Coin Metrics - Q1 2025 Bitcoin Data Special

Q1 2025 Bitcoin Data SpecialBitcoin mining trends, evolving network usage, and their impact on miner incentivesGet the best data-driven crypto insights and analysis every week: Q1 2025 Bitcoin Data SpecialBy: Tanay Ved Key Takeaways:

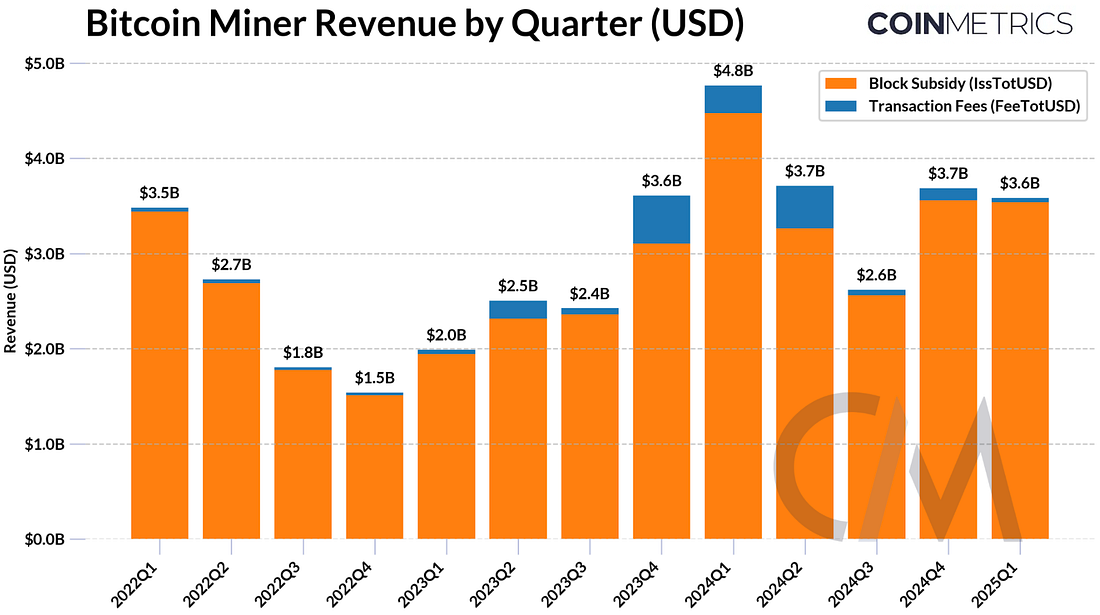

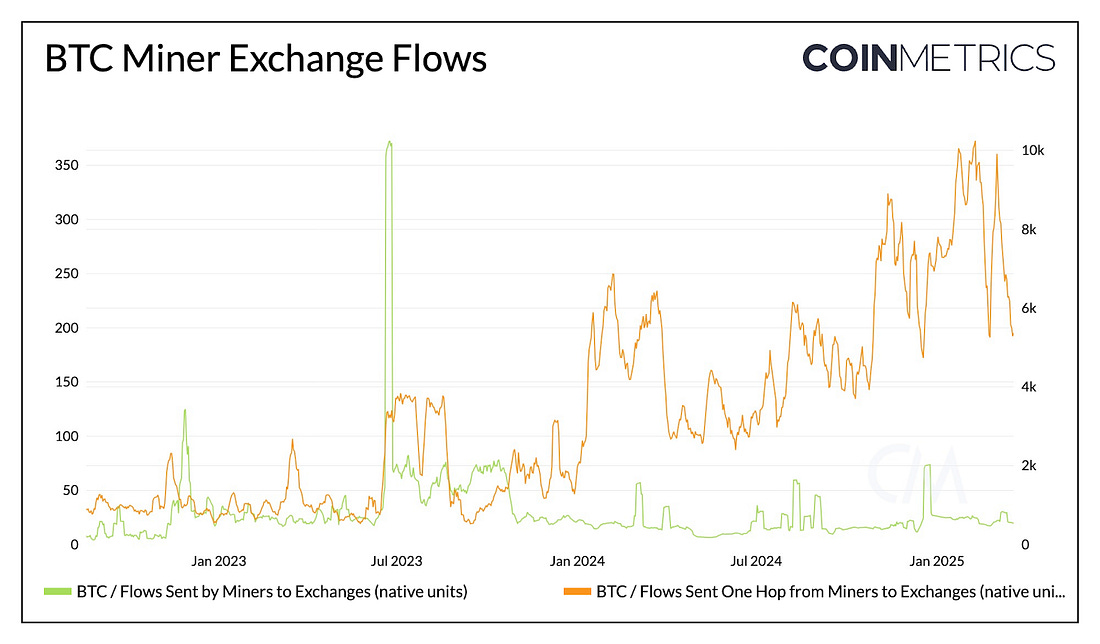

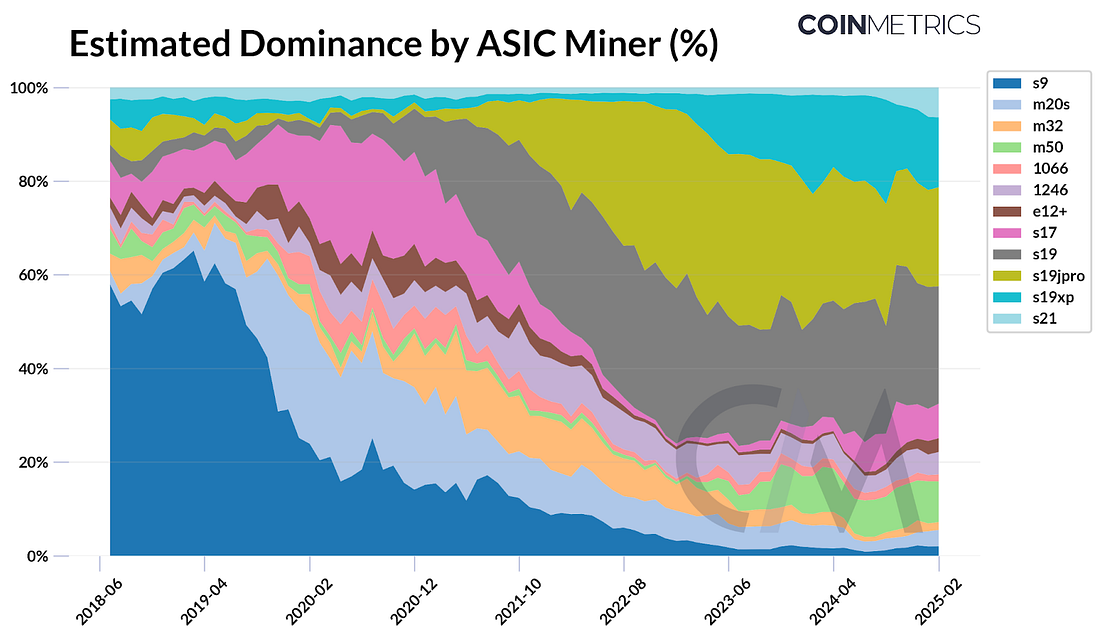

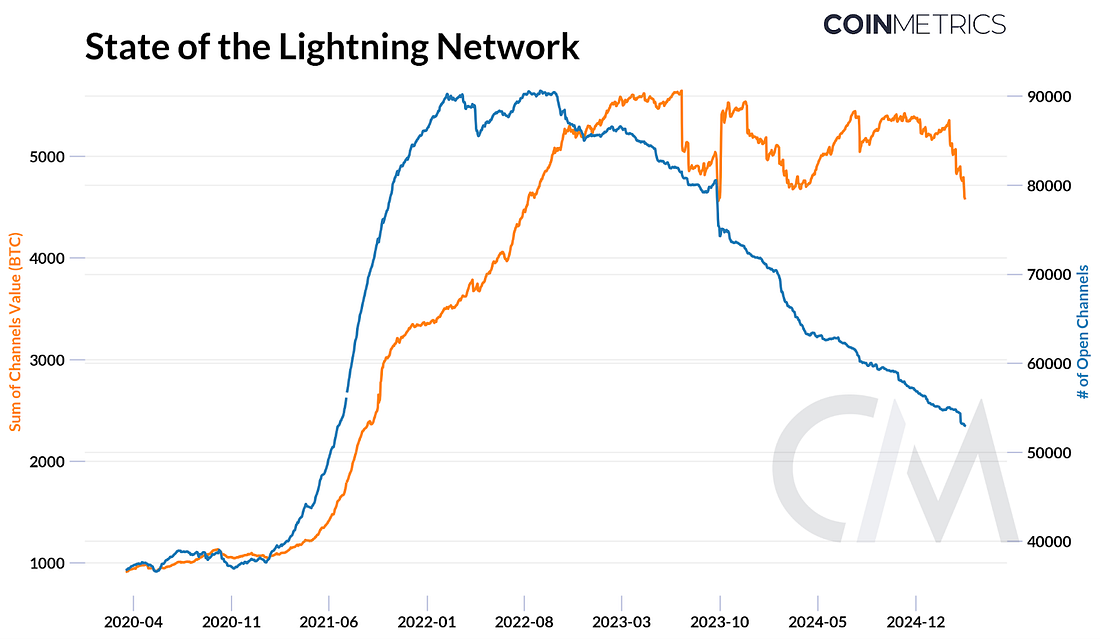

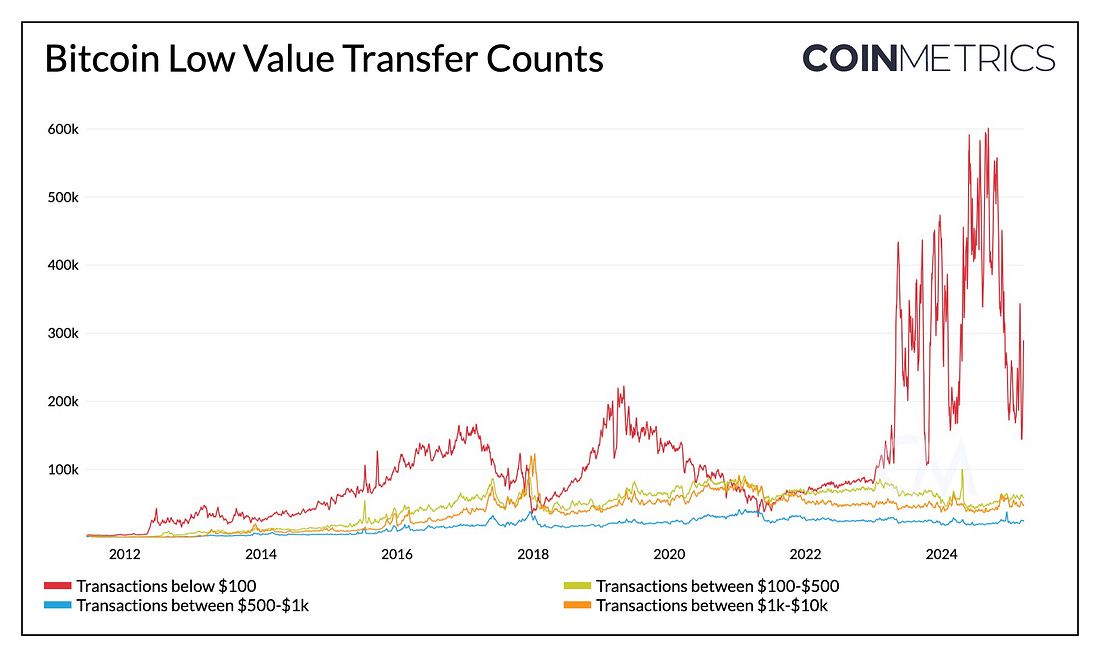

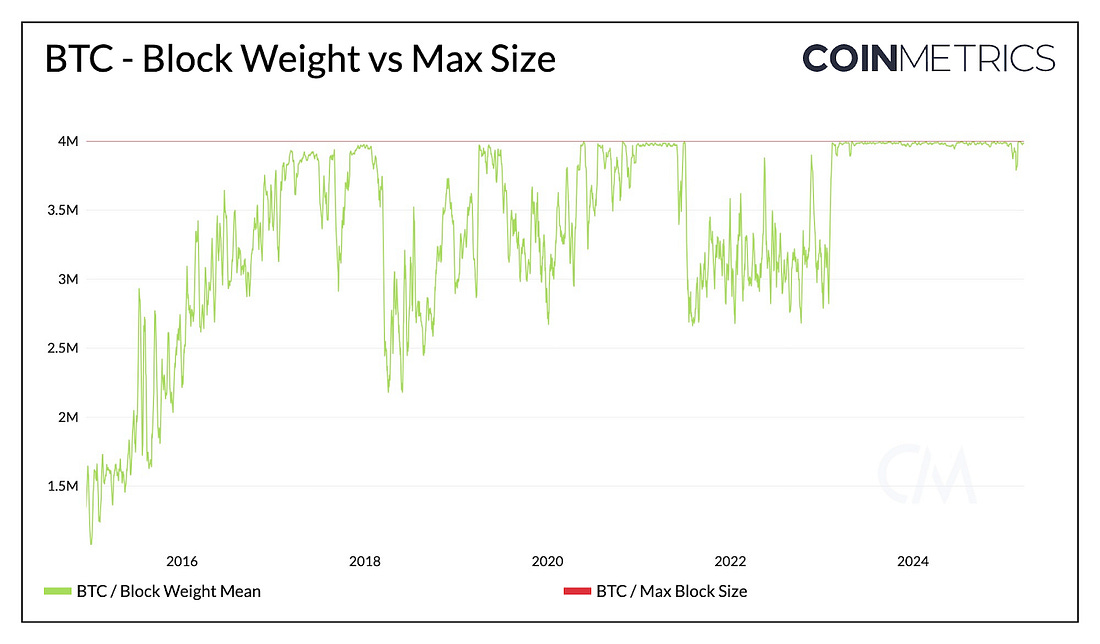

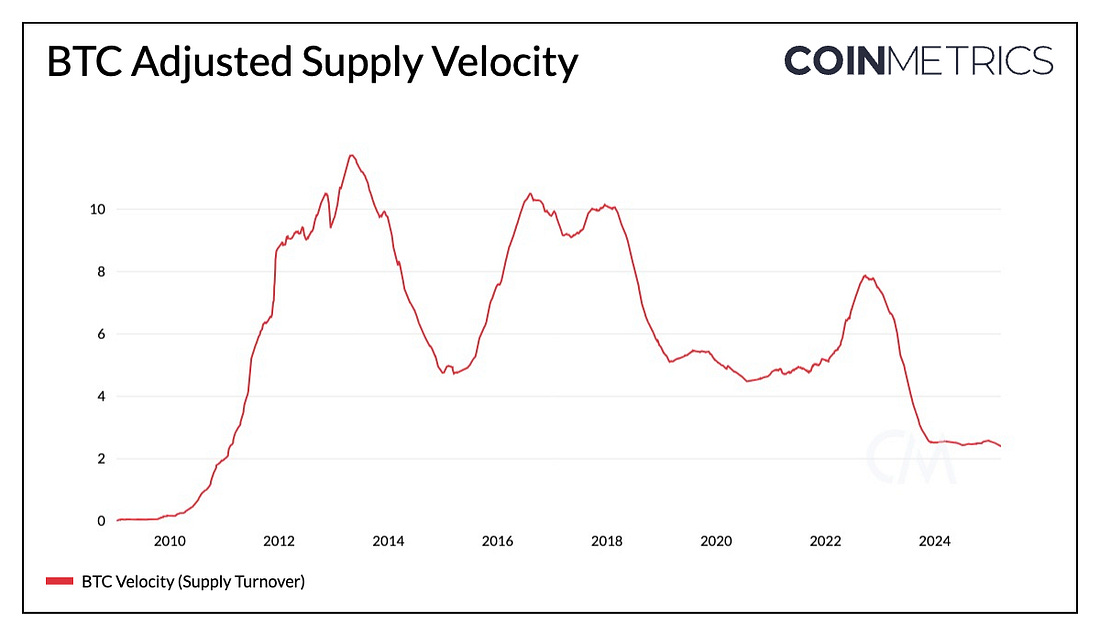

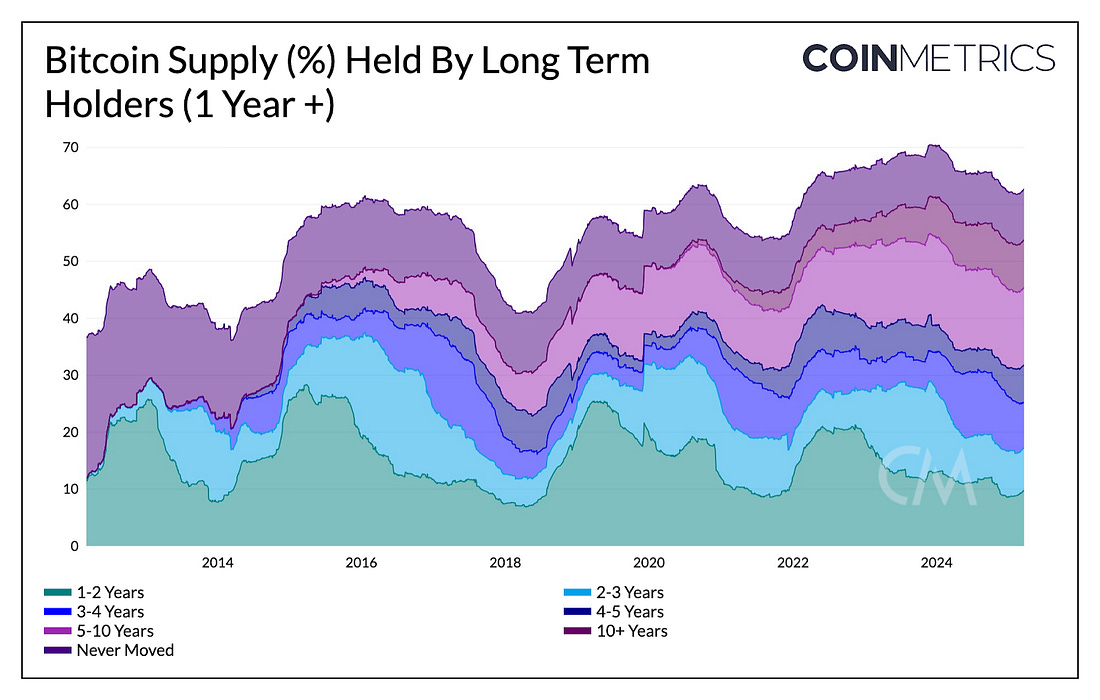

IntroductionWith almost one year elapsed since Bitcoin’s 4th halving, miners have endured a period of stabilization, adapting to reduced block rewards, tighter margins, and shifting operational dynamics. In this issue of Coin Metrics’ State of the Network, we provide an update on the Bitcoin mining landscape, including miner revenues, exchange flows, and ASIC distribution. We also explore how Bitcoin is being used today, whether as a medium of exchange or a store of value, and what that means for miner incentives and the network’s long-term sustainability. Mining UpdateMiner Revenue & FlowsTotal miner revenue, measuring both total fees for transactions included in blocks as well as block rewards from issuance, reached $3.7B in Q4. This represents a 42% increase from Q3 2024, a period where miners combatted the effects of halved block rewards, a lower BTC price, and pressure on margins due to