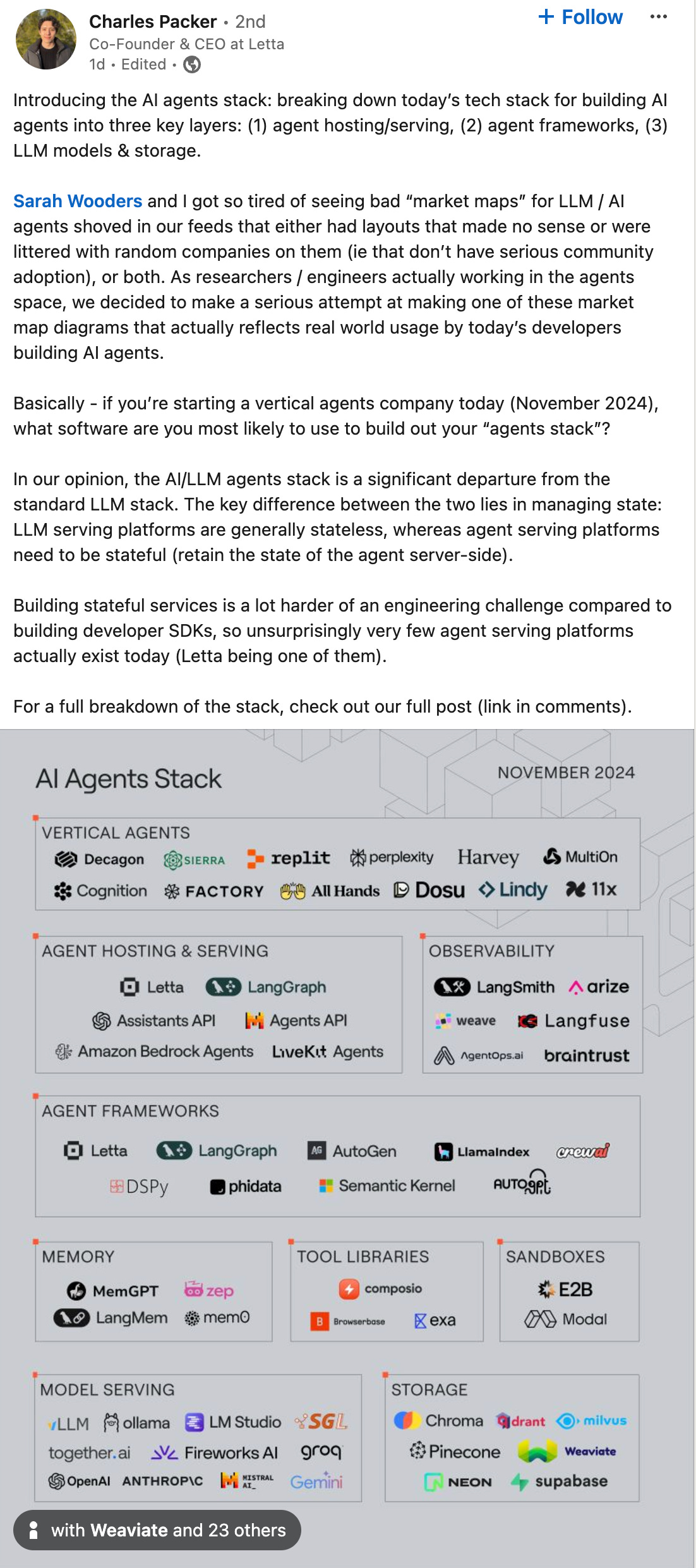

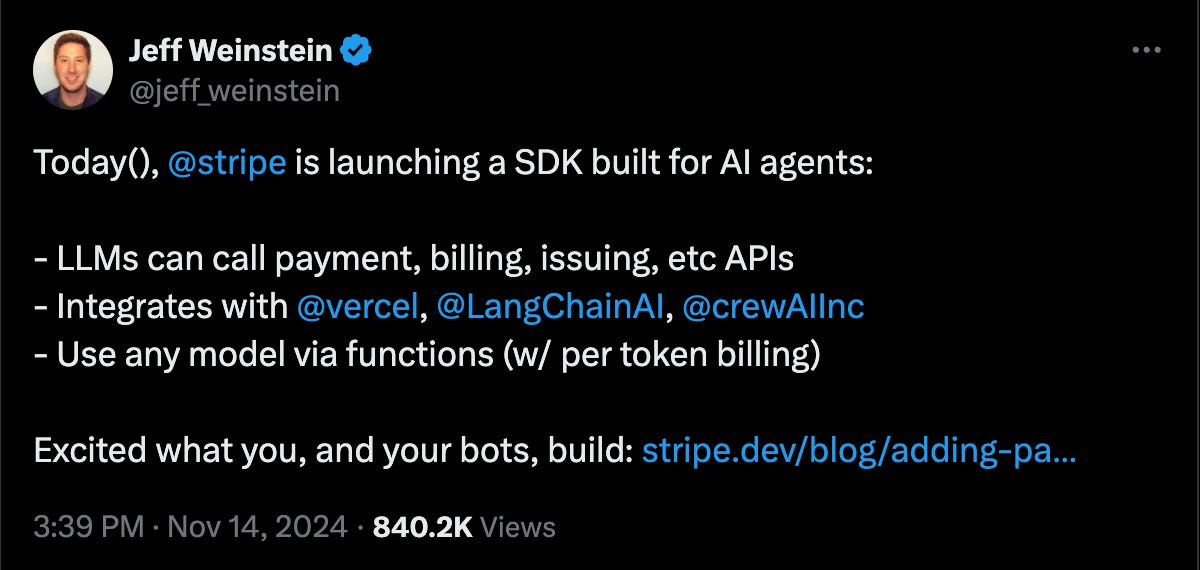

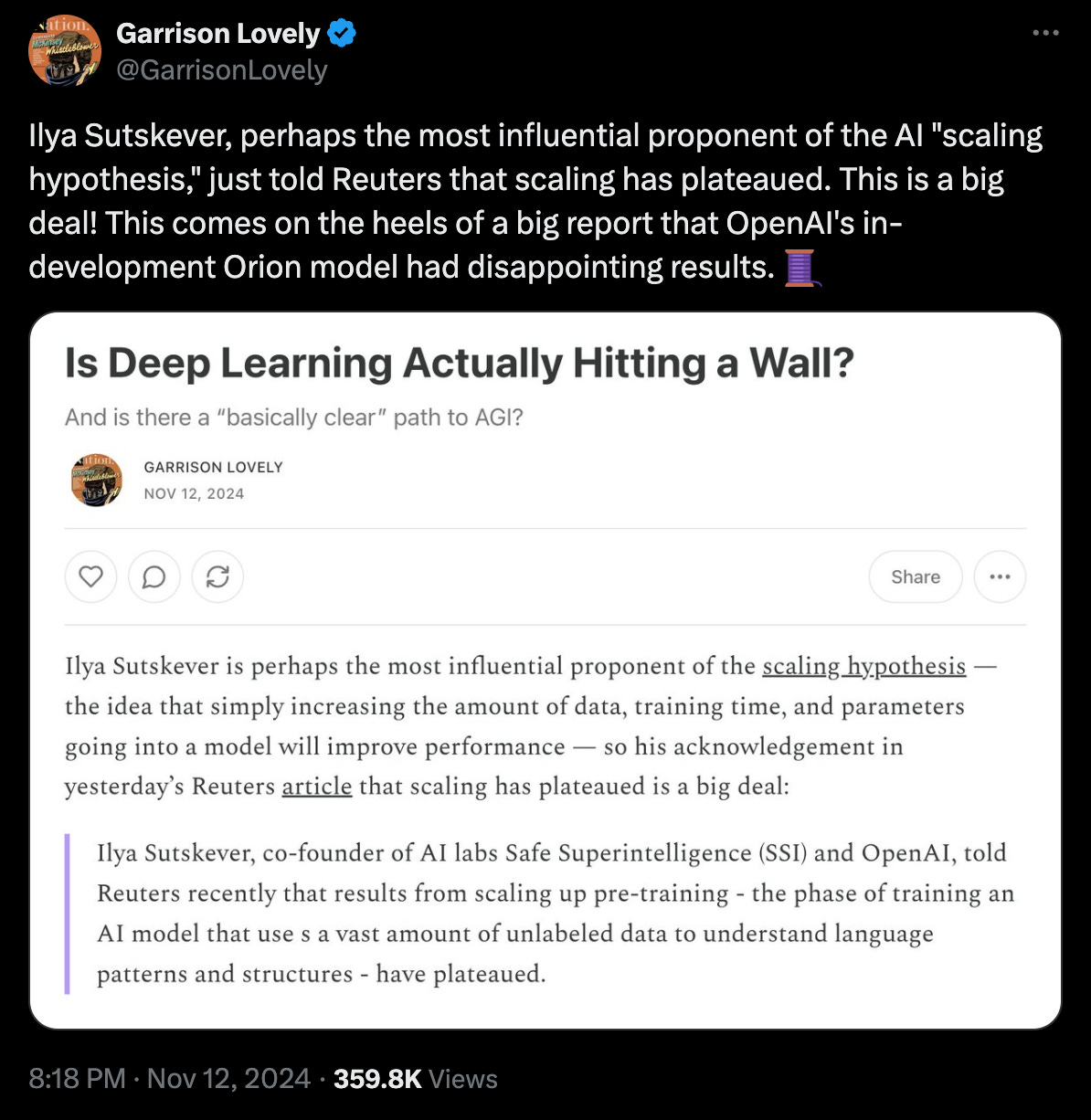

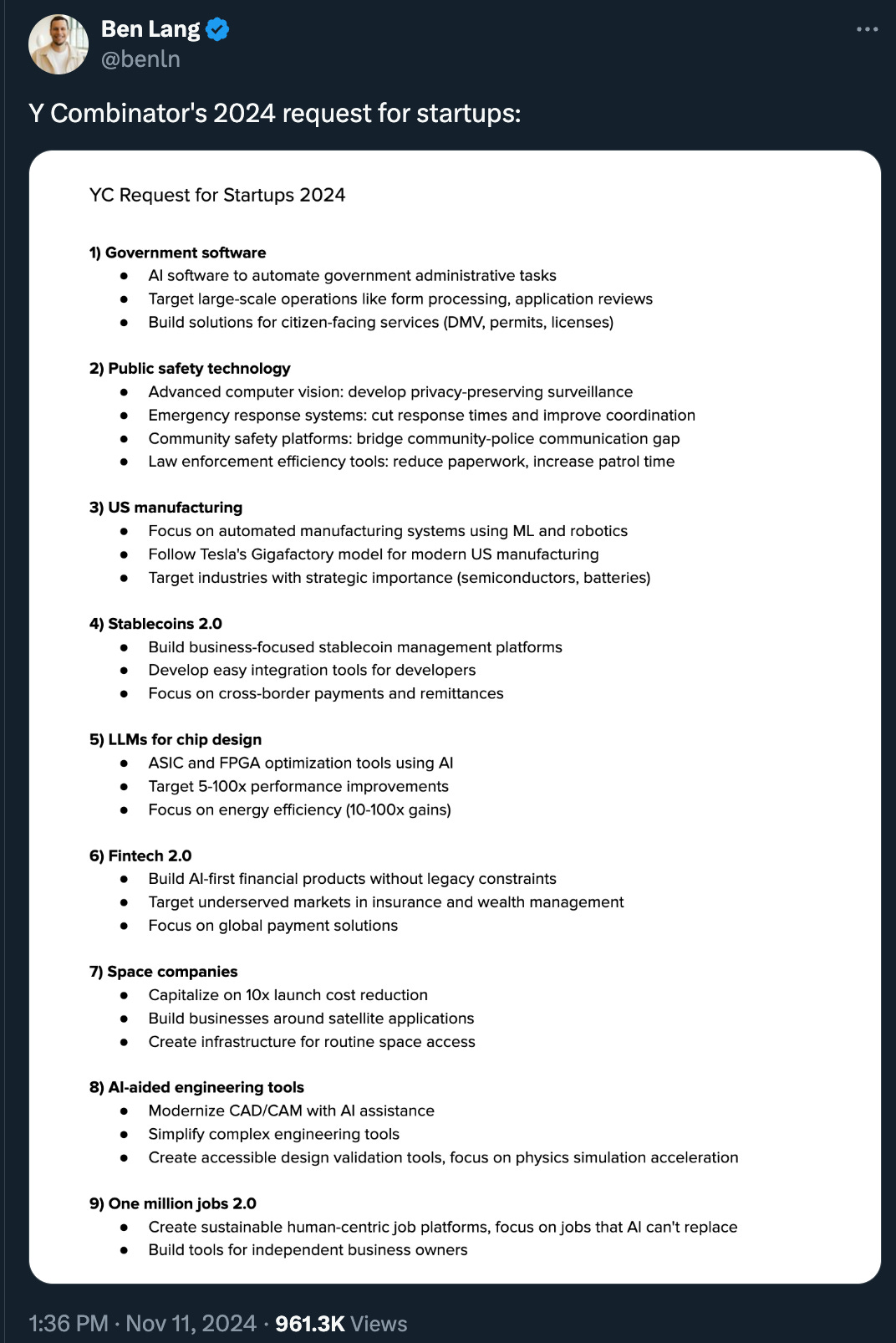

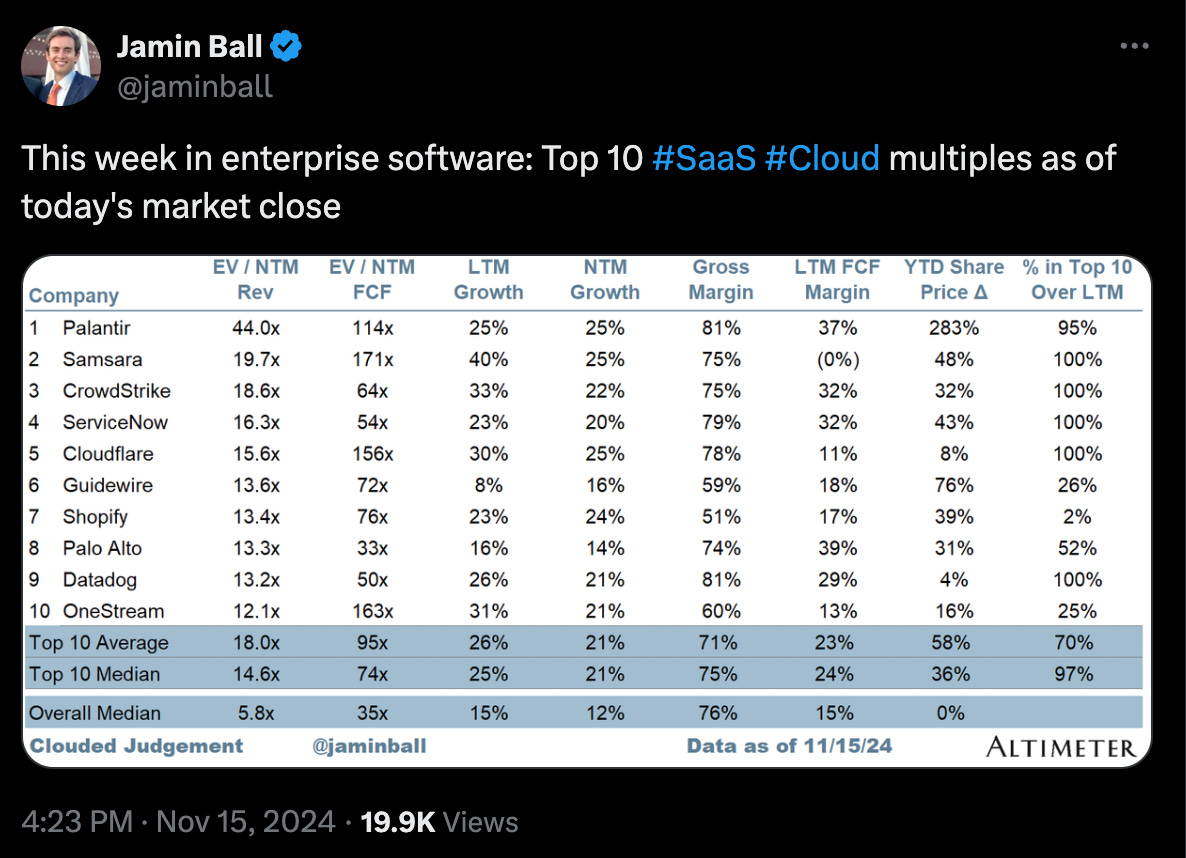

What’s 🔥 in Enterprise IT/VC #420Why we wrote our largest initial Inception check of $12.5M in Tessl to build AI Native Software Development - what this means for Inception/seed fund sizing?It’s been quite a week as we hosted our investors and a number of founders for our AGM (annual general investor meeting) in Miami 🏝️. The core theme was the Future of Intelligent Automation, one which we started thinking about back in 2017. All of the shortcomings back in the day (see deck) are ready for primetime now. This is just a reminder for all of us that this really does take a long time! I want to thank all of our LPs who have supported boldstart through the years and for the many founders who came to present their vision for the agentic future - CrewAI, Kustomer, Noded, Waldo, and a number of other founders from unannounced stealth cos along with our F500 AI panelists from some of the largest banks in the world. It was also a big week because this happened 👇🏼 Guy’s announcement here: Yes, we are absolutely 🔥 up to partner from Inception with founder and friend Guy Podjarny for a 3rd time (Blaze sold to Akamai, Snyk - our initial why we invested post) as Tessl embarks on a mission to bring AI Native Software Development to the world. However, I