This is the once-a-week free edition of The Diff, the newsletter about inflections in finance and technology. The free edition goes out to 16,866 subscribers, up 292 week-over-week.

In this issue:

What’s Gold for?

Bitcoin, Flows, Autochthony

Digital Media, Distribution, Autochthony

Leaving “Little Taipei”

Scrap

Programming Note: The Diff will be off on Thursday 11/26, in recognition of the Thanksgiving holiday. The Diff will be back Friday 11/27, with a shorter issue, in recognition of the fact that the market is open half-days on the Friday after Thanksgiving. A formative early experience in my buy-side career was when a story came out the afternoon before Thanksgiving, was widely ignored the next Friday, and caused the stock in question to rise 10% or so on Monday once it was widely reported.

What’s Gold For?

For reasons that have more to do with physics than finance, gold is the asset class with the longest unbroken performance record. We have a decent idea of what a given amount of gold bought in ancient Greece, imperial Rome, renaissance Genoa, revolutionary France, and the modern US. Other products have existed about as long; there are records of loans going back to ancient Mesopotamia. But they’re a discontinuous time series—we have those records because they were written on clay tablets, which were then baked because the city they were in was razed to the ground. This typically results in a default with no recovery for the creditor. Gold, though, is durable; in general, the gold we have will last indefinitely, barring extreme events.[1]

There are roughly three ways to think about gold, two of which are fairly crazy, one of which is boring but sometimes useful.

Crazy View #1: Gold is (the only kind of) Money

Money is gold, and nothing else.

J.P. Morgan, 1912

Money is a slippery concept. It’s a general agreement to treat a fungible category of goods as though they are worth much more than they really are, and, importantly, to treat them as a legal way to settle a debt. Humans have used many kinds of money in the past: gold and silver, of course, but also immovable stones, cowry shells, Bitcoin, paper money, ledgers representing theoretical rights to paper money, ledgers representing theoretical rights to Bitcoin, and of course packets of mackerel from the prison commissary ($, WSJ).

Something is a good form of money if it’s readily divisible, easy to move around, and hard to make more of. It’s a better source of money if it’s not used for some other purpose, or rarely so, because this means that savings don’t reduce the availability of any real-world goods. Gold satisfies all of these criteria. When people start hoarding gold, something interesting happens: gold becomes a better way to store wealth. If gold is less prone to inflation than a cowry shell and easier to transfer than a Rai stone, it’s more likely to become the default. And once it’s the default, you know it’s the default. You buy it, because other people buy it. That sounds like participating in a bubble, and it is; money is, possibly by definition, the bubble that never pops.[2]

Unfortunately, it has some obvious problems: it’s quite valuable in inconveniently small amounts, so it’s hard to use gold for everyday spending. (A gold coin the weight of a penny would be worth $164.) And the difficulty of finding new gold, which makes gold a very durable medium of savings, also means that the money supply in a country that uses gold is inflexible.

Inflexible money supplies can be very helpful under some circumstances. When governments are untrustworthy, for example, the inability to produce more currency acts as a brake on their spending. But it’s less useful for an expanding economy, where the demand for money expands, too. England was on a gold standard starting in 1717, but the amount of ostensibly gold-backed paper currency circulating there was far higher than the Bank of England’s gold stocks. For example, during the Napoleonic Wars, the Bank of England dramatically increased the English money supply, but backed less than half of it with gold reserves.

When gold standards are universal, this kind of thing is self-correcting over time. A well-run central bank can extend credit a bit beyond its reserves. If that credit leads to good investments, the loans get paid off and the country prospers. If it leads to consumption, that requires imports, which have to be paid for with gold. As gold leaves the country, extending further loans gets difficult, so the bank shrinks available credit. This tends to cause a quick and painful recession, but in economies with little net borrowing and lots of agricultural jobs as a labor market backstop, recessions hit hard and end quickly.

But one thing this means is that as economic growth accelerates, and as the economy gets more complicated, a gold standard is, increasingly, a constraint. The First World War significantly weakened the gold standard, and by the end of the Second, most of the world had switched to a strange top-down system: most currencies were convertible into dollars (at fixed prices) and dollars were convertible to gold (also at a fixed price). Since dollars earned interest and gold didn’t, countries wanted to accumulate dollars. But as the dollars outstanding exceeded the gold backing them, those dollar holders got increasingly nervous. This led to a long period of diplomatic and economic acrobatics (summarized in this subscribers-only post), which ultimately ended when the US left the gold standard in 1971.