higher energy costs and the need for more efficient mining hardware. So far in Q1 2025, miner revenues sit at a healthy ~$3.6B, with transaction fees accounting for merely 1.33% of total revenue, while the 30D hashrate has risen to 807 EH/s. Source: Coin Metrics Network Data Pro In the interim, miner behavior and strategy has continued to evolve in response to tightening margins. Miner flows suggest that direct flows (0-hop) from miners to exchanges have remained relatively stable with occasional spikes, indicating steady treasury management and opportunistic selling by larger operations. Meanwhile, 1-hop flows—BTC sent to exchanges one step from a mining entity (through intermediary addresses)—have steadily increased, pointing to gradual sell-pressure from smaller mining entities or pool participants. Source: Coin Metrics Network Data Pro Evolving Miner StrategiesWell capitalized miners are in a better position to withstand reduced incentives. They are adapting in numerous ways, such as upgrading to more energy efficient ASICs, relocating to regions with cheaper and abundant renewable energy resources, such as wind farms in Texas, or in developing regions across Africa and Latin America with underutilized resources. In some cases, miners are also diversifying into AI data-center hosting as a way to expand revenue and repurpose existing infrastructure for high performance computing. For instance, Core Scientific committed to 200 MW of capacity to host CoreWeave’s AI workloads, highlighting how