do want to share that this was our largest Inception check ever, $12.5M out of our $192,168,111 fund vi (notice the Easter egg here). On the one hand there was no doubt that we wanted to lead/co-lead Guy’s initial round, but on the other hand, we were certainly sweating 😓 a bit as he told us folks were offering $50-100M sight unseen to help him get started. Ultimately, we worked out a number for a sizable Jumbo Inception round of $25M co-leading with our friend Tom Hulme from GV who we got to know from the Snyk journey. Here are a few pictures from that weekend in Miami from earlier this year with Guy, my partner Eliot Durbin, and our trusty pals 🐶 (notice the boat name - I couldn’t resist 🤣). As a fund manager, some may think we are nuts 😜. We obviously don’t think so, but yeah, it’s a huge initial check for a fund our size with a follow-on check which is just as big. However, we’ve been preparing for this moment for a long time. We’ve been experiencing increasing initial round sizes since we started boldstart in 2010, and that trend has only accelerated with AI. Increasingly we saw the multistage funds get bigger and bigger and point their howitzers at being first, for all the reasons I laid out here in What’s 🔥 #365 “What is Inception Investing and The Race to Be First.” As we’ve evolved from a $1M fund to almost a $200M fund today, we had to answer one question - if the some of the best founders can now raise $6M, $10M, $20M or