Never have I been 😄 for a week when tech stocks got 🔨 with the news of Pfizer’s COVID vaccine results at 90% efficacy and the pending positive results from Moderna Health. With the rotation out of tech stocks and back to the “real world”, we all must remember this shift to the ☁️ is decades+ long and this will not change overnight. Below you’ll find an article on how Capital One finally closed its last data center and moved fully to the cloud 6 years after starting. It is now the first financial services firm fully in the ☁️, and 🤔 about how many more Global 2000 companies are out there that are just in the beginning!

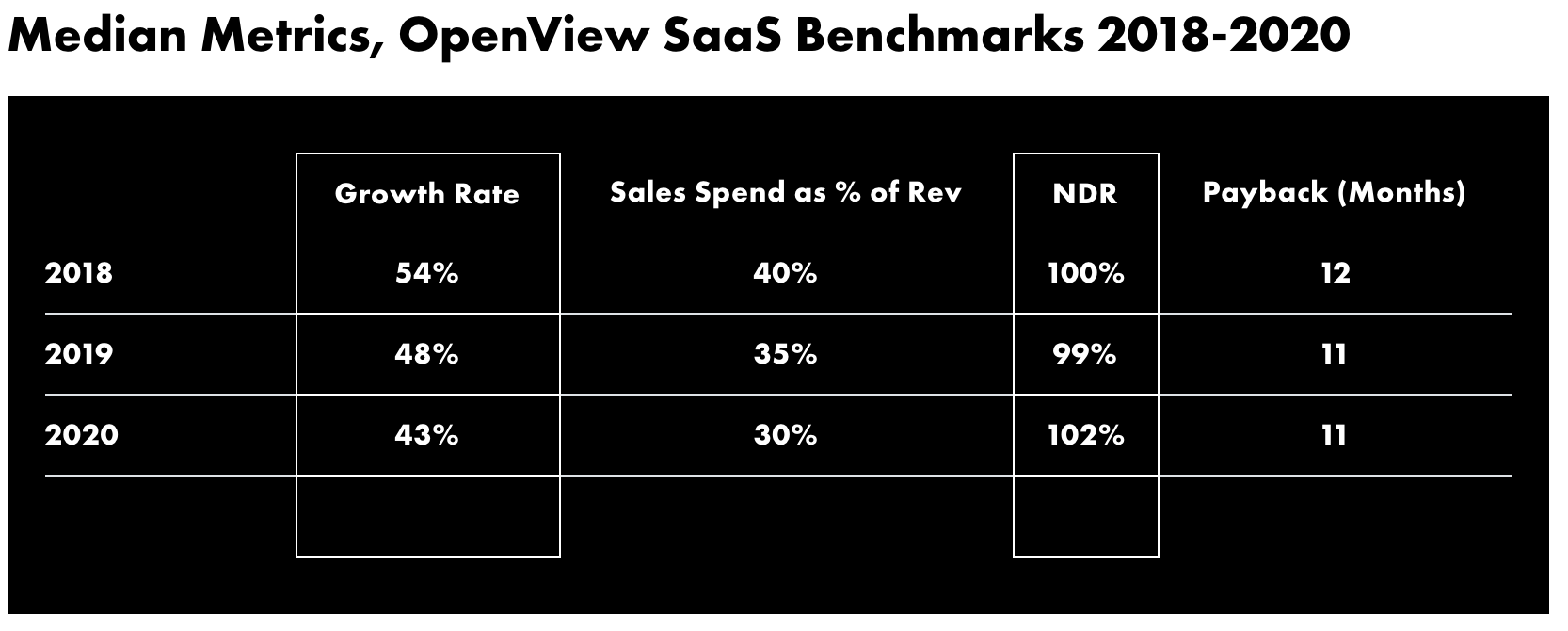

Speaking of COVID and rapidly shifting strategies, take a look at the 4th Annual OpenView SaaS Benchmarking survey with over 1200 respondents worldwide. Boldstart was happy to participate once again as some of this data can help you put together your 2021 plans with a macro check while you build bottoms up.

One of the key takeaways is that all of us rightly overindexed on cutting back on discretionary sales and marketing spend as times were quite uncertain. Data shows while the YoY median ARR growth slowed along with sales & marketing spend, net dollar retention and payback improved meaning that companies were able to find new ways to efficiently reach customers.

