From PumpFun to FourMeme: A Review of the Top Five Token Launchpads

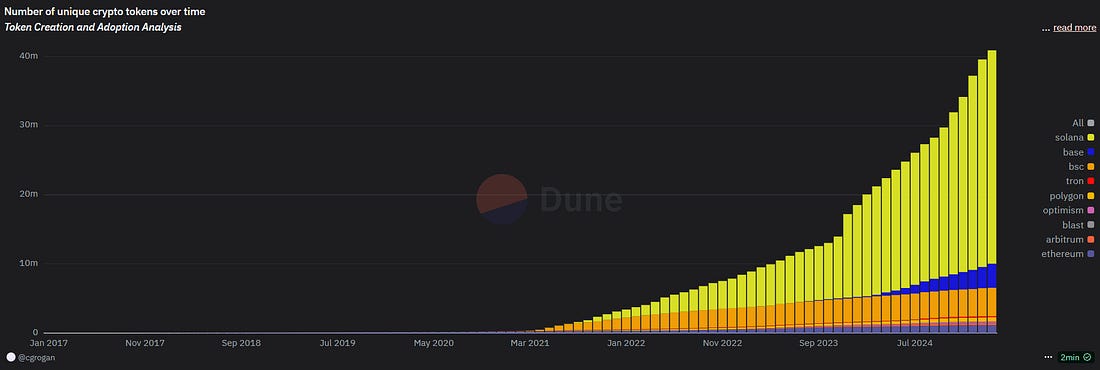

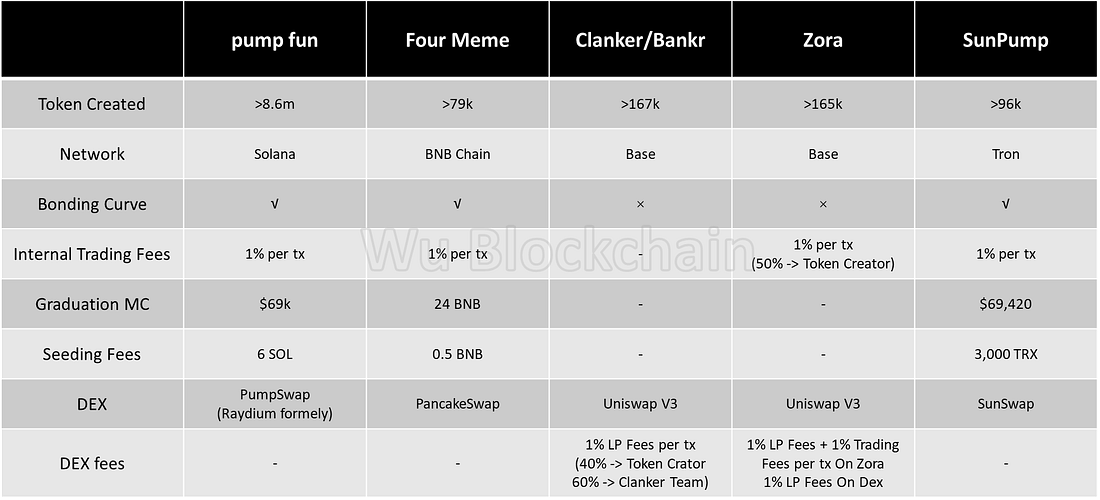

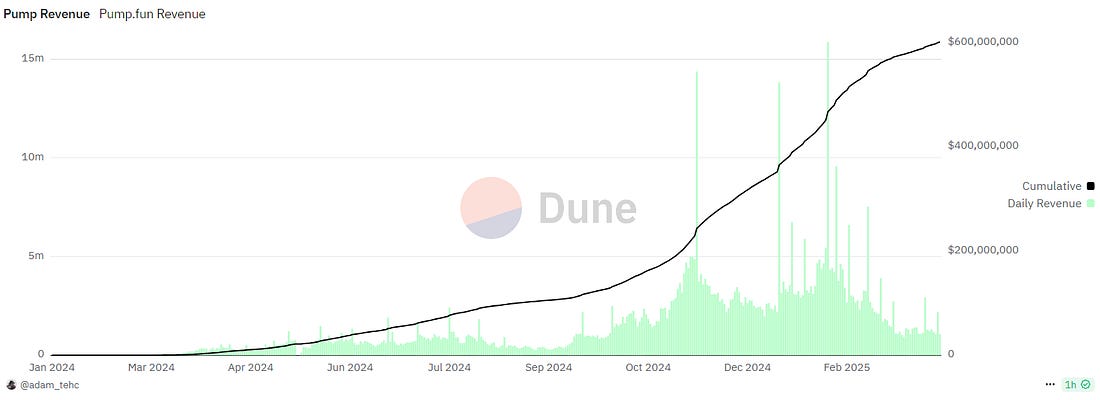

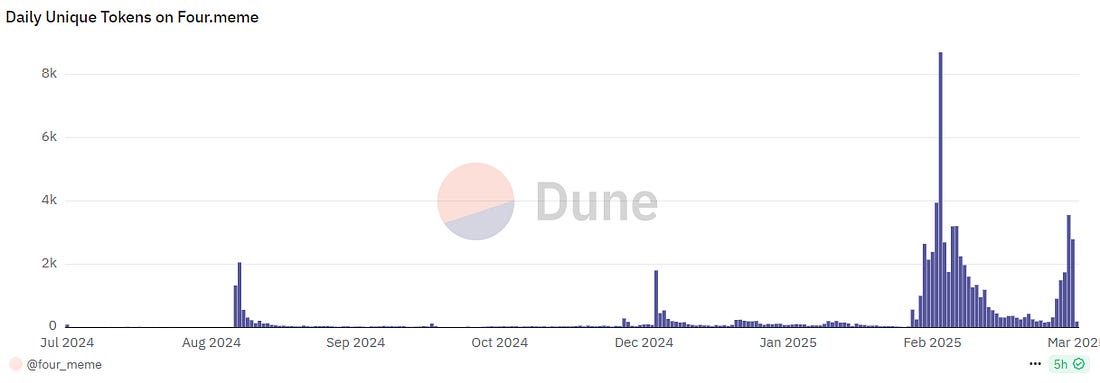

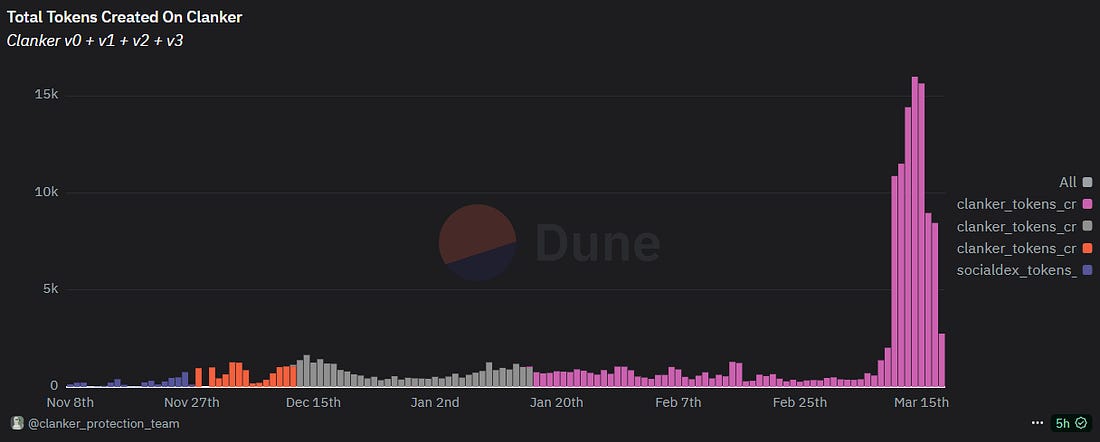

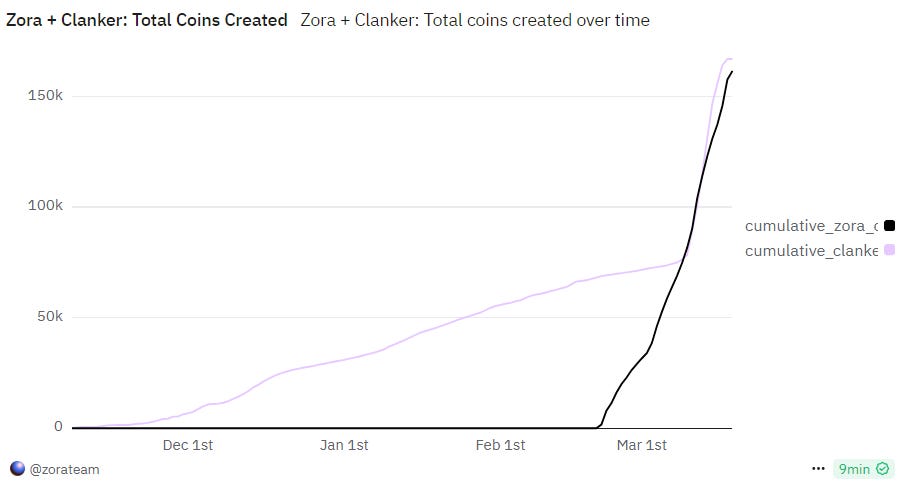

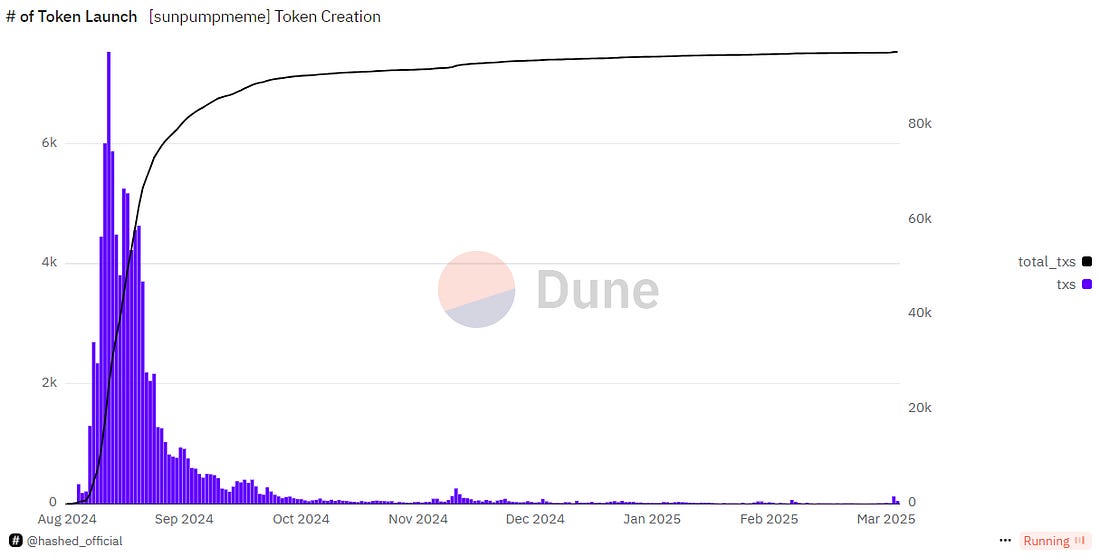

Author | defioasis Between 2017 and 2018, the number of cryptocurrency was less than 17,000; amidst the ICO boom at that time, nearly all were created on Ethereum using the ERC-20 standard. However, fast forward to the present—March 2025—and as of March 19, the number of cryptocurrency has surpassed 40 million. Of these, 75.5% of tokens were created on Solana (exceeding 30 million), about 10% on BNB Chain (over 4 million), approximately 8.5% on Base, while Ethereum accounts for only about 2.8%. (Data Source: https://dune.com/queries/4303251/7229047) In December 2023, the number of token asset on the Solana network surpassed 10 million for the first time, a milestone that took over three years to achieve. However, with the introduction of pump fun’s innovative asset issuance model, a staggering 13 million tokens were launched on the Solana network throughout 2024 alone. When calculated on a daily basis, this translates to over 36k tokens being launched on the Solana network each day, marking a dramatic surge in asset issuance. Launchpads like pump fun have enabled ordinary users to enter and capture on-chain assets starting from zero with lower costs and fewer resources, creating wealth effects for a select few. Yet, as on-chain assets balloon and the relentless “angle hunting” persists, the crypto space has plunged into an extreme PvP environment. From a product perspective, however, the tools themselves are not to blame. In fact, such Launchpads align with the PMF that VC have long preached and pursued, effectively catering to the demands of speculative users. This article will review the leading token Launchpads. pump fun Pump fun is a Memecoin launch platform based on the Solana network, introduced in January 2024. It is a flagship product of the Alliance DAO incubator. Unlike traditional Launchpads, pump fun not only reduces the cost of token launches to a nearly negligible level but also innovatively introduces internal pool trading