The Generalist - How to Exit

🌟 Hey there! This is a subscriber-only edition of our premium newsletter designed to make you a better investor, founder, and technologist. Members get access to the strategies, tactics, and wisdom of exceptional investors and founders. Become a member today. Friends, In all of venture capital’s rush to enter investments – to find and jockey and win – it can be easy to forget that you must exit them, too. No matter how long-term your vision, how persevering your commitment to founders, there is a moment when you must part ways and cash out. It is not just a part of the game; it is the point of the game. Yet, it is rarely discussed. In part, that’s a consequence of venture capital’s time horizon. Ten years is a long time, especially when managers face more pressing problems daily. Another is that exits have historically depended almost entirely on external forces – an IPO or an acquisition. Save for the asset class’s greatest powerbrokers (who can broker alliances and arrange marriages), exits are often perceived as something to be experienced rather than created. You play the cards you are dealt and sit at the felt table until someone else carries your chips to the cashier’s cage. This vision of venture capital no longer holds. Market and regulatory shifts have altered the category’s complexion and made it more possible – and more vital – for investors to forge exits for themselves through secondary transactions and crypto sales. Both have become essential parts of the savvy VC’s toolkit: mitigating startups’ increasing long lives as private companies and pulling forward returns for LPs. Understanding how to manage this is now a crucial part of the venture capital craft. Otherwise

The opacity and complexity of secondary transactions – who they involve and how they occur – make them tricky subjects for investors to master and use to their advantage. Many give them little thought until an opportunity arises. Foresight and planning can make a significant difference. To deliver that foresight to readers, we’ve spent months researching the space and interviewing a dozen investors with experience buying and selling secondaries. Today’s guide unpacks how these transactions occur, the major players, and the frameworks elite VCs use to time and size their exits. What to expect

You can unlock the full guide, and the rest of our premium membership for just $22/month. Brought to you by MercuryYou can’t look into a crystal ball to gauge a company’s future performance — but you can get clarity with a financial forecast. Building a financial forecast model can give you a picture of a company’s viability and help with fundraising and future decision-making. Mercury’s VP of Finance, Dan Kang, shares why and how to build a financial forecast model, along with his personal template. Table of contents1. The rise of secondaries