Gold had been at a fixed price from 1933 to 1971, and inflation was high and accelerating. Cutting off the dollar’s connection to gold led to a spectacular bull market. Gold started 1970 at $35/oz, and in January of 1980 it hit $850/oz, for a 37% compounded return over ten years.

It subsequently crashed, and underperformed relative to other assets over an extended period. Perhaps the most striking comparison is that the Dow was at 860 when gold was at $850. Today, the Dow is at 29,483, and gold is at $1,866. Four decades after the peak of the great inflationary gold bubble, a gold investor is enjoying capital appreciation close to what an equity investor had clocked in 1986, ignoring dividends.

It has gotten increasingly difficult to argue that gold is the only kind of money. If money constitutes something that can be readily exchanged for goods and services, then gold is emphatically not money; the merchants who accept gold as payment are the ones in the business of exchanging gold for currencies people actually spend.

Any thesis that makes sense based on first principles but doesn’t make a practical profit will lead to two responses:

Some people will decide that some of their first principles were wrong; they’ll take their losses and lick their wounds.

Other people will decide that the prices are wrong, and come up with increasingly elaborate theories as to why.

Goldbugs are very well-informed, and have some completely deranged views about central bankers, the media, other insufficiently pure goldbugs, whether or not stated gold reserves are fictitious, whether or not prices are being manipulated etc. There is a lot of information out there on what’s happening with gold prices and why at any given moment, but some of it is based on pretty conspiratorial assumptions. The goldbugs have had great moments, but over long periods, gold has been a poor asset to own.

Crazy View #2: Gold is Worthless

If we restore the gold standard, are we to return also to the pre-war conceptions of bank-rate, allowing the tides of gold to play what tricks they like with the internal price-level, and abandoning the attempt to moderate the disastrous influence of the credit-cycle on the stability of prices and employment? Or are we to continue and develop the experimental innovations of our present policy, ignoring the “bank ration” and, if necessary, allowing unmoved a piling up of gold reserves far beyond our requirements or their depletion far below them? In truth, the gold standard is already a barbarous relic.

Keynes, 1923

It gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

Warren Buffett, 1998

A realistic definition of insanity is that it involves behaviors that don’t make sense given one’s goals. But sensibility is in the eye of the beholder, and goals have a funny way of getting redefined after the fact. So a good working definition is that anyone who a) behaves differently from other people, and b) attributes this to the fact that everyone but them is crazy, is crazy.

For everyday behavior, “everyone” means everyone. In financial markets, though, “everyone” means a dollar-weighted average opinion of buyers and sellers who are active in a given market. Some investors buy and sell entirely based on an independent evaluation of companies' prospects, but most try to articulate the view they’re betting against. It’s not enough to buy something cheap; it’s important to explain why it’s cheap, and why that explanation is wrong.

The view that gold is nonsensical has to argue against several millennia of human beings all thinking gold is quite valuable indeed. They might all have been wrong, but every time a new generation arrives and the price of gold doesn’t collapse to nearly zero, it’s Bayesian evidence that gold has value for a reason.

Like many other social phenomena, gold’s value starts with a kernel of irrationality—someone valuing a shiny metal because it looks good—and then proceeds from there to the schelling point of gold as a vehicle for savings. It’s possible to design a better monetary system on a blank sheet of paper, but money evolves just like every other institution, and it’s subject to selection pressure, too. A new system can be designed, but implementing it while the old system is still running is a daunting challenge. Keynes was a genius, he surrounded himself with other geniuses, and when he and his fellow economists designed the postwar financial system, they had the advantage that the US had most of the world’s gold and almost as much of its industrial output, as well as the world’s strongest military and only superweapon. It was the best time in history to escape a local maximum and build a better system—and it didn’t work.

The Sane, Boring View

After the first Gulf War, sanctions prevented the Iraqi government from printing its old currency. The country printed some new notes, but the old ones kept circulating, and appreciated relative to the new currency.

Gold is basically an Old Iraqi Dinar without the Iraq: it’s less liquid than a currency, but has the currency-like characteristic that people use it as a vehicle for savings. It also has the Old Iraqi Dinar-like characteristic that it’s a currency whose supply is predictable, and that doesn’t produce interest.

Ultimately, currency moves are driven by expectations about relative real returns. Those real return expectations, in turn, are driven by a) interest rates in a given currency, and b) inflation expectations. The naive theory would be that every currency should have exactly the same value for interest rate plus expected inflation. If a few years ago you earned 2% in dollars and experienced 2% inflation, then a 15% interest rate for Turkish Lira implied 15% inflation for the Lira. In practice, this is not always so; higher-yielding currencies historically produced excess returns, with a bit more risk of sudden depreciation, although in the post-crisis environment this was less straightforward.