based on a Bonding Curve, pioneering a new approach to asset issuance. In simple terms, pump fun’s internal pool trading means that token prices dynamically adjust based on buying and selling volume—prices rise as more people buy and fall when people sell. This internal trading occurs within the pump fun platform. Once a token’s market cap reaches a certain threshold (set at $69,000 on Solana), it transitions to external trading on a DEX like Raydium. Users creating tokens on pump fun do not need to pay platform fees (though network fees are required). During internal pool trading, the platform charges a 1% fee per transaction, with SOL used as both the trading pair and fee currency. When a token reaches a market cap of $69,000, the platform migrates the token and its liquidity to Raydium, deducting a fixed fee of 6 SOL from the liquidity to cover the migration costs (including network gas fees and Raydium fees). Pump Fun has announced the launch of its own DEX, PumpSwap, and will no longer use Raydium. PumpSwap offers features and functionalities such as instant migration, 0 migration fees (previously 6 SOL), and profit-sharing for token creators. (Data Source: https://dune.com/adam_tehc/pumpfun) Pump fun has emerged as one of the most profitable crypto applications since 2024, amassing over $600 million in cumulative fee revenue historically. More than 60% of tokens on the Solana network have been launched through pump fun. Notably, pump fun is also developing its own AMM functionality, aiming to take over the external trading currently dominated by Raydium. Four Meme BNB Chain was the most active network for Memecoins during the 2020-2021 bull market cycle, predating Solana’s rise. However, it gradually lost ground due to the emergence and competition from Ethereum Layer 2 solutions and high-performance Layer 1 public blockchains. With Binance achieving breakthroughs in regulatory compliance, the return of CZ, and a strategic shift focusing more on-chain, Four Meme—incubated by the veteran BNB Chain team BinaryX—has emerged as the most significant Launchpad on BNB Chain. Recently, the personal involvement of CZ and Binance co-founder Yi He in CT interactions has sparked a new wave of on-chain wealth effects. (Data Source: https://dune.com/four_meme/fourmeme) Since the second half of 2024, Four