I don’t know about you, but this week was 🤯. From SaaS Merger Monday with Salesforce/Slack rumors (announced Tuesday), Facebook/Kustomer (proud day one investor 🙏🏼😃), and Gainsight/Vista to earnings galore in Snowflake, Zoom, Okta, and more, it was hard to keep track.

And then add the insanity in the private markets (see thread for more)

All I can say is that we are going to have a wild next few weeks to close out 2020, which can’t come fast enough. But one question I keep asking myself is “are we all loco?” How do we justify and sustain these stratospheric multiples for future earnings and growth? I go back to Cypress Hill for some inspiration…

Let me share 3 thoughts on why I think not:

☁️ still early, way early! Andy Jassy gave his keynote at a virtual AWS Re:invent and laid out his bull case for what’s ahead (from Information Week):

Despite such gains, AWS is part of a much broader IT global segment, he said, where spending on cloud is just 4% of the overall IT market. Jassy said AWS believes the vast majority of computing will move to the cloud in the next 10 to 20 years. “It means there’s a lot of growth ahead of us,” he said

That growth might build from moves organizations made out of necessity in 2020. The onset of the pandemic compelled most companies to try and save money, Jassy said, which included rethinking their plans. Many enterprises, he said, went from just talking about migration to forming real plans. “When you look back on the history of the cloud, it will turn out that the pandemic accelerated cloud adoption by several years,” Jassy said.

Future of work is still early, way early! Here’s Aaron Levie from Box and his version of what’s ahead (notice a similar theme? early adopters, i.e., us in tech are only the tip of the iceberg in terms of the $$$ spend to be unlocked in the next 10 years)

The last decade has been about building the tools that power new ways to work from anywhere, collaborate with anyone, and automate workflows and business processes in the cloud. The next decade will be the era when organizations adopt these technologies en masse and transform their enterprises.

And here’s why the Salesforce/Slack deal is interesting for all founders in the productivity/collaboration space - choice!

Most importantly, this is massive validation of the modern, best-of-breed enterprise software stack. It creates even more choice in the ecosystem for the future of work. And given Slack's focus on being an open platform, there will be even more opportunity for developers to integrate into a common platform that tens of millions of users are already working from and interacting with everyday. It's hard to overstate how critical this development is for innovation in enterprise software and for IT buyers and users. We're on the verge of another massive wave of adoption and innovation that is going to be fundamentally enabled by the move to the cloud.

Automation of Excel, never ending! It’s no secret that Excel still powers most of the business world today as a glue layer for processes. And as Nick Mehta, founder and CEO of Gainsight so aptly stated there is still so much more room for innovation! I couldn’t agree more especially as applications and services become even more fragmented.

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

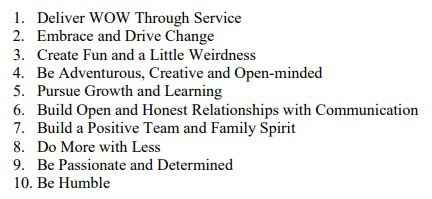

RIP Tony Hsieh of Zappos who pioneered a new way for employees and customers by Delivering Happiness

👇🏼💯 But I wouldn’t say a hard and fast rule for $20mm ARR and we have several PLG cos in portfolio that did it sooner. Beauty is over time you can surround larger accounts from every path, end users or devs at bottom, top down with account based marketing or ABM, and partners with integrations. Hardest part is being patient enough and investing enough in the product for product led growth and to get that initial flywheel going. Layering in enterprise too early can be a distraction.

1/Some of the most exciting enterprise startups we see are product-led and bottom up. As growth investors, we often get asked how to scale ARR 10x+ beyond the first ~$20M 👇 a16z.com/2020/12/03/add…

💪🏼

Enterprise Tech

Is the ☁️ run going to run out of steam? Must read exclusive interview with Andy Jassy of AWS who thinks not (Silicon Angle):

“If you look at the global IT segment… 96% of those dollars are spent on-premises, not in the cloud,” said Jassy. ($3.6 trillion Gartner)

And part of that is Jassy’s definition of hybrid which includes edge compute:

We think of hybrid as including the cloud along with various other edge nodes (including on-premises data centers). ‘Edge’ and ‘hybrid’ are terms that are starting to merge together.”

And as I’ve always said it’s all just cloud-native whether running in public or private cloud and we still have more room to 🏃🏼♂️.