more, should we invest, and if so, how big would we need to be to still maintain ball control (lead/co-lead). Or should we just raise a smaller fund and decide not to lead/co-lead any rounds bigger than say $5-6M and let the multistage firms own that space. Ultimately, we decided that in order to fulfill our mission of Inception Investing in the best founders whether it be first timers or multitimers that we unequivocally must play ball in the Jumbo rounds to give our investors the opportunity to generate the best returns. If not, we would have already missed a chance, for example, to co-lead Protect AI’s initial $10.5M round in early 2022 on its way to building a leading AI security platform with a number of Global 200 customers and raising a Series B a few months ago at a $460M post money valuation. So I’m glad we made that decision to invest across the whole Inception landscape. What it really boils down to at Inception is answering two questions - if right, how big and what could our return look like, and what gives this team the right to win. After having partnered with Guy through the life of boldstart from Fund I to Fund III to now Fund VI, it’s pretty clear that he is one of those special founders that we can’t miss (Snyk is a multibillion company), and we’re thrilled to join the journey again. Here’s more on why we invested in Tessl and what AI Native Software development is. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups#💯 the importance of a common vision from Steve Jobs - watch this, absorb it, and apply #Wonder why some of these Inception rounds are so massive for AI startups? Salary inflation for even the median engineer at OpenAI is at $500K 🤯. Hiring Tier 1 talent requires a big mission and also real 💰 #current state of valuations as per Peter Walker - Carta - the more money raised the higher the valuation and dilution… Enterprise Tech#a16z’s new thesis on AI - “Intelligent Automation” Just a reminder we’ve been down this road before…check out our boldstart CXO deck from 2018 - all of the issues we saw back then are ready for primetime today and our F500 Intelligent Automation Dinner we hosted in 2019 discussing the limitations of RPA back then and that we need bots who can make decisions powered by AI - the time is now! #AI agent stack - really great overview from Charles Packer - Letta #OpenAI Shifts Strategy as Rate of ‘GPT’ AI Improvements Slows (The Information) - just plain running out of high-quality training data and if true, this has huge implications #this is a massive deal - agents with virtual credit cards to actually make purchase decisions and also cool to see Stripe use portfolio co CrewAI as one of the integrations! #Andrew Ng on the evolution of LLMs from being “optimized to answer peoples’ questions to agentic workflows, giving a huge boost to agentic performance!” ( #more on AI scaling laws from Ilya, formerly OpenAI - has it really