Meme has launched over 77k tokens on BNB Chain, with the majority of these launches occurring since February of this year. Structurally, Four Meme can be seen as the BNB Chain equivalent of pump fun, similarly divided into internal and external pool trading. Users creating tokens on Four Meme do not need to pay platform fees (though network fees are required). During internal pool trading, the platform charges a 1% fee per transaction and supports eight assets as trading pairs: BNB, CAKE, WHY, USDT, BNX, LisUSD, THENA, and SHELL—though BNB remains the mainstream choice. Once a token reaches a market cap of approximately 24 BNB, the platform migrates the token and its liquidity to the DEX PancakeSwap, deducting a fixed fee of 0.5 BNB from the liquidity to cover migration costs. On BNB Chain, Four Meme faces competition from several other Launchpads, such as Spring Board launched by PancakeSwap, GraFun proposed by DWF and Floki, and others. However, these alternatives have ultimately failed to gain BNB Chain’s support. In contrast, Four Meme has partnered with BNB Chain to launch an accelerator program, enabling Memecoins on the network to receive support in terms of traffic and liquidity funding. Clanker/Bankr Clanker is a Launchpad on the Base network that enables token creation through the decentralized social platform Farcaster. Users can create tokens by posting a message via the @clanker bot on Farcaster, with the option to reserve up to 30% of the token supply for themselves, provided it is locked for at least 30 days. Unlike pump fun, Clanker does not feature internal pool trading. Instead, it operates using single-sided liquidity on Uniswap V3. Specifically, after deducting the creator’s reserved portion, the remaining supply is fully injected into Uniswap V3 as single-sided liquidity, with an initial market cap paired against a default of 10 WETH. The LP is permanently locked in the Clanker LP Locker contract. The LP pool charges a 1% trading fee, of which 40% is distributed to the token creator and 60% goes to the Clanker team. (Data Source: https://dune.com/clanker_protection_team/awesome-clanker) As of now, Clanker has launched over 167k tokens, but its true explosion occurred in mid-March. From March 11 to March 15, the daily launch exceeded 10k tokens. Prior to this, Clanker