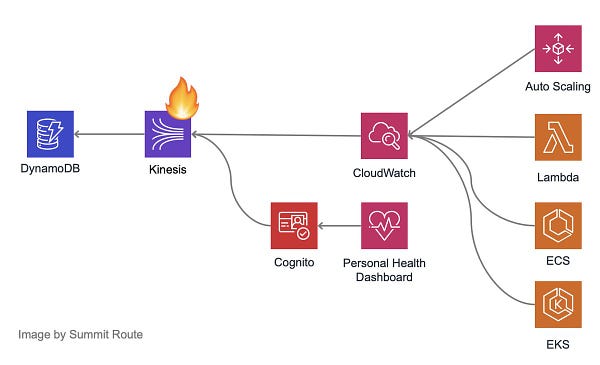

Post-mortems are so important to learn from incidents - here’s AWS analysis of what happened to Kinesis. It’s a great deep dive into how systems are interconnected and the importance of resiliency engineering

AWS has posted a post-mortem of Nov 25 incident. From the info there, we learn some of the internal service dependencies that caused the cascade of failures across services. aws.amazon.com/message/11201/

Most fascinating is their monitoring system Cloudwatch relied on Kinesis for processing metric and log data which made it hard for impacted users to actually even understand what was happening.

I shared some of my thoughts on Salesforce/Slack in Divinations substack from Nathan Baschez

Will it work?

Ed is bullish:

“It reminds me of Mulesoft — a fabulous acquisition by Salesforce in 2018.”

Much like Slack is a central nervous system for employee-facing information flows, Mulesoft ties together back-end data from various disparate systems.

At the time, most analysts thought Salesforce had overpaid for Mulesoft. But since then it’s been a huge hit — proving Salesforce’s ability to cross-sell high quality products they acquire to their large, existing customer base.

While most of the headlines for Salesforce were around the acquisition of Slack, this product release was under the radar - Salesforce enters automation space with Einstein Automate. This is yet another example of how Salesforce has Microsoft in its crosshairs as Microsoft released Power Automate last year. In addition, they launched an app store for RPA with Automation Anywhere, one of their investments, UIPath, and Blue Prism.

The new Einstein Flow Orchestrator is a low-code workflow development tool that allows users to compose workflows that automate complex, multi-user processes and approvals. Flow Orchestrator speeds up projects and processes with AI-generated next steps and recommendations that prompt users throughout processes and quickly identify bottlenecks causing delays. For example, the mortgage approval process, which is complex and requires extensive documentation and verification, can be streamlined into an automated workflow that helps process applications seamlessly and without delays.

Developers, Developers, Developers - up from 40m in last year’s report to 56m this year, 44m repos to 60m 📈

☁️☁️☁️ - Mark Wang, head of cloud engineering at S&P Global, shares how a 160 year old organization is moving at pace of fintech and its 3 year journey to move fully to cloud. Cloud spurs more spending, dev tools, devops, CI/CD, and more.

Unlike fellow financial services stalwart Bloomberg, which has chosen to implement modern cloud technologies alongside older but stable internal infrastructure, S&P is in the middle of a wholesale renovation of its internal workings. The idea is to improve the speed at which S&P ships software, and to give developers the freedom to write code without having to think about where that code will wind up running.

And yes, multicloud is real:

Well, not technically everything. We also have a presence in Alibaba, and we're starting to use Azure as well. Amazon was our first target move. But our cloud strategy is multicloud, cloud agnostic, because of things like what happened to Azure [in September]. We always see that as a risk, if we've put all our eggs in one basket, given the criticality of a ratings agency. We want business continuity.

And AWS can’t ignore this fact any longer as it just launched ECS Anywhere and EKS Anywhere this past week

two new versions of AWS' managed containers and managed Kubernetes services, both designed for customer data centers — can be used to manage applications running on Microsoft Azure and Google Cloud. Each service "works on any infrastructure," according to the slide, and AWS confirmed to Protocol that they would allow customers to use its software to manage workloads running on other cloud providers.

Great read on how JPM is making its 50,000 technologists and $11 billion tech budget more efficient - always a balance between speed and control or policy and self service - Gitops is the way!

JPMorgan has used modular design to create "opinionated blueprint architectures as products," said Reid. It's built a compliant and secure blueprint architecture in the cloud that adheres to JPMorgan's compliance and security policies. The resulting architecture enables developers to self-serve from the blueprints available and to create new ones. Developers have autonomy and efficiency within the bank's predefined parameters.

My new remote work presence

Markets

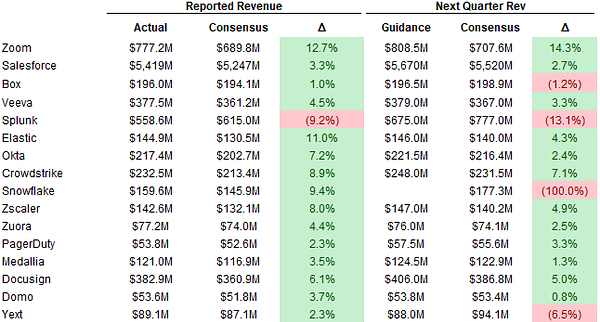

Too much to cover - check out Jamin Ball’s Clouded Judgement for the roundup of earnings this week