Last week I wrote about how the enterprise funding market continues to be 🔥both at the seed and growth stage. There’s been much more discussion on that this week with David George and Alex Immerman from Andreessen Horowitz sharing their thoughts in “When Entry Multiples Don’t Matter.” This is a super helpful lens from one of the top growth investors on how they think about valuations.

While multiples are indeed often an input for valuing mature, slower growing companies, in the private, high growth tech market, entry multiples tend to be a byproduct of the valuation process: What investors are really trying to understand are possible exit values. If a company is expected to be very valuable on a probability-weighted outcomes basis, the investor can afford to pay a higher entry valuation, and implicitly, a higher entry multiple. In other words, the ends (like the possible exit values) can justify the means (a seemingly higher present-day valuation).

And further…

As growth investors who believe in companies executing big, risky visions, we look at how long a company could grow at a high rate when assessing potential investments. This growth could be a function of product differentiation, go-to-market operations, sheer market size, new geographies, and expansion into adjacent categories.

Which then leads me to my next thought - how do 2 technical founders with a slide deck get to the above, a fast growing, high flying 🦄🦄🦄🦄🦄?

The short answer is you don’t start there! Here’s part of my mental model for partnering with technical founders at the slide deck stage.

Founders need to nail this and also never forget their product North ⭐no matter how big they get. If you can create a rabid base of customers super early focusing on one narrow pain or problem, you will have the opportunity to add more features or products selling to the same installed base. But this requires incredible patience and not going too fast. This also requires founders to sell the product at the microscopic but market the vision of what could be once you execute on the first part, i.e. additional product extensions and more.

Example 1 from this week includes Snyk (a portfolio company) whose product North ⭐ is to be the most-developer friendly security product. The company focused narrowly on scanning and fixing vulnerabilities in third party open source packages starting with javascript alone. The company nailed that which took about 2 years and then was able to add Ruby and more. Over time Snyk has attached container scanning at deployment and now runtime and just this past week the company’s developer friendly version of finding and fixing Infrastructure as Code is out. Sequencing is so important! It’s last reported valuation was at over $1 billion as of early January.

Example 2 from this week is Superhuman, another portfolio company. Superhuman’s product North ⭐ is to be the fastest email experience ever made. Well 5 years from slide deck, the company launched it’s first add on product with their new calendar feature and 😲do they deliver!