was constrained by Farcaster’s limited user base, preventing it from achieving a significant scale effect. However, the introduction of Clanker World and the Clanker API extended its launch capabilities from Farcaster to Twitter. Among these developments, Bankr capitalized on the integration of Twitter’s large language model, Grok, quickly becoming one of the mainstream methods for launching tokens from Twitter. As a result, Clanker, operating in the background, has also reaped the benefits. Similar to launching on Farcaster, users on Twitter can create tokens simply by mentioning @bankr in a post and specifying the ticker. Some users have generated a large number of tokens by guiding Grok and leveraging Bankr. Notably, unlike other Launchpads, Clanker and Bankr also allow users to trade or transfer tokens by tagging the respective accounts with an @ mention. Zora Zora, which secured investments from Paradigm and Coinbase Ventures, was previously well-known for promoting NFTs as a selling point on Ethereum Layer 2. However, with the decline of NFTs and its persistent focus on the creator economy, Zora eventually became niche. Yet, at the end of February and the beginning of March this year, Zora broke from its usual pattern by launching a Launchpad for Memecoins on Base and announcing the introduction of a ZORA token on the Base network, which notably does not grant governance rights to holders. (Data Source: https://dune.com/zorateam/coins) Despite being less than a month old, the number of tokens launched through Zora is already approaching that of Clanker, which has been operational for several months. Zora’s core mechanism revolves around creating posts, with each post automatically generating a tradable ERC-20 token on the Base network. The total supply is fixed at 1 billion, with the creator initially receiving 10 million tokens (1%), and liquidity automatically deployed to a Uniswap 1% Fee Pool. Additionally, transactions on Zora incur a 1% trading fee. After launching a token on Zora, creators can earn revenue through trading and market rewards. For transactions within Zora, creators receive 0.5% of the trading fee plus 0.5% of the fee income from the Uniswap LP Pool. For transactions outside Zora, creators earn 0.5% of the fee income from the Uniswap LP Pool. When a token is purchased, creators