plateaued? #queuing this up for the weekend - read 🧵 also - covers some of AI scaling law questions and what does AGI look like and when 🤔 #speaking of AI scaling laws and the need for more data, we have to remember that there is so much dark data that models don’t see sitting behind enterprise firewalls. Pretty cool and no surprise that F500s like Bayer are now using that data to create small industry specific models (WSJ) #👀Anysphere, creators of AI coding assistant Cursor, rumored to be raising at $2.5B valuation with all of the big firms chasing - revenue apparently went from $4M per year to $4M per month 🤯 (TechCrunch) #Writer AI raises $200M at a $1.9B valuation (TechCrunch) with a big vision (see post from CEO) calling it the Future of Enterprise Work - Building an autonomous AI platform for the enterprise - all roads lead to Glean, Perplexity, Writer battling it out for AI platform 💰 #great way to see what’s trending in Silicon Valley with YC latest request for startups Markets#Multiples - outside of Palantir at 44x, Top 10 is mostly 12-14x NTM with highest forecasted growth at 25% - also if you notice these companies outside of OneStream all have pretty sizable market caps which means scale matters - OneStream is at $7B, Guidewire at $16B, and then next lowest is Samsara at $27B What's Hot 🔥 in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot 🔥 in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What’s 🔥 in Enterprise IT/VC #419