In our view, it’s time to ramp back up GTM investment. Companies are acquiring and retaining their customers as efficiently as ever. They’re just not spending nearly enough on acquisition to actually reach those customers who have demonstrated they still want to invest in digital transformation.

It is clear that companies responded to COVID with an abundance of caution. With hindsight bias, many companies may have actually overreacted. Now, some are faced with a scenario where competitors are leapfrogging them because they pulled back on growth initiatives while competitors kept going. At this point, the data prove that demand remains strong. Start investing again to get back on your pre-COVID growth trajectory and make your 2021 an accelerating growth year.

Also read on about the importance of true PLG vs. free trials and more.

As always 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

🙏🏼 to @SeanDelaney23 for having me on the What Got You There Podcast! Here’s a short clip on why I believe specialization of stage and focus matters and how it takes a village to help technical founders become great CEOs and go from whiteboard to scale.

If interested, check out the full podcast and show notes to hear more about my thoughts on the following:

📈 Investing w/courage + conviction

👩🏼💻 5 Ps on what we look for in founders

🤝 3 Chs on what makes a great value add investor

💪🏼 memory building to PMF vs. scaling

🤔 like a founder when building your VC firmShreyas from Stripe nails it again…

Definition of a thesis-driven preemptive round is when someone not only does customer calls before you are raising but when they also show up with a 40 page memo explaining their investment thesis for your company

As a FYI, I’m seeing more and more of this now…

“This was a very productive thing for us,” Fishtown Analytics co-founder and CEO Tristan Handy told me when I asked him why he raised again so quickly. “It’s standard best practice to do quarterly catch-ups with investors and eventually you’ll be ready to fundraise. And Matt Miller from Sequoia showed up to one of these quarterly catch-ups and he shared the 40-page memo that he had written to the Sequoia partnership — and he came with the term sheet.”

Initially, Handy declined. “We’re very bullheaded people, I think, as many founders are. It took some real reflection and thinking about, ‘is this what we want to be doing right now?’

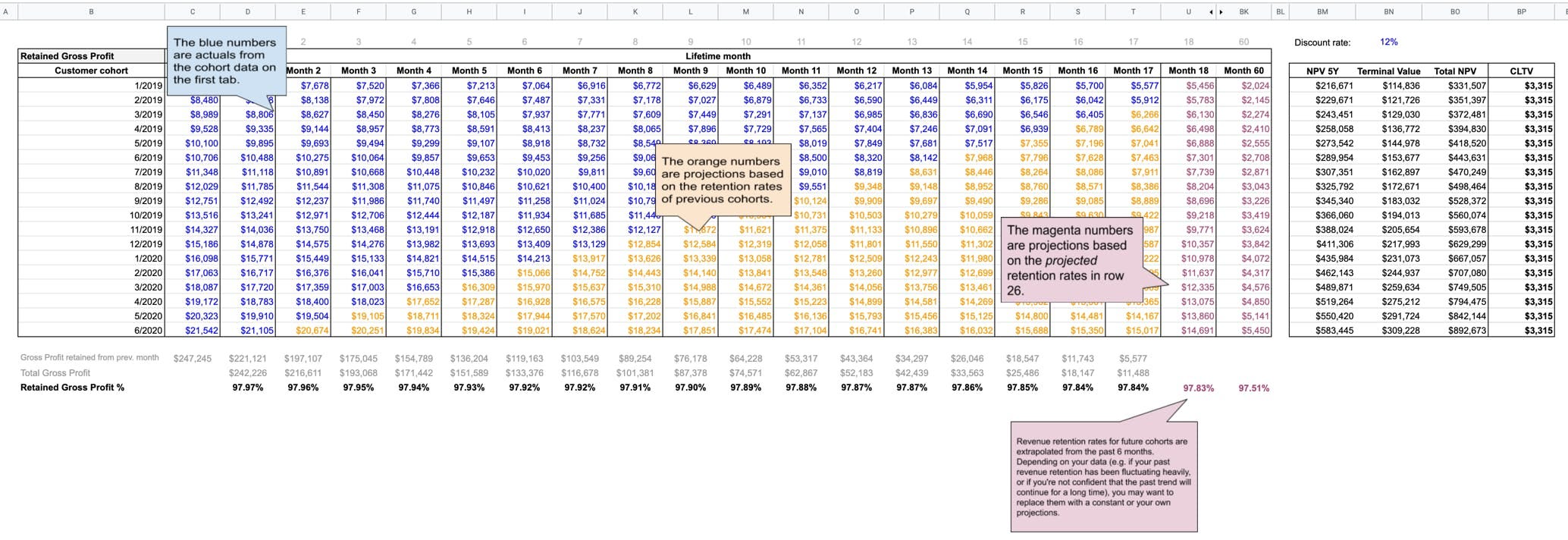

SaaS LTV Calculator from PointNine

Always 🤔 about what’s next…

Enterprise Tech

👇🏼

Part 2 - reminder Capital One started their journey in 2014, 6 years ago - imagine how far behind many other Global 2000 companies are - lots of IT Spend to come in the future no matter what happens to stock market in next couple of years