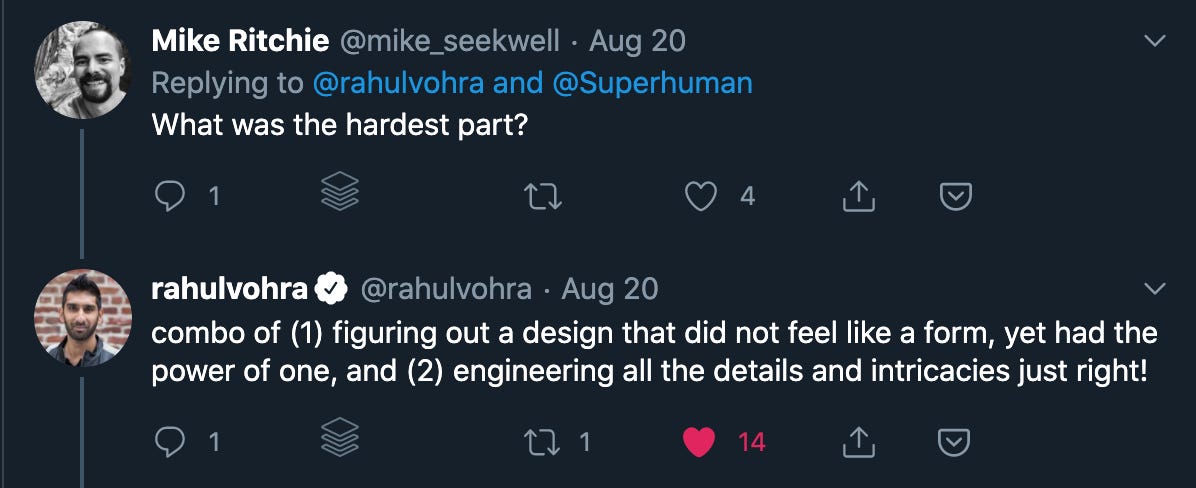

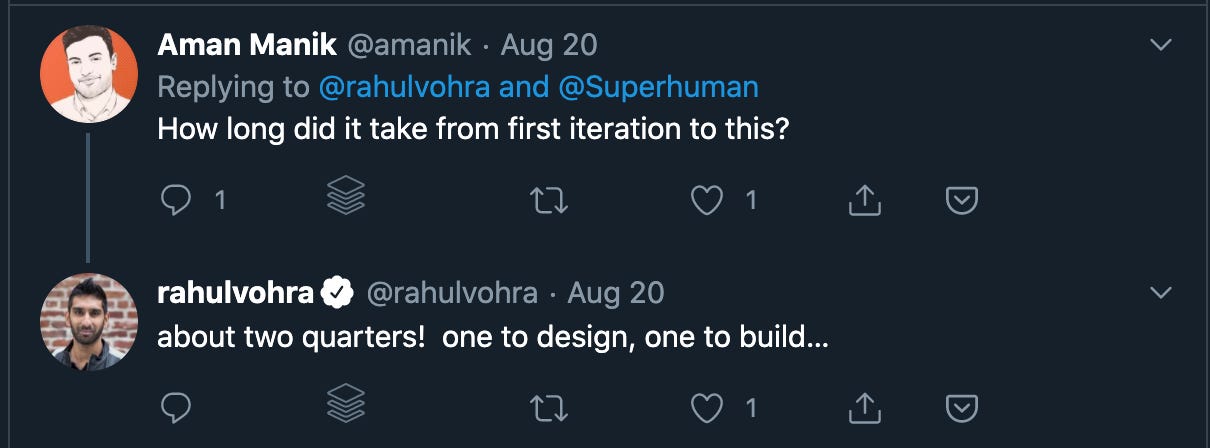

Once again, incredible patience was required to understand who the target users are, how Superhuman makes their lives immeasurably better, and understanding what and how to add new features/products. Here’s more from Rahul on the hardest part of adding calendar functionality in the “Superhuman” way and how long it took (PATIENCE 😃).

|

|

As always, 🙏🏼 for reading and please share with your friends.