Some currencies move in response to disasters. The Yen, for example, tends to rally during crises, because Japan’s overseas investors repatriate funds. Gold, too, moves in response to crises: during the first Gulf War, its price rose 7% in a few days after the invasion of Kuwait. Gold was up 5.5% on 9/11. And the day AIG was forcibly recapitalized in September 2008 was one of gold’s best days ever, up 11%.

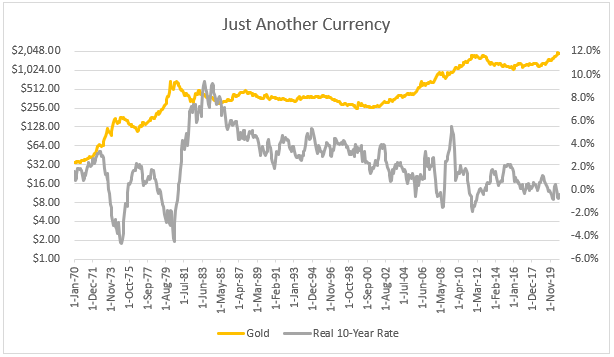

This has given gold a reputation as the asset to buy during a disaster, but that’s a side effect. Gold is, much more prosaically, a carry trade: a currency issued by a theoretical, abstract central bank that keeps the money supply growing at a roughly fixed, very low rate of about 1.6% per year. This central bank maintains a resolute 0% interest rate policy. Most of the time, this makes gold a terrible currency, but when inflation is high and rates are low, it’s a competitive one:

When real yields are below zero, gold is a high-yield currency. Imagine, earning an almost-0% return after inflation on your savings!

There are good reasons to expect a negative real rates environment in the next few years. The Federal Reserve has promised to keep rates low for as long as it takes to achieve full employment, even tolerating higher inflation along the way. Unemployment is falling, but current stats also include a two point reduction in the unemployment rate from people who have left the workforce, and the pre-Covid economy was able to sustain surprisingly long gains in employment. So that takes care of the “rates” part.

The “real” part is up to deferred consumption, fiscal policy, and vaccines: US consumers have, since the start of the Covid Crisis, paid down credit card debt and home equity loans, and saved money at all-time highs. Some kinds of consumption have been voluntarily reduced, and other kinds are impossible. But there’s clearly pent-up demand; every quarter, cruise lines talk about how a) they are currently bleeding money, because they still have expenses but can’t carry passengers due to plague, and b) passengers are buying tickets for future sailings. Restaurants, bars, theaters—all of them have immense pent-up demand. And that ignores the growing possibility of a CARES Act follow-up that would provide more immediate relief and increase the post-vaccine consumption boom.

If gold were a crisis asset, then vaccines and a spending bill would be bad for gold. But since gold is a real-rates asset, it is, at the moment, a bet on technocracy: a bet that governments will use fiscal policy to aggressively manage the economy, that the Federal Reserve will decide to reinterpret its own mandate, and of course that the healthcare and logistics industries will get hundreds of millions of vaccine doses delivered on time. It’s a bet that the world’s experts will go to extraordinary lengths to make life ordinary again for everyone else.

Does it make sense to be bullish on technocracy? I’d argue that it does. The Trump administration widened the Overton Window with respect to what the executive branch can claim it will do, but many of those aggressive, norms-busting promises were not actually implemented. How you explain this depends on your personal partisan alignment: on the right, you might say that Trump was facing off against the Deep State; on the left, you might say that he did not have a large enough group of competent, institutionally-savvy civil servants who were willing to implement his goals. From a non-partisan perspective, it’s crucial to point out that these are exactly the same critique: a deep state can only thwart someone if it’s full of people who know how a given department works, can make that department do what the President says, and… don’t. Different connotation, same denotation.

In that model, a Biden administration has a wider range of options, and is more likely to achieve its goals. One of those goals is to get through the remainder of the Covid-19 epidemic with a minimal loss of a) lives, and b) economic output. And the way to do that is to combine more restrictions on potentially infectious behavior with more transfer payments to offset the attendant loss of income.

Asset allocation is, among many other things, the art of teleporting purchasing power into the future. Each asset class is a teleporter with different specs. Stocks are a better purchasing power teleportation machine when growth is high and the timeline is long; bonds are best in deflationary or at least disinflationary environments. And when rates are low, but there’s accumulated spending to do, gold becomes the purchasing-power teleporter of choice.

[1] The two historical big ones are 1) since gold is malleable, coins that are in frequent use will wear down over the centuries, and 2) Georgy de Hevesy dissolved two gold Nobel Prize medals in acid to hide them from the Nazis in 1940.