Saturday, November 9, 2024

To believe or not to believe, that is the question - AI is eating software but will it also eat labor? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #418

Saturday, November 2, 2024

Who wins in AI? The Incumbent, the AI Native Startup, or...the Goldilocks Startup? The future is here: WORK BASED PRICING! No MORE SEATS - anatomy of the Kustomer relaunch ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #417

Saturday, October 26, 2024

What happens when hundreds of thousands of agents with read/write access run amok in an enterprise - "like hornets fleeing a nest" according to Bill McDermott ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #415

Sunday, October 20, 2024

Old school enterprise sales + delivery needed to solve the last mile problem in the enterprise - yes, services needed! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #416

Sunday, October 20, 2024

8 years of What's 🔥 🙏🏼 - more on Palantir's model from services (FDE) to product and now product + some services + why every startup will have to provide some bodies to deliver to the ente ͏ ͏

You Might Also Like

UK startups roll back hiring

Friday, March 28, 2025

+ Bending Spoons almost doubles in value; Web Summit legal drama View in browser Vanta_flagship Author-Amy by Amy Lewin Good morning there, If I were to take a bet on which of Europe's startups

🗞 What's New: Is Gemini 2.5 the new vibe coding standard?

Friday, March 28, 2025

Also: Vibe coding to $12K in 4 weeks ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⏰ 72 hours left - grab your seat and change your business forever

Thursday, March 27, 2025

We've taken the most game-changing, highly rated sessions and packed them into one powerful day. Hey Friend , The Ecommerce Product Sourcing & Manufacturing Summit Highlights goes live in just

SaaSHub Weekly - Mar 27

Thursday, March 27, 2025

SaaSHub Weekly - Mar 27 Featured and useful products todo.vu logo todo.vu todo.vu combines task and project management with time tracking and billing to provide a versatile, all-in-one productivity

81 new Shopify apps for you 🌟

Thursday, March 27, 2025

New Shopify apps hand-picked for you 🙌 Week 12 Mar 17, 2025 - Mar 24, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Draft Orders automatically removed after 1 year of

🧠 This Week in GrowthHackers: AI Advances, SEO Strategies & Market Shakeups

Thursday, March 27, 2025

Key updates from OpenAI, Databricks, and Tesla—plus tools and how-tos to sharpen your growth edge..

Investors Guides: The Full Series + Exclusive Cheat Sheet

Thursday, March 27, 2025

Tactics from 50 elite investors on finding breakout companies, winning deals, and constructing enduring firms. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

the drug R&D playbook

Thursday, March 27, 2025

AI is rewriting the rules across the entire R&D pipeline. here's what you need to know. Hi there, The drug R&D playbook is being rewritten. Join CB Insights' Senior Analyst, Ellen Knapp

Sneak Peak Of My Latest Podcast & PH Hunt

Thursday, March 27, 2025

Hey everyone 👋 how have you been? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

That magic moment

Thursday, March 27, 2025

Read time: 57 sec. You ever had a moment where something just clicks? Zach, one of our AI Build Accelerator members, dropped this message in Slack the other day: “Had a pretty surreal moment yesterday.