earn profits in ETH; when it is sold, they earn profits in the form of their own token. Overall, when users trade on the Zora platform, each transaction incurs a 2% fee, of which 1% is the LP fee and 1% is the platform trading fee. In contrast, trading directly on a DEX only requires paying a 1% LP fee. Of the platform trading fee, 50% is allocated to creators (i.e., 0.5% per transaction), 15% is distributed as trade referral rewards, 15% as post (token) creation referral rewards, and 20% goes to the Zora team. Of the LP fee, 50% is allocated to creators (i.e., 0.5% per transaction), 25% is distributed as post (token) creation referral rewards, and 25% goes to the Zora team. Following the launch of its Launchpad, many Base ecosystem builders have launched Memecoins by posting on Zora, providing it with traffic support and establishing Zora as one of the leading Launchpads on Base alongside Clanker. However, Zora’s transformation has sparked some controversy. Some users have called for a return to its original NFT functionality, arguing that the new system has fully morphed into a Memecoin Launchpad, straying from its initial mission of serving content creators. Regardless, with the anticipation of a token airdrop, Zora has garnered unprecedented attention thanks to its Launchpad. SunPump SunPump is a Memecoin Launchpad built on the Tron network, supported by Justin Sun’s team, and shares similarities with platforms like pump fun and Four Meme. At its peak, SunPump significantly boosted the Tron network, capturing over $60 million in monthly fees in August 2024, marking the second-highest level in its history. To date, it has facilitated the creation of over 95k tokens on the Tron network. (Data Source: https://dune.com/hashed_official/sunpumpmeme) Users creating tokens on SunPump are required to pay an approximate creation fee of 20 TRX. During internal pool trading, the platform charges a 1% fee per transaction, with TRX serving as both the trading pair and the currency for fee collection. Once a token reaches a market cap of approximately $69,420, the platform migrates the token and its liquidity to the DEX SunSwap, deducting a fixed migration fee of 3,000 TRX from the liquidity. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Asia's weekly TOP10 crypto news (Mar 17 to Mar 23)