Scaling Startups

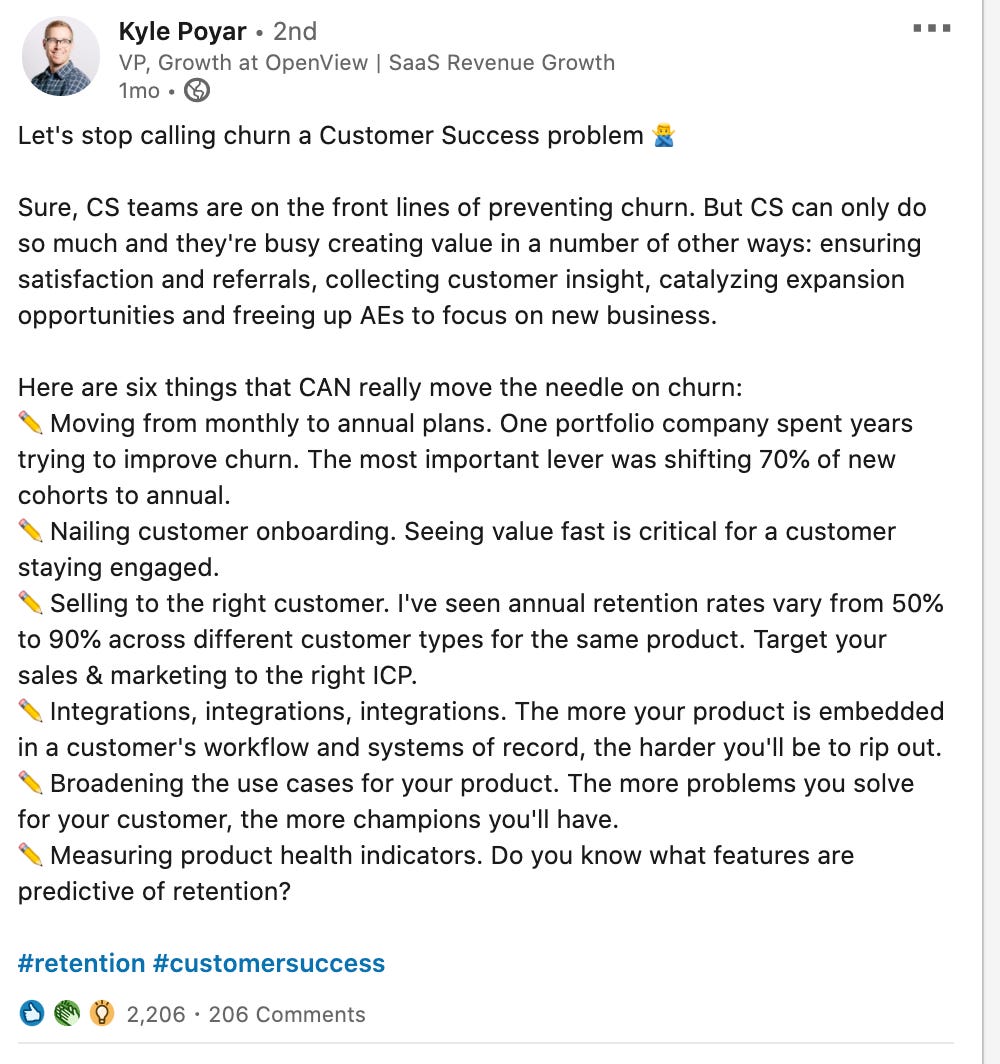

On customer churn, Kyle Poyar from OpenView nails it…for me, always starts with the product and ends with product as well

Huge reminder - it’s ok to fail

Figma going hybrid - remote/office and Dylan shares the thought process and data and potential challenges as the company embarks on a new long term policy

The data showed our employees valued flexibility but still had an attachment to our office. So we decided to talk with a number of hybrid companies, which led to some really valuable insights:

1. Where to find someone: It’s important for employees to have a predictable mental model for where they can find the people they work with.

2. Timing for office days: Implementing a fully flexible WFH schedule can lead to a “ghost town” office. If no one comes in at the same time, then you lose the moments of connection and serendipity that make in-person offices beneficial.

3. The hybrid model is hard: All the companies we talked with were committed to the hybrid workplace model, but they all were open about its challenges, especially with remote inclusion.

Enterprise Tech

Every Fortune 500 is a tech company - more examples from earnings this past week in WSJ showing importance of developers, agility, and cloud as online sales at the old cos keep accelerating -Home Depot (doubled online sales) and Nestle (>50% online growth)

At Home Depot, online sales doubled in the quarter ended Aug. 2, representing more than 14% of the approximately $38.1 billion of net sales, a spokesman for the company said Wednesday. That proportion was up from about 9% in the same period last year. Total sales growth in the quarter—23%—was the company’s strongest in nearly 20 years, it said.

In mid-March, Home Depot’s tech team quickly developed a feature on the company’s mobile app and website to let customers pick up items in front of the store if they didn’t feel comfortable going inside. The rate at which customers were engaging with the mobile app and website has more than doubled in the year to date compared to the same period in 2019, the company said. So tech teams have had to monitor the compute capacity on infrastructure services such as Google Cloud to make sure there are no website slowdowns or interruptions, Mr. Siddiqui said.

Target 🚀 - developers, developers, developers!

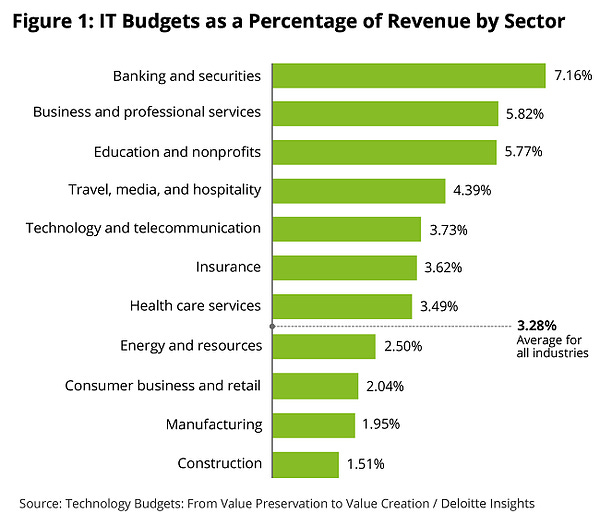

Finally, why I’m so bullish on developer first and infra spend even still. This % spend will certainly increase in the coming years.