2. The buying landscape

3. Transaction types

4. When to sell

5. How to win

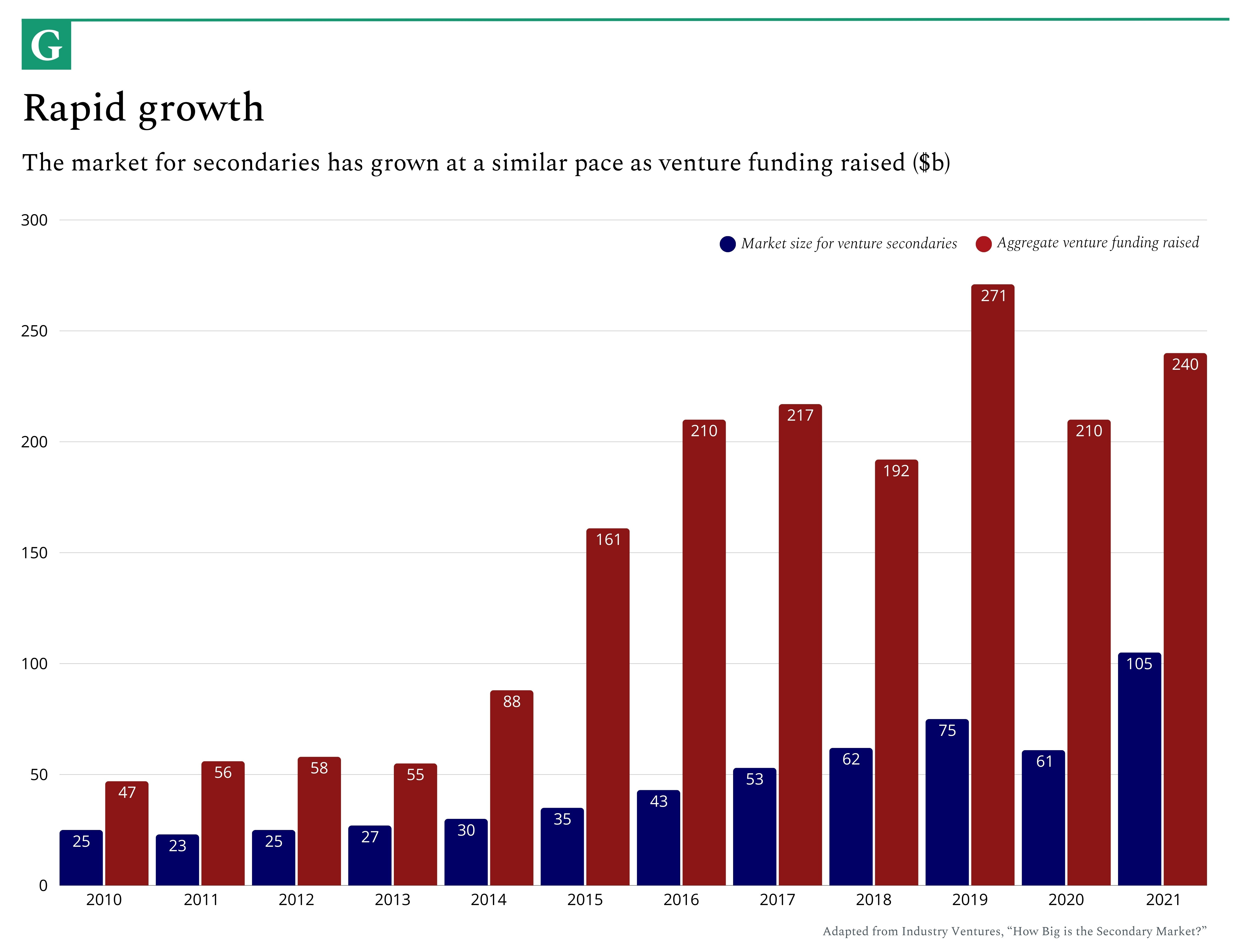

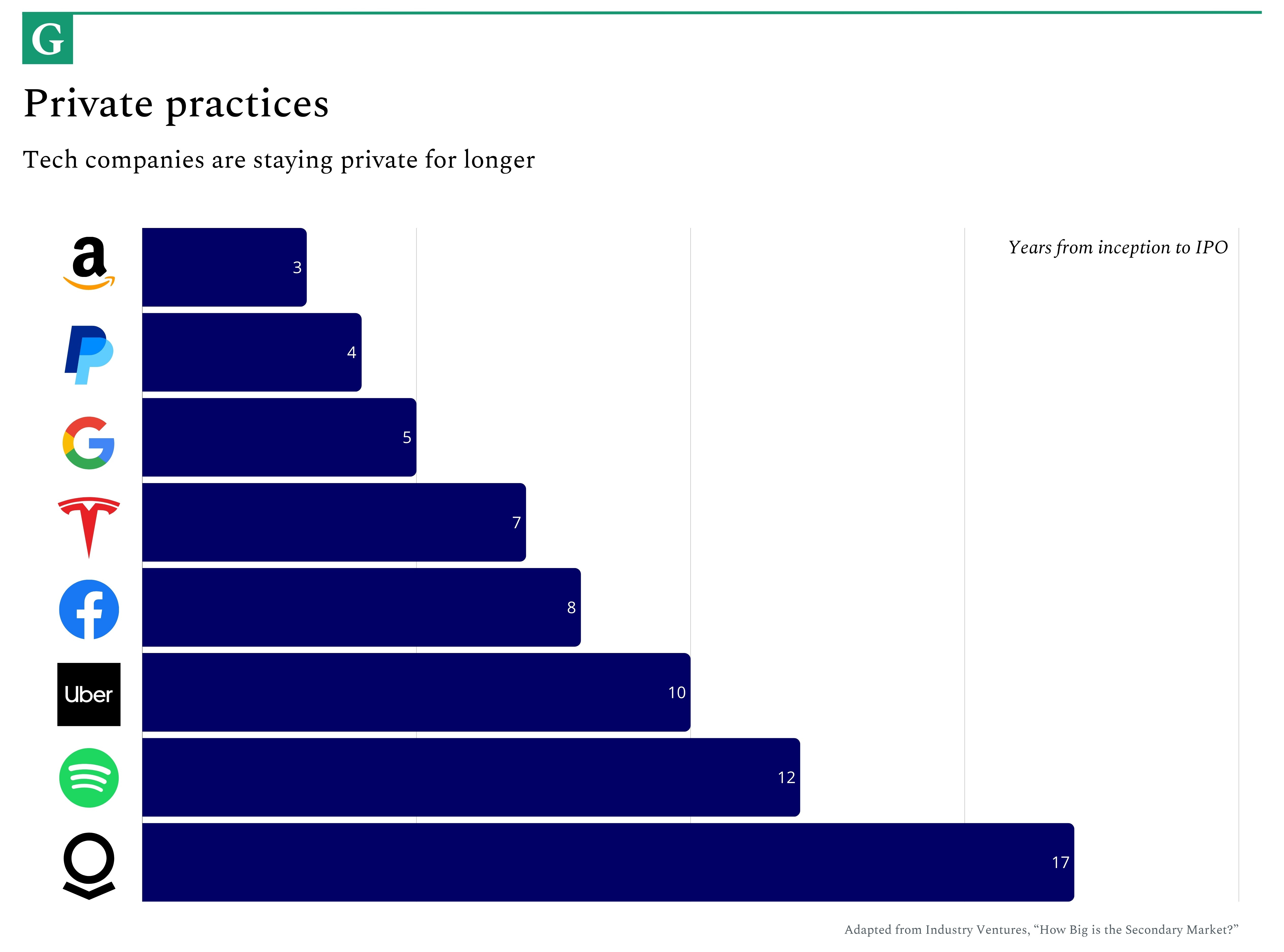

1: The rise of secondariesAccording to Industry Ventures, the global addressable market for secondary transactions in venture was $25 billion in 2012. A decade later, it had hit $105 billion – a 4.2x increase. That quantifies just how rapidly this part of the venture asset class has grown and illustrates the scale of the opportunity for both buyers and sellers. Market shiftsMarket changes have been a critical part of this increase. Between 2012 and 2021, annual capital raised by venture funds grew from $58 billion to $240 billion, approximately a 4.1x jump. With larger coffers, venture firms have been able to capitalize startups at greater rates for longer, extending their stints as private businesses and delaying public market debuts. Today, it’s common for a startup to spend over a decade as a private business. Stripe is 14 years old and Palantir made its IPO at 17. SpaceX is the same age as The Wire, Eminem’s “Lose Yourself,” and the circulation of the Euro – all products of 2002. Giants of the past took a much shorter route to an exit, as Forerunner’s Kirsten Green remarked: Forerunner

Amazon, Google, Adobe, Apple, Salesforce, PayPal, and Tesla are all examples of startups that reached the public markets in five years or less. They entered as much less mature businesses with lower annual revenues. According to Industry Ventures, the average company that went public in 1989 was 6 years old and had $30 million in revenue; by 2021, businesses were 12 years old and had $200 million in revenue. CRV

Though the outcomes are larger today, previous generations’ timelines mapped much better to venture capital. Traditionally, funds have 10-year lifespans; the first five are used to deploy capital, and the last five to reap the returns. CRV

Startups’ desire to celebrate their quinceañera in the private markets has forced VCs to look for liquidity elsewhere. Acrew

As Mike Jung explains, the asset class seizes without funds returning to LPs – many of whom are overexposed to venture. Founders Circle