[2] This argument has been approximated in various places, but I first saw it made compellingly here.

Further reading: The Power of Gold is a good general history of gold and its obsessions, and the historical anecdotes above draw heavily on it. This essay turned out to be wrong, at least so far, but has many provocative ideas. “Money is the bubble that never pops” is useful in a variety of contexts.

Disclosure: I’m long gold, and this post is not investment advice. Please do your own research—as long as you promise to tell me what I got wrong.

A Word From Our Sponsors

Want to Improve Your Portfolio? 88% of Wealth Managers Say This Asset Does Just That.

Sometimes, the smartest thing to do with your money is to copy what the top dogs are doing. So when the vast majority of wealth managers recommend investing in art—we’re inclined to agree.

But don’t just take our word for it, check out these juicy stats:

180%: art outperforming the S&P from 2000–2018

0.13: the lowest stock market correlation of any asset class

10–30%: historical yearly appreciation

The only problem? Access to this under-the-radar performer is exclusive to all but the ultra-wealthy. Masterworks gives every investor access to the very same investments reserved for founders and CEOs.

Offerings can sell out quickly, so act fast and skip the 25,000 waitlist2 →*

*See important information

Elsewhere

Bitcoin, Flows, Autochthony

Bitcoin’s price movements are a mystery. It’s a volatile asset, and there’s continuous demand for sensible explanations for any given price movement. (The general explanation is that Bitcoin is a very low-probability bet on a potential reserve asset, and since the odds of it functioning as a reserve asset are positively correlated with price, it’s prone to bubbles.) Sometimes, though, there’s a (relatively) real-world explanation for why the price has risen. FT Alphaville compiles evidence that the most recent run-up—Bitcoin is up 57% in the last month, and close to an all-time high—is due to Paypal allowing users to purchase Bitcoin.

This is an odd echo of Paypal’s early pitch, which was to create a digital, inflation-proof currency that could be used to avoid inflationary crises. The carrot of consumer demand and the stick of regulation pushed Paypal into offering e-commerce payments instead of insurgent savings accounts, but a few decades later they’ve returned to form.

(Disclosure: I’m long Bitcoin.)

Digital Media, Distribution, Autochthony

Buzzfeed, whose founder and CEO previously co-founded HuffPo, has acquired HuffPo ($, WSJ). Buzzfeed’s Jonah Peretti has previously argued that digital media companies need to consolidate to survive, but the companies plan to operate independently for now, which will mute the economic benefits of consolidation, except on the ad sales side. Consolidation among clickbait media companies is a similar phenomenon to the roll-ups of Amazon third-party retailers: relying on a massive external distribution platform like Facebook/Twitter/Google is a great way to grow fast, but a terrible way to achieve any kind of stability, so it’s optimal for any given media company to make diversified bets.

Leaving “Little Taipei”

If it didn’t involve the hypothetical risk of nuclear war, the relationship between China and Taiwan would be the international relations equivalent of a sitcom: China formally denies that Taiwan as a country exists, but grew its economy through direct investment from Taiwanese companies:

Today three of China’s 12 most popular consumer-goods brands by revenue are Taiwanese. Chinese gobble up Master Kong instant noodles, Want Want rice crackers and Uni-President juices. Apple’s three biggest China-based suppliers—Foxconn, Pegatron and Wistron—are all Taiwanese.

That relationship is fraying ($, Economist), both because of that geopolitical risk and for more economic reasons. This is part of a larger trend: as operating in China has gotten more expensive, manufacturers who moved there for cost reasons are considering where to move next. The timing isn’t urgent; profitability is down, but not negative. Geopolitical risk, though, makes a “some time in the next few years” decision more urgent.

Scrap

In 2019, the cruise ship assembly business was booming, with a record-setting 117-ship backlog through 2027. This year, the cruise ship disassembly business is hot ($, WSJ):

Ten cruise ships were sent to recycling this year after nine were demolished over the previous two years combined.

Shipping in general is one of those frustratingly cyclical businesses where capacity is ordered years in advance, so record increases in capacity happen after peak demand. (This dynamic shows up in other fields, too; petroleum engineering degrees granted usually peaks about two years after oil prices in each cycle.) When cyclical companies are undercapitalized, recoveries are slow; they can sell enough capacity to service debts but not turn a profit, and that’s what they do. What’s unique about the Covid recession is how abundant capital is; cruise lines have enough access to funding that they can afford to ditch their lowest-ROI ships, meaning that the industry can return to supply-demand balance faster than in a typical recession.