Sunday, March 23, 2025

The Financial Supervisory Service (FSS) of South Korea has required cryptocurrency exchanges to pay a total of 7.9 billion South Korean won (approximately $5.54 million) in annual regulatory fees. ͏ ͏

Weekly Project Updates: Berachain PoL Officially Launches, Pumpfun Introduces PumpSwap, PancakeSwap's Trading Volu…

Saturday, March 22, 2025

The TON Foundation has announced that a group of well — known VCs have purchased $400 million worth of TON from TON's private investors. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: OKX DEX Abruptly Suspends Services, Binance Releases Article on Binance Alpha 2.0, RWA TVL Su…

Friday, March 21, 2025

The Federal Reserve has announced its interest rate decision. The upper limit remains at 4.50%, in line with expectations, and the previous value was also 4.50%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Recent Trends in RWA and the Next Major Sector in the Coming Cycle

Thursday, March 20, 2025

In the previous article, we explored market perspectives from both Eastern and Western viewpoints. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyzing the Reasons Behind OKX DEX's Suspension of Services in Response to MiCA Regulations

Wednesday, March 19, 2025

Recently, the cryptocurrency exchange Bybit was involved in the largest theft in the crypto industry, with North Korean hackers stealing approximately $1.4 billion in cryptocurrency from Bybit's

You Might Also Like

WuBlockchain Interviews InvestHK: Hong Kong's Natural Advantages in Web3 and Cryptocurrency Development

Wednesday, March 26, 2025

Prior to joining the government, Mr. Leung was a tech entrepreneur, angel investor, and fintech lecturer. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Stablecoin active addresses surged 53%; pump.fun launched its own DEX while Radium respond…

Wednesday, March 26, 2025

The number of stablecoin active addresses surged by 53%; Evmos was open-sourced as a native EVM for Cosmos; pump.fun launched its own DEX, and Raydium responded with its own launchpad. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 The number of stablecoin active addresses surged 53%; pump.fun launched its own DEX while …

Wednesday, March 26, 2025

Stablecoin active addresses surged 53%; Interchain Foundation open-sourced Evmos as a native EVM for Cosmos; pump.fun launched its own DEX, and Raydium responded with its own launchpad. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump Media to launch crypto ETFs on Crypto.com amid CRO controversy

Tuesday, March 25, 2025

TMTG's ETF launch with Crypto.com could broaden crypto access, yet faces backlash from the community. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Q1 2025 Bitcoin Data Special

Tuesday, March 25, 2025

Bitcoin mining trends, evolving network usage, and their impact on miner incentives ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Canary Capital’s Frequent ETF Filings: Are Alternative Crypto ETFs Just a Marketing Ploy?

Tuesday, March 25, 2025

On March 20, US-based financial firm Canary Capital filed an application with the SEC for the Canary PENGU ETF, a fund designed to hold both Pudgy Penguins NFTs and the $PENGU token. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

US Senator submits proposal to end the FED while White House advances Bitcoin reserve buying

Monday, March 24, 2025

Senator Mike Lee's proposal to dismantle the Federal Reserve and Trump's pursuit of a Bitcoin reserve suggest a potential recalibration of US monetary policy. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

💰 Tether was the 7th largest buyer of US treasuries in 2024; Crypto.com secured its Virtual Asset Service Provide…

Monday, March 24, 2025

Tether was the 7th largest buyer of US treasuries in 2024; Crypto.com secured its VASP registration from Argentina; US SEC clarified that PoW mining does not involve offer and sale of securities ͏ ͏ ͏

Paul Atkins To Be Sworn In As SEC Chairman

Monday, March 24, 2025

March 24th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Paul Atkins To Be Sworn In As SEC Chairman Ripple CEO Claims SEC Lawsuit Is Almost Over Elon Musk Claims The US Has 'Magic