mining operations are evolving to meet broader compute demands while seeking improved profitability per terahash. Bitmain’s Hardware Dominance & Geopolitical ImpactWhile geographic decentralization and mining pool distribution of hashrate are critical for Bitcoin’s network resilience, the distribution of ASIC hardware is another important factor to consider. Economic incentives and energy needs are naturally driving mining operations to diversify geographically, but the geopolitical environment introduces additional complexity to the hardware supply chain. Source: Signal & The Nonce, MINE-MATCH Based on nonce patterns linked to real-world ASICs, we estimate that machines manufactured by Bitmain Technologies Ltd. (such as the S19, S19j Pro, and S19 XP) currently contribute between 59% and 76% of Bitcoin’s network hashrate. This range is based on estimates derived from lower-bound, adjusted, and fully processed datasets representing different levels of ASIC coverage. With Bitmain accounting for a majority of Bitcoin’s network hashrate, reliance on a single manufacturer, despite having distributed supply chains presents a potential risk. Since Bitmain is primarily based in China, its dominance highlights how geopolitical dependencies can affect the stability of mining operations. In early 2025, several U.S miners experienced delays in receiving Bitmain shipments due to heightened customs scrutiny and new tariffs levied on Chinese imports. While these delays have varied in impact, they highlight how the geopolitical environment could introduce friction into global mining operations and reshape the current dynamic. How Bitcoin Is Being Used TodayAs mining becomes more competitive and reliance on transaction fees increases, understanding how Bitcoin is used today offers valuable insight into the sustainability of the network and miner incentives. While its roots lie in being a “peer-to-peer electronic cash system,” and medium of exchange, Bitcoin’s usage is increasingly shifting toward that of a global store of value and reserve asset. State of The Lightning Network & Bitcoin L2’sFor Bitcoin to function effectively as a medium of exchange, limitations around scalability and unpredictable transaction fees prompted the development of second-layer solutions like the Lightning Network. The Lightning Network works by creating off-chain payment channels between users, allowing for near-instant and low-cost transactions that settle on the Bitcoin network when channels are closed. Recently, the number of open lightning channels has declined to around 52.7K, while total channel value has remained stable between 4500-5000 BTC. Despite fewer visible channels, this suggests the network has sufficient capacity to handle a similar amount of value, likely due to improved routing efficiency, channel consolidation and the growing use of private channels. Many other Bitcoin rollups and sidechains, such as Stacks, and Botanix are being developed to boost scalability, transactional activity and ultimately drive higher fee revenue on Bitcoin. These solutions aim to expand Bitcoin’s utility by enabling smart contracts, faster transactions, and new use cases, while anchoring to the security of the base layer. Interestingly, the Bitcoin network itself has seen growth in lower value transactions. Transactions below $100 currently represent ~60% of Bitcoin’s total transaction count, and times have also represented ~80% during parts of 2024. Higher value transactions (between $100k-$1M) have also grown in count, but account for a smaller portion of activity than they have before. Source: Coin Metrics Network Data Pro Bitcoin blocks are consistently reaching their maximum weight limit of 4 MB, even as mempool size and transactions remain relatively low. This suggests that block space is being filled primarily by low-value, low-fee transactions, with limited competition for inclusion—resulting in lower average and total fees, aside from occasional spikes driven by demand for Ordinal inscriptions and Runes. Over time, increased participation from higher-value or more time-sensitive activity could help drive stronger fee revenue, supporting miner incentives as block rewards decline. Source: Coin Metrics Network Data Pro Store of Value & Reserve AssetWhile multiple efforts to enhance Bitcoin’s transactional utility and role as a medium of exchange are underway, Bitcoin is increasingly being recognized as a “Store of Value”. Its scarcity and predictable issuance schedule are key properties that have earned it the title of “digital gold.” This narrative has accelerated in recent years, with ownership shifting toward institutions, public companies, ETFs, and even nation-states, with over 14% of BTC supply held by such entities. Source: Coin Metrics Network Data Pro The shift towards long-term holding is supported by on-chain data. Bitcoin’s supply velocity, measuring the ratio of adjusted transfer volume to its current supply (rate of turnover), has declined over time, reinforcing the idea that BTC is increasingly held rather than transacted. Additionally, Bitcoin supply age bands (“HODL Waves”) allow you to see Bitcoin’s evolving supply distribution based on holding time. The share of supply held by long-term holders (1-year or more) continues to rise, recently reaching ~63%. These trends highlight how Bitcoin’s role is evolving into that of a store of value and reserve asset. Source: Coin Metrics Network Data Pro ConclusionAs Bitcoin miners adapt to the realities of reduced block rewards, adapting through hardware upgrades, regional shifts, and strategic diversification, the importance of sustainable fee revenue continues to grow in importance. At the same time, Bitcoin’s usage is evolving: while low-value transactions and Layer-2 activity continue to grow, long-term holding is increasingly dominant, reinforcing its role as a store of value. Balancing these dual narratives will be key to ensuring the long-term health of the network and the economic viability of its security model. Coin Metrics Updates

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

The Cross-Currents Shaping Crypto Markets

Tuesday, March 18, 2025

Exploring the macro and crypto forces driving current market dynamics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bybit Burglarized For a Billion

Thursday, February 27, 2025

Analyzing the Bybit hack with on-chain data ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

WuBlockchain Interviews InvestHK: Hong Kong's Natural Advantages in Web3 and Cryptocurrency Development

Wednesday, March 26, 2025

Prior to joining the government, Mr. Leung was a tech entrepreneur, angel investor, and fintech lecturer. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Stablecoin active addresses surged 53%; pump.fun launched its own DEX while Radium respond…

Wednesday, March 26, 2025

The number of stablecoin active addresses surged by 53%; Evmos was open-sourced as a native EVM for Cosmos; pump.fun launched its own DEX, and Raydium responded with its own launchpad. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 The number of stablecoin active addresses surged 53%; pump.fun launched its own DEX while …

Wednesday, March 26, 2025

Stablecoin active addresses surged 53%; Interchain Foundation open-sourced Evmos as a native EVM for Cosmos; pump.fun launched its own DEX, and Raydium responded with its own launchpad. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump Media to launch crypto ETFs on Crypto.com amid CRO controversy

Tuesday, March 25, 2025

TMTG's ETF launch with Crypto.com could broaden crypto access, yet faces backlash from the community. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Canary Capital’s Frequent ETF Filings: Are Alternative Crypto ETFs Just a Marketing Ploy?

Tuesday, March 25, 2025

On March 20, US-based financial firm Canary Capital filed an application with the SEC for the Canary PENGU ETF, a fund designed to hold both Pudgy Penguins NFTs and the $PENGU token. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

US Senator submits proposal to end the FED while White House advances Bitcoin reserve buying

Monday, March 24, 2025

Senator Mike Lee's proposal to dismantle the Federal Reserve and Trump's pursuit of a Bitcoin reserve suggest a potential recalibration of US monetary policy. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

💰 Tether was the 7th largest buyer of US treasuries in 2024; Crypto.com secured its Virtual Asset Service Provide…

Monday, March 24, 2025

Tether was the 7th largest buyer of US treasuries in 2024; Crypto.com secured its VASP registration from Argentina; US SEC clarified that PoW mining does not involve offer and sale of securities ͏ ͏ ͏

From PumpFun to FourMeme: A Review of the Top Five Token Launchpads

Monday, March 24, 2025

Between 2017 and 2018, the number of cryptocurrency was less than 17000; amidst the ICO boom at that time, nearly all were created on Ethereum using the ERC-20 standard. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Paul Atkins To Be Sworn In As SEC Chairman

Monday, March 24, 2025

March 24th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Paul Atkins To Be Sworn In As SEC Chairman Ripple CEO Claims SEC Lawsuit Is Almost Over Elon Musk Claims The US Has 'Magic