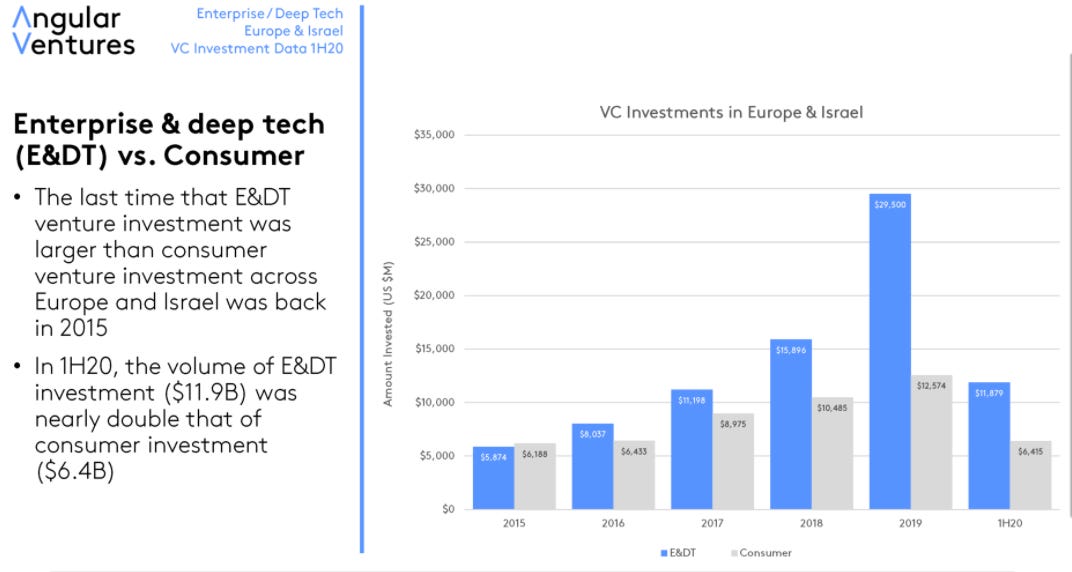

It’s no secret that European and Israeli enterprise tech has been 🔥 - Gil Dibner from Angular Ventures breaks out the data into finer detail evaluating “enterprise and deep tech” and yes, as already guessed, more 💰is flowing into these companies than consumer. Remember - great companies can be built anywhere!

|

As you know I’m a huge fan of resilience engineering, and here’s a great video and slide deck on what Steadybit is doing with Instana helping you proactively find vulnerable dark debt. What is most exciting to me is bringing the idea of “chaos engineering” and resiliency testing to the testing/product phase or shifting left vs. just remaining with ops teams.

steadybit acts as a meaningful supplement to your quality assurance and testing-workflow: By combining chaos engineering with intelligent agents it scans your system for possible weaknesses and recommends the appropriate experiments to uncover potential breaking points and issues. In the long run it helps you to build up trust in your distributed system landscape by implementing an empirical, system-based approach.

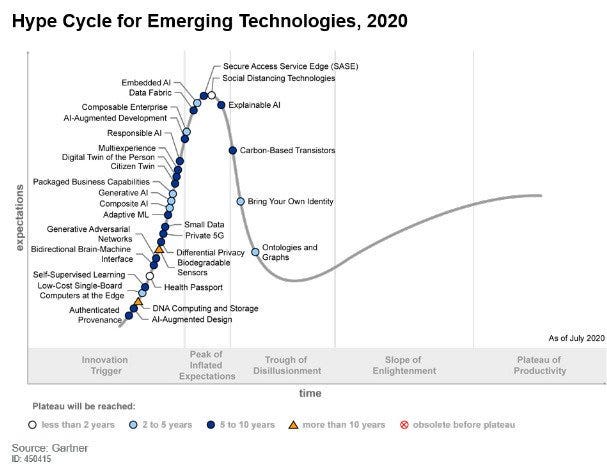

Gartner Hype Cycle - a little too much AI here for my taste - more on CIO Dive for a summary

Markets

Everything you wanted to know about SPACs (public blank check companies) and why this is Silicon Valley’s latest fad (Techcrunch)

Palantir which plans to go public via direct listing has slowing growth and huge losses according to Techcrunch

In screenshots of a draft S-1 statement dated yesterday (August 20), Palantir is listed as generating revenues of roughly $742 million in 2019 (Palantir’s fiscal year is a calendar year). That revenue was up from $595 million in 2018, a gain of roughly 25%. That’s growth, although not particularly great, given some of the massive SaaS growth we have seen in recent IPOs like Datadog.

The company’s revenue is a disappointment, after the company was reported to have been on the cusp of $1 billion in revenue for years. Private companies, of course, do not normally disclose their financial results, but the company’s size falls far short of expectations, leaks and other reports.