Power of land and expand at scale - this from CFO of Datadog as they look at their revenue numbers for 2021

About 60% of our revenue growth comes from existing customers. So we start with the land and expand and look at those cohorts inorganic. And I think we referred to looking at pre-pandemic and historical trends. So that's at the sort of lynchpin making the business relatively predictable even in uncertain times. And then we look at the market size, the opportunity, which tends not to be a limit. And so what is, is that the execution, how many salespeople we get in, how we can ramp them, et cetera. And we theen essentially have some experience in understanding ramp and understanding productivity. And those are the algorithms we use in looking at growth.”

Notion staffing up for enterprise…

This is a huge goal. And right now, we're just 70 people going after it together. That's where today's news comes in. Five of these people are leaders who just joined from some of the most important enterprise companies of the last generation. Now they're helping us build the next one!

We’ve had a few of our infrastructure companies rebuild in Rust - great article on Go vs Rust (def. no javascript 😃) 🎩 DevOpsWeekly

We've said that both Go and Rust produce extremely fast programs because they're compiled to native machine code, without having to go through an interpreter or virtual machine. However, Rust's performance is particularly outstanding. It's comparable with C and C++, which are often regarded as the highest-performance compiled languages, but unlike these older languages, it also offers memory safety and concurrency safety at essentially no cost in execution speed. Rust also allows you to create complex abstractions without paying a performance penalty at run-time.

By comparison, although Go programs also perform extremely well, Go is primarily designed for speed of development (including compilation), rather than speed of execution. The Go compiler doesn’t spend a lot of time trying to generate the most efficient possible machine code; it cares more about compiling lots of code quickly. So Rust will usually beat Go in run-time benchmarks.

Rust’s run-time performance is also consistent and predictable, because it doesn’t use garbage collection.

My colleague Shomik Ghosh shared his thoughts on what it takes to go from open source project to business using his 🤿 Scuba Framework- 14 minutes of packed power!

Tenry Fu from Spectro Cloud (a portfolio co) shares why “Kubernetes will be ideal for edge, but edge cluster management is still challenging” and ZDNet covers what Dell and FedEx are doing on the edge

❤️ Goldens!

Markets

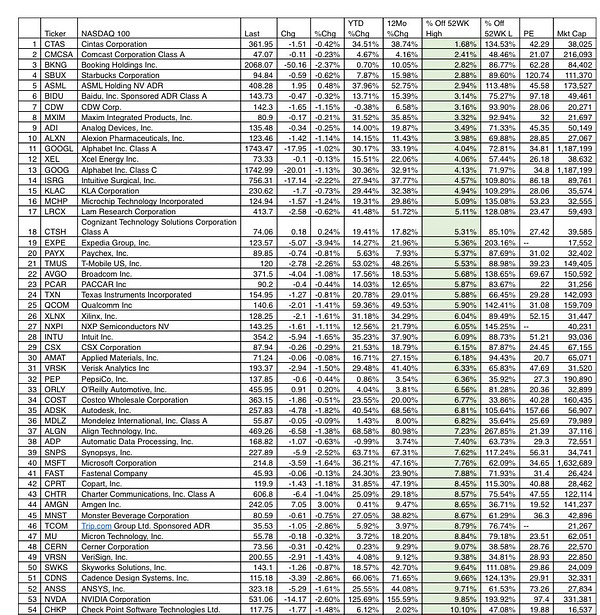

Great news from Pfizer on a potential vaccine and how it impacted some of the tech stalwarts during our lockdown…

Among the week’s biggest losers were companies that had benefited from the stay-at-home trade—businesses that can prosper when lockdown measures force people to spend more of their work and leisure time at home. Amazon.com and Facebook both fell more than 5% this past week, while videoconferencing firm Zoom Video Communications slumped 19%.

Wow