Although market changes have played the biggest role in the rise of secondaries, regulations have also had an influence. Regulatory shiftsThe SEC’s “500 Shareholders Threshold” required companies with more than 499 investors to follow reporting requirements similar to those of public companies, pushing startups into faster IPOs. When the rule was relaxed in 2012, allowing 2,000 shareholders, a forcing function was removed. CRV

Competitive shiftsCompetitive dynamics and cultural norms have also contributed. As tech has grown, the war on talent has intensified. To stop Big Tech from poaching their employees with bumper pay packages, startups have looked to mitigate their longer paths to liquidity through secondary sales. Founders Circle

Whatever the precise causes behind the rise in secondaries, the result is the same: every thinking investor must recognize it as part of their craft. It is your job to drive returns for investors, and as the landscape changes, that necessitates different approaches and strategies. USV

Subscribe to The Generalist to unlock the rest.Become a paying subscriber of The Generalist to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Final hours: 30% off Generalist+ ends at midnight

Monday, December 2, 2024

The time is now. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

30% off our premium newsletter (lowest price ever!)

Friday, November 29, 2024

The only down round you'll be happy to see. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Mullet Capitalists

Tuesday, November 26, 2024

To survive venture's “extinction event,” emerging managers should adopt a new style ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to Avoid Becoming a VC Meme and Actually Add Value

Thursday, November 21, 2024

A guide to avoid becoming a venture cliché and aiding your companies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Bitter Religion: AI’s Holy War Over Scaling Laws

Friday, November 15, 2024

The AI community is locked in a doctrinal battle about its future and whether sufficient scale will create God. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Modern Meditations: Caleb Watney

Thursday, December 19, 2024

What DOGE should do, the potential in far-UV, and how billionaires should spend their money ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Shopify builds a high-intensity culture | Farhan Thawar (VP and Head of Eng)

Thursday, December 19, 2024

Shopify's Farhan Thawar on how he leads 1000+ engineers, builds intensity, embraces pair programming, and creates innovative engineering cultures ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🥰 Full Replay of the Ecommerce Summit 2025 Now Available!

Thursday, December 19, 2024

Free but for a limited time only! Goes back to the vault soon. Hey Friend , Good news and bad news. Good news is that a lot of people enjoyed the Summit. But a few wrote in saying they missed out on

TheToolNerd, Cabina.AI, Moneo AI, Preneur, Oyeeah, and more

Thursday, December 19, 2024

All-in-one AI Platform BetaList BetaList Weekly Cabina.AI All-in-one content creation platform. Preneur The visual productivity app for founders. Oyeeah All-in-one AI Platform Moneo AI Aesthetic

🗞 What's New: TikTok's top 2024 trends

Thursday, December 19, 2024

Also: Rethinking hustle culture ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

79 new Shopify apps for you 🌟

Thursday, December 19, 2024

New Shopify apps hand-picked for you 🙌 Week 49 Dec 2, 2024 - Dec 9, 2024 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Collective retailers display supplier's online inventory

🚀 FREE: Here's the 2025 Influencer Marketing Playbook

Thursday, December 19, 2024

Learn how people like Selena Gomez built billion dollar ecommerce brands Hey Friend , Want to know the secret sauce that skyrockets brands from average to iconic? It's influencer marketing.

Europe's fastest-growing deeptechs

Thursday, December 19, 2024

Plus: No code and dev tools market map; latest deals View in browser Sponsor Card - Up Round-34 Good morning there, Last week, Sifted's leaderboard of Europe's 250 fastest-growing startups by

European Ambition

Thursday, December 19, 2024

The Old World's Meek Culture Must Change ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Your Sifted 250: Europe Leaderboard 🚀

Thursday, December 19, 2024

Uncover the region's 250 fastest-growing startups in 2024 View in browser Sifted Hello there, Discover the 250 fastest-growing startups reshaping Europe's tech landscape in